SRS Acquiom recently published its 2017 Deal Terms Study. The report draws on data from 795 private-target transactions that closed between 2013 and 2016 using SRS Acquiom's services. The results of this study offer a unique and valuable perspective of private M&A transactions that might not otherwise be reported. Some of the key findings are outlined below:

Financial terms:

- Consideration: After a mild decline from 6% to 4% from 2013 to 2015, all-stock deals shrunk to a total of 1% of deals in 2016. Cash/stock combo deals also shrunk to 15% from 21% of deals in 2015 although the 2016 figure is in line with what was seen in 2013 and 2014. Similarly, the proportion of deals in which the buyer assumed options shrunk to 20% from 26% in 2015.

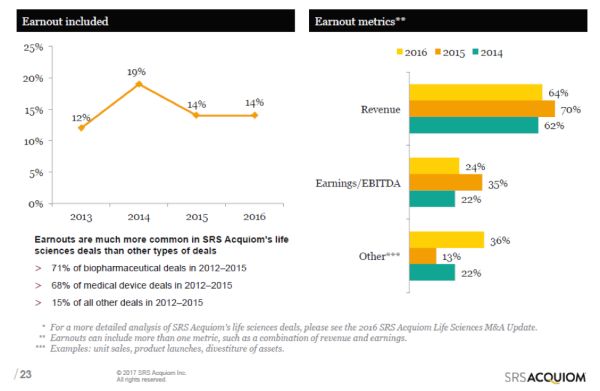

- Earnouts: 14% of non-life sciences deals included earn outs in 2016 which was the same level seen in 2015. While earnouts in deals completed in 2015 were more focused on traditional metrics such as revenue and earnings, earnouts in 2016 were more significantly based on achievements such as unit sales, product launches and asset divestiture.

Closing conditions

- Materiality Threshold for Seller's Representations: A narrow majority of deals required that the Seller's representations be accurate "in all material respects." In most other deals, inaccuracies in the Seller's representations were permissible if they could not be reasonably expected to have a material adverse effect. A small number of deals required the Seller's representations to be accurate "in all respects." Notably, deals where the representations were required to be accurate at signing were about twice as likely to require accuracy "in all respects."

Indemnifications terms

- Indemnification Survival Period: Deals that closed in 2016 saw a slightly decreased survival time. In 2016 50% of deals included survival periods less than 18 months whereas in 2015, that proportion was 43%.

- Indemnity Caps: In all deals studied, the median indemnity cap was 10.2% of transaction value. Most deals included an indemnity cap that was less than 15% or less of the total transaction value.

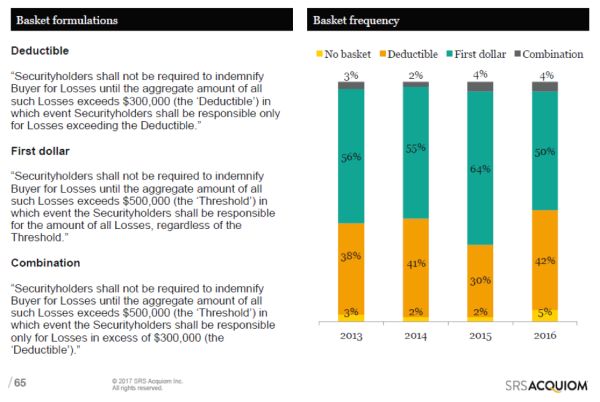

- Baskets: Baskets continue to be a popular deal term, found in 95% of 2016 deals. In particular, deductible baskets become more prominent rising to 42% of all baskets in 2016 from 30% in 2015. First dollar baskets continue to be the most popular with combinations being quite rare. Since 2013, median deductible baskets grew from 0.61% to 0.73% of transaction value.

Trends

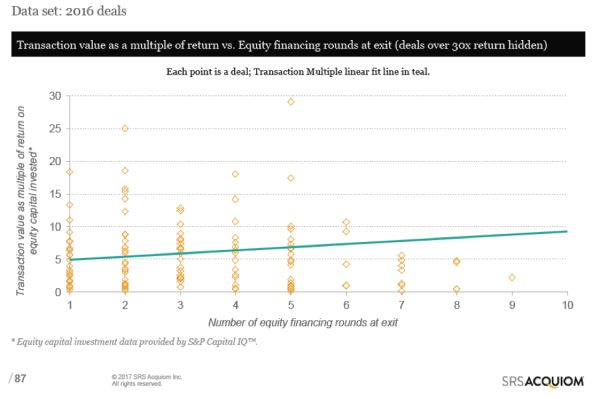

- Financing Rounds vs Transaction Value at Exit: Generally, deals where the target underwent more equity financing rounds increased the transaction return multiple, although this correlation becomes less clear after five rounds of financing.

- Foreign Buyers Earned Higher Multiples: In all deals that closed in 2016, foreign buyers earned a 7.7x multiple on average. Private investors earned the lowest average multiple at 4.8x with public and financial investors in the middle at 6.6x and 6.7x respectively.

The author would like to thank Dan Weiss, Summer Student, for his assistance in preparing this legal update.

About Norton Rose Fulbright Canada LLP

Norton Rose Fulbright is a global law firm. We provide the world's preeminent corporations and financial institutions with a full business law service. We have 3800 lawyers and other legal staff based in more than 50 cities across Europe, the United States, Canada, Latin America, Asia, Australia, Africa, the Middle East and Central Asia.

Recognized for our industry focus, we are strong across all the key industry sectors: financial institutions; energy; infrastructure, mining and commodities; transport; technology and innovation; and life sciences and healthcare.

Wherever we are, we operate in accordance with our global business principles of quality, unity and integrity. We aim to provide the highest possible standard of legal service in each of our offices and to maintain that level of quality at every point of contact.

For more information about Norton Rose Fulbright, see nortonrosefulbright.com/legal-notices.

Law around the world

nortonrosefulbright.com

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.