Amid the swirling political winds of the early days of the Trump administration, there is growing speculation that the President may throw his support behind the House Republican Conference's "Better Way" Blueprint (the Blueprint) for tax reform in the United States.

While President Trump's enthusiasm for the Blueprint has appeared to ebb and flow, recent signals, including comments from the administration regarding the funding for building the "wall," have reinvigorated concerns that he could endorse this plan championed by Republicans in the U.S. House of Representatives. If enacted, the Blueprint proposals would represent a tectonic shift in the U.S. taxation system by effectively repealing the income tax and replacing it with a VAT-like regime referred to as a "destination-based cash flow tax" (DBCFT). The implementation of a DBCFT would have a significant impact on Canadian companies, given the level of economic integration between the Canadian and U.S. economies.

PREPARING FOR THE BLUEPRINT'S POTENTIAL IMPACT

Whether the President chooses to adopt the DBCFT or to chart his own course on tax reform, it is clear that profound proposals are coming. Interestingly, one of the chief architects of the Blueprint, Kevin Brady (R-Texas), has said publicly that he believes that Trump's tax policy team are about "80 percent" on the same page as the Blueprint and indicated that he sees that gap closing. On February 9, 2017, Trump stated that an announcement about a plan regarding taxes would be forthcoming and promised that it would be "phenomenal in terms of tax." We note that President Trump is scheduled to speak to a joint session of Congress on February 28 and, given his inclination to use a big stage to make important announcements, it is possible that he may use that opportunity to announce his tax reform plan.

We believe strongly that early engagement is vital for thoughtful Canadian enterprises deeply invested in the U.S. economy.

There are, of course, very formidable political and practical obstacles to enacting the DBCFT. Despite this, many spectators have noted that there is a viable legislative path to enactment: if the Blueprint proposal is revenue neutral over the relevant budget window and other requirements are met, it could be enacted through the "budget reconciliation" process. This would mean that only a bare majority of Senate votes would be needed to pass the reform (i.e., the legislative vehicle would be filibuster-proof). Skeptics should also take note that senior Republican House leaders – including Paul Ryan, Speaker of the House – are extraordinarily committed to the Blueprint.

It is not the object of this article to engage in speculation about the political prospects for enactment of the DBCFT. Rather, the focus here is to provide a working framework for thinking about the Blueprint and what it means for corporate Canada. While we recognize that the details of the Blueprint at this stage are limited and this discussion is, in that sense, early, we also recognize that the stakes are high. We believe strongly that early engagement is vital for thoughtful Canadian enterprises deeply invested in the U.S. economy. As noted recently by Joe Baratta, global head of private equity at Blackstone Group LP, when speaking to Bloomberg Television about the potential impact of U.S. tax reform: "It's beginning to creep into our investment decision-making. We have to take on board the seriousness of particularly the [Blueprint]. To ignore it would be a breach of our duty to our investors."

These concerns are creeping north of the border into Canada. More particularly, we anticipate that in the coming weeks Canadian tax directors and other officers responsible for managing enterprise risk will be called upon to inform their superiors about the potential effect that the Blueprint may have on their business. This article is intended to assist in that process.

For a copy of the Blueprint, visit A Better Way [PDF].

WHAT IS THE BLUEPRINT?

The Blueprint is a proposal for U.S. tax reform contained in a position paper entitled "A Better Way: Our Visions for a Confident America" published on June 24, 2016, by House Republicans. The goal of the Blueprint is to create growth in American jobs, investment and business opportunities. As part of a broad rethinking of the U.S. federal income tax system, the Blueprint recommends that the current tax rules be largely discarded in favor of the DBCFT. To use the words of the Blueprint itself, the DBCFT would be "a move toward a consumption-based approach to taxation" and "will deliver a 21st century tax code that is built for growth and that puts America first."

There are two key distinguishing features of the DBCFT. The first is that it adopts "cash flow" as its taxing base instead of "net income" (this is where the "CFT" in DBCFT comes from). While macroeconomic analysis is beyond the scope of this article, economists explain that the principal difference between an income tax and a cash flow tax is that an income tax taxes business income as well as income from capital assets (i.e., income attributable to invested capital, such as capital gains, dividends, interest, etc.) whereas a cash flow tax does not tax capital income. Inclusion of capital income in the tax base, it is theorized, represents an undesirable drag on capital investment which, in turn, impairs business growth, productivity and job creation. In addition, cash flow is thought to be a more "raw" measure of profitability that is less susceptible to manipulation than net income (which currently features a multitude of special deductions, depreciation rates and income exclusions chiseled out by special interests).

The second key feature of the DBCFT is that it is "destination-based" (this is where the "DB" in DBCFT comes from) as opposed to "origin-based." These terms reflect, in essence, alternative ways to set the geographic or jurisdictional scope of a cash flow tax. In general, a destination-based cash flow tax imposes the tax based on where consumption occurs (i.e., the tax is imposed on goods and services consumed by U.S. "customers" no matter where those goods or services were produced). By contrast, an origin-based tax asserts tax on cash flows based on where production of the underlying good or service occurs (i.e., cash flows associated with U.S. manufactured goods would be subject to the U.S. tax, no matter where the customer was located in the world).

The shift from an income tax toward a consumption tax would be nothing less than a transformative event and would move the United States into uncharted territory.

To offer context, the Blueprint notes that most of the United States' major trading partners have adopted a VAT or consumption tax to act as a supplement to their regular (territorial) income tax The Blueprint further observes that those VATs are almost universally "destination-based." Accordingly, the core mechanical elements of the Blueprint proposal are hardly new and, in fact, are widely used by most developed economies today. If anything, the United States is an outlier for not having already adopted such a regime. The Blueprint goes on to explain that the coexistence of a VAT with a conventional income tax system has allowed these trading partners to decrease their fiscal reliance on income tax revenues and, as a result, to gradually reduce their corporate income tax rates. Over time, headline rates of corporate taxation in the OECD countries have floated down to levels that are conspicuously lower than U.S. rates. The adoption of the DBCFT would be striking in that it would result in the United States going from a situation where it has no consumption-style tax to a situation where it is virtually "all-in" on this tax. In this way, the United States would be leapfrogging its foreign trading partners by jumping directly to a lower tax rate and a more comprehensive consumption tax base.

WHAT EXACTLY DOES THE BLUEPRINT CALL FOR?

The shift from an income tax toward a consumption tax would be nothing less than a transformative event and would move the United States into uncharted territory. The prospect of such a rupture from existing taxation norms is creating tremendous demand for further detail and confusion about how even the most rudimentary aspects of the DBCFT regime would work in practice. Compounding this uncertainty is the fact that the Blueprint itself is a slim 35-page document that provides only a skeletal outline. However, the Blueprint shares many conceptual roots with the "Growth and Investment Tax" (often referred to as the GIT) proposed by President Bush's Federal Tax Reform Advisory Panel in 2005. Readers looking for more detail about how the Blueprint may work in practice should look at the 2005 GIT discussion and read more about the GIT [PDF].

Pulling these strands of information together, we believe there are eight important components of the Blueprint for Canadians:

- Taxpayers subject to the DBCFT

- Reform the tax base

- Lower the rates

- Border adjustability

- Interest not deductible

- Immediate deduction of most business expenditures

- Losses

- Territorial taxation

Taxpayers subject to the DBCFT

The DBCFT would apply to corporations and individuals. It also appears that the DBCFT would apply to "pass-through" entities (like partnerships) at the entity level rather than the partner level. In a cross-border context (after taking into account the border adjustment mechanism described below), non-U.S. persons would not be subject to U.S. tax unless they sell to U.S. customers. Similarly, U.S. persons would not be subject to U.S. tax on sales to non-U.S. persons. Canadian parent companies with U.S. subsidiaries would apparently not be subject to U.S. taxes on dividends or interest paid by the U.S. subsidiary. It is not yet clear whether the DBCFT proposal would retain the FIRPTA rules which allow the United States to tax foreigners on gains realized on the disposition of certain U.S. real property assets.

Reform the tax base

The Blueprint would discard the old tax base (net income) and replace it with a hybrid tax base of "cash flow" and, to a limited extent, income from capital. The tax base underlying the DBCFT would be comprised of:

- Cash flow: loosely defined as business receipts minus costs incurred by the taxpayer for its production inputs (including labour, materials, supplies and capital expenditures). Essentially, the base would be cash received less cash paid out.

- Investment income: as noted above, capital income (e.g., capital gains, dividends and interest) is not generally included in the tax base of a consumption tax. However, under the Blueprint, individuals would be subject to tax on these items, albeit at reduced rates (6% – 12.5% and 16.5%). The Blueprint's retention of capital income taxation for individuals appears to be a lever to address concerns regarding regressivity as well as the budgetary goal of revenue neutrality.

Lower the rates

The Blueprint would lower the tax rate on corporations to a flat rate of 20% (down from 35%). The Blueprint highlights that this reduction "represents the largest corporate tax rate cut in U.S. history." Flow-through entities would be subject to a 25% rate. Individual tax rates would be graduated at 12%, 25% and 33% (except in the case of income from capital, which would be subject to tax at 50% of those rates – 6%, 12.5% and 16.5%). The alternative minimum tax (AMT) and so-called Obamacare tax (3.8%) on net investment income of individuals would be repealed.

Border adjustability

The "border adjustment" is the mechanism that ensures that the cash flow tax is "destination-based" (i.e., limited to U.S. consumption). More specifically, the border adjustment makes sure the tax is imposed on U.S. sales less the cost of U.S. inputs. The corollary of this is that (a) sales to non-U.S. persons (i.e., exports) are excluded from the tax base, and (b) sales of inputs from non-U.S. persons to U.S. persons (i.e., imports) are subject to the tax. The net effect of these adjustments at the border is, to borrow a metaphor, to build a "tax wall" around the U.S. tax system under which the only thing that is relevant to determining U.S. tax liability is consumption activity that occurs within the United States. As such, cross-border transactions (inbound or outbound) would become non-factors in determining U.S. tax liability. While the border adjustment feature has attracted a disproportionate amount of vitriol, Republicans emphasize that it is actually a common element of almost all VATs adopted by OECD countries.

Interest not deductible

Under the Blueprint, no deduction is allowed for net interest expense (meaning interest expense is only deductible against interest income). The Blueprint appears to posit a distinction between "business" cash flows and "financial" cash flows. Financial cash flows (like net interest expense) are not included in the tax base for business entities and therefore do not appear to be taken into account in determining tax liability under the DBCFT. The challenges associated with taxing financial businesses under a consumption tax framework are well known and not at all unique to the DBCFT. The Blueprint notes that "special" rules with respect to interest expense for financial services companies (such as banks and insurance companies) will be developed. The discussion of what this regime might look like under the DBCFT is for another day, but one option appears to be disaggregating financial flows, such as interest rate spreads and financial margins, into "financial cost" (e.g., time-value of money return) and embedded services components and then applying the cash flow tax to the service fee components. We will continue to monitor this area and update clients as meaningful details emerge.

Immediate deduction of most business expenditures

Under the Blueprint, most business expenditures (including capex) may be deducted fully in the year in which the expense is incurred (subject to the border adjustment in respect of expenses incurred for imported inputs). The Blueprint indicates that allowing business expenditures to be immediately written off provides a better and more neutral incentive to invest than is provided through interest deductions.

Losses

The treatment of losses are very important in a destination-based consumption tax system. Under the DBCFT, businesses that incur losses from domestic business operations (i.e., costs from U.S. inputs in excess of revenues from U.S. sales) are not allowed to claim an immediate refund for such amounts, but are allowed to carry these losses forward indefinitely. In addition, the amount of the net operating loss (NOL) would be increased by an interest factor. The amount of NOLs allowed to be carried forward to any taxable year is limited to 90% of the net taxable amount for such year. By contrast, losses attributable to export sales exceeding cost of U.S. inputs would be immediately refundable under the Blueprint. Accordingly, if the DBCFT is enacted, it will be important that it has rigorous rules for distinguishing between domestic and export sales.

Supporters argue that the Blueprint will dismantle many of the deeply embedded biases in the current tax regime which favor foreign imports and distort economic choices.

Territorial taxation

The migration to a cash flow tax base, coupled with border adjustments, would mean that the U.S. tax system would become a "territorial" system (much like Canada) under which a U.S. person's foreign earnings would not be subject to tax. To address the estimated $2 trillion of cash that is currently "trapped" offshore under the lock-out effect of existing federal income tax rules, the Blueprint provides that such amounts may be repatriated to the United States at a rate of 8.75% (in the case of cash or cash-equivalent assets) or 3.5% (in the case of other assets) and that such tax liability may be paid over an eight-year period.

WHAT DO SUPPORTERS SAY ABOUT THE BLUEPRINT?

Broadly speaking, supporters of the Blueprint say that it will create powerful incentives for capital investment inside the United States which will create real growth in U.S. businesses and American jobs. These supporters also argue that the Blueprint will dismantle many of the deeply embedded biases in the current tax regime which favor foreign imports and distort economic choices. More particularly, proponents highlight that the Blueprint would

- remove impediments to capital investments by allowing full deductibility of business expenditures

- remove the implicit unfair advantage afforded to foreign produced goods/services over U.S. goods/services. The mechanism for leveling the playing field would be the border adjustment which would ensure that imported foreign products and services would be subject to same U.S. tax burden (either by way of a tax imposed at the border or, less directly, by denying a deduction for the cost of imported goods/services in determining tax liability) as U.S. produced goods and services

- correct harmful incongruity between the systems of the United States and other OECD countries. The Blueprint argues that the increasingly asymmetric interaction between the border-adjusted VATs of foreign trading partners and the non-border-adjusted U.S. income tax has exacerbated a "self-imposed unilateral penalty on U.S. exports and a self-imposed unilateral subsidy for U.S. imports." The Blueprint aims to correct this imbalance by ensuring that U.S. tax is imposed on products, services and intangibles that are imported into the United States

- provide a strong incentive for both U.S. and foreign businesses wishing to sell products or services to U.S. consumers (the single most attractive market in the world) to locate factors of production inside the U.S. market and generate domestic expenditures that will be deductible against U.S. revenues. The lower rate of 20% would also strongly reinforce this incentive

- remove the incentive for U.S. businesses to shift factors of production (e.g., manufacturing, labour, R&D and IP) and their related economic returns offshore. This would occur because border adjustment would impose the same tax on U.S.-based consumption regardless of whether the underlying goods were produced in the United States or abroad

- eliminating interest deductions will eradicate the overt tax bias favoring debt over equity capitalization, thereby preventing tax considerations from distorting capitalization decisions. Eliminating tax differences between debt and equity would also improve the administration of the tax system by removing a major source of complexity – distinguishing between debt and equity (for example, the recent Section 385 regulations could become irrelevant)

In some ways, the DBCFT represents a leveraging by the United States of perhaps its most powerful strategic economic asset – the U.S. consumer base – to coerce U.S. and non-U.S. businesses that wish to profit from that economic engine to invest into the United States.

Perhaps the most profound observation about the Blueprint is that by making U.S. consumption its tax base (i.e., U.S. sales less cost of U.S. inputs), the price of cross-border transactions (into or out of the United States) becomes largely irrelevant in computing liability under the DBCFT. Much of the driving force behind international tax planning over the last 25 years has been about modifying the geographic location of key elements in the commercial value chain – moving manufacturing, important people functions, risk assumption, IP and other asset ownership – to minimize the incidence of taxable income in high-tax jurisdictions. Indeed, the entire impetus behind the OECD's BEPS project was to combat the tactics systematically employed to achieve these goals. The DBCFT is a "new deal" that fundamentally changes the terms of engagement between the taxing system and taxpayers by anchoring its tax base to the one element of the value chain that is least mobile – the location of customers. Moreover, it reverses the incentive to push other factors of production offshore by instead creating incentives to re-route those factors into the United States. In some ways, the DBCFT represents a leveraging by the United States of perhaps its most powerful strategic economic asset – the U.S. consumer base – to coerce U.S. and non-U.S. businesses that wish to profit from that economic engine to invest into the United States.

Even though the Blueprint is relatively undeveloped, it has already been the subject of intense debate.

This sudden reversal of deeply engrained tax planning norms will set in motion new dynamics that cannot be accurately predicted from our current vantage point. As a start, several commentators have noted that unilateral adoption of a DBCFT by the United States would turn it into a tax haven of sorts for non-U.S. enterprises who would be attracted to the prospect of sourcing factors of production in the United State to minimize their U.S. tax exposure, as well as to support tax efficient exporting operations out of the United States. If the United States adopted a DBCFT and Canada did not, Canada may find itself in the unusual predicament of having its tax base come under acute BEPS pressure from the United States. For example, in such a scenario, Canadian businesses may have an incentive to move manufacturing operations to U.S. affiliates and to inflate the intercompany price of imports from the United States to deflate profitability in Canada. In this case, the United States would not be asserting taxing jurisdiction over the exports to Canada so there would be no downward pressure on that cross-border transfer pricing – only an incentive to inflate that price so as to minimize Canadian tax. Over the longer term, these dynamics could create strong pressure for Canada and other trading partners that rely heavily on the U.S. economy to modify their own tax systems to minimize structural asymmetries with the tax system of the United States.

WHAT DO OPPONENTS OF THE BLUEPRINT SAY?

Unsurprisingly, there is much anxiety about the fact that the changes proposed by the Blueprint could create "winners" and "losers" and otherwise uproot vested interests (many of whom are very influential in the political spheres). As a result, even though the Blueprint is relatively undeveloped, it has already been the subject of intense debate. Opponents of the Blueprint have emphasized the following problems:

- The DBCFT will unfairly punish importing industries

- Pragmatism and politics

- Depreciation of foreign assets held by Americans

- WTO compliance

The DBCFT will unfairly punish importing industries

U.S. businesses that rely on foreign imports, such as retailers of consumer goods and oil refiners, fear that the border adjustment, which subjects imported goods and services to the DBCFT, will result in a sharp net increase in the economic cost of these inputs. This will, they argue, materially compress their operating margins and/or result in increased costs for consumers which will potentially depress their sales.

Supporters of the DBCFT counter this concern with patriotism and economic theory. First, they assert that the imposition of the DBCFT on imports merely "levels the playing field" between foreign produced goods (which don't currently bear the economic burden of U.S. tax) and U.S. produced goods (which do). Second, DBCFT proponents argue that principles of supply and demand will result in a significant and swift appreciation of the U.S. dollar which, according to economic theory, should completely (or substantially) offset the economic drag created by the tax.

More specifically, if the U.S. dollar did appreciate in this way, the price of foreign imports (denominated in U.S. dollars) would decrease, offsetting the increased "cost" imposed by the DBCFT tax on imports. Similarly, economists argue, the increased value of the U.S. dollar will blunt the "positive" effect that the DBCFT would have on U.S. exports. Accordingly, prevailing economic theory predicts that, although the DBCFT appears to favour exports over imports, over the long run, this tax should not affect the overall balance of trade between the United States and its trading partners. Importers and other U.S. businesses that rely on foreign inputs observe that foreign exchange rates are, in reality, influenced by a multiplicity of complex factors that are impossible to predict. They are concerned that if these economic theories don't materialize (or take too long to materialize) the DBCFT will represent a massive governmentally imposed distortion of the marketplace in which their business will "lose" and exporting businesses will "win."

For example, many U.S. manufacturers are heavily invested in carefully constructed international supply chains and rely on these networks to deliver their necessary inputs in a tax efficient manner. If currency exchange rates don't "fully" adjust, these manufacturers can't simply flip the switch and immediately begin obtaining those inputs from U.S. sources. It may take years for those supply chains to be re-engineered and, in the interim, these industries fear they will be hostage to suddenly uneconomic commercial arrangements. As a result, these businesses have begun to mobilize as a powerful force against enactment of the DBCFT.

Pragmatism and politics

Republican pragmatists recognize that, although they currently control the House, the Senate and the White House, there is only a two-year window to work with before the next mid-term congressional elections. They are concerned that, as with the Obama administration, single party control over the legislative branches may be a fleeting opportunity and that the need to act fast and decisively is paramount. These voices are concerned that the Blueprint is too revolutionary, too complex, too disruptive and politically divisive. For example, if there is a perception among the American public that the DBCFT will result in higher prices at Walmart or at the gas pump, this will create extremely unfavourable optics which will be difficult to explain away through untested economic theory. In this most politically charged of environments, realists worry that the Blueprint may simply be too ambitious and that the party would be better served to change course and pursue more measured reform within the framework of the existing income tax system.

Depreciation of foreign assets held by Americans

If, as economists predict, the DBCFT were to precipitate a swift and strong appreciation of the U.S. dollar, this would have the effect of deflating the value of foreign assets held by Americans. For example, if the U.S. dollar was to appreciate by 20% against the Canadian dollar, Canadian assets held by U.S. pension funds could lose an enormous amount of value. Some observers have estimated that this currency shift could result in trillions of dollars of value being lost by U.S. investors. By contrast, appreciation of the U.S. dollar could result in an immediate shift of value to foreign pension funds and other investors holding U.S. assets. This tacit value transfer from holders of foreign assets to holders of U.S. assets will create powerful political cross-currents which, on balance, could present a significant impediment to advancing the Blueprint through the political process.

WTO compliance

It is unclear whether the DBCFT will comply with anti-tariff rules of the World Trade Organization (WTO). Under WTO policy, border adjustments are allowed for "indirect" taxes, but are prohibited for "direct" taxes. Supporters of the Blueprint believe the DBCFT should be analogized to a VAT which is recognized as an indirect tax. The DBCFT diverges significantly from a typical VAT, however, in that its cash flow base is U.S. business cash inflows less U.S. business cash outflows, including costs of labour. A pure VAT tax base does not allow labour costs to be deducted. The DBCFT's allowance of deductions for labour costs causes some to believe that it is, in reality, a tax on profits which arguably brings it into the realm of a "direct" tax on income and therefore ineligible for border-adjustment under current WTO rules.

The implementation of a DBCFT in conjunction with the repeal of NAFTA could be particularly dislocating for Canadian industry.

One of the reasons why there is confusion in this area is that economists acknowledge that the DBCFT is economically equivalent to a destination-based VAT that is supplemented with some form of payroll subsidy which provides relief for labour costs. The VAT supplemented with a separate payroll subsidy (that is not technically a component of the VAT) is widely acknowledged to be WTO-compliant so many observers suggest that it should follow that the DBCFT should similarly be compliant given that it delivers the same net effect. While there is no clear consensus yet on whether the DBCFT should be regarded as a "direct" tax, Republican leaders are confident that the DBCFT is WTO-compliant. If the concern over compliance with WTO rules becomes more weighty, it is possible that the DBCFT proposal could be modified to deny deductibility of labour costs or that the United States could take more bold measures – such as seeking to change WTO rules.

WHAT DOES THE BLUEPRINT MEAN FOR CANADIANS?

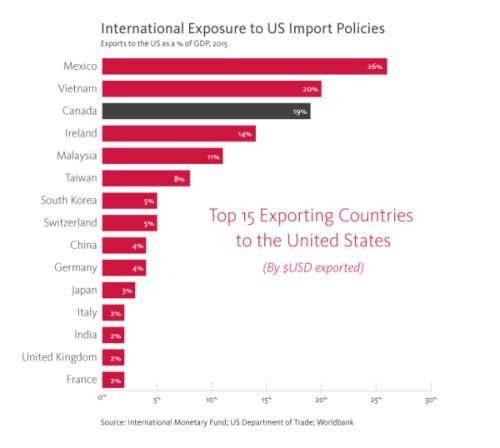

The adoption of the DBCFT would have a profound and lasting impact on all of the United States' major trading partners. But the impact on Canadian companies would be particularly intense given the degree of economic integration between the U.S. and Canadian economies. The following chart shows one important measure of Canada's exposure to tax reform in the United States.

The implementation of a DBCFT in conjunction with the repeal of NAFTA could be particularly dislocating for Canadian industry. Even if the formidable headwinds on imports created by the DBCFT were, as economists predict, neutralized by a stronger U.S. dollar, it's difficult to predict the correlative impact that a swift and sharp devaluation of the Loonie would have on the Canadian economy. Once these market forces are set in motion it's difficult to know where they will lead. Despite this macro-economic uncertainty, we believe it is possible to identify certain broad trend-lines that Canadian businesses should be turning their minds to:

- Pressure for exporters

- Increased U.S. investment

- Countervailing changes to Canadian tax law

Pressure for exporters

Canadian industries that rely heavily on exports to the United States (e.g., oil & gas producers, auto or auto-parts manufacturers) stand to be significantly and adversely affected by a move to a DBCFT. Even assuming currency adjustment occurs, it may phase in over a prolonged period and not perfectly offset the economic impact of the tax. Furthermore, even if the currency adjustment does occur immediately, deeply entrenched supply chain channels can't be reconfigured immediately so there may be a prolonged adjustment period during which profitability of certain industries could be locked into an uneconomic operating structure. Accordingly, as the potential for a DBCFT increases, one area of key focus for Canadian businesses should be to advocate for effective and generous transition rules which might smooth the jagged edge of immediate enactment.

Increased U.S. investment

The DBCFT may reasonably be expected to create a powerful incentive for Canadian exporters that rely on sales to U.S. consumers to increase the amount of U.S. deductions available to them to shelter the U.S. tax on those sales. This will place a premium on U.S. located inputs (e.g., U.S. manufacturing facilities and U.S. labour) which may divert capital flows to the United States (e.g., U.S. capex and/or U.S. acquisitions). While this incentive may be dampened by an appreciated U.S. dollar, the currency adjustment could be gradual. In such a case, it is possible that there would be a transitional window during which Canadian businesses may rush to acquire U.S. assets before the FX adjustment is fully "priced in." Canadian businesses thinking about their business in a new DBCFT environment might wish to model the expected value of their after-tax cash flows under various capex assumptions in order to model out, at least directionally, whether their business would be stronger with a higher proportion of U.S. assets.

Countervailing changes to Canadian tax law

The United States implementing the DBCFT (or something like it) would have a radical impact on cross-border Canada-U.S. tax planning norms. As noted above, the adoption of lower marginal rates, coupled with (i) a destination-based component, and (ii) a tax base which effectively does not impose the DBCFT on labour costs could, very broadly speaking, reverse the flow of BEPS incentives. Cross-border businesses would suddenly have an incentive to explore ways of shifting profits out of Canada and into the United States. This could place enormous pressure on anti-BEPS remedies and perhaps even more radical reforms of Canadian tax law, to create more structural parity between the Canadian and U.S. taxing regimes. Although it's clearly too early to suggest that U.S. tax reforms may spread north of the border, it is appropriate to recognize that any move toward a DBCFT in the United States would set in motion new and powerful dynamics that would not be easily contained.

CONCLUSION

While details regarding U.S. tax reform are still hazy, one thing that is clear is that we are at a juncture that is unlike any we have seen for decades. Policy directions that seemed theoretical just a few months ago now appear to be tangible possibilities. The DBCFT is one potential path this reform could take and it has formidable political backing. Alternatively, President Trump's "phenomenal" tax plan, promised in a matter of weeks, could pursue a different course. No matter how these events unfold, Canadian companies and investors are well advised to be thoughtfully proactive about how tax reform will affect their business. As part of our commitment to keeping our clients and readers ahead of the curve in this area, we will continue to provide updates as key events unfold.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.