2018年8月31日,全国人大常委会审议通过《关于修改<中华人民共和国个人所得税法>的决定》,本次修订新增"个人转让股权办理变更登记的,市场主体登记机关应当查验与该股权交易相关的个人所得税的完税凭证"。鉴于上海、深圳、广州等一线城市此前尚未实施该规定,本文尝试分析该新规对个人转让股权可能产生的影响,并对比股权转让在个人所得税、企业所得税层面的纳税办法及优惠政策的差异,为个人直接持股是否需要进行股权结构调整提供参考并对个人转让股权的风险管理提供建议。

一、个税法股权转让所得"新规"

2018年8月31日,全国人大常委会审议通过了《关于修改<中华人民共和国个人所得税法>的决定》,本次修订新增的 第十五条第二款中规定"个人转让股权办理变更登记的,市场主体登记机关应当查验与该股权交易相关的个人所得税的完税凭证"。本次个税法修订决定自2019年1月1日起施行。

实际上,早在2009年5月,国家税务总局就出台过类似的规定。2009年5月28日《国家税务总局关于加强股权转让所得征收个人所得税管理的通知》(国税函[2009]285号)规定,签订股权转让协议并完成股权转让交易以后至企业变更股权登记前,负有纳税义务的主体应到主管税务机关申报纳税,并持税务机关开具的股权转让所得纳税证明(包括完税凭证或免税、不征税证明),到工商行政管理部门办理股权变更登记手续。由于该文件为国家税务总局单独发布,国家税务总局与国家市场监督管理总局均属国务院直属机构为平级单位,国家税务局出台的该文件并未得到工商部门的有效执行,多地工商局未据此将股权转让所得纳税证明作为个人转让股权办理工商变更登记的前置文件。2014年12月,国家税务总局出台《股权转让所得个人所得税管理办法(试行)》(国家税务总局公告2014年第67号,以下简称"67号文"),上述国税函[2009]285号通知被废止,取而代之的是"税务机关应加强与工商部门合作,落实和完善股权信息交换制度,积极开展股权转让信息共享工作"的规定。

不过,虽然国家税务总局层面此后没有明确文件要求,部分省市地区为保障个人转让股权所得的税收征收工作,陆续出台类似规定。笔者根据实务经验及于互联网查询,部分省市地区明确规定(很多地方税务局依据国家税务总局的文件单独发布了类似的规定,以下仅包括部分地区税务局与工商局联合发布、地方人民政府发布或转发的类似政策)个人转让股权办理工商登记前应当办理纳税申报,部分摘录如下:

因此,前述个人所得税法新规实际是不少地区已经实际执行的做法,该项新规并不"新"。不过,根据笔者此前执业经验并再次电话咨询上海市浦东新区市监局、深圳市市监局、广州市工商局,该等部门均明确表示纳税证明非个人转让股权办理工商变更登记的前置文件。

笔者认为,鉴于《个人所得税法》为全国人大常委会颁布,效力层级高,本次个人所得税修订增加该项规定,从法律层面明确将个人所得税的完税凭证作为个人转让股权市场主体登记机关应当查验的材料之一,可以预见上海市、深圳市、广州市等尚未实施该等规定地区的工商部门将于2019年1月1日起逐步吸纳实施该项规定,因此该新规对个人转让股权可能带来的影响不可不察。

二、税收政策对交易的影响

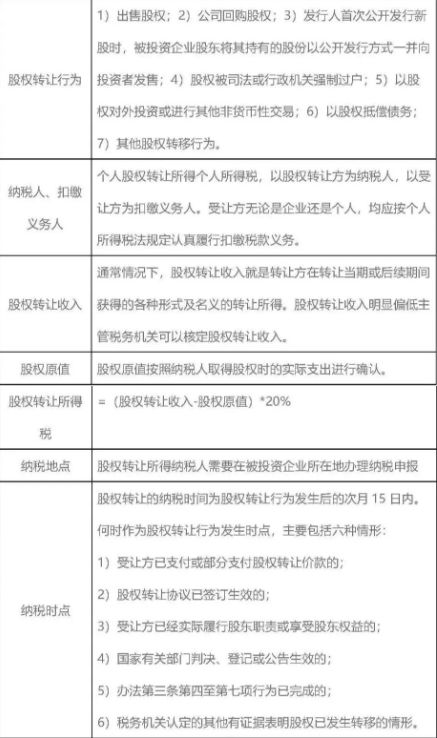

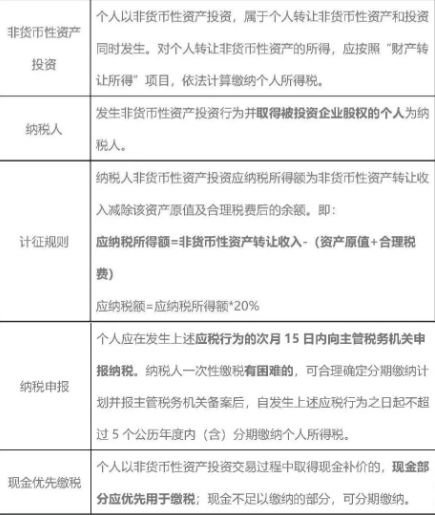

个人转让股权取得现金支付,纳税政策相对较为明确。对于个人转让股权获得股权或股份支付,《关于个人非货币性资产投资有关个人所得税政策通知》(财税[2015]41号,以下简称"41号文")及《关于个人非货币性资产投资有关个人所得税征管问题的公告》(国家税务总局公告2015年第20号,以下简称"20号文")规定,个人转让股权应于应税行为的次月15日内向主管税务机关申报纳税,并有条件的准予在应税行为之日起不超过5年度内分期缴纳个人所得税。

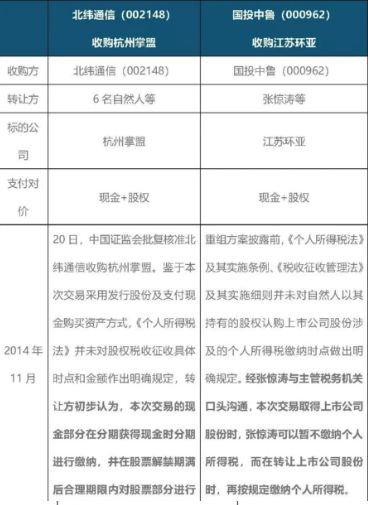

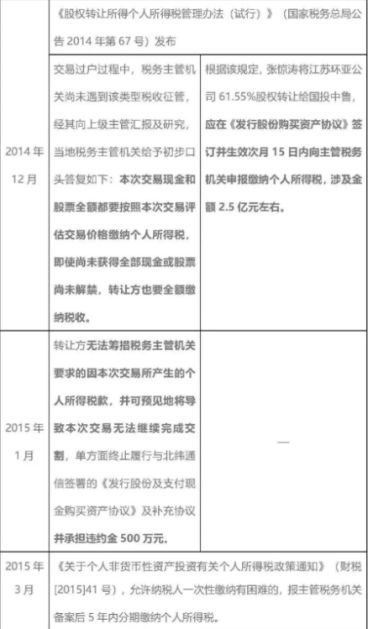

就上述新个税法新规可能带来的影响,首先回顾资本市场两项因个人转让股权税务问题导致交易终止的"经典案例"。

其中,北纬通信收购杭州掌盟,标的公司位于浙江省杭州市,而浙江省政府自2013年即要求在工商部门办理股东股权变更登记手续时应核对纳税人提供的所得税完税凭证或者不征税证明,北纬通信该项收购未考虑到当地税务部门的纳税政策,导致转让方无法承受超预期的高额税款、被迫终止交易并赔偿违约金。国投中鲁收购江苏环亚实质为借壳上市,但因个税政策不明确,交易过程中税收新政出台,转让方个人股东面临高额所得税而被迫终止交易。

从这两项"经典案例"可以看出,税收政策的不稳定会对个人转让股权交易带来极大的不确定性。笔者曾协助客户转让位于江西省某地区公司的股权,该地方将纳税证明作为股权转让工商登记前置条件,但因税务部门不了解不熟悉业务处理,以致与税务部门沟通近一天才办理取得相关证明;同时公司因估值调整,拟调整股东持股比例,因涉个人股东股权转让办理工商前需要办理纳税证明,调整方案的设计亦颇费周折。

三、个人转让股权纳税政策存在的问题

如果上述个税法新规在全国范围推广实施,个人转让股权在办理工商变更登记时即应当向税务主管部门申报纳税或取得纳税证明,而税务主管部门亦需依据具体政策文件确定具体个人转让股权所得的纳税办法,在税收政策不明确的情况下,税务主管部门可能倾向从严办理,转让方或受让方依据双方协议约定的交易进行履行纳税义务的灵活性降低,取得个人转让股权的纳税证明的要求将显著影响交易进程和交易方案。

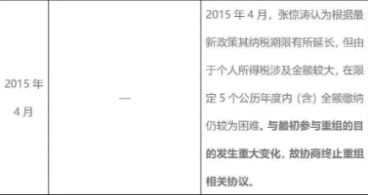

个人转让股权所得纳税政策主要依据是67号文、41号文及20号文。67号文主要内容如下:

41号文和20号文主要内容如下:

如将个人转让股权纳税证明作为办理工商变更登记的材料之一,67号文及41号文在实务适用时可能存在以下问题:

1)股权转让协议已签订生效,但协议约定办理工商变更登记后受让方再支付股权转让对价,此时已符合纳税时点第二项的规定,办理工商登记时,受让方(为扣缴义务人)或转让方(为纳税人)是否应在尚未收到股权转让对价的情况下缴纳税款?

2)如股权转让协议约定受让方分期付款,受让方是在分期支付各笔款项时代扣代缴该期对价对应的税款,还是在纳税时点一次性代扣代缴全部税款;

3)上市公司收购股权时,股权转让协议通常约定业绩承诺,因此今后交易对价存在调整的可能性,如转让方未能完成业绩承诺需要赔偿受让方部分转让对价,该部分对价已缴纳的个人所得税如何处理;

4)上市公司发行股份及支付现金购买转让方持有的股权,转让方取得的现金如大于全部应付税款,此时转让方是否应一次性缴纳税款,获得的股份支付部分能否办理5年分期缴纳个人所得税备案;

5)上市公司发行股份购买转让方持有的股权,转让方取得的股权依据41号文即使与税务机关沟通并获准在5年内分期缴纳该项所得税,转让方是否有能力承担该等税款;如之后股价下跌,转让方折价处置取得的股权,原备案的纳税方案能否根据处置时的情况调整等等。

四、个人、公司转让股权税收政策对比

实际上,如果北纬通信收购杭州掌盟或国投中鲁收购江苏环亚时,杭州掌盟、国投中鲁个人股东通过公司间接持有杭州掌盟、国投中鲁的股权,则可以回避在股权办理工商变更登记时支付大额税收的问题。

笔者将个人直接转让所持股权及公司转让所持股权税收政策对比如下:

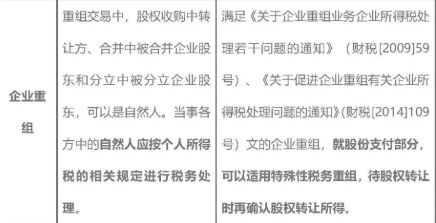

从上述政策比对可以看出,就股权转让所得,企业所得税模式下的税收政策相较于个人所得税模式,企业相较于个人有更多的税收优惠政策和税收筹划空间。如企业转让股权无需在办理工商变更登记时将纳税证明作为前置条件,而是按期申报、年度汇算清缴所得税;如企业所得税就企业年度经营利润计缴所得税,成本、费用作为扣除项,有一定的税收筹划空间;如符合特性税务处理的企业重组,转让方取得的股权支付对价,可以在最终处置取得的股权时再确认所得等;这些都是个人所得税模式不具备的税收政策优势。

因此,考虑到今后个税法新规在全国范围内实施,个人直接持有经营实体股权还是个人通过中间层公司间接持有经营实体股权,是一项可以严肃考虑的抉择。

当然,如果个人利用中间层公司间接持股经营实体股权,而中间层公司未能合法合理地进行税收筹划,那么会面临中间层公司最终形成的利润缴纳企业所得税后个人股东收取的股息红利缴纳个人所得税的双重征税问题。

五、结语与建议

综上,关于个人直接持有经营实体股权及涉及个人转让所持股权的交易,根据上述分析,笔者建议:

1.涉及个人转让所持股权的交易,尤其是交易对价的支付方式涉及股权或股份支付时,可提前与税务机关沟通,确定是否可以办理41号文规定的5年分期纳税备案;在设计交易结构、安排交易流程时,及时与税务机关沟通,确定当地对个人转让股权的征税政策、纳税时点和税收优惠政策的理解,防止盲目签署交易协议导致协议执行时陷入困境。

2.个人股东应合理选择持股方式。鉴于四大一线城市中,上海、深圳、广州此前均未实施个人转让股权纳税证明作为股权转让工商变更登记的前置条件的政策,如之后按照新的《个人所得税法》的规定执行该等规定,个人转让直接持股可能因税负成本较高、纳税时点可能影响交割等对交易造成不利影响;而转让通过公司间接持有的股权,利用企业所得税的税收政策,可以规避个人转让直接持股的一些问题;个人股东可根据投资的实际情况及时调整对外持股结构安排。

3.考虑纳税前置对交割时间的影响。个人直接转让其持股权时,可了解标的企业所在地股权变更登记办理政策,申报纳税是否是个人转让股权办理工商变更登记的前置条件,考虑个人股东股权转让办理工商变更登记可能需要的额外的时间,并在协议中为办理股权转让变更登记预留充足的时间,防止因不了解税收政策或政策变动导致转让方未能及时交割而违约。

4.涉及个人转让股权的交易,应充分考虑个人履行缴纳相应的个人所得税的资金需求和支付能力。如转让方资金紧张无力及时履行纳税义务,可考虑调整交易架构由受让方提前向转让方支付预付款、受让方向转让方提供借款等方式为转让方提供资金,避免因转让方没有充足资金履行纳税义务而导致交易失败。

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.