Five top tips for success

Five common pitfalls to avoid

What's coming up on the calendar for 2018

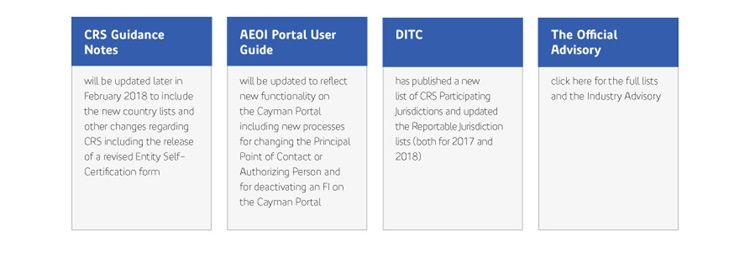

The Cayman Department for International Tax Cooperation (DITC) recently advised industry participants of the following:

Reportable jurisdiction update

The below is the list of jurisdictions to be treated as Reportable Jurisdictions for the purposes of the Common Reporting Standard contained in Schedule 1 of those regulations. This notice supersedes the notice published by Extraordinary Gazette No. 49/2017 dated Wednesday, 14 June 2017.

Azerbaijan and Pakistan will be Reportable Jurisdictions for reports due in 2018 onwards and Kuwait has been removed as a Reportable Jurisdiction for reports due in 2018 onwards.

*For reports due in 2017 and 2018 onwards please consult the

flyer by clicking here.

*Updated 3 January 2018 Issued by: Tax Information Authority

Department for International Tax Cooperation, Government

Administration Building, Box 135

133 Elgin Avenue, Grand Cayman KY1- 9000, Cayman Islands | www.ditc.gov.ky

1 Reference to an Account Holder means anyone who holds a debt

or equity interest in an Investment Entity as defined in the Cayman

Islands FATCA and CRS legislations.

2 Controlling Person has the definition prescribed to it in the

Cayman Islands FATCA and CRS legislations

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.