This is the fifth installment in our periodic series on National Instrument 43-101.

Also in the series:

Part 1:

What Issuers Need to Know about Technical

Reports

Part 2:

What Issuers Need To Know About Terminology

Part 3:

What Issuers Need To Know About Historical

Estimates

Part 4:

What Issuers Need To Know About Economic Analysis

Disclosure of future exploration targets is an area of difficulty for issuers. Whether out of a desire to increase share price or simply to provide the market with current and complete disclosure, issuers often want to disclose the exploration potential of mineralization of a property when there has been insufficient exploration to prepare a mineral resource estimate. To avoid issuers misleading the market, National Instrument 43-101 prohibits an issuer from disclosing the quantity, grade, or metal or mineral content of a deposit that has not been categorized as a mineral resource or mineral reserve.

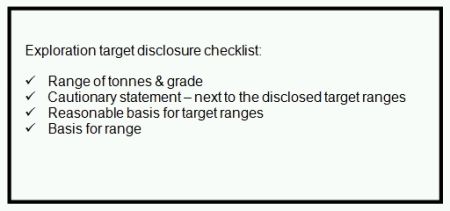

As a result, this prohibition makes it difficult for an issuer to explain why it is focusing time and money on a prospect for further exploration. However, National Instrument 43-101 does allow an issuer to disclose in writing the potential quantity and grade, expressed as ranges, of a target for further exploration if the disclosure states with equal prominence:

- that the potential quantity and grade is conceptual in nature,

- that there has been insufficient exploration to define a mineral resource, and

- that it is uncertain if further exploration will result in the target being delineated as a mineral resource.

The disclosure must also state the basis on which the disclosed potential quantity and grade has been determined.

Unfortunately, many issuers do not comply with the above requirements. Regulators have indicated that they commonly see the following disclosure issues related to exploration targets:

- lack of ranges of tonnes and grade,

- missing cautionary language,

- unrealistic and untestable exploration targets with no explanation of the basis for the data,

- extrapolating resource grades into unsampled areas,

- creating a block model with a cut-off grade, but not disclosing it as a mineral resource estimate,

- using an exploration target as a proxy for a mineral resource or mineral reserve estimate, and

- disclosing an economic analysis on an exploration target.

In addition, issuers must remember when discussing an exploration target to not use the term "ore" as it implies technical feasibility and economic viability that have not been shown. The term "ore" should only be used when attributed to mineral reserves.

When Regulators identify material NI 43-101 disclosure deficiencies, they will usually require that an issuer correct the deficiency by restating and re-filing the documents. Failure to comply with such a request by Regulators may result in an issuer being placed on the reporting issuer default lists and a cease trade order until the issuer corrects the deficiency. Regulators may also take other regulatory actions depending on the circumstances.

An example of how an exploration target should be disclosed is as follows:

"The Company believes that the property has the potential for # to # oz Au contained within # to # Mt grading # to # g/t Au. This is based on previous exploration on the property, including over # historic drill holes. The exploration target potential was derived by modeling the identified vein systems, and their surrounding "halo" mineralization, as evidenced by drill intercepts in the exploration target area, across vertical long sections of mine area. The volume of the modeled areas determines the potential tonnage statement in the exploration target. The grade range given in the exploration target is determined with consideration to the drill results within the modeled exploration target area and consideration of the geological setting in an established mining camp where grades are generally observed to increase with depth. The potential tonnages and grades are conceptual in nature and are based on previous drill results that defined the approximate length, thickness, depth and grade of the portion of the historic resource estimate. There has been insufficient exploration to define a current mineral resource and the Company cautions that there is a risk further exploration will not result in the delineation of a current mineral resource."

Overall, it is very important that issuers take the above considerations into account prior to the disclosure of an exploration target in their public disclosure or marketing materials. While the requirements of National Instrument 43-101 may make the disclosure longer and require some additional work, complying with the requirements for making public disclosure of a target exploration area and its potential should not pose marketing issues. Compliance is simply a matter of recognizing what is being disclosed and complying with the above noted requirements.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.