Ongoing corporate requirements

The Companies Law (2018 Revision) (the "Companies Law") imposes continuing obligations on all exempted companies, including those registered as mutual funds under section 4(3) of the Mutual Funds Law (2015 Revision) (the "Mutual Funds Law"). The main relevant requirements of the Companies Law are summarised below.

Registered office

Every exempted company must at all times maintain a registered office in the Cayman Islands and notice of such office must be given to the Registrar of Companies ("ROC"). If the company decides to change its registered office, ordinarily its directors must adopt a resolution authorising such change. The resolution must be filed with the ROC, along with fee of US$92, within 30 days from the date the resolution was adopted. A failure to do so will incur a fee of US$12 per day capped at $610. The company must, in addition, inform the Cayman Islands Monetary Authority ("CIMA") of this change.

Annual return

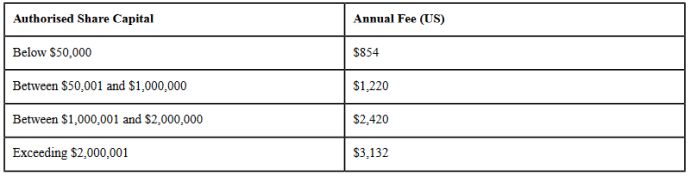

An exempted company must file an annual return with the ROC at the start of each year together with an annual fee. The fee payable depends on the authorised share capital of the company and is as follows:

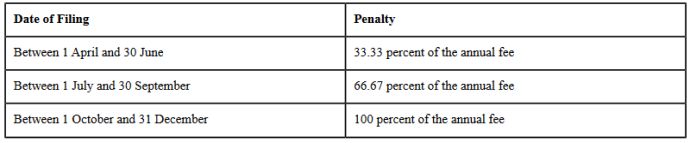

The deadline for filing the annual return and payment of the fee is 31 March of each year and failure to do so may cause the company to be struck off the register. In addition, the company will not be in good standing until such filing and payment is made, even though the penalties are only incurred from 1 April. The late filing penalties are set out below:

To view the full article, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.