The first budget of Ford's Ontario government was introduced on April 11, 2019 (the "2019 Budget"). The 2019 Budget includes proposed changes to the Estates Administration Tax Act, 1998, and an associated Regulation, to be effective January 1, 2020.

Reduction of Estate Administration Tax

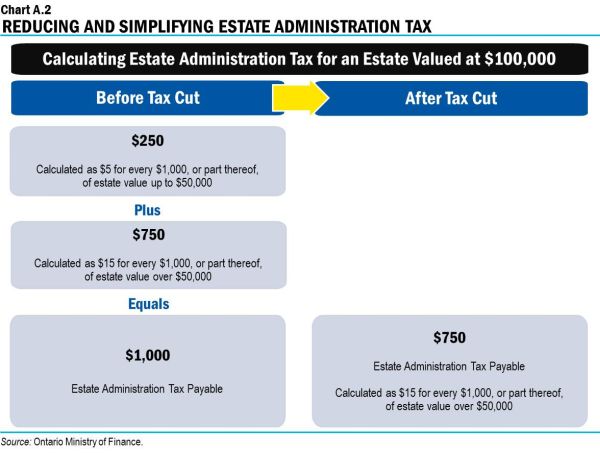

The first proposed change is to the calculation and payment of Estates Administration Tax (more commonly known as "Probate Fees"). Probate Fees are payable at the time an application for a Certificate of Appointment of Estate Trustee with or without a will (the "Certificate") is filed with the Court. Currently, Probate Fees are levied at a rate of $5 per $1,000, or part thereof, on the value of estate assets between $1,000.00 and $50,000.00, and at a rate of $15 per $1,000, or part thereof, on the value of estate assets in excess of $50,000.00.1

The 2019 Budget proposes to eliminate the payment of Probate Fees on the first $50,000 of value of an estate. This means that, for an individual who passes away owning assets with a value of less than $50,000 which require a Certificate to be administered by the individual's executor or administrator, no Probate Fees will be payable by the individual's estate. For larger estates, with a value of greater than $50,000, this change gives rise to a savings of $250, as no Probate Fees will be payable on the first $50,000 of asset value. Below is a chart provided in the 2019 Budget illustrating the proposed savings to an estate valued at $100,000.

Extending the time for filing an Estate Information Return

Introduced by Regulation in 20142 and effective as of January 2015, an executor or administrator for whom a Certificate has been issued is required to file an "Estate Information Return" with the Ministry of Finance within 90 days of the issuance of the Certificate. The Estate Information Return requires greater details than the application for the Certificate regarding the assets of the estate. An inventory of the assets of the estate setting out the fair market value at the date of death of each asset is required, as well as specific details for each type of asset, e.g. for real property, the address of the property, assessment roll number and property identifier number; for bank accounts, the name and address of the financial institution and account number; for investments, the details of all shares, stocks, bonds and the broker/agent name and address; and for vehicles, the vehicle identification number and make and model.

The 2019 Budget proposes to increase the initial filing deadline from 90 days after the issuance of the Certificate to 180 days, thus giving the executor or administrator an additional 90 days to prepare and file the required Estate Information Return.

Currently, if after submitting the initial Estate Information Return, the executor or administrator discovers incorrect or incomplete information, an amended Estate Information Return must be received by the Ministry of Finance within 30 days of the discovery. The 2019 Budget proposes to increase this filing deadline from 30 days to 60 days.

With the proposed increase in the initial filing deadline to 180 days, this may eliminate the need to file amended Estate Information Return.

Footnotes

[1] s.2 of the Estates Administration Tax Act, 1998, S.O. 1998, c.34., Sched.

[2] O. Reg. 310/14.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.