On September 21, 2007, representatives of Canada and the U.S. signed the Fifth Protocol (the "Protocol") to the Canada-United States Income Tax Convention1 (the "Treaty"). Canada ratified the Protocol on December 14, 2007. On July 10, 2008 the U.S. Treasury Department released the Technical Explanation (the "TE") to the Protocol and the Department of Finance (Canada) issued a press release stating that the TE "accurately reflects understandings reached in the course of negotiations with respect to the interpretation and application of the various provisions of the Protocol". On July 29, 2008, the U.S. Senate Foreign Relations Committee approved the Protocol and sent it to the full U.S. Senate for approval. The U.S. Senate, on September 23, 2008, ratified the Protocol by unanimous consent. It remains for the President and the Secretary of the Treasury to sign the Protocol and for Canada and the U.S. to exchange instruments of ratification. This is expected to occur before the end of 2008. The Protocol completes a negotiation process that has lasted nearly a decade.

Overview

While the Protocol contains important changes which include, among others, zero rated withholding tax on interest, a deemed services permanent establishment, mandatory arbitration and Canada's first limitation on benefits provisions, two changes in particular have been the focus of considerable attention and will lead to significant rethinking of the way cross-border investments are made into and from Canada:

- the addition of a look-through rule for corporate shares owned through a limited liability company ("LLC") or other fiscally transparent entity ("FTE") in the case of dividends paid within a corporate group, and

- the provision of treaty benefits in respect of income derived through LLCs and other FTEs, subject to a potential denial of benefits in specified circumstances for amounts received from or through certain hybrid or reverse hybrid entities (the latter provision having effect on January 1, 2010).

Dividends

The Protocol proposes no broad changes to the rates of withholding tax on dividends under the Treaty, despite the fact that several other recent protocols to U.S. bilateral tax treaties have introduced withholding tax exemptions for certain dividends within controlled groups. Accordingly, the Treaty's general 15% reduced rate of dividend withholding tax and the 5% reduced rate for dividends paid to corporate shareholders holding 10% or more of a corporation's voting shares will remain the same.

However, two important changes will be made to Article X as described below.

Extension Of 15% Rate On REIT/SIFT Dividends

The Protocol will extend the application of the Treaty's 15% dividend withholding tax rate to dividends on Canadian investor portfolio holdings of U.S. real estate investment trusts ("REITs"). In addition to the application of the 15% rate to Canadian resident individuals owning 10% or less of a U.S. REIT, the 15% rate will apply to Canadian residents, generally, owning either less than 5% of a class of publicly traded REIT shares or less than 10% of a diversified REIT.

The diplomatic notes accompanying the Protocol also explicitly acknowledge that distributions from Canadian income or royalty trusts that are treated as dividends for Canadian tax purposes will be considered dividends for the purpose of the reduced withholding tax rate under Article X. This provision has application to the specified investment flow-through trust ("SIFT") rules which apply to Canadian income and royalty trusts and partnerships (but not certain REITs) established after October 31, 2006, with grand-fathering until 2011 for trusts and partnerships that were publicly trading on October 31, 2006. The purpose of the SIFT rules is to equalize the Canadian tax treatment of these investment vehicles and Canadian corporations. Among the tax consequences of these rules is the re-characterization of income distributions from SIFT trusts and partnerships as dividends for Canadian tax purposes.

One potential consequence of the treatment of SIFT deemed dividends as dividends under Article X is that a qualifying U.S. pension plan or other exempt organization investing in a SIFT will be able to receive deemed dividends from the SIFT trust or partnership free of Canadian non-resident withholding tax pursuant to Article XXI(2) of the Treaty. However, the same investor investing in a Canadian REIT, royalty trust or other trust arrangement that is not subject to the SIFT rules may be subject to Canadian non-resident withholding tax on its income distributions because Article XXI(2) exempts only interest and dividend receipts, not "other income" described in Article XXII.

Look-Through Rule For Share Ownership Through FTEs

The Protocol will also amend Article X of the Treaty to permit the use of a "look-through" in the case of FTEs for the purposes of determining eligibility for the 5% and 15% reduced dividend withholding tax rates. Provided that an FTE is disregarded for U.S. tax purposes and is not resident in Canada, the Protocol will require Canada to look through the FTE and deem a U.S. corporate member of the FTE to own its proportionate share of the Canadian corporate shares owned by the FTE. This look-through treatment provides a significant benefit for U.S. corporate members of fiscally transparent LLCs and complements the Protocol's extension of Treaty benefits in respect of income derived through LLCs and other FTEs.

The TE provides an example clarifying that, for the purposes of determining whether the 10% share ownership threshold is met, a corporation's direct shareholding in a corporation resident in the other Contracting State as well as any indirect shareholding through an FTE may be aggregated. However, neither the Protocol nor the TE provides any guidance on determining a shareholder's proportionate share ownership in an FTE where the shareholder owns more than one class of shares of the FTE.2

FTEs for U.S. tax purposes will include partnerships, grantor trusts, common investment trusts under section 584 of the Internal Revenue Code, and a business entity such as an LLC that is treated as either a partnership or a disregarded entity for U.S. tax purposes. FTEs for Canadian tax purposes are (except to the extent the law provides otherwise) partnerships and "bare" trusts3. As such, once the Protocol enters into force, the Canada Revenue Agency ("CRA") will no longer be able to deny a U.S. resident corporation the benefit of the 5% withholding tax rate under the Treaty on the basis that it is not deemed to own the shares of a Canadian corporation which are owned by a partnership of which it is a partner.

The TE also states explicitly that where an entity is subject to tax but such tax is relieved under an integrated system, the entity is not considered to be an FTE. Accordingly, a Canadian trust (other than a bare trust) that is not subject to tax under the Income Tax Act (Canada) as a result of flowing through all of its taxable income to its beneficiaries should not be considered to be an FTE for purposes of the Treaty. At the International Fiscal Association's 2008 Annual Tax Conference ("2008 IFA Conference"), the CRA confirmed that it would not generally consider a trust that is not disregarded for Canadian tax purposes to be an FTE4.

S corporations, which generally elect to be treated as pass-through entities for U.S. tax purposes, were not specifically contemplated when the Protocol was negotiated. The CRA's general administrative practice has been to treat an S corporation as a U.S. resident for Treaty purposes, thereby allowing it to benefit from the 5% reduced rate of Canadian non-resident withholding tax on dividend receipts where it holds at least 10% of the voting shares of a Canadian corporation. In contrast, the application of the look-through rule in the Protocol would qualify the S corporation only for the 15% reduced rate and not the 5% rate under Article X of the Treaty since its shareholders are individuals rather than corporations. The TE confirms that after the Protocol comes into force, Canada will continue to adhere to its administrative practice of treating S corporations as U.S. residents and not as fiscally transparent for purposes of determining entitlement to the 5% reduced rate of dividend withholding tax under the Treaty5.

Extension Of Treaty Benefits To Income Derived Through FTEs

The benefits of the Treaty are available only to a "resident of a Contracting State", defined in Article IV as a person that, under the laws of that contracting state, is liable to tax in that contracting state by reason of the person's domicile, residence, citizenship, place of management, place of incorporation or any other criterion of a similar nature. The requirement that a person must be a taxable entity in order to claim the benefits of the Treaty has curtailed the use of LLCs in cross-border activities and arrangements.

A U.S. LLC that is treated as a partnership or is disregarded for U.S. tax purposes is not considered by Canada to be a U.S. resident under the Treaty because it is not liable to tax. Therefore, U.S. LLCs have been unable to claim the benefits of the Treaty and have generally been taxable on all profits from a business carried on in Canada, regardless of whether they conduct the business through a permanent establishment situated in Canada. Dividends, interest and royalties paid by a Canadian resident to a U.S. LLC have been ineligible for Treaty-reduced rates of Canadian non-resident withholding tax and have been subject to the full 25% domestic rate. Moreover, Canada has, in the past, not looked through the LLC to its members to determine entitlement to Treaty benefits because the LLC is considered to be a corporation for Canadian tax purposes.

The Protocol addresses the application of the Treaty in respect of income derived through LLCs and other FTEs by introducing new Paragraph 6 to Article IV which will take effect shortly after the Protocol comes into force.

Article IV(6) deems an amount of income, profit or gain to be derived by a resident of the residence state if:

- the person derives the income through an entity that is not subject to tax in the residence state (other than an entity resident in the source state), and

- the treatment of the income under the laws of the residence state is the same as if it were earned directly by that person ("same treatment of income test").

Under Article IV(6), when a Canadian-sourced amount is earned by a U.S.-owned FTE that is not resident in Canada and that is considered to be a partnership or disregarded entity for U.S. tax purposes, that amount will be treated as being derived by the U.S. resident member(s) of the entity for purposes of the Treaty provided that it meets the same treatment of income test. In effect, Article IV(6) will, in such cases, shift the determination of Treaty application to the member level and will result in the entity being disregarded for purposes of Canada's application of the provisions of the Treaty. A similar interpretation will apply for U.S. tax purposes.

Interpretive Issues

The test in Article IV(6) is whether the person "derives" the income through an FTE, not whether the person "beneficially owns" the income which is the operative test for the purposes of applying Treaty reduced rates of withholding tax under the Treaty. The wording of Article IV(6) raises the issue of whether a U.S. or Canadian resident who is considered to derive income through an FTE pursuant to Article IV(6) is also considered to beneficially own that income for the purposes of qualifying for Treaty reduced rates of withholding tax on cross-border payments. The Protocol is silent on the point, but the TE provides guidance on the intended interaction of new Articles IV(6) and IV(7) with the other provisions of the Treaty.

The TE notes that generally the determination of whether a U.S. (or Canadian) resident who derives directly an amount of income, profits or gain from Canada (or the U.S.) is the beneficial owner of such amount will be determined under the internal law of the source country. Where new Article IV(6) applies, i.e., the person receives the amount through an FTE, the internal laws of the residence country must first be applied to determine who is considered to derive the amount under Article IV(6), and then the laws of the source country must be applied to determine whether the person who is considered to derive the amount is the beneficial owner of that amount for purposes of the Treaty.

If the person who derives the income, profits or gain under Article IV(6) is considered to be the beneficial owner of the amount under the source country's internal laws, then the person will be granted Treaty benefits in respect of the amount as long as the person qualifies for Treaty benefits under the new LOB provisions and the anti-hybrid rules in Article IV(7) do not apply. However, where another person is considered to be the beneficial owner of the amount under the source country's internal laws, the source country will grant Treaty benefits only if that person is resident in the other country under the Treaty and is not disqualified under the LOB or anti-hybrid provisions of the Protocol.

The TE also provides some guidance on the criteria for determining whether the same treatment of income test in Articles IV(6) and (7) is satisfied. For these purposes, the U.S. will determine whether the treatment of an amount derived by a person through an entity under the tax laws of the residence country is the same as its treatment would be if that amount had been derived directly by that person in accordance with the principles in section 894 of the Internal Revenue Code and its accompanying regulations. Those principles provide that:

"...an entity will be fiscally transparent under the laws of an interest holder's jurisdiction with respect to an item of income to the extent that the laws of that jurisdiction require the interest holder resident in that jurisdiction to separately take into account on a current basis the interest holder's respective share of the item of income paid to the entity, whether or not distributed to the interest holder, and the character and source of the item in the hands of the interest holder are determined as if such item were realized directly from the source from which it was realized by the entity."

Although Canada's domestic law currently has no similar provisions, the TE states that it is anticipated that Canada will apply principles similar to those adopted by the U.S. in determining whether the same treatment of income test is met.

Furthermore, the TE emphasizes that the tax laws of the residence state will govern both the determination of whether an entity is fiscally transparent and the determination of whether the same treatment of income test is satisfied. It will be irrelevant for these purposes whether an entity would be viewed differently under the tax laws of the source state.

Application Issues

One criticism of the TE is that it does not address the application of Article IV(6) where there are multiple tiers of LLCs or other FTEs with both Treaty-protected and non-Treaty-protected members. At the 2007 CTF Conference, the Canadian Department of Finance indicated that it will look through multiple tiers of FTEs to determine notional Treaty-protected income.

The TE does, however, provide guidance on the application of Article IV(6) by Canada and the U.S. in other contexts. While Article IV(6) provides a look through rule determining entitlement to Treaty benefits in respect of an item of income where it is derived by a U.S. resident through a fiscally transparent U.S. LLC, Canada views the LLC as the relevant taxpayer in respect of the income because the LLC is considered to be a corporation rather than an FTE for Canadian tax purposes. Accordingly, the LLC (and not its U.S. resident members) will be required to file a Canadian tax return in which it claims the benefit of Article IV(6) and provides necessary documentation supporting this claim in respect of its U.S. resident shareholders6. The CRA is expected to provide the administrative procedures for establishing entitlement to Treaty benefits under Article IV(6).

In addition, the TE confirms that if a portion of a U.S. LLC's income constitutes business profits and is not considered to be derived by its U.S. member(s) under Article IV(6), then the income will be subject to Canadian tax. Canadian taxation is imposed irrespective of whether the LLC earns this income through a permanent establishment ("PE") situated in Canada since the LLC is not considered to be a resident of the U.S. under the Treaty. However, the determination of whether the LLC earns the income through a PE situated in Canada is relevant where the income is considered to be derived by a U.S. resident member under Article IV(6), since the income will be considered to have been derived by the member "inclusive of all attributes of that income", including having been earned through a PE. The PE determination must be made based on the presence and activities of the LLC, not its members. Also, as described above, it is the LLC (and not its member(s)) that will be subject to Canadian tax on the business profits attributable to the PE situated in Canada. The Protocol does not address the situation where U.S. members of such an LLC dispose of their participating interests in the LLC. It is expected that Canada will not attempt to tax such dispositions except by applying the normal rules applicable to capital gains or income on dispositions of shares of a corporation.

Canada's approach is contrasted in the TE with that of the U.S., where a Canadian resident is a partner of a Canadian limited partnership which carries on business in the U.S. and is considered to be fiscally transparent for Canadian tax purposes but not for U.S. tax purposes. In determining whether the partnership has a PE in the U.S., the U.S. will look at the activities of both the partnership and its partners. If the partnership does carry on the business through a PE in the U.S., the PE may be attributed to its partners for U.S. tax purposes. If the partnership does not carry on the business through a PE in the U.S., the Canadian resident partner who derives income through the partnership may claim the benefits of Article VII (Business Profits) of the Treaty with respect to its income on the basis that the income is not attributable to a PE of the partner.

Although the Technical Interpretation does not address the interaction of Article IV(6) with the branch tax provisions in Article X(6), the application of Article IV(6) should result in the extension of the 5% reduced branch tax rate under Article X(6) to the repatriated earnings of a Canadian (or U.S.) branch of a U.S. (or a Canadian) FTE with U.S. (or Canadian) resident corporate members.

Potential Impact Of Article IV(6)

It remains to be seen what effect the accommodations granted to members of fiscally transparent LLCs under the Protocol will have in practice. For example, in the case of a widely held LLC, it may be difficult for the LLC to obtain all of the necessary information in respect of its members in order for the payer to withhold at the applicable Treaty reduced rate. Furthermore, since Treaty benefits will be extended only to U.S. resident members of LLCs, U.S. investment vehicles with both U.S. and international investors may continue to be structured as partnerships rather than LLCs. In addition, the combined effect of Article IV(6) and the anti-hybrid rules in Article IV(7) may be to strip away any benefits granted under the former rule.

Nevertheless, the inclusion of Article IV(6) may make it tax efficient for U.S. LLCs to be used in certain circumstances as the direct U.S. parent of a Canadian acquisition corporation without triggering adverse withholding tax consequences.

Denial Of Treaty Benefits Under The Anti-Hybrid Rules

While new Article IV(6) expands access to Treaty benefits for income derived through LLCs and other FTEs, new Article IV (7) introduces rules denying Treaty benefits in two broadly defined sets of circumstances, with adverse effects on certain hybrid and reverse hybrid arrangements beginning in the third calendar year after the Protocol enters into force (January 1, 2010).

Specifically, Article IV(7) will deny Treaty benefits, i.e., an amount of income, profit or gain will be considered not to be paid to or derived by a person who is a resident of a contracting state (the "residence state") if:

- the person is considered under the tax laws of the source state to have derived the amount through an entity (other than an entity resident in the residence state), but by reason of the entity not being treated as fiscally transparent under the laws of the residence state, the treatment of the amount under the tax laws of the residence state is not the same as its treatment would be if the amount had been derived directly by that person (the "Source Hybrid Rule"); or

- the person is considered under the tax laws of the source state to have received the amount from an entity that is a resident of the source state, but by reason of the entity being treated as fiscally transparent under the laws of the residence state, the treatment of the amount under the laws of the residence state is not the same as its treatment would be if the entity were not treated as fiscally transparent in the residence state (the "Recipient Hybrid Rule").

The general principles for, and the domestic law relevant to, determining whether an entity is fiscally transparent and whether the same treatment of income test is satisfied is as described above. However, in contrast to Article IV(6), the determination of whether an item of income is derived or received by a resident of the residence state under Article IV(7) is made in accordance with the domestic laws of the source state, not the residence state.

Source Hybrid Rule

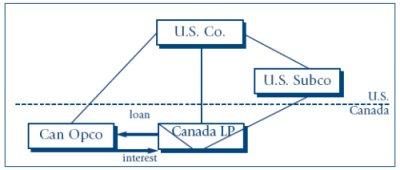

The Source Hybrid Rule will affect common reverse hybrid/synthetic NRO structures used by U.S. corporations to finance their Canadian subsidiaries. In this type of arrangement, the U.S. parent corporation will normally form a partnership under Canadian provincial law and elect to treat the partnership as a corporation for U.S. tax purposes. The partnership, funded with capital contributions from the partners, lends funds to the Canadian subsidiary of one of the partners.

Prior to the effective date for the application of the Source Hybrid Rule, the tax consequences of this arrangement under the Protocol are as follows. For U.S. tax purposes, the partnership will be treated as a foreign corporation. The partnership is deemed, for Canadian tax purposes, to be a non-resident person since its partners are not Canadian residents. However, Canada will look through the partnership to its U.S. resident partners and allow the applicable 7% or 4% reduced rate of Canadian non-resident withholding tax on nonarm's length interest payments made to the partnership, depending on whether the interest is paid or credited in 2008 or 2009.

In contrast, once the Source Hybrid Rule becomes applicable to this arrangement, the interest payments made to the partnership will not be considered to be derived by U.S. residents, with the result that the full 25% domestic rate of Canadian non-resident withholding tax will apply to the interest payments. Accordingly, while it might otherwise be assumed that in this arrangement withholding tax on non-arm's length interest payments will be phased out over a three year period once the Protocol comes into force, such withholding tax will instead increase to the full domestic rate once the Source Hybrid Rule becomes effective.

The impact of the Source Hybrid Rule on Canadian financing of U.S. subsidiaries through an intermediary U.S. LLC may be less significant, since the U.S. anti-hybrid rules in Section 894(c) of the Internal Revenue Code currently apply to LLC hybrid financing arrangements and subject U.S. source passive (non-business) income of the LLC to the full 30% U.S. domestic withholding tax rate. However, as noted in the TE, the Source Hybrid Rule is broader in scope than section 894(c) and may apply in certain circumstances where the U.S. anti-hybrid rules are not triggered, such as where the LLC earns U.S. source business income or income effectively connected with the conduct of a trade or business in the U.S.

Recipient Hybrid Rule

The Recipient Hybrid Rule will also affect structures commonly used by a U.S. resident to invest into Canada.

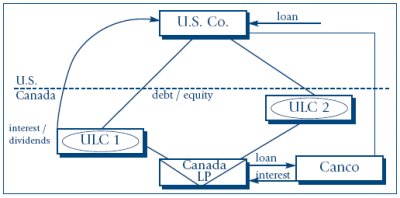

In a basic Canadian acquisition structure, a U.S. resident may incorporate a Canadian unlimited liability company ("ULC") to acquire and hold the shares of a Canadian operating company or partnership, funding the acquisition with a combination of debt and equity. The ULC is considered under Canadian tax law to be a Canadian resident corporation, but is considered under U.S. tax law to be a partnership or disregarded as an entity depending on the circumstances. Prior to the effective date for the application of the Recipient Hybrid Rule, the tax consequences of this arrangement under the Protocol are as follows. Canada will allow the applicable 7% or 4% Treaty reduced rate of Canadian non-resident withholding tax, depending on the timing of the interest payment, on non-arm's length interest payments made by the ULC to its U.S. parent, and the 5% Treaty reduced rate on dividends paid by the ULC to its U.S. parent. However, once the Recipient Hybrid Rule becomes applicable, interest payments made by the ULC to its U.S. parent under this arrangement will not be considered to be derived by a U.S. resident and, therefore, will be subject to the full 25% domestic rate of Canadian non-resident withholding tax. The TE also makes it clear that dividends paid by the ULC to its U.S. parent will also be subject to the full 25% domestic non-resident withholding tax rate.

The Recipient Hybrid Rule will also affect commonly used hybrid financing arrangements in which a U.S. resident contributes capital and lends funds to its Canadian ULC subsidiary which is a partner in a Canadian partnership. The ULC makes a capital contribution to the partnership, with the partnership then lending funds to the U.S. resident's Canadian subsidiary.

Prior to the effective date for the application of the Recipient Hybrid Rule, Canada will levy the applicable 7% or 4% reduced rate of Canadian non-resident withholding tax, depending on the timing of the interest payment, on non-arm's length interest payments made by the ULC to its U.S. parent. However, once the Recipient Hybrid Rule becomes applicable, interest payments made by the ULC under this arrangement will not be considered to be derived by a U.S. resident, with the result that the full 25% domestic non-resident withholding tax rate will be exigible. Again, while it might otherwise be assumed that in this arrangement withholding tax on non-arm's length interest payments will be phased out over a three year period once the Protocol comes into force, it will instead increase to the full 25% domestic rate once the Recipient Hybrid Rule becomes effective.

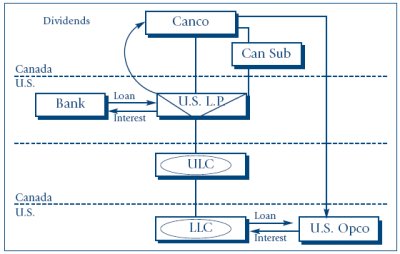

The Recipient Hybrid Rule will also impact Canadian financing of U.S. acquisitions. Where a U.S. partnership which is a hybrid makes distributions to its Canadian partners, the Recipient Hybrid Rule will apply to deny Treaty benefits where Section 894(c) of the Internal Revenue Code does not already apply.

Potential Impact Of The Anti-Hybrid Rules

The new anti-hybrid rules in the Protocol will apply broadly to cross-border arrangements involving the use of hybrids or reverse hybrids. In the Canadian inbound context, U.S. residents have routinely used Canadian ULCs, which are treated as fiscally transparent for U.S. tax purposes, to make investments and to carry on business activities in Canada. Concerns have been expressed that these new rules will affect structures that are not tax abusive, i.e., structures that do not generate double deductions, deductions without income inclusions, or double non-inclusions.7 As noted by the U.S. Joint Committee in its Explanation of the Protocol, legitimate reasons for using such structures include enabling the U.S. parent to operate in branch form for U.S. tax purposes, facilitating the management of foreign taxes for U.S. tax purposes, and maximizing the tax basis of a Canadian stock acquisition.

Furthermore, while the Source Hybrid Rule is similar in scope and effect to Article 1(6) of the U.S. Model Treaty, the Recipient Hybrid Rule is new to U.S. tax policy. The Joint Committee points out that neither the Protocol nor the TE distinguishes between acceptable and unacceptable uses of hybrids, and questions whether another rule may have been negotiated in place of the Recipient Hybrid Rule that would be more precisely targeted to abusive hybrid structures while leaving in place non-abusive structures. In any event, both countries have emphasized that the effective date of the anti-hybrid rules has been set for the beginning of the third calendar year after the Protocol enters into force in order to give taxpayers ample opportunity to restructure their arrangements if necessary. This deferral will be cold comfort to those taxpayers on either side of the border who have structured hybrid arrangements, sometimes with the benefit of tax rulings, and now face the tax costs of unwinding or restructuring.

Another criticism of the anti-hybrid rules is that they do not distinguish between deductible payments such as interest and royalties and non-deductible payments such as dividends or interest that is subject to domestic thin capitalization rules. The Canadian Department of Finance indicated that the anti-hybrid rules were intended to apply to deductible payments such as interest and royalties. However, there is currently no exception from the application of the anti-hybrid rules for non-deductible payments. Widely used basic ULC structures for the acquisition and financing of Canadian businesses will become tax inefficient under the anti-hybrid rules. So far, no commitment has been made by either the U.S. or Canada to consider the issue further or to allow exceptions for non-deductible payments. In fact, the examples provided in the TE of the Source Hybrid Rule make it clear that Treaty benefits will be denied in respect of dividend payments as well as in respect of interest and royalties where Article IV(7) applies.

The Joint Committee has also noted in its comments on the Protocol that it is uncertain from the examples provided in the TE whether the Recipient Hybrid Rule will apply in the same way to deductible interest or royalty payments derived from a hybrid entity that is treated as a partnership rather than as a disregarded entity for U.S. tax purposes. Also, while the TE provides examples from both a U.S. and Canadian tax perspective with respect to the application of the Source Hybrid Rule and the application of the Recipient Hybrid Rule where the hybrid entity is disregarded for tax purposes, it does not provide reciprocal examples of the application of the Recipient Hybrid Rule where the entity is treated as a partnership for tax purposes. If the application of the Recipient Hybrid Rule were to result in the differential treatment of income derived through a hybrid partnership and a disregarded entity, it is unknown what policy rationale, if any, would justify this distinction.

Although the TE has not provided the hoped for clarification and narrowing of the scope of the anti-hybrid rules, it remains to be seen whether the concerns raised about the anti-hybrid rules will be addressed prior to their taking effect. At the American Bar Association Taxation Section's fall meeting in September, 2008, a representative from the U.S. Treasury Department acknowledged that there has been much criticism of the wide scope of the anti-hybrid rules and that the Treasury Department intends to speak with Canadian officials about these concerns, but only after the Protocol is ratified.

Since no grandfathering is provided for existing structures, in addition to determining the potential impact of the anti-hybrid rules on future cross-border financing arrangements, it is crucial that Canadian and U.S. taxpayers re-examine and restructure, if necessary, any existing cross-border arrangements which will be affected. Alternatives to existing cross-border hybrid financing structures are being considered and developed - many of them involving substitution of current Canadian or U.S. hybrids with foreign FTEs or hybrid instruments - on the assumption that the rules will be implemented as they are currently formulated and taxpayers are being advised to give these alternatives serious consideration in their tax planning.

Footnotes

1. Convention Between Canada and The United States of America With Respect to Taxes on Income and on Capital Signed on September 26, 1998, as Amended by the Protocols Signed on June 14, 1983, March 28, 1984, March 17, 1995 and July 29, 1997.

2. See CRA document no. 2007-0261901C6, Article IV(6) "fiscally transparent", dated July 17, 2008.

3. Pursuant to subsection 104(1) of the Income Tax Act (Canada), a trust is considered to be a bare trust where the trustee can reasonably be considered to act as agent for all the beneficiaries under the trust with respect to all dealings with all of the trust's property and the trust is not otherwise excluded. In the CRA's view, a trustee can reasonably be considered to act as agent for a beneficiary when the trustee has no significant powers or responsibilities, can take no action without instructions from that beneficiary and the trustee's only function is to hold legal title to the trust property. In order for the trustee to be considered to act as agent for all the beneficiaries, generally the trustee must consult and take instructions from each and every beneficiary with respect to all dealings with all of the trust property. See CRA document no. 2008-0280771E5, Trustee acts as bare trustee, dated July 28, 2008.

4. See CRA document no. 2007-0261901C6, Article IV(6) "fiscally transparent", dated July 17, 2008.

5. See also CRA document no. 2007-0261911C6, S Corporation and Article IV(6) Canada-US Treaty, dated July 18, 2008.

6. See CRA document no. 2007-0259011C6, "TEI-Taxation of LLC under Protocol", December 4, 2007; 2008 IFA Conference.

7. Tax Analysts Document No. 2008-2256, "NYSBA Members Comment on U.S.-Canada Tax Treaty Protocol", dated January 29, 2008.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.