Well, the 2019 Federal Budget was released today. Overall, outside of a couple of surprises, the tax content was almost not newsworthy. This summary discusses the tax content of the Budget that we believe is relevant to our clients and friends. For people that do not have the patience to wade through our entire blog, the following is an executive summary:

- No Tax Rate Reductions – the 2019 Federal Budget contained no personal or corporate tax rate reductions.

- No Commitment to Comprehensive Tax Review/Reform – notwithstanding numerous people and bodies calling on the government to engage in comprehensive tax review/reform, the Budget documents do not contain any plan to carry out such an exercise. Disappointing but not surprising.

- Employee Stock Options – the Liberals' 2015 campaign promise to remove the tax preference on employee stock option benefits is resurrected in a limited form. The Government wishes to remove the tax preference for individuals who work for large, mature companies (the Budget documents do not define this) for benefit amounts associated with the options in excess of $200,000 of the gross value held by individuals. Detailed measures will be released before the summer of 2019 and will be effective on a go-forward basis only and will not affect employee stock options granted before the legislative announcement.

- Intergenerational Transfers – no legislative proposals were introduced in Budget 2019 to address intergenerational transfers of business interests. The government is continuing its outreach to affected parties to try to address and implement some solutions.

- Canada Business Corporations Act Amendments – the Budget documents announce that further amendments to the Canada Business Corporations Act will be made to make newly required beneficial ownership information readily available to tax authorities and law enforcement. The proposed amendments were not included in the Budget materials.

- Canada Training Credit – The Budget introduces a new refundable personal tax credit which allows adults to recover up to half of the eligible tuition costs based on a new "Training Amount Limit" notional account that accumulates by $250 per year.

- Incentives for First-Time Home Buyers – The Budget proposes to expand the RRSP Home Buyer Plan by increasing the withdrawal limit from $25,000 to $35,000 and by expanding access to separated spouses/common-law partners. The Budget also introduced a new CMHC shared equity mortgage program that may have important tax considerations.

- TFSA Amendments – under current rules, if a TFSA is "carrying on a business," the trustee of a TFSA trust (normally a financial institution) is jointly and severally liable with the TFSA for income tax on income from the business or non-qualified investments. The Budget proposes that the joint and several liability for tax owed on income from carrying on a business in a TFSA be extended to the TFSA holder.

- Expanded Annuity Choices for Registered Plans – effective 2020 and subsequent years, the Budget proposes to permit two new types of annuities for certain registered plans: advanced life deferred annuities ("ALDA") and variable payment life annuities ("VPLA").

- Small Business Deduction Fixes for Farmers and Fishers – The Budget expands the "specified cooperative income" exemption for the Small Business Deduction rules to any farming or fishing products sold to an arm's length corporation.

- Accelerated Capital Cost Allowance for Zero-Emission Vehicles – The Budget proposes a 100% accelerated capital cost allowance rate for qualifying Zero-Emission Vehicles purchased before 2024 (with a phase-out afterwards).

- Change in use rules – The elections that enable deemed dispositions of property that occur on a change of use from personal use to income producing or vice versa will be expanded to be utilizable when a property's use is partially changed.

- Journalism Tax Incentives – following up on measures announced in last year's Fall Economic Update, ridiculous measures were introduced to "incentivize" Canadian media companies and "donors" to such organizations. These measures, in our opinion, constitute a threat to a free press.

1. No Tax Rate Reductions

The 2019 federal Budget contained no personal or corporate tax rate reductions. While this is not surprising, it is still disappointing given the fact that our country's personal and corporate tax rates (and the range of personal tax brackets) are not competitive when compared to the gorilla south of the border (the United States). Our firm continues to hold the strong view that tax rate reductions are needed to compete with the US given the strong magnetic pull that US tax reform has had on investment capital.

2. No Commitment to Comprehensive Tax Review / Reform

Notwithstanding numerous academics, business organizations, professional bodies and tax practitioners calling on the government to engage in comprehensive tax reform/review (especially in light of the disastrous July 18, 2017 private corporation tax proposals that attempted to introduce significant tax reform for private corporations and their shareholders), no comprehensive review was announced in this Budget. The last significant tax review/reform occurred by way of the Royal Commission on Taxation chaired by Kenneth Carter (and thus commonly known as the Carter Commission) that was appointed in 1962 and released its final report in 1966. After vigorous debate, the final report's recommendations were instrumental in the implementation of significant tax reform in 1972. Our Income Tax Act (the "Act") has since become a patchwork quilt of amendments that is extremely difficult to navigate and costly for taxpayers to interpret. A little more than a year ago, some Department of Finance bureaucrats were quoted as saying that "Canada is not ready for comprehensive tax reform." Assuming such a quote is true, this statement is, in our experience, not correct.

Comprehensive tax review/reform is sorely needed in Canada to modernize our tax systems. Such a review should include all stakeholders in our tax system and not just the government or academics. There are numerous other "studies" are in existence – or announced – by this Government (such as the Advisory Council on the Implementation of National Pharmacare announced in Budget 2018 and a new Expert Panel on the Future of Housing Supply and Affordability announced in this Budget) and we see no reason why a similar initiative shouldn't be announced for taxation.

3. Employee Stock Options

When the Liberals were campaigning for the 2015 federal election, one of their key campaign promises was to eliminate the existing tax preference on the exercise of employee stock options. Overly simplified, in the right circumstances, any benefit received by an employee on the exercise of stock options can be taxed in a capital-gains-like fashion (since the benefit is fully taxable, but a 50% deduction of the benefit is allowed in most situations thus resulting in a 50% income inclusion for the benefit). Shortly after the Liberals' 2015 election, the Government announced they were not going to carry out their election promise.

The 2019 federal Budget resurrects the 2015 Liberal campaign promise in limited form. While the Budget documents are short on detail, it did contain the following material:

Budget 2019 announces the Government's intent to limit the use of the current employee stock option tax regime and move toward aligning the tax treatment with the United States for employees of large, long-established, mature firms.

Employee stock options, which provide employees with the right to acquire shares of their employer at a designated price, are an alternative compensation method used by businesses to increase employee engagement, and promote entrepreneurship and growth. Many smaller, growing companies, such as startups, do not have significant profits and may have challenges with cash flow, limiting their ability to provide adequate salaries to hire talented employees. Employee stock options can help such companies attract and retain talented employees by allowing them to provide a form of remuneration linked to the future success of the company.

To support this objective, the tax rules provide employee stock options with preferential personal income tax treatment in the form of a stock option deduction which effectively results in the benefit being taxed at a rate equal to one half of the normal rate of personal taxation, the same rate as capital gains. The tax benefits of the employee stock option deduction, however, disproportionately accrue to a very small number of high-income individuals.

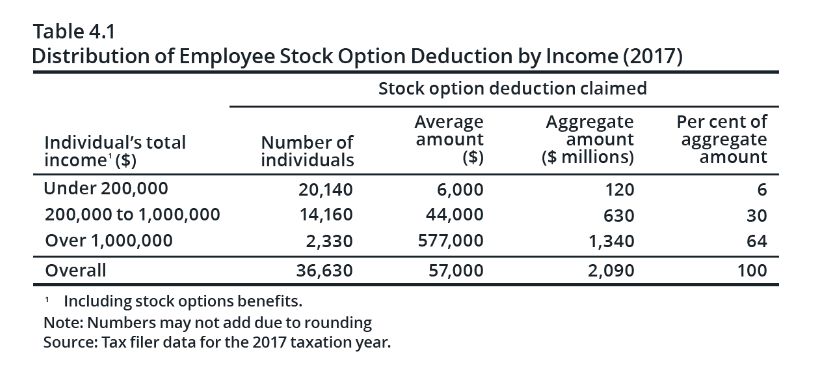

When examining the evidence, it is clear that the employee stock option deduction is highly regressive. In 2017, 2,330 individuals, each with a total annual income of over $1 million, claimed over $1.3 billion of employee stock option deductions. In total, these 2,330 individuals, representing 6 percent of stock option deduction claimants, accounted for almost two-thirds of the entire cost of the deduction to taxpayers.

The public policy rationale for preferential tax treatment of employee stock options is to support younger and growing Canadian businesses. The Government does not believe that employee stock options should be used as a tax-preferred method of compensation for executives of large, mature companies.

To address this inequity, the Government intends to move forward with changes to limit the benefit of the employee stock option deduction for high-income individuals employed at large, long-established, mature firms. In its approach, the Government will be guided by two key objectives: 1. to make the employee stock option tax regime fairer and more equitable for Canadians, and 2. to ensure that start-ups and emerging Canadian businesses that are creating jobs can continue to grow and expand.

Specifically, the Government will move toward aligning Canada's employee stock option tax treatment with that of the United States by applying a $200,000 annual cap on employee stock option grants (based on the fair market value of the underlying shares) that may receive tax-preferred treatment for employees of large, long-established, mature firms. Under this approach, the vast majority of employees of these firms that may receive employee stock option benefits would be unaffected.

For start-ups and rapidly growing Canadian businesses, employee stock option benefits would remain uncapped. In this manner, start-ups and emerging Canadian businesses will be protected and maintain the ability to use employee stock options as an effective tool to attract and reward employees and accelerate their growth.

Further details of this measure will be released before the summer of 2019.

Any changes would apply on a go-forward basis only and would not apply to employee stock options granted prior to the announcement of legislative proposals to implement any new regime. [emphasis added]

As mentioned, the details of this proposed measure are lacking but here are our initial comments/questions:

- What will the definition of "large, long-established, mature firms be? This definition will be important;

- The $200,000 annual cap on employee stock option grants is based upon the gross value of the underlying stock options as opposed to the underlying gains associated with such grants. Not sure what the policy rationale is behind this arbitrary number;

- Will the $200,000 be increased in the future? Say, indexed to inflation?

- Will these new rules apply to large Canadian-controlled private corporations ("CCPC") as well? If so, the stock option rules under subsection 7(1.1) of the Income Tax Act will need to be amended. Existing subsection 7(1.1) can provide significant deferral opportunities (since the taxability of the stock option benefit is automatically deferred until the underlying stock is sold whereas for non-CCPCs, the amount of the stock option benefit is taxed upon exercise of the option);

Stay tuned once the details of the new proposals become available before the summer of 2019 (which technically should be before the first day of the summer – June 20, 2019), we will provide comments then. In the meantime, affected persons should consider an accelerated exercise plan if the underlying investment conditions are appropriate. New option issuances and acceleration of vesting requirements should also be considered before the start of summer 2019.

4. Intergenerational Transfers

During the July 18, 2017, private corporation tax proposal debacle, the issue of intergenerational transfers of private business interests – including those of farmers, fishers and all small businesses – became a prominent issue. This is because the original July 18, 2017 proposals would have seriously impacted the ability of private business owners to tax efficiently transfer businesses down to the next generation or related parties. Those proposals, had they been enacted, could have resulted in egregious rates of tax – some as high as 93% upon death. Such proposals were ultimately withdrawn, but it highlighted an old chestnut issue that most private corporation tax advisors have struggled with for years – it is often better from a tax perspective to transfer the family business to an arm's length party to:

- utilize the capital gains deduction since the capital gains deduction is often restricted or unavailable in a situation if the family business is transferred to a related party; and

- avoid deemed dividend treatment if family-owned corporate funds were used to make the purchase.

There are a number of organizations – including the Conference for Advanced Life Underwriting ("CALU") – who have written the government with suggestions on how to tackle this old issue. Also, the province of Quebec has tackled this issue with its legislation to assist – in very limited circumstances – such intergenerational transfers. Unfortunately, little federal progress has been made, but the government made the following comment in the 2019 Budget documents:

The Government understands the importance Canadian farmers, fishers and other business owners place on being able to pass their businesses on to their children. The Government will continue its outreach to farmers, fishers and other business owners throughout 2019 to develop new proposals to better accommodate intergenerational transfers of businesses while protecting the integrity and fairness of the tax system.

Accordingly, all we can do is stay tuned for further progress on this important matter.

5. Canada Business Corporations Act ("CBCA") Amendments

Last year, amendments were made to require federally incorporated corporations to maintain beneficial ownership information. While no explicit details were released, the Budget documents mention that further amendments to the CBCA will be made to require such beneficial ownership information be readily available to tax authorities and law enforcement.

Our firm will be interested in reviewing the proposed amendments when they become available. While having such information available to tax authorities makes sense to us, the circumstances as to when such information could be obtained by law enforcement personnel will be noteworthy. Stay tuned.

6. Canada Training Credit

The Budget introduces a new Canada Training Credit that will no doubt be prominently featured by the Government as a flagship tax incentive for working adults. Starting in 2019, every individual who meets certain criteria will automatically accumulate $250 into a notional "Training Amount Limit" account. These criteria are:

- The individual has attained the age of 26, and has not attained the age of 66, before the end of the year;

- The individual is resident in Canada throughout the preceding year;

- The individual reports by way of filing an income tax return at least $10,000 of earnings in the year from employment, self-employment and certain other sources; and

- The individual's net income for the year does not exceed the top of the third tax bracket for the year ($147,667 in 2019).

Each individual is allowed to accumulate a maximum of $5,000 into the account over a lifetime. The accumulated dollars in the Training Amount Limit account can be claimed as a refundable tax credit by the individual to cover half of the eligible tuition fees incurred after 2019 at an eligible Canadian educational institution.

The catch is that any such credit received would reduce the amount that may be claimed under the existing Tuition Tax Credit regime. The logic being that an individual should not be entitled to a Tuition Tax Credit for the portion of the tuition that is offset by the credit. While this logic appears reasonable, it is incongruent with the tax treatment of scholarships, which while being tax-free, does not decrease the Tuition Tax Credit that may be claimed. It also adds another layer of complexity to the already busy field of personal tax credits.

7. Incentives for 'First-Time Home Buyers'

Expanded Home Buyers' Plan for RRSPs

Currently, an individual who did not own a principal residence during the current and four preceding years (generally referred to as 'First-Time Home Buyers') may withdraw up to $25,000 from their RRSP under the Home Buyers' Plan (HBP) to purchase or build a home. The Budget proposes to expand the HBP as follows:

- Effective 2019, the HBP withdrawal limit will increase from $25,000 to $35,000; and

- Post-2019, the HBP will be available, with limits, to individuals living separate and apart from their spouses/common-law partners as a result of relationship breakdown.

New CMHC Shared Equity Mortgage for First-Time Home Buyer

A big-ticket item announced in the Budget is a new shared equity mortgage program for first-time home buyers. The new program will be administered by the Canada Mortgage and Housing Corporation ("CMHC") and not under the Act. Under the new program, the CMHC will offer qualified first-time home buyers a 10 percent shared equity mortgage for a newly constructed home or a 5 percent shared equity mortgage for an existing home. The shared equity mortgage will be repayable when the property is sold in the future, and the amount repayable will likely depend on the extent of any appreciation or depreciation in the value of the property although details on the repayment amount lack in the Budget documents.

What seems to be missing from the Budget documents are the details behind the tax implications of such shared equity mortgages. The shared equity mortgage is essentially a price reduction benefit received by the home-buyer, and the Government shares in the rewards and risks of acquiring the property. Is the shared equity mortgage amount an inducement under paragraph 12(1)(x) of the Act? Is there an implied notional interest benefit that should be taxable? Is it completely non-taxable? Also, on the repayment of this shared equity mortgage, how – if at all – does it impact the proceeds of disposition for computing capital gains? Hopefully, Finance will consider these tax issues when they roll out the new program.

8. TFSA Amendments

Under current rules, a TFSA is liable to income tax under Part I of the Act if it is carrying on a business or holds non-qualified investments. In recent years, the CRA has been aggressively reviewing TFSAs – through one of its audit projects – to see if such vehicles realize business income. The CRA has been interested in large gains accumulated in TFSAs through aggressive trading strategies and has been asserting that such TFSAs are carrying on a business and assessing such TFSAs for income tax. While such a position is debatable, the financial institution trustee of the TFSA has been held liable for the resulting income tax given the existing rules provide for such.

Budget 2019 proposes that the joint and several liability for tax owed on income from carrying on a business in a TFSA be extended to the TFSA holder. This new proposal is harsh but makes sense from our perspective.

9. Expanded Annuity Choices for Registered Plans

Effective 2020 and subsequent years, the Budget proposes to permit two new types of annuities for certain registered plans: advanced life deferred annuities ("ALDA") and variable payment life annuities ("VPLA"). ALDA will be of particular interest to those retirees who prefer to retain as much capital as possible in their registered retirement plans, as it allows for deferring commencement of the annuity until the year in which the annuitant reaches age 85.

10. Small Business Deduction Fixes for Farmers and Fishers

The 2016 federal Budget introduced wholesale amendments to the small business deduction ("SBD") regime to curtail planning that multiply access to the $500,000 SBD limit. Under the originally introduced rules, farmers and fishers who sell to cooperatives in which they have an interest would be prevented from claiming the SBD. To fix this, Finance subsequently inserted an exemption for "specified cooperative income" so that these farmers and fishers continue to benefit from their SBD.

The 2019 Budget proposes a further expansion of this exemption. Retroactive to tax years that begin March 21, 2016, a farmer or fisher's income would be exempt from the SBD curtailment rules introduced in 2016 as long as their produce is sold to an arm's length corporation. This is welcome news and may provide new tax planning opportunities for farmers and fishers.

11. Accelerated Capital Cost Allowance for Zero-Emission Vehicles

The Budget proposes to offer a 100% accelerated capital cost allowance ("CCA") rate for motor vehicles that are either fully electric, plug-in hybrids with a battery capacity of at least 15 kWh or fully powered by hydrogen. The enhanced CCA rate will apply to eligible vehicles that are acquired and become available for use on or after March 19, 2019, with a phase-out starting 2023, as follows:

If you have been eyeing a zero-emission vehicle, and you will be able to use that vehicle to earn income from a business or property (one of the criteria for claiming CCA), this may be the time to take the plunge.

12. Change in Use Rules – Subsection 45(2)

Under current rules under section 45 of the Act, when a taxpayer changes the use of a real estate property from personal-use (such as using the property as a principal residence) to income producing (such as using the property for a rental property) or vice versa, the Act deems the person to have disposed of the property – and reacquired it – at the time of the change in use. Under existing subsection 45(2) of the Act, an election can be made to deem the disposition not to have occurred and thus to defer the gain until it is realized upon a future disposition. Under subsection 45(3) of the Act, when an election is made on a conversion to or from a principal residence, the property can be designated as a taxpayer's principal residence for an additional period up to 4 years before or after the period for which the taxpayer could otherwise claim the principal residence exemption in respect of the property (provided no other principal residence exemption is claimed in respect of those additional years).

The deemed disposition rules also apply when the use of part of a property is changed. The Budget documents use the example of a duplex when a person starts renting one of the units or moves into one of the units. Under current rules, the affected taxpayer cannot elect out of the deemed disposition that arises on such a partial change. Budget 2019 intends to implement rules to enable such partial change in use deemed dispositions to be eligible for election to defer such gains. This is welcome news.

13. Journalism Tax Incentives

Last fall, the Government announced its intentions to provide tax incentives/relief for certain Canadian journalism. The Budget documents follow through on their stated intentions with the following three new measures:

- Allows certain journalism organizations to register as qualified donees which will enable those organizations to register as a "registered journalism organization." Once registered, those organizations will be able to issue charitable receipts to donors of such registered journalism organizations. This measure will apply as of January 1, 2020;

- Qualifying journalism organizations will be eligible for a refundable tax credit equal to 25% on salary or wages paid to eligible newsroom employees subject to a cap on labour costs of $55,000 per eligible employee per year (thus equating to a maximum refundable credit of $13,750 per employee). This measure will apply to salary and wages earned in respect of a period on or after January 1, 2019. Wow.....this is extremely rich; and

- A new temporary non-refundable credit is introduced for individuals to claim up to 15% of their eligible digital news subscriptions subject to a cap of $500 paid towards such subscriptions. This new credit will be available for subscriptions amounts paid after 2019 and before 2025.

Overall, these measures are horrible. And a threat to the free press given the likelihood that our country's media will be incentivized to receive these tax goodies and perhaps cater to big "donors." Will they be incentivized to hold our government to account given such free money? Perhaps not. In our opinion, the threats to our Canadian democracy cannot be overstated by introducing ridiculous measures like this. Can the press be "bought" by our Canadian government? Let's sure hope not.

Moodys Gartner Tax Law is only about tax. It is not an add-on service, it is our singular focus. Our Canadian and US lawyers and Chartered Accountants work together to develop effective tax strategies that get results, for individuals and corporate clients with interests in Canada, the US or both. Our strengths lie in Canadian and US cross-border tax advisory services, estateplanning, and tax litigation/dispute resolution. We identify areas of risk and opportunity, and create plans that yield the right balance of protection, optimization and compliance for each of our clients' special circumstances.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.