Have you received advice from an accountant or a lawyer on the best way to structure your fishing business? If so, did that advice take the most recent Income Tax Act amendments into consideration? Finding the structure that is optimal for your circumstances can make a world of difference to you and your family. Cox & Palmer is committed to ensuring that our clients are structuring their businesses in the best way possible to help them meet their goals.

Types of Business Organizations

Sole Proprietorship

If your business assets (such as licences and vessels) are owned by you personally and you report your business income on your personal tax return, you are likely carrying on business as a sole proprietor. If this is the case, you may be missing out on valuable benefits that a corporate structure can provide.

There are scenarios in which a sole proprietorship is the best way to carry on business, especially in the early or start-up stage. Generally, from a taxation perspective, as the business begins to produce more income than the owner(s) spend in any given year, other types of business organization should be considered. Additionally, from a legal risk perspective, sole proprietorships do not limit your personal liability (to creditors, employees, lawsuits, etc.) so determining your exposure to potential liabilities is an essential step in considering whether you should make the change to another structure.

Corporation

A corporation is a separate legal entity and a separate taxpayer. Generally, a corporation's liabilities are its own, which means less risk for its owners. Corporations carrying on fishing business generally pay tax at lower rates than sole proprietorships. The most significant tax benefit of using a corporation to carry on fishing business is that tax can be deferred. The money you don't need to spend on yourself and your family in any given year can be left inside the corporation and invested. The 2018 Federal Budget brought limitations to the amount of investment income that corporations can generate while still benefiting from a low tax rate, but those limitations only kick in when the corporation is generating over $50,000 per year in investment income (the equivalent to earning 5% on $1,000,000 in investments being held in the corporation).

It should also be mentioned that corporations offer added benefits in estate planning. If you plan to pass your business onto the next generation, having a corporation in your business structure should be considered as it may offer flexible solutions for transitioning the business in a tax-efficient manner.

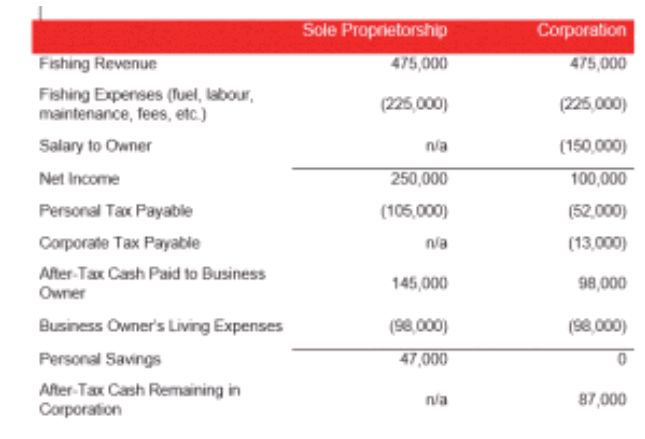

Sole Proprietorship Versus Corporation Example *

In the above example, if the business owner required $98,000 in after-tax cash to live off (for housing costs, car payments, food, clothing, family expenses, healthcare, etc.), he or she would have $47,000 ($145,000 – $98,000) in savings that year to invest personally. However, if the business was operated through a corporation, the owner would take a salary of $150,000, resulting in approximately $98,000 in after-tax income. This would leave $87,000 in the corporation to be invested there.

All else equal, the $87,000, when invested, is going to generate a higher return than the $47,000 and, over time, this advantage will be compounded. The cash in the corporation is subject to personal tax when it is eventually paid out of the corporation to the business owner, but nevertheless, tax deferral will prove to be more advantageous, especially over the long-run.

__________

* The example above is overly simplistic as it is meant to briefly illustrate the difference between income tax paid by a sole proprietorship and income tax paid by a corporation and its principal. None of the figures or calculations should be relied upon as constituting tax or legal advice.

Written with contributions by Alicia Wilbert, CPA, CA, JD, Articled Clerk.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.