Expanding growth in nearly all sectors

Norton Rose Fulbright focuses its services on 6 key industry sectors and, according to a study released recently by the Globe and Mail on Canadian corporations, almost all of these sectors have seen an expansion in revenue and most have seen growth in profits during the period from 2011 to 2015. While such expansion does not on its own drive M&A activity, it is important factor for identifying trends. Industries with the greatest growth may see increased M&A activity in the future; likewise industries with prolonged under-performance may be primed for consolidation.

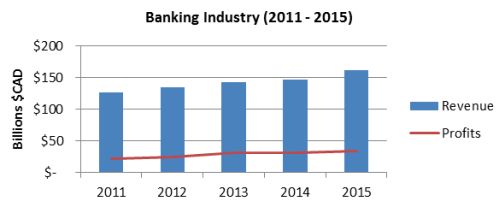

Banking

The Canadian banking industry has witnessed increased revenue and profits over the past five years. The industry is dominated by the Big Five banks which suggests limited M&A transactions in the near future.

That said, Canada has seen recent M&A in banking alternatives, for example in 2012 Scotia Bank acquired a division of ING Group to form Tangerine. Likewise, Norton Rose Fulbright recently advised Richardson GMP Limited in its high profile 2013 acquisition of Macquarie Private Wealth Inc. Expanded M&A activity in wealth management companies and banking alternatives is likely to continue.

An additional area which could be subject to deal-making is smaller technology players who specialize in mobile payments, digital security and app development. Banks and their service providers will look to these companies for sources of growth in this mature industry.

Oil & Gas

The downturn in oil prices has impacted the profitability of Canadian oil and gas companies while overall revenue has increased over the past five years. The volatility with the price of oil has caused M&A transactions to slow, especially in Q1 of 2015.

Price stability or price increases will likely lead to increased transaction volumes as purchasers will see greater certainty in the risks and rewards of potential acquisitions. Others have seen the downturn as a buyer's market and predict a 'take-over blitz' as the next phase in the Canadian oil patch.

Metals & Mining

Revenue has stayed essentially flat but profits have dropped considerably over the past five years for the metals and mining industry. Prospects do not appear to be improving in the near future as Q1 2015 saw the lowest number of M&A transactions in many years. However, a positive sign is the fact that Canadian mining companies have increased both the rate of domestic spending in the past two years and the amount of capital invested in domestic projects. As suggested by E&Y's Q1 2015 Canadian Mining Eye report, big players have recently been divesting non-core assets (for example, Newmont Mining, Cliff Natural Resources Inc., etc.), and if the Canadian economy continues to slow, this trend could continue. Alternatively, with any pick up in the Canadian economy, consolidation may follow as a player may choose to acquire undervalued assets.

Transportation

The Canadian transportation industry has seen steady increases in both revenue and profits over the past five years. Since this is a relatively mature industry, growth is not likely to exceed broader economic growth by a wide margin. However, there are several factors which will positively affect profitability such as low oil prices and increased exports to the US.

One potential area which may see increased M&A activity is companies which specialize in retail e-commerce and other technology-based solutions.

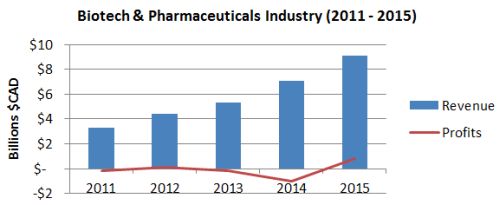

Biotech & Pharmaceuticals

The biotech and pharmaceuticals industry has seen revenue growth almost triple over the past five years along with a shift from net losses to profitability for Canadian corporations. However, the overall growth of the industry in Canada has been slow.

The pressure facing large multi-national pharmaceutical companies to replace their drug pipelines as patents expire will be a key driver of M&A activity in this sector. This, coupled with the fact that Canada is the 8th largest pharmaceutical market in the world, should also drive investment and M&A activity.

The author would like to thank Mark Bissegger, summer student, for his assistance in preparing this legal update.

Norton Rose Fulbright Canada LLP

Norton Rose Fulbright is a global legal practice. We provide the world's pre-eminent corporations and financial institutions with a full business law service. We have more than 3800 lawyers based in over 50 cities across Europe, the United States, Canada, Latin America, Asia, Australia, Africa, the Middle East and Central Asia.

Recognized for our industry focus, we are strong across all the key industry sectors: financial institutions; energy; infrastructure, mining and commodities; transport; technology and innovation; and life sciences and healthcare.

Wherever we are, we operate in accordance with our global business principles of quality, unity and integrity. We aim to provide the highest possible standard of legal service in each of our offices and to maintain that level of quality at every point of contact.

Norton Rose Fulbright LLP, Norton Rose Fulbright Australia, Norton Rose Fulbright Canada LLP, Norton Rose Fulbright South Africa (incorporated as Deneys Reitz Inc) and Fulbright & Jaworski LLP, each of which is a separate legal entity, are members ('the Norton Rose Fulbright members') of Norton Rose Fulbright Verein, a Swiss Verein. Norton Rose Fulbright Verein helps coordinate the activities of the Norton Rose Fulbright members but does not itself provide legal services to clients.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.