Welcome to our Listings Bulletin where we take an opportunity to reflect on the highlights of 2017 and to gaze into the 2018 crystal ball. From CLOs to sovereigns, and all forms of debt securities that fall in between, we highlight an impressive breadth of products and issuers who continue to choose the Irish Stock Exchange as their international exchange of choice and for whom Walkers Listing Services (WLS) was pleased to act as listing agent.

2017 Trend-Spotting: Impressive growth by Region and Debt Type

2017 was a record year for WLS reflecting growth in our ever-expanding international client base. We increased our global footprint attracting business from new regions and were delighted to act as listing agent to a number of headline deals throughout the year. One of the keys to our success has been our commitment to spot and follow trends in the capital markets and we share below some of the trends that contributed to record 2017 being a record year for WLS.

Euro and U.S. CLO: What a year for CLOs! New issuance, refinancings and resets hit records numbers in 2017 where market sources estimate US$285.3bn U.S. CLO issuance and €45.9bn Euro CLO issuance. The ISE has long been the exchange of choice for CLO issuers and WLS was pleased to act on US deals ranging in size from US$320mn to US$620mn while the Euro CLOs on which we acted showed issuance size from €247mn to €616mn, including the largest Euro CLO this year. 2017 was an exciting time for our global CLO offering as our Cayman and Dublin offices, respectively, brought new managers to the CLO market. Indeed early warehouse activity in 2018 signals another positive year for CLOs.

Sovereign bonds: A growing number of governments successfully tapped the capital markets in 2017 as they endeavoured to bridge budget deficits and, in fact, some returned to the markets on a regular basis. Among others, we were pleased to represent Oman, Kuwait, Iraq, Russia and Jordan. As governments become more and more comfortable with tapping the capital markets for funding, and as the ISE has proven to be the premier venue for listing government bonds, we anticipate this trend will continue into 2018.

Group financing: The global reach of the ISE was evident among international issuers raising finance for group companies and WLS was pleased to represent issuers with businesses in jurisdictions including the People's Republic of China, France, Spain, Kazakhstan, Kuwait and Italy, to name but a few. Typically classified as corporate debt and/or high yield bonds, we represented a vast array of industries including railway transport; real estate investment; gaming; energy; banking; vision and hearing etc. which made for some very interesting listings.

Project Finance: We were also pleased to act on a number of project finance transactions during 2017, originating in particular from the UK and Middle East, and we expect new project finance deals already appearing in our 2018 pipeline.

Islamic finance & Sukuk: We continue to experience growth from the Middle East where issuers across the GCC region and beyond choose to list their debt securities on the ISE, predominantly on the regulated market. To date we have represented companies from various industries including real estate, banking, petrochemical and energy industries, some of whom have tapped the markets by way of conventional bond issuance while others have established Sukuk structures reflecting Shari'a compliant offerings.

ABS: WLS acted on a wide variety of asset-backed deals in 2017 including auto loans, consumer loans, aircraft securitisation, CMBS and RMBS, originating from countries including the UK, The Netherlands, Norway, Sweden and Italy.

2017 Headline Deals - a record year for WLS

- Acted on the largest Euro CLO deal in 2017

- Acted on the first REIT sukuk to list on regulated market of the ISE

- Acted on the winner of the Investment Grade Bond/Sukuk Deal of the Year awarded at the Bonds, Loans and Sukuk Awards, Middle East 2017

- Acted on the largest project finance deal in the U.A.E.

- Acted on the only Italian CMBS deal to cross the line in 2017

- Acted on the first sovereign GMTN programme offered by the State of Kuwait

- Acted on the first sovereign sukuk programme offered by the Sultanate of Oman

- Acted on the first ever marketed and syndicated international bond issue by the Republic of Iraq.

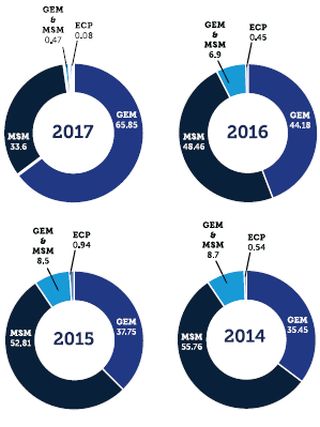

Bumper year for GEM

While the ISE's Main Securities Market (MSM) remains the EU regulated market of choice, the Global Exchange Market (GEM) accounted for 66% of all documents approved during 2017, signalling a recognition from investors, issuers and arrangers that a listing on a reputable EU exchange-regulated market is strongly valued.

Sovereigns In-Focus – MENA

During 2017 we acted on close to 50% of sovereigns who each chose to list their Eurobonds on the regulated market of the ISE.

Issuance size has ranged from US$500 million up to U$5 billion. According to market sources, many sovereign issuances were 3-4 times oversubscribed during 2017 demonstrating the market's favourable appetite towards these debt securities. Indeed early signs in 2018 show that a number of inaugural deals may come to the market, in addition to tap issuances being conducted by experienced issuers.

Accessing funding through the capital markets has become an increasingly attractive and necessary tool for governments seeking to finance their anticipated budget spending and we anticipate further growth in the listing of sovereign Eurobonds. In fact it is interesting to note that a number of sovereigns have established programmes, in the form of conventional GMTN programmes and sukuk programmes, showing an intention to tap the market for funding on a regular basis.

Regulatory Corner

Market Abuse Regulations (MAR) - As is evidenced by our bumper listing numbers in 2017, issuers and practitioners in the capital markets space continue to list all forms of debt securities on the GEM and regulated market of the ISE, including asset-backed debt, vanilla debt, government bonds and high yield bonds. As with any new regulation, MAR raised a number of questions upon its introduction and it is clear that the markets have grown comfortable with MAR compliance and the various available solutions.

MiFID II / Legal Entity Identifier (LEI) - From a listing perspective, MiFID II has brought about new disclosure in MSM prospectuses with reference to Product Governance, among others, and also introduced the requirement for each issuer listing on an EU regulated market or exchange-regulated market to obtain an LEI code. WLS is happy to assist clients to obtain an LEI.

EU Benchmarks Regulation (BMR) - As of 1 January 2018 the BMR introduced new compliance requirements for benchmark administrators, contributors, and users, with regard to interest rate, foreign exchange, security, commodity, and other benchmarks used in financial transactions. Article 29 of the BMR notes that "where the object of a prospectus to be published under Directive 2003/71/EC or Directive 2009/65/EC is transferable securities or other investment products that reference a benchmark, the issuer, offeror, or person asking for admission to trade on a regulated market shall ensure that the prospectus also includes clear and prominent information stating whether the benchmark is provided by an administrator included in the register referred to in Article 36 of this Regulation". Accordingly, for an issuer seeking to list on the MSM, a prospectus will now include a standard disclosure addressing compliance with the BMR, where relevant.

Securitisation Regulation: On October 26, 2017 the European Parliament voted on and approved the new Securitisation Regulation. The new regulation will apply from 1 January 2019 and, amongst other things, introduces new rules to create a European framework for simple, transparent and standardised (STS) securitisations, as well as new rules on preferential capital treatment for STS securitisations.

Outlook for 2018

In November 2017 Euronext announced its acquisition of the ISE, with such acquisition expected to complete in Q1 2018. It is expected that the ISE will have a strong group-wide position within Euronext's highly inclusive federal governance structure as a global centre of excellence for all group-wide activities in the listing of Debt, Funds and ETF (Exchange Traded Funds) securities. We head into 2018 with a strong pipeline of debt securities transactions comprising a deep mix of product and region, and given strong market sentiments, we expect further growth for our Listings team throughout this year. May we take this opportunity to wish you every success in 2018 - we look forward to working with you!

Top reasons why investors continue to seek an ISE listing

The ISE is recognised internationally by arrangers, managers, law firms and investors as one of the leading stock exchanges on which to list debt securities. Arrangers and distributors return to the ISE, deal after deal, to satisfy some or all of the following investor criteria:

- Quoted Eurobond Exemption

- Institutional investors/Pension Funds required to meet internal investment criteria regarding investment in bonds that are listed on a recognised & reputable EU market

- Liquidity i.e. the ability to sell the bonds in the future to investors who may require a listed note.

- Bonds may be listed to qualify for ECB Bond purchasing programmes.

- UCITS Funds – better to have debt listed on an EU market for bucketing purposes, especially a regulated market listing.

- It has become a standard feature in OCs and is expected by investors.

Outlook for 2018

In November 2017 Euronext announced its acquisition of the ISE, with such acquisition expected to complete in Q1 2018. It is expected that the ISE will have a strong group-wide position within Euronext's highly inclusive federal governance structure as a global centre of excellence for all group-wide activities in the listing of Debt, Funds and ETF (Exchange Traded Funds) securities. We head into 2018 with a strong pipeline of debt securities transactions comprising a deep mix of product and region, and given strong market sentiments, we expect further growth for our Listings team throughout this year. May we take this opportunity to wish you every success in 2018 - we look forward to working with you!

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.