For over a decade, many pension funds, government agencies and even actuarial consultancies have signed on to the United Nations-supported Principles of Responsible Investment (PRI).1 However there still appears to be considerable confusion about what responsible investment entails for institutional pension, benefit or social security funds. This confusion has professional and reputational implications for actuarial and other firms that advise pension funds, since actuaries are often the primary point of contact for many pension funds.

Many pension actuaries routinely provide advisory services relating to funding, asset allocation and investment manager selection. Accordingly, most actuarial consultants are intimately familiar with general duties of care, diligence and skill required to be exercised in dealing with pension assets. Indeed, actuaries are highly valued as a source of authority and knowledge in helping pension fund clients avoid corporate and personal liability for failure to adequately protect or reasonably invest pension fund assets. It is therefore important that pension actuaries have a clear view of where the basic legal2 and practical implications fit into the ESG landscape.

The starting point for investment management in many jurisdictions is developing a written investment policy to guide prudent management.3 Actuaries are often involved in the development of those policies because the goal of the investment function is to generate the best possible returns having regard to plan liabilities, the rate of funding and the demographic characteristics of the plan's beneficiaries. Increasingly, that written policy must expressly disclose whether ESG factors are considered, and if so how.4

The purpose of this paper is to highlight the main legal issues relating to ESG factor integration, provide some insight into the current state of ESG analytics and to provide some practical guidance. A bit of understanding can help actuaries better assist fiduciaries (trustees) to avoid making statements or disclosures about ESG investment practices that could provide proof they don't understand their fiduciary duty or, worse, that they are in breach of it. After all, written investment policies and other disclosures are evidence.

A major theme of this paper is the distinction between socially responsible, ethical or impact investing (which is referred to herein as SRI), and ESG factor integration. Legislation, regulatory guidance and statements from agencies, such as the United Nations blur these distinctions.5 The purpose of ESG factor integration from the perspective of a pension fund should not be to stop climate change, improve workplace diversity or end child labour. That is more of what is referred to as SRI investing in this paper. Such results may flow from integrating ESG factors into investment policy, but the purpose of employing ESG factor integration should be to improve financial performance or mitigate financial risk. From a legal perspective, other non-economic goals or aspirations are at best distractions, and at worst departures from proper fiduciary behaviour.

In other words, the purpose of ESG integration from a fiduciary perspective should be to take into account any and all financially material risks and opportunities that arise out of environmental, social and governance information; it is not about achieving particular environmental, social or governance goals. The latter is the purpose of SRI, and may not be consistent with fiduciary duties.

The other area of focus will relate to the quality of ESG information and analysis, since there are often significant concerns expressed about whether an ESG informed approach will negatively affect investment performance or financial risk.

1. ESG vs SRI – The Law

A major barrier to understanding the legal obligation of plan fiduciaries relating to ESG factor integration seems to be the confusing language that shades the boundary between taking into account financially relevant ESG factors on the one hand and promoting ethical or social behaviour for its own sake on the other. Legislation and regulatory guidance notes blur these distinctions. Ontario's 2016 Investment Guidance Note on ESG disclosure suggests they are part of a continuum.6 They aren't. They're distinct. One relates to ESG integration; the other is a moral or ethical imperative.

It is also not helpful to talk about ESG factors as being 'non-financial' factors as legislation in the Canadian province of Manitoba does.7 This is because if ESG factors are not financial factors, then they cannot be advancing the primary purpose of a pension plan, which in most jurisdictions will be to provide financial benefits in the form of lifetime retirement income. If the 'non-financial' factors are not relevant to providing financial benefits, they shouldn't be considered, except in extremely well-defined and exceptional situations, as discussed below. When ESG factors inform performance assessment, sustainability or risk, they are ipso facto financial factors and can be, and where they are known and relevant, must be taken into account by fiduciaries.

There has been debate for many years in many jurisdictions about legislating ESG consideration or disclosure. At the moment in the U.S. and the UK there is no requirement on fiduciaries to take ESG factors into account - or indeed to disclose whether they have done so or not. This may be about to change in the UK and continue to change in the EU. The trend seems to be to require disclosure.8

One issue has been the availability and quality of ESG related information. This too appears to be changing. For example, securities laws in some jurisdictions, like the UK, require listing companies to report on emissions and certain environmental matters9, others like Australia, recommend companies disclose material exposure to economic, environmental or social sustainability risks10, and others like Canadian and American securities regulators do not prescribe specific disclosures, but offer information or educational initiatives.11 Securities regulators also appear to be monitoring developments in reporting frameworks, evolving disclosure practices and investor's needs for additional and consistent ESG disclosure to make better investment and voting decisions.

(a) ESG

Unlike many other areas of fiduciary responsibility, the law on ESG investing in all parts of Canada is very clear and has been clear for many decades. In the context of a defined benefit pension fund or fiduciary-directed defined contribution plan, if ESG factors relate to financial performance or risk mitigation, taking them into account is not only allowable, but may be legally required.12 As a consequence, fiduciaries in Canada should probably avoid statements in an investment policy, or elsewhere, to the effect that they never take ESG factors into account. According to the United Nations, that appears to be the law in other jurisdictions as well.13

Just to be perfectly clear, and to paraphrase from the U.S. Department of Labor, where ESG issues have a direct relationship to the economic value of the pension fund's investment, they are proper components of the fiduciary's primary analysis of the economic merits of competing investment choices. In these instances, such issues are not merely collateral considerations or tie-breakers, but rather are relevant financial factors.14

(b) SRI

The legality of investing to achieve social, ethical or non-economic purposes – socially responsible investing (SRI) – is different. The general legal rule is that fiduciaries cannot exercise a discretionary investment power in a manner that does not relate to carrying out the purposes of the trust. Because the primary purpose of pension plans is to provide financial benefits on retirement, pension fund fiduciaries must consider economic factors – i.e., factors relating to financial performance or financial risk mitigation. That opens up a broad spectrum of factors, which might not be the usual financial metrics, but may be information that informs financial performance or financial risk mitigation. But that opening does not grant a license to pursue social, ethical or other non-economic goals except in four types of circumstances, and possibly a fifth, most of which are likely to be relatively rare.

First, it will be possible to provide a choice of SRI funds to members under defined contribution plans in which members may choose their own investments. The choice of SRI funds in that context is more common, and raises a host of legal issues that will be dependent on context and which are too specific to cover in this paper.

Second, fiduciaries may take into account SRI, where it is not discretionary. In other words, fiduciaries must take into account moral or ethical factors that the foundation documents legally direct them to consider. If the pension fund's constating plan rules or trust instrument take away discretion by providing a clear direction that is not otherwise illegal, they must follow it.15 One can, for example, imagine a sovereign wealth fund under which the constating legislation directs or excludes certain types of investment. One might also imagine a pension fund for employees of the Cancer Society in which the fiduciaries are directed to avoid investment in tobacco companies. It should be noted that where the original constating documents do not provide moral or ethical restrictions or directions, it will be a question of law as to whether the settlor or sponsor has reserved sufficient power to amend the rules to add such restrictions or directions. An investment policy will not, all by itself, be legally effective.16

Third, general common-law legal principles would suggest that fiduciaries are entitled to have a policy on ethical, moral or socially responsible investment and to pursue that policy, so long as they treat the financial interests of the beneficiaries as paramount and the investment policy is otherwise consistent with the standards of care and prudence required by law. In other words, it can be used as a "lens"; but fiduciaries would be well-advised to ensure any SRI motivated investment decision is supported by carefully documenting the additional analysis that lead to a conclusion to pursue the non-economic goal in making the particular investment.

Fourth, and similar to the last point, general common-law legal principles should not preclude consideration of collateral non-economic factors or goals if they are used as a tie-breaker between two or more investments where all other relevant economic factors are equal.

Lastly, one of the hallmarks of fiduciary or trust law is to treat the interests of the beneficiaries as paramount. This does not mean pension fiduciaries may exercise their investment discretion to take into account non-economic factors if a survey or vote of pension fund members indicates that would be the preference. This is because a vote would conflict with the "non-delegation rule." Trustees (and by extension, other fiduciaries) must act personally in exercising trust or fiduciary powers. It is possible that the harshness of this "non-delegation rule" could be alleviated if the original constating documents allowed for that, but conducting a vote or survey will raise practical as well as legal difficulties if the vote or survey is not unanimous.

The bottom line is that unlike the law which clearly permits, and arguably requires ESG integration as a part of the economic analysis to achieve financial goals, investing to achieve SRI goals is more complicated and uncertain. The main problem is how, in legal and practical terms, the decisions of fiduciaries to consider non-economic goals can be compatible with their duty to maximize the plan's investment returns for the benefit of its active and retired members without undue risk of loss. As a consequence, fiduciary decisions to pursue SRI should be rare, and when made, should be well-documented.

2. ESG Investing – How To

If ESG factors are considered by fiduciaries (as they should be), disclosure rules in Ontario as well as recommendations from other bodies such as the United Nations supported PRI, also require an explanation of how ESG factors are to be considered.17

The 'how' should be broadly stated, because specific actions or strategies must be reasonable in the particular circumstances. How fiduciaries deal with any ESG factor is a matter of discretion, and, in our view, should be a matter for fiduciary discretion. Fiduciaries should not be fettering, restricting, or pre-guessing future context by detailed written statements or policies of what will or won't be done. Nor should legislators be defining the filtering criteria – and not because the ultimate choice of criteria is heavily influenced by individual values and moral concepts, but because the choice should be dictated by prevailing circumstances.

For many, this will result in broad investment policy statements that simply indicate ESG factors are taken into account to evaluate the economic benefits of investments, to identify economically superior investments, or to assess materiality to financial performance and risk in a way that informs decisions to buy, sell, retain, engage, or sue. The ESG policy might also signal that pension funds and their managers are more likely to invest in companies that make efforts to report material ESG risks and opportunities. This approach will encourage efforts by issuers to provide more detailed ESG reporting18 and, ultimately, that will leave open a myriad of options that can respond reasonably to particular ESG factors and circumstances. The actual action taken can be specifically documented in minutes or file notes if necessary to support the reasonableness of any fiduciary decision taken that either relies on or ignores ESG considerations.

(a) ESG Integration that Results in Social Change vs. SRI Investing

As noted above, fiduciaries cannot use the pension fund to achieve social goals – at least not directly, unless legislated, the plan's foundation documents authorize it, it contributes to economic assessment, or it's a tie-breaker. This does not mean fiduciaries cannot respond to ESG concerns in a manner that has the effect of achieving social goals.

If a company's record on the environment is dismal, and there are reasonable grounds to believe that this may be a factor that bears on the performance or financial sustainability of that company as a pension fund investment, then, as noted above, the fiduciary may, and arguably must, take those factors into account. Then what?

Selling may not be the best fiduciary decision, particularly if the plan holds large positions or the investment is an important part of a long investment horizon.

Engagement, or nudging the company to do better (or nudging a mutual fund manager to nudge investee companies), might be a more productive response from a financial performance and fiduciary point of view. Investors that take ESG factors into account have often worked hard to persuade publicly held companies to address poor labour and human rights practices in their global supply chains, address climate change, improve health, safety, and environmental records, or promote racial or gender diversity on their boards. This might be perceived to be social activism. Maybe it is. But as long as the primary motivation is to improve financial performance, to improve short-, medium-, or long-term sustainability19 or to mitigate risk, then it is perfectly allowable from a legal perspective, at least in Canada. It is only when investments are made or avoided and actions are taken to better society without giving primary consideration to the financial impact on the pension fund that a pension fiduciary crosses a line that takes it out of ESG territory and puts it in SRI territory ‒ where it may not be compliant with its fiduciary obligations unless it meets one of the exceptions discussed above.

The specifics of engagement should not be part of the policy statement; that too should be dictated by circumstance. The policy statement only needs to accommodate a broad range of responses and might identify sample engagement strategies.

Engagement on ESG factors is not likely to be fundamentally different than it would be for other more traditional financial factors. The details of engagement will, and should be, driven by particular circumstances, overall investment style (passive or more active), the investment time frame for that investment, the urgency of the situation, the fiduciary's level of confidence that the investee company can respond, whether direct conversations with directors or senior management are possible, whether collaboration with other investors is possible, consistency with proxy voting guidelines, the nature of the ownership structure and the plan's investment in it, the investee company's history of response to shareholder engagement, and ‒ bottom-line ‒ whether the plan fiduciaries can identify and articulate a path to financial improvement that can be driven by engagement on ESG factors.

3. ESG Integration vs. SRI:

Differences in their Relationship to Corporate Financial

Performance

Another way to distinguish between ESG integration and SRI would be to look for differences in financial performance between those using ESG integration for financial purposes, and those using ESG integration to achieve SRI. One might expect financially motivated use of ESG would result in better performance on the theory that more information would lead to better investment decisions and outperformance. One might expect that SRI on the other hand would be more mixed, because it may be motivated by many different personal values, goals, and philosophical concerns about the environment, society or other matters. SRI doesn't always insist on financial outperformance or financial risk mitigation. It has other ethical and moral focal points that may be off-limits to pension fund fiduciaries, and may very well lead to less consistent financial results.

Notwithstanding the difficulty in disentangling socially responsible motivations from purely financial ones, better performance from taking ESG factors into account appears to be supported by several well researched studies, as discussed below. There appears to be only anecdotal evidence or commentary that SRI -- whether it is "impact investing" or "exclusionary investing" -- might put a drag on returns.20 We are hopeful that this distinction may be a matter of interest for researchers in the future. The question is, does the motivation matter? We believe it does. It would certainly be of assistance to pension fund fiduciaries and their advisors to know with more certainty whether it does.

(a) ESG Integration

As noted, there seems to be little doubt that using ESG information when making investment decisions has a positive impact on the risk and return profile of an investment portfolio. Below we list some recent studies that all point in this direction.

Summary of recent ESG and financial performance literature

| Study | Date | Organization | Scope | Key findings |

| The materiality of ESG factors for equity investment decisions: academic evidence | Apr-2016 | NN Investment partners | 3,000 listed companies | Incremental changes in ESG scores are a better indicator of future financial performance than absolute ESG scores |

| ESG and financial performance: aggregated evidence from more than 2000 empirical studies | Dec-2015 | Journal of Sustainable Finance & Investment | 2,200 studies | 90% of reviewed studies find a non-negative relationship between corporate ESG performance and corporate financial performance |

| Research analysis on environmental, social and corporate governance factor material | May-2015 | risklab (Allianz Global Investors) | 197 studies | The majority of analyzed studies report a positive relationship between sustainability scores and stock performance |

| Corporate sustainability: First evidence on materiality | Mar-2015 | Harvard Business School | 2,307 listed companies | Companies with good performance on material sustainability issues for their industry significantly outperform companies with poor performance on these issues |

| From the stockholder to the stakeholder: How sustainability can drive financial outperformance | Sep-2014 | Arabesque Partners and University of Oxford | 190 studies | 80% of reviewed studies demonstrate that ESG factors have a positive effect on investment performance |

Source: Sustainalytics (2017)21

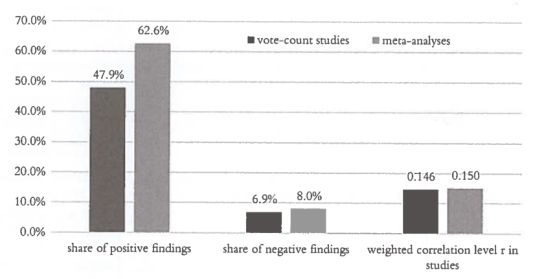

Probably the most comprehensive study to examine the link between ESG and corporate financial performance is one conducted in 201522 that combined the findings of about 2,200 individual studies that were the subject of 60 review studies analyzed by its authors. The results show that the business case for taking ESG into account in investing is empirically well founded. Roughly 90% of the researched studies found a non-negative relationship between ESG and corporate financial performance (predominantly measured by stock returns). The large majority of studies reported a positive correlation, and that the positive ESG impact on corporate financial performance appeared to be stable over time.

The following table gives an overview of the results, distinguishing between so called vote count studies23 and meta-analyses (econometric review studies).

Strong business case for ESG integration – Overview over the results of almost 5 decades of empirical research

Source: Friede/Busch/Bassen (2015)

In this summary of the empirical evidence collected over several decades, no explicit distinction is made based on the underlying motivation for using ESG information in the investment process. Accordingly, the results are a mixed bag that include approaches with a pure SRI background, i.e. ethical, moral, exclusionary and impact driven motivations, as well as approaches motivated purely by financial performance.

Disentangling SRI considerations from the results is not an easy task, since the test design in academic research typically doesn't model exactly how ESG is used in an investment approach. In practice, for example, a portfolio manager may use ESG factors to manipulate the parameters of the discounted cash flow model for a company. Accordingly, ESG assessments are applied in the context of a specific investment decision and not isolated from it. In empirical research this is typically not taken into account, partly because there are valid limitations to doing it. In any event, the consequence typically is that either ESG ratings (provided by ESG research providers such as MSCI, Sustainalytics or oekom) are used, or simple exclusion criteria are applied. ESG Ratings combine ESG individual indicator scores that are typically based on company reported information.

The way these indicators are designed, scored and then combined inevitably reflect certain attitudes and convictions of their providers. Each empirical test of the relationship between ESG and financial performance that uses these ratings, therefore, is a joint test of the providers' methodology and judgemental capabilities on the one hand, and the value of taking ESG information into account on the other. This means that empirical tests may either be biased towards "ESG Integration" (financial materiality) or "SRI" (non-financial objectives).

As noted above, the practice up until now is that review studies do not try to make the distinction. And there is a perfectly valid reason for not doing so; it would be a very difficult and tedious mission to disentangle results and allocate them to different buckets according to the underlying motivation of the investment strategy that is to be empirically tested. Maybe this could be a matter of interest for researchers in the future. It is clearly beyond the scope of this paper; so we decided to take a look at individual studies that may shed some light on the question of whether there are performance distinctions between financially motivated ESG integration and SRI motivated ESG integration.

The first is a study published in by the Harvard Business School in 201524 that has been frequently cited recently and has gathered a lot of attention in academia and practice. The study examines the question of whether there is a significant performance difference between portfolios constructed based on ESG issues (such as climate change, human rights, water scarcity, etc.) that are either material or non-material for companies in a given industry (the assessment of the materiality of an ESG issue was based on SASB's materiality map).25 The results of the study are striking. They show that companies with good performance on ESG issues that are considered material for the industry they are operating in significantly outperform companies with a poor performance on these issues over the period from 1991 to 2012. The table below summarizes the most important findings of the study.

Stock market performance on material & non-material ESG issues

Source: Khan/Serafeim/Yoon (2015)

| Low performance on material issues |

High performance on material issues | |

| Low performance on non-material issues |

-2.90% (8.90%***) |

6.01% |

| High performance on non-material issues |

0.6% (5.41%***) |

1.96% (4.05%**) |

** sign. at 5% level; *** sign. at 1% level

The highest positive alpha is generated by portfolios that comprise companies that perform well on material ESG issues and, at the same time, perform poorly on immaterial issues. The annualised risk-adjusted performance is 6%, which is economically highly significant. All four results shown in the table above have the expected sign, and provide evidence that that "ESG Integration" for financial purposes may outperform "SRI".

(b) Rationale for the financial value from ESG Integration

The reasons for findings like the ones described above seem self-obvious. ESG investors are guided by financial performance. Taking ESG factors into account provides them with more financial information that may have a direct relationship to the economic value of the investment. Hence, it appears logical that investors who take ESG factors into account may be in a better position to make better financial decisions.

It is also worth briefly looking at the rationale on the corporate side.26 After all, effective corporate ESG performance typically requires financial resources to support beyond-compliance environmental and social programmes and a transparent corporate reporting function. Researchers have found a variety of benefits associated with advanced corporate ESG performance, including superior resource and energy efficiency, the ability to attract and retain higher quality employees, more effective marketing of products and services and a reduced likelihood of incurring negative regulatory, legislative or fiscal penalties. More broadly, corporate ESG performance is often seen as a proxy for overall management quality.

On a forward-looking basis, a more crucial factor may even be that the financial impacts of many key ESG issues such as climate change, water scarcity, and human capital, to just name a few, appear to be escalating. The growing materiality of these issues is reflected in increasing levels of generalized ecosystem stress, broad-based changes in consumer preferences and tightening regulation. The entry into force of the Paris Agreement in November 2016, together with the release of reporting guidelines from the Task Force on Climate-Related Financial Disclosures, have also played an important role in raising the market's awareness of the growing financial impacts of climate change and energy issues.

All in all, with regard to "ESG Integration" we do see a combination of a strong rationale with strong empirical evidence of outperformance.

(c) SRI Investment Performance

SRI, on the other hand, is different in nature. This is because SRI does not seem to have any single point of financial focus to guide it. In "Impact Investing",27 for example, which we consider to be a subset of SRI, the financial return/risk objective is explicitly considered to be secondary to achieving a positive social or environmental impact.28. SRI tends to be a mixed bag of values-based considerations and norms. It doesn't explicitly target financial outperformance or financial risk mitigation. It has other focal points that relate to many different concerns (typical ones comprise equal employment opportunity, diversity, alleviation of poverty, and human rights), some of which overlap with those ESG issues that are typically considered to be financially material by investors, such as climate change.29 The difference is often one of motivation. SRI tends to be motivated by the specific concern itself – for example, the protection of the environment for the sake of the environment – or by a particular ethical perspective. ESG integration all by itself is simply cold-hearted financial risk/return optimization.

Because the motivations underlying SRI are primarily non-financial, it is not surprising that the empirical evidence, although difficult to isolate, provides a less clear-cut picture than it does for ESG integration for financial purposes. Again, we are only providing an example here that, in our opinion, strongly supports our claim that SRI approaches are likely to be financially less attractive than those investments that integrate ESG information in investment processes with the objective to achieve a superior risk/return profile. Specifically, the example is looking at the success of an approach that is typically found in the SRI space, and that example is the approach to exclude companies from the investable universe.

SRI investors are often exclusionary investors. They exclude certain companies or whole industries because of their products or services regardless of individual companies' financial performance. According to Eurosif, (the European Social Investment Forum), exclusion strategies are still by far the SRI category with the highest volume of assets under management in Europe (amounting to more than 10 trillion Euro in 2015).30

There are certainly many studies that looked at the financial performance of exclusionary investment approaches. One of them is the widely recognized study "The Price of Sin",31 in which Hong and Kacperczyk (2009) found that companies involved in tobacco, alcohol and gambling (the "triumvirate of sin"), are underrepresented in the portfolios of institutional investors subject to social norm pressures (such as pension funds)32 and do also tend to receive less coverage by financial analysts (institutional neglect). Against this background they also found that sin stocks outperformed comparable stocks (similar in size, beta, liquidity, industry, etc.) by a statistically significant margin of 30 basis points per month or about 3.6 percent per year.

Hong and Kacperczyk conclude that sin stocks have higher expected returns due to the neglect effect or heightened litigation risks driven by these companies' higher exposure to social norms. SRI investors who exclude sin stocks from their portfolios, hence, appear to run the risk of systematically underperforming the market. Of course, this is just one example and there are other types of exclusions (e.g., oil, coal, weapons) for which the results may differ. And one also needs to acknowledge that return patterns can change over time. In any case, one important disadvantage of all exclusion approaches is that the reduction in the investable universe necessarily leads to sub-optimal outcomes in the portfolio optimization, in the spirit of Markowitz.33 All in all, although it's beyond the scope of this paper, and hasn't been researched systematically so far, we think it's fair to say that theoretically and empirically the case can be made that there is a performance difference between "ESG integration" and SRI.

Distinguishing between the two at times is confusing not only to governments, plan sponsors, and fiduciaries, but to their service providers as well, including consultants, investment managers, and, yes, even lawyers. In an era where ESG disclosure is being promoted as a minimum legal compliance issue for fiduciaries, it behooves plan fiduciaries to understand where the boundary line is, particularly as it relates to financial performance and financial risk mitigation. As argued above, the legal line is not that vague or uncertain, and it certainly does not encompass the wide spectrum suggested by FSCO's guidance note.34 The economic line is less clear to draw without more research, but there seems to be enough evidence to suggest ESG integration results in outperformance and SRI is less consistent.

4. DOCUMENTING ESG DISCLOSURE

(a) General Dos And Don'ts

In many jurisdictions pension fund fiduciaries must disclose whether, and if so how, ESG factors are incorporated into investment policies. Here are some dos and don'ts.

- Get the disclosures checked by a lawyer. Any written statement can and will be used in evidence in any matter where a proper understanding of fiduciary duty is in issue. It is expected fiduciaries will engage with their actuarial consultants and investment professionals, but the final copy should be reviewed by a lawyer.

- Keep the disclosure short and to the point. Four or five sentences should be sufficient for most pension funds, except possibly larger funds that engage in direct investments and more sophisticated investment consortia or investment structures. More documentation will be required to support particular actions that are taken, but that will usually be in the form of minutes of particular decisions.

- Never say 'never.' Fiduciary duty requires pension fund fiduciaries to consider relevant factors. If a relevant ESG factor is brought to the attention of the pension fund fiduciaries, they should not ignore it. If fiduciaries determine that they will not consider ESG factors, they better explain it.

- Don't get too specific. Fiduciary duty requires factors relevant to financial performance and financial risk mitigation to be considered and others to be ignored. Many factors are contextual and cannot be anticipated. A general reference is less likely to provide evidence that fiduciaries unreasonably restricted their discretion or ignored or excluded relevant ESG factors that arose after development of a policy statement. A general reference should be interpreted as including the broadest range of ESG factors, so fiduciaries might consider referencing whatever radar system they have in place for picking them up, rather than the factors themselves.

- Don't confuse ESG investment practices with SRI or ethical investing. If fiduciaries engage in SRI, then among other things, they better make sure foundation documents or other legal parameters support it. Where SRI is taken into account, fiduciaries might also indicate that they appreciate the differences between pure ESG factor integration and SRI and provide some reasons to demonstrate that they are properly exercising their fiduciary duty and not violating the usual duty to act in the best financial interests of plan members.

(b) Documenting How Fiduciaries take ESG into Account

Again broad statements are best, with only enough detail to relate the factor to what is relevant in the circumstances. Fiduciaries should also ensure the decision is consistent with all parts of an investment policy, for example, keeping the 'how' consistent with proxy voting statements and the rest of an investment policy and philosophy.

Since most plans use external managers, the investment policies for most plans will not be able to say much more than that they take their manager's ability to identify and take ESG factors into account in manager selection, retention, and termination. It doesn't mean it will be a governing consideration, since ESG abilities may be completely offset by management fees, expense ratios, or manager experience. In cases where it's a close call, written reasons for any particular decision to hire, fire, or keep a manager that has to do with their ability to consider ESG factors ought to be set out in minutes or file notes relating to the decision.

For DC plans where investment options are provided to plan members, there may be some additional language required to support the selection of options, or to support inclusion or exclusion of ESG or SRI options.

For larger plans that make direct investments, general statements of principle are likely to be the best course for investment policy disclosure, along with some indication that they use those factors in making decisions to hire, fire, invest, sell, engage, or sue. Again, keep it short. It is the reaction to circumstances and facts that drive the reasonableness of fiduciary behaviour; policy disclosure should not be a 'how to' manual. It should be developed as strategic guidance. The detail of engagement and of other actions taken can ultimately be set out in minutes of meetings or file memoranda that may or may not end up being in the public domain. The point at which a specific decision is made is the point at which reasons for what was done can be contextualized to the circumstances. An investment policy should be broad enough to allow a contextual application that can then be documented to demonstrate reasonableness.

5. FINAL THOUGHTS

ESG disclosure and the confusing and conflating nomenclature that entwines ESG factor integration with SRI and other terms has contributed to considerable confusion. But it has also raised consciousness, resulting in better information about ESG risks and opportunities that could materially affect corporate financial performance as well as the performance of corporations relating to other SRI goals. ESG factors should not be viewed as mere collateral considerations or tie-breakers, but rather, and certainly in any case where the information is readily available, they ought to be viewed as proper components of the fiduciary's primary financial analysis of the economic merits of competing investment choices. More information is usually better in terms of pricing and in terms of encouraging investee companies to do better financially.

While pension fund fiduciaries must inevitably be motivated by financial goals, it is possible they may be able to layer SRI on top of or alongside the financially motivated ESG analysis; but they should seek expert guidance before doing so.

The bottom line is that a proper perspective on ESG for pension fiduciaries is one that sees it as financial insight. As a result, fiduciaries, fund managers and their consultants should be demanding better and more fulsome ESG disclosure. It ought to be dealt with just like any other consideration in the risk-performance-assessment matrix. Fiduciaries and their advisors who understand this will no doubt gain more confidence in devising and disclosing appropriate ESG investment policy that first and foremost serves their fiduciary duty to plan beneficiaries. Who knows, it may also be socially responsible.

Footnotes

1 The United Nations ("UN") Principles for Responsible Investment ("PRI") is a joint initiative of the UN Environment Programme Finance Initiative and the UN Global Compact. It encourages collaboration among its signatories relating to the adoption and incorporation of Environmental, Social and Governance ("ESG") issues into investment decision-making and ownership practices, as well as promoting appropriate disclosure on ESG issues. The six principles can be found at Principles for Responsible Investment, "What are the Principles for Responsible Investment", online: https://www.unpri.org/pri/what-are-the-principles-for-responsible-investment. A complete list of signatories can be found at Principles for Responsible Investment, "Who has signed the Principles?", online: https://www.unpri.org/signatories/who-has-signed-the-principles.

2 This Paper focuses on very basic legal principles that are likely to be relevant in many jurisdictions; however, the authors' acknowledge it is primarily derived from Canadian legislation and law.

3 In Canada, this is referred to as a "Statement of Investment Policies and Procedures" ("SIPP"). The minimum content for a SIPP governing a plan registered in Ontario can be found at subsection 78(1) of R.R.O. 1990, Reg. 909 ("Regulation 909") made pursuant to Ontario's Pension Benefits Act, R.S.O. 1990, c. P.8. Regulation 909 requires SIPP to meet the requirements of Schedule III to the federal Pension Benefits Standards Regulations, S.O.R./87-19 made pursuant to the federal Pension Benefits Standards Act, R.S.C. 1985, c. 32 (2nd Supp.), as modified by sections 47.8 and 79 of Regulation 909. Other jurisdictions have similar requirements (e.g. in the U.K., there is a requirement to adopt a "Statement of Investment Principles").

4 In 2016, the Province of Ontario became (and remains) the only jurisdiction in Canada to adopt an ESG disclosure rule. (The Canadian Constitution Act, 1982, being Schedule B to the Canada Act 1982 (UK), 1982, c. 11 is interpreted to grant legislative authority over pension standards legislation to the 10 provinces and the federal government, depending on the nature of the employment.) Regulations made under the Pension Benefits Act, supra requires there to be an investment policy and since 2016, the policy must indicate "whether environmental, social and governance factors are incorporated into the plan's investment policies and procedures and, if so, how those factors are incorporated." (Regulation 909, supra at s. 40(v)(ii)). The regulations also require a similar disclosure to be included in annual statements to members and deferred vested members and in biennial statements to retirees. See Regulation 909, supra at ss. 78(3), 40(1)(v), 40.1(1)(s) and 40.2(1)(r) respectively. Regulators in several Canadian jurisdictions have effectively indicated ESG factors may be incorporated where they are relevant or consistent with the standards of care and prudence, and therefore no specific regulation is required. In 2005, the Province of Manitoba amended its pension standards legislation in a rather circular fashion to state: "Unless a pension plan otherwise provides, an administrator who uses a non-financial criterion to formulate an investment policy or to make an investment decision does not thereby commit a breach of trust or contravene this Act if, in formulating the policy or making the decision, he or she has complied with ..." the legislated prudence standards. (The Pension Benefits Act, C.C.S.M. c. P32 at s. 28.1(2.2)). Under Canadian law, the "administrator" is the plan fiduciary.

5 In the authors' view, ESG integration is simply about taking into account any and all financially material risks and opportunities; it is not about achieving particular environmental, social or governance goals. The latter seems to be the purpose of SRI.

6 Ontario, Financial Services Commission, Investment Guidance Note IGN-004: Environmental, Social and Governance (ESG) Factors (October 2015), online: http://www.fsco.gov.on.ca/en/pensions/policies/active/documents/ign-004.pdf.

7 Manitoba's Pension Benefits Act, supra at s. 28.1(2.2).

8 See e.g. Stephanie Baxter, "Government plans to change investment regulations on ESG risks" (18 December 2017), Professional Pensions, online:https://www.professionalpensions.com/professional-pensions/news/3023289/government-plans-to-change-investment-regulations-on-esg-risks. See also Susanna Rust, "UK politicians up ante over pension funds and climate change, ESG" (5 March 2018), IPE, online: https://www.ipe.com/news/esg/uk-politicians-up-ante-over-pension-funds-and-climate-change-esg/10023501.article. Risk relating to ESG factors is on the agenda in the revised Directives, EC, European Parliament and Council Directive 2016/2341 of 14 December 2016 on the activities and supervision of institutions for occupation retirement provision (IORPS), [2016] O.J. 2341 (commonly known as the "IORP II Directive".) There are a number of ESG-related clauses in the Directive, that can be broadly summarised as requiring occupational pension providers to evaluate ESG risks and disclose information to current and prospective pension plan members.

9 Companies Act 2006 (U.K.), c. 46

10 Recommendations from the Australian Securities Exchange ("ASX") provide that companies listed on the ASX should disclose whether they have any material exposure to economic, environmental and social sustainability risks and, if so, how they manage or intend to manage those risks.

11 See e.g., Ontario Securities Commission, CSA Staff Notice 51-354: Report on Climate change-related Disclosure Project (5 April 2018). See also section 3.4 of Ontario Securities Commission, National Policy NP 58-20, Corporate Governance Guidelines (17 June 2005) states that an issuer's board should adopt a written mandate that explicitly acknowledges responsibility for, among other things: (i) adopting a strategic process and approving, at least annually, a strategic plan that takes into account the opportunities and risks of the business; and (ii) the identification of the principle risks of the issuer's business and ensuring the implementation of appropriate systems to manage these risks.

12 Common law principles as expressed in a long history of English cases that predate and follow Balls v. Strutt (1841) 1 Hare 146, including Cowan v. Scargill, [1985] Ch. 250 (H.C.) and Harries v. Church, [1993] 2 All. E.R. 300 (H.C.) appear to be entirely consistent with Canadian law (and would in any case inform Canadian law) insofar as it is a pension fiduciary's duty when exercising a discretion to take into account matters or information relevant to the purposes of the trust. Where the purpose of the trust is to provide retirement benefits (i.e., financial benefits), information relevant to financial performance or financial risk mitigation are not only appropriate to take into account, but where they are known, must be taken into account. Accordingly, ignoring ESG information relevant to financial performance may be considered a breach of trust, which is not to say that there may be other counter-balancing factors or circumstances that could trump ESG factors in the final decision. The point is that fiduciaries in Canada should not limit the scope of relevant information by indicating ESG factors are never considered because if relevant information is readily available or comes to their attention, they may have a duty to consider it.

13 See e.g., PRI, supra; the UN Environmental Protection Financial Initiative ("UNEP FI"); and The Generation Foundation, Fiduciary Duty in the 21st Century, Canada Roadmap (17 January 2017), online: https://www.unpri.org/news/pri-publishes-recommendations-for-market-wide-esg-adoption-in-canada.

14 Preamble to US, Federal Register, ERISA Interpretive Bulletin 2015-01: Interpretive Bulletin Relating to the Fiduciary Standard Under ERISA in Considering Economically Targeted Investments (Washington, DC.: US Department of Labor, 2015): "Environmental, social, and governance issues may have a direct relationship to the economic value of the plan's investment. In these instances, such issues are not merely collateral considerations, or tie-breakers, but rather are proper components of the fiduciary's primary analysis of the economic merits of competing investment choices."

15 For example, it would not be permissible to follow a direction that was at odds with relevant pension standards, tax, human rights or similar standards. It should also be noted that in Canada, in order to receive preferential tax treatment for pension funds, subsection 8502(a) of the Income Tax Regulations, C.R.C, c. 945 requires "the primary purpose of the plan [to be] to provide periodic payments to individuals after retirement and until death in respect of service as employees". In other words, the primary purpose must be financial, but that would not necessarily preclude giving consideration to moral or ethical purposes, as long as the documents establishing the plan make it clear that achieving such purposes is secondary to the primary financial purpose.

16 At least in Canada. The investment policy is a governance tool that guides strategy and conduct; it does not dictate conduct. The investment policy flows from and must be consistent with the constating documents.

17 Supra notes 2 and 10.

18 This presupposes that more economic information relevant to the making of investment decisions would be a positive development.

19 ESG factor integration is not an investment discipline that only considers ESG criteria to generate long-term competitive financial returns. Most pension funds will have short, medium and long term goals that depend on the nature of the plan liabilities, the rate of funding and the demographic characteristics of the plan's beneficiaries. It is the goals of the pension fund that are relevant, not social impact. SRI, on the other hand, tends to incorporate ESG criteria to generate positive societal impact which tends to lead SRI almost exclusively to long-term considerations.

20 See e.g., Siddiqui, Anum, "Morningstar Minute: SRI exclusion vs. ESG inclusion" (13 December 2016), Morningstar, online: http://tools.morningstar.ca/cover/videoCenter.aspx?region=CAN&culture=en-CA&id=784535. Ms. Siddiqui notes "in particular, excluding so-called sin stocks, such alcohol tobacco and gambling, can have a negative impact, as these stocks have higher expected returns and can be more attractive from a risk-adjusted return perspective."

21 Sustainalytics, ESG risk in default funds: Analysis of the UK's DC pension market, PLSA discussion paper (2017). https://www.plsa.co.uk/Policy-and-Research/Document-library/ESG-risk-in-default-funds-analysis-of-the-UKs-DC-pension-market.

22 Gunnar Fried, Timo Busch & Alexander Bassen, "ESG and financial performance: aggregated evidence from more than 2000 empirical studies" (2015) 5 Sustain. Fin. & Invest. J. 210, online: https://www.tandfonline.com/doi/pdf/10.1080/20430795.2015.1118917 This very comprehensive study is a meta-analysis of over 2,000 empirical studies conducted since the 1970s. They concluded that the business case for ESG investing is empirically very well founded. Roughly 90% of studies find a nonnegative ESG to corporate financial performance (CFP) relationship, but more significantly, a large majority of studies report positive findings. "We highlight that the positive ESG impact on CFP appears stable over time."

23 Vote-count studies count the number of studies with significant positive, negative and nonsignificant results, and "votes" the category with the highest share as winner.

24 Mozaffar Khan, George Serafeim & Aaron Yoon, "Corporate Sustainability: First Evidence on Materiality" (2015) Harvard Business School Working Paper No. 15-073.

25 The Sustainability Accounting Standards Board ("SASB") is an independent, private-sector standards setting organization based in San Francisco, California, dedicated to enhancing the efficiency of the capital markets by fostering high-quality disclosure of material sustainability information.

26 See Sustainalytics (2017), footnote 21.

27 "Impact investing" refers to investments" made into companies, organizations, and funds with the intention to generate a measurable, beneficial social or environmental impact alongside a financial return". Wikipedia, "Impact investing", online: https://en.wikipedia.org/wiki/Impact_investing.

28 The Rockefeller Foundation, "2012 Annual Report" (2012), online: http://annualreport2012.rockefellerfoundation.org/.

29 For an interesting opinion piece, see Dimitris Tsitsiragos, "Climate change is a threat – and an opportunity – for the private sector" (13 January 2016), The World Bank, online: http://www.worldbank.org/en/news/opinion/2016/01/13/climate-change-is-a-threat---and-an-opportunity---for-the-private-sector.

30 See Eurosif, European SRI Study 2016, online: http://www.eurosif.org/wp-content/uploads/2016/11/SRI-study-2016-HR.pdf.

31 Harrison Hong & Marcin Kacperczyk, "The price of sin: The effects of social norms on the market" (2009) 93:1 Fin. Econ. J. 15.

32 The mean institutional ownership in their sample is 24%. In contrast, sin stocks on average have about 19% of their shares held by institutions.

33 Harry Markowitz, the Nobel Prize winning economist who devised the modern portfolio theory, introduced to academic circles in his article, "Portfolio Selection", which appeared in the Journal of Finance in 1952.

34 Supra note 3.

To view the original article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.