- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Accounting & Consultancy, Banking & Credit and Insurance industries

The end of the calendar year, which for many taxpayers is also the end of the tax year, brings with it various tax-planning deadlines. Some of those deadlines are unique to 2014 and others arise every year. It is useful to review some of the most important deadlines in a cross-border tax context, and we do so in the context of a taxpayer that is a Canadian resident corporation (Canco).

| Table 1. Summary of Special Tax Deadlines for 2014 | |

| Event | Action/Deadline |

| New back-to-back loan rules limiting interest expense deductions or increasing Canadian interest withholding tax starting in 2015 | Review existing debt financing of Canadian subsidiaries to see if new rules apply to deem debt owed to persons other than the actual creditor for thin capitalization and interest withholding tax purposes |

| Termination of exception from nonresident trust rules for trusts that have received contributions from persons who have been Canadian residents for less than 60 months | Tax reporting and payment obligations will apply to affected trusts for trust tax years ending after 2014 by virtue of being deemed Canadian residents and taxable on worldwide income |

| Amendment of the definition of investment business in foreign accrual property income rules to limit exception for regulated financial services business to controlled foreign affiliates of Canadian financial institutions for tax years starting after 2014 | Canadian taxpayers (other than Canadian financial institutions) with controlled foreign affiliates earning income from property as locally regulated financial institutions will have to report that income as FAPI on an accrual basis |

I. TAX DEADLINES SPECIFIC TO 2014

A. Back-to-Back Loan Rules

The 2014 federal budget proposed adding anti-avoidance provisions to two aspects of Canada's treatment of Canco's debt:

- Interest withholding tax exigible on payments of interest made by Canco: Canadian domestic law imposes nonresident withholding tax only on interest paid to nonresidents not dealing at arm's length with Canco and on participating interest (that is, computed using profits, revenue, and similar items); and

- Interest deductibility limitations on interest expense incurred by Canco under Canada's thin capitalization rules: Essentially, if Canco incurs debt owing to non-arm's-length nonresidents in excess of 150 percent of its ''equity''1 for these purposes, interest on that excess debt cannot be deducted by Canco and is treated as a dividend for withholding tax purposes.

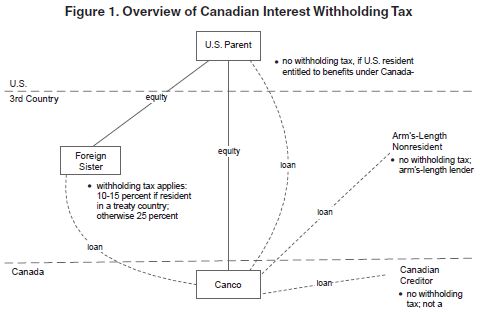

For non-arm's-length nonresidents, the relevant rate of Canadian interest withholding tax will generally be 25 percent for recipients resident in a country with no Canadian tax treaty; 0 percent for U.S. residents entitled to benefits under the Canada-U.S. tax treaty; and 10 or 15 percent for recipients resident in any other country with a Canadian tax treaty (see Figure 1).

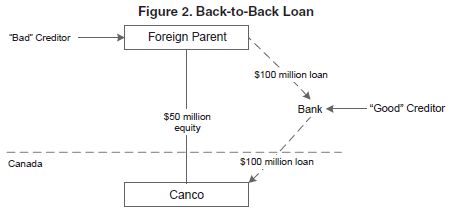

For both interest deductibility and withholding tax purposes, debts owed to arm's-length creditors (Canadian or foreign) are treated more favorably than those owed to non-arm's-length creditors. The Department of Finance is concerned about arrangements that ostensibly result in Canco paying interest to an arm's-length creditor but that in substance constitute the debt financing of Canco by a non-arm's-length nonresident. The simplest example is a back-to-back loan, illustrated in Figure 2, whereby Canco's foreign parent makes a loan to a bank that simply on-loans to Canco.

Starting in 2015 it will no longer be possible to determine the Canadian thin capitalization and interest withholding implications of a particular Canco debt simply by reference to who Canco's direct creditor is. Instead, Canco will be deemed to pay interest to a non-arm's-length nonresident (and not the actual creditor) if the new back-to-back loan rules apply. In very general terms, the new rules will apply if the following conditions are met:

- Canco's actual creditor (Creditor) is either an arm's-length Canadian resident or a nonresident person;

- a secondary obligation meeting specific conditions exists between Creditor or someone not dealing at arm's length with Creditor (in either case, a Creditor Party) and a nonresident of Canada who does not deal at arm's length with Canco (Nonresident); and

- Nonresident is a ''worse'' creditor than Creditor from either a thin capitalization or interest withholding tax perspective — that is, Canco owing money to Creditor is tax advantageous compared with owing money to Nonresident.2

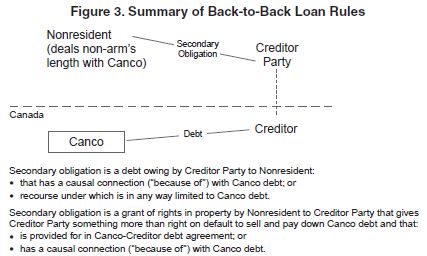

Figure 3 illustrates the essence of the rules. Essentially, a secondary obligation sufficient to trigger the application of the rules can be either:

- a debt owed to Nonresident by a Creditor Party, if the Canco-Creditor debt can be said to exist ''because of '' that other debt (for example, a classic back-to-back loan);3 or

- Nonresident's grant of a specified right in property to a Creditor Party, if that right is either required under the terms of the Canco-Creditor debt or the Canco-Creditor debt can be said to be outstanding because of the specified right.

The idea behind the second scenario is to catch situations such as Nonresident depositing marketable securities with a Creditor Party that the Creditor Party can use for its own purposes, as opposed to simply lending money to the Creditor Party. A specified right generally does not exist if the Creditor Party's rights in Nonresident's property are limited to (i) the right upon default to sell the property and apply the proceeds against Canco's debt (or a ''connected'' debt owed to the same Creditor), and (ii) the right to pledge or encumber the property to secure payment of the Canco debt (or a connected debt owed to the same Creditor).4

The new rules apply starting in 2015, with no grandfathering for existing debt. As a result, Canadian subsidiaries of foreign multinational groups need to review their debt financing arrangements to identify situations in which the new rules may apply to either deem the Canco debt to be subject to thin capitalization restrictions or increase the amount of Canadian interest withholding tax exigible. Things to watch for include:

- obligations between a Creditor Party and a nonresident not dealing at arm's length with Canco that either are explicitly provided for in the Canco-Creditor debt agreement or have a causal connection with the Canco debt;

- security interests provided by nonresidents not dealing at arm's length with Canco that give the secured party more than the basic right to sell the secured property on a default and apply the proceeds against the Canco debt; and

- group cash-pooling arrangements.5

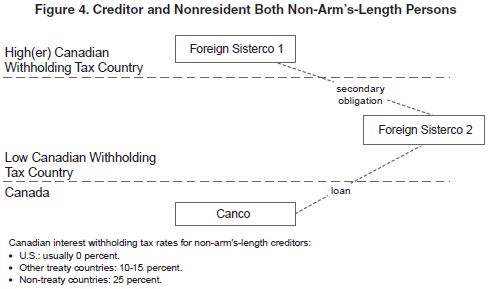

When considering the rules, it is important to note that the interest withholding tax element could apply even when Creditor is a nonresident that does not deal at arm's length with Canco, because different withholding tax rates apply to different countries. Put another way, one foreign group member can be a ''worse'' creditor than another group member who is Canco's actual creditor so as to potentially engage the rule (for example, see Figure 4). That will occur particularly when Canco's creditor is a U.S. resident, because Canada's tax treaty with the United States is the only one with a 0 percent interest withholding tax rate. That subtle element of the rules effectively constitutes an anti-treaty-shopping provision, unrestricted by any concept of what constitutes abuse — that is, it is per se deemed abusive when Creditor is entitled to a lower withholding tax than Nonresident, irrespective of why Creditor was chosen as Canada's lender and what the purpose of the secondary obligation was — and has been the source of significant controversy.

B. Immigration Trusts

For many years, Finance has been concerned about the use of nonresident trusts by Canadian residents to earn foreign-source income and defer Canadian tax indefinitely. Canada's rules for nonresident trusts provide that the trust may be deemed resident in Canada (so as to be taxable on worldwide income) if property has been contributed to the nonresident trust by a person who is a Canadian resident.

For that purpose, an individual who has been resident in Canada less than 60 months is excluded as a Canadian resident contributor to the nonresident trust. As a result, new residents of Canada have been able to establish a nonresident trust to earn income free of Canadian tax during their first five years of Canadian residence. The 2014 federal budget eliminated that 60- month exemption, effective for trust tax years that end after 2014.6 As a result, income earned by those ''immigration trusts'' will be taxable in Canada as it accrues.

C. Foreign Accrual Property Income

To prevent undue deferral of Canadian tax on foreign-source passive income earned indirectly by Canadian residents through controlled foreign corporations, the foreign accrual property income regime in Canada's Income Tax Act takes some forms of passive or deemed-passive income (FAPI) earned by a controlled foreign affiliate (CFA) of a Canadian resident and imputes a proportionate share of it to the Canadian resident.7 Among the types of income deemed to constitute FAPI is income from an investment business, being defined essentially as a business whose principal purpose is to earn income from property.

Income from a financial services business carried on by the CFA that is regulated as a financial institution under the laws of its home country has been exempted from the definition of the term ''investment business'' for many years. However, in the 2014 federal budget, Finance announced a change in law that limits the financial services business exception to CFAs of Canadian taxpayers that are themselves regulated Canadian financial institutions (for example, banks, trust companies, and insurance companies).8 Thus, effective for tax years beginning after 2014, other Canadian taxpayers will no longer be able to rely on the exception from the investment business definition for financial services income earned by their CFAs regulated as such in their home country.

To read this article in full, please click here.

Originally published byTax Notes Int'l, December 8, 2014.

Footnotes

1. For this purpose, the word ''equity'' consists of Canco's unconsolidated retained earnings, the paid-up capital of Canco shares held by nonresident shareholders holding at least 25 percent of Canco's shares, and contributed surplus attributable to those shareholders. See Section II.F, infra, for further discussion.

2. For more detail on the final version of those rules, see Suarez, ''Canada Releases Revised Back-to-Back Loan Rules,'' Tax Notes Int'l, Oct. 27, 2014, p. 357 (see in particular the decision tree overview of the rules on p. 360).

3. Or if Nonresident's recourse under the debt is in any way limited to Creditor's receivable from Canco.

4. The explanatory notes accompanying the rules indicate that merely providing a security interest in property is not intended to constitute a secondary obligation if the security interest does not in and of itself provide a way for the Creditor Party to raise funds that it may use for a purpose other than reducing an amount owed to it under the Canco debt or a ''connected'' debt.

5. That is, when the argument could be made that a negative Canco balance with the lender exists ''because'' another group member has a positive balance with the lender.

6. For trusts to which the exemption applied during the portion of 2014 before February 11, and to which no contributions were made after that date. For other trusts, the exemption simply ends for tax years ending on or after February 11.

7. For further discussion of the FAPI regime, see Mining Tax Canada, ''Investment Outside of Canada,'' available at http://miningtaxcanada.com/investment-outside-of-canada/.

8. In the budget documents, Finance expressed concern that Canadian taxpayers other than financial institutions were taking advantage of that exception inappropriately to earn income from proprietary investment and trading activities through CFAs.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]