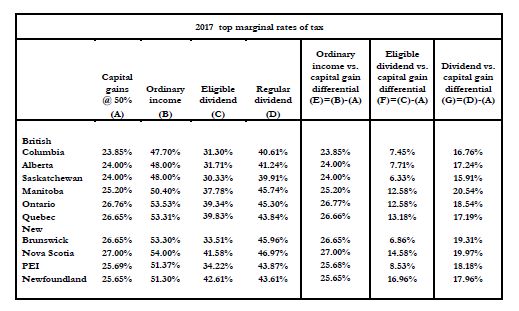

With the 2017 federal budget likely due to be released in late February or March, there is speculation that the government may curtail the preferential tax treatment afforded to gains on the disposition of capital property. Currently, only 50% of gains realized on the disposition of capital property is included in a taxpayer's income and subject to tax; this has resulted in a significant tax rate differential between ordinary income and dividends compared to capital gains. It is no surprise that a number of planning strategies have been developed to convert dividends and ordinary income to capital treatment. The significance of the tax rate differential between ordinary income, dividends and capital gains (by province) is best illustrated in the chart below. Note that the tax rate differential is the largest for ordinary income (i.e., could be as high as 27% for those in Nova Scotia) and smallest for eligible dividends (i.e., for those in Saskatchewan; however, there is still a difference of at least 6.33%).

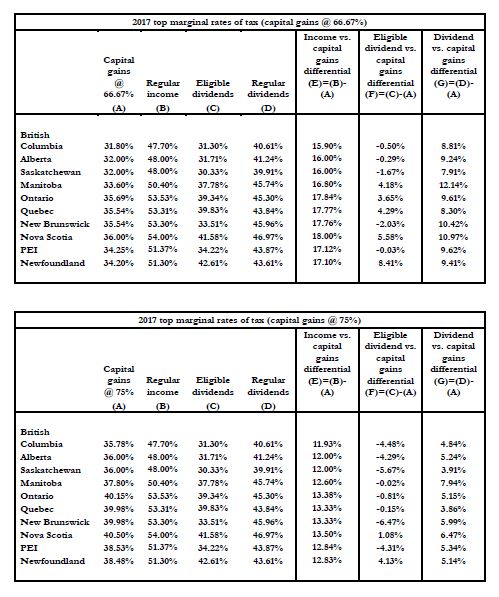

It is anticipated that the government will increase the capital gain inclusion rate from 50% to 66.67% or possibly 75% to address the current deficit. The implication of this change is illustrated in the chart below. Note that a 75% inclusion rate would result in a 50% increase in capital gains tax and a 66.67% inclusion rate would result in a 33.33% increase in capital gains tax.

Given these potential changes, where a significant capital asset sale is being contemplated, you may want to consider structuring the transaction to provide you with flexibility should the inclusion rate change. This change could also affect any succession or estate plans currently in place. Before changes to the tax legislation are announced by the government, please contact us to discuss how you, your family and your business may be affected and what can be done.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.