Paul Byles takes a deeper look into recent trends from the Global Financial Centres Index to assess how the major offshore centres are doing.

If we are to go by the news stories in the media, or the latest Hollywood flick, with the now almost mandatory references to an 'offshore account', it's clear there is still some way to go before offshore centres put a dent into the negative perceptions (mostly unwarranted) that still prevail. But what if we were to use a more objective measure of perception rather than those occasional news stories and movies targeted at entertaining readers? And in the face of numerous global regulatory changes and pressures, what has been the impact on these centres? Since 2007, the Z/Yen group in London has published the Global Financial Centres Index (GFCI) twice per year. The survey is based on a mix of instrumental factors and an online survey aimed at financial services professionals around the world. Using data from the past six reports, from 2016, dating back to 2011, this article looks at how the mainstream offshore centres in the Caribbean (Cayman Islands, Bermuda and BVI) are doing in comparison to the offshore crown dependencies from across the Atlantic (Isle of Man, Jersey, and Guernsey). The GFCI is being used here to illustrate what can be achieved through the use of similar tools. Taking a look at how certain IFCs have fared with this measure might give us some insight into whether the various changes made to their regimes and efforts to counter negative publicity have had any impact so to speak, on how they are perceived.

The GFCI has been consistent in its methodology, so it may be a useful exercise to compare how these countries have performed over a period of time. The fall report has been used, which is normally published in October/ September each year.

Looking at the numbers, the regional IFCs have displayed a stronger trend upwards and have stuck closely together in terms of perception (see Figure 1). This supports the idea that the region (or islands) tend to suffer from being lumped together perception-wise. It also explains why their reputations would tend to improve together as well.

On the contrary, Figure 2 shows there is a much larger gap between the scores of the Channel Islands IFCs during the period with the possible exception of the drop in 2014, suggesting their reputations may be more independent of each other.

All of the regional IFCs also have a higher score in 2016 than the Channel Islands. The regional IFCs demonstrate contrasting fortunes in 2016, with the Cayman Islands being the only financial centre to show an increase in its index, while the BVI and Bermuda both declined.

There is a similar trend at play in 2016 in the Channel Islands, with Jersey demonstrating an upward bias over the year while Isle of Man and Guernsey both saw declines in their indices. That the Cayman Islands and Jersey have experienced an upward trend is not especially surprising because anecdotal evidence suggests these two centres are held in high esteem by clients in their respective areas.

This does not mean the other centres are viewed poorly but relatively speaking, Jersey and Cayman are regarded as being more developed than their respective peers in each group.

One of the key differences between the Caribbean and the Channel Islands is that the Channel Islands started off with relatively high indices in 2011 and are all lower now as compared to five years ago, while the Caribbean IFCs generally started at lower points and have all experienced consistent average increases in their indices over the same period, see Table 1.

ALL ABOUT PERCEPTION?

Using the index as a proxy for perceived reputations, the Caribbean based centres have done much to improve their perception over the years and this may be the direct result of numerous sweeping enhancements to their regulatory regimes, some of this starting as early as 2001 after the OECD blacklisting. This is very interesting because in general the Caribbean IFCs have most certainly faced the harsher criticisms over the years in terms of media reporting of weaknesses in regulatory frameworks, reinforcing negative perceptions. Since those heavy criticisms at the start of the century, there have been numerous objective assessments conducted including by the IMF, which highlighted that weaknesses existed across many varying financial centres and that, not only were earlier perceived well developed IFCs such as the USA failing in certain areas, but some of the previously perceived weaker jurisdictions ranked higher in some key factors relating to AML and CFT frameworks.

It could be argued that the Caribbean based IFCs, faced with relatively more pressure have pushed hard to either correct their true deficiencies or address the perceived ones with effective public relations campaigns, while the Channel Islands which have not faced similar pressures (relatively speaking), have not benefitted from any additional 'push' to address such perceptions.

RELATIVE REPUTATIONS

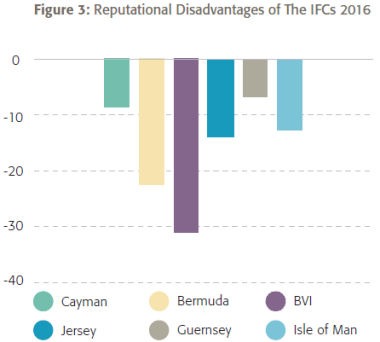

The GFCI report also provides a measure of what it terms 'reputational advantage' or 'disadvantage'. In summary this measure looks at the average score that a centre receives from financial professionals across the world and compares that number with the actual GFCI index. The report explains that if a centre has a higher average assessment than its GFCI rating this indicates that respondents' perceptions of a centre are more favourable than the quantitative measures alone would suggest. The difference between the two is then regarded as a reputational advantage (a positive number) or a reputational disadvantage (a negative number).

Figure 3 demonstrates that all of the IFCS in the Caribbean and Channel Islands suffer to varying degrees from this reputational disadvantage. At -5, Guernsey has the least reputational disadvantage with Cayman being next while Bermuda and BVI demonstrate the largest reputational disadvantage (meaning the index scores are worse than respondents expected).

Delving into the numbers (and the numbers behind the numbers) the GFCI provides some interesting insights into how Caribbean IFCs compare with their counterparts across the Atlantic. Perception is almost as important as the reality in the market place and this is especially the case where financial services and financial markets are concerned. In that sense the GFCI data presents a useful comparison on how the global market place continues to perceive these centres. Policymakers would do well to follow its trends as an objective measure of, if nothing else, how their jurisdictions are perceived by thousands of financial services professionals around the world, as well as how that perception compares to their competitors and importantly how reputations might be impacted by changes in regulatory frameworks.

About the Author

Paul is Managing Director of First Regents Bank & Trust. He is also serves as an independent director and consultant to financial services firms.

He is an economist and former regulator who has worked in the offshore sector for over 20 years. He is author of the books "Inside Offshore" and "Introduction to Offshore Financial Services: A BVI Text."

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.