A few years ago, we canvassed the now outdated and antiquated financial assistance (or illicit loan) provisions that remain in the Newfoundland and Labrador Corporations Act (the "Act") and the problems they create for financial institutions seeking guarantees in financing transactions. In that article, we highlighted the statutory provisions that place significant restrictions on inter-company financial assistance (most typically in the form of cross-corporate guarantees between related companies), the consequences for a breach of those provisions and some possible solutions to the problems they create. That article, Trapdoors in Newfoundland and Labrador Transactions: Prohibited Financial Assistance, can be found in the right-hand margin of the web version of this article, listed under Related Articles. There is no doubt that the illicit loan provisions make secured cross-corporate guarantees – which are a staple in many financings – a challenge for lenders and borrowers alike. We also provided several solutions to respond to the provisions of the Act, including:

- Solvency Certificates

- Qualify for Statutory Exemption

- Co-Borrower Structure

- Exporting to a Different Jurisdiction

This article seeks to examine in greater detail the solutions and work-arounds.

Solvency Certificates

If done right, solvency certificates can be an effective method of satisfying the illicit loan provisions of the Act. On the surface the presentation of a solvency certificate seems to be an easy solution, but in reality they are complex to prepare and are becoming more and more difficult to obtain.

Their purpose is simple: "circumstances prejudicial to the corporation", which would trigger the illicit loan provisions, occur if the corporation would be put offside either of two financial tests, when called upon to give financial assistance under a guarantee. Thus, an independent financial professional provides a certificate that must confirm that the corporation is, or would be after giving financial assistance, able to pay its liabilities as they become due (the cash flow test), and, after giving financial assistance, the realizable value of the corporation's assets, including the amount of financial assistance, would not be less than the aggregate of liabilities and stated capital (the balance sheet test).

To be reliable, solvency certificates require a deep dive into the financial status of the business and therefore should be provided by an independent and experienced financial professional. Certificates of internal accountants, CFOs, or owners are generally not sufficient. Accountants are increasingly reluctant to provide certificates for the purposes of these sections of the Act which may create difficulty in implementing this solution.

Qualify for Statutory Exemption

A second technique to solve the problem presented by the illicit loan provisions is to qualify for a statutory exemption. Under the Act, financial assistance may be given to a parent holding company by a wholly-owned subsidiary, or to a subsidiary by a parent company.

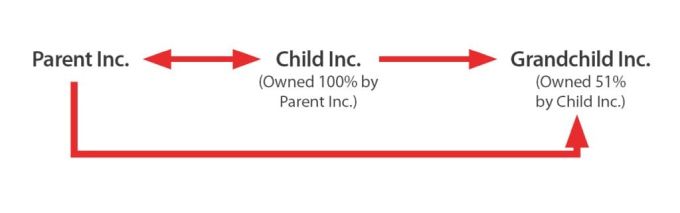

For example, in the graphic below:

- Child Inc. could provide a guarantee for a loan obtained by Parent Inc. because it is 100% owned by Parent Inc.

- Parent Inc. can give financial assistance to both Child Inc. and Grandchild Inc. as they are both subsidiaries.

- Grandchild Inc. could receive financial assistance from Child Inc., but could not give financial assistance to either Child Inc. or Parent Inc. as it is not wholly owned by either.

Restructuring corporate ownership can allow companies to take advantage of an exemption. However, before implementing this solution it is important to first determine the implications to the corporation, including the cost to complete a restructuring, and potential tax implications.

Co-Borrower Structure

A third method employed in dealing with the illicit loan provisions of the Act is to make the guarantor a co-Borrower. The co-Borrower is then no longer giving the "financial assistance" that is prohibited by the Act, but is instead a recipient of a loan.

For this to be a viable option, the co-Borrower must actually receive a benefit under the loan agreement. Where it does not receive a benefit, the co-Borrower, who would otherwise have been a guarantor, may be found to have given prohibited financial assistance. To prevent such a finding it must be evident that both borrowers are receiving a benefit from the loan, and that the co-Borrower structure is not merely a vehicle to avoid the restrictions of the Act.

Exporting to a Different Jurisdiction

A fourth, and perhaps the safest way of dealing with the illicit loan provisions of the Act, is to export and continue the Corporation outside of Newfoundland and Labrador to a jurisdiction that does not have such restrictions in its incorporation statute. Every other jurisdiction in Canada (including the federal Canada Business Corporations Act) has more or less done away with prohibitions against illicit loans. After exporting the corporation, the corporation is governed by the law of the jurisdiction to which it has been exported, thereby avoiding the illicit loan provisions of the Act altogether. Depending on the circumstances, our recommendation is often to export the guarantor to Canada, thereby avoiding the issue entirely.

Whether or not this technique can be utilized effectively and efficiently depends on a number of practical considerations, and it can be relatively costly and time consuming. Furthermore, it cannot occur if it would adversely affect the corporation's creditors or shareholders and it requires shareholder approval.

None of these options is particularly ideal. However, with some advance planning, lenders can chart a course that avoids the risk of illicit loans and the risk they create to the enforceability of lender security. Regardless of the method selected, it is an easier issue to consider and resolve before the term sheet is signed and the deal is almost closed. Lenders and borrowers (and their legal counsel too) prefer solutions that are "by design" rather than facing the delay and distraction of a "fix" or "work-around" at the eleventh hour.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.