Published in Private Equity International's 2005 Report on Canadian Private Equity.

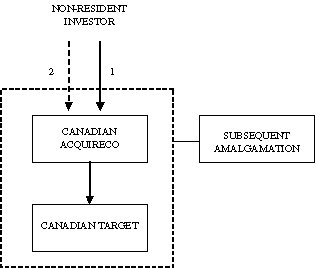

The use of "hybrid entities" to acquire Canadian companies can have significant benefits for U.S. investors in the appropriate circumstances. The conventional acquisition structure is depicted in Figure 1.

Figure 1

Non-residents have acquired Canadian corporations by incorporating a Canadian acquisition corporation (CanAcquireco) in a Canadian jurisdiction and funding it by way of interest-bearing debt and equity on a 2:1 basis to comply with Canadian thin capital rules. CanAcquireco purchases all the shares of the Canadian target corporation (CanTarget). CanAcquireco and CanTarget typically then amalgamate (forming CanAmalco). The "internal" debt used in this structure and the other structures described in this article normally takes the form of subordinated unsecured debt carrying a higher rate of interest than senior secured debt.

Some of the advantages of this acquisition structure are as follows:

- Interest on the debt owing by the amalgamated company to the non-resident owner is deductible against the earnings of the acquired business; this comes at a cost of Canadian withholding tax on the interest (when paid) of 10%.

- The non-resident owner can extract cash from CanAmalco without attracting Canadian withholding tax by having the principal of the debt owing to it repaid and by having the paid-up capital of CanAmalco’s shares returned to it (and the amount of that paid-up capital will, in general, equal the amount the non-resident owner originally invested in the shares of CanAcquireco).

- Depending on the application of a tax treaty between the non-resident’s country and Canada, the non-resident investor can generally sell the shares of CanAmalco and not be subject to Canadian tax on any capital gain realized, provided CanAmalco’s shares do not derive their value primarily from Canadian real property.

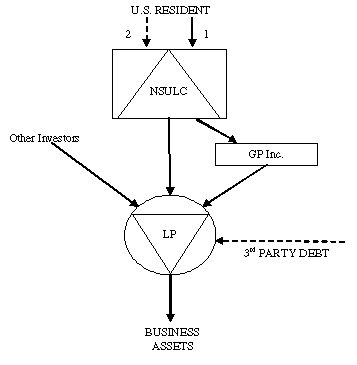

Use of Hybrids to Acquire Canadian Businesses: Businesses in Flow-Through Form

A U.S.-based investor may consider the method depicted in Figure 2 for acquiring a Canadian business that is owned in a flow-through form (such as a partnership). A Nova Scotia unlimited liability company (NSULC) is a corporation incorporated in the province of Nova Scotia, but unlike a regular corporation, it has an unlimited liability feature for which protection steps are required. For U.S. tax purposes, an NSULC can be a disregarded entity (if it is wholly owned) or treated as a partnership (if it has more than one shareholder). Under this structure, the U.S.-based investor invests in a newly established NSULC by way of interest-bearing debt and equity on a 2:1 basis to comply with Canadian thin capital rules. An NSULC is a corporation for Canadian tax purposes but is disregarded for U.S. tax purposes. The NSULC incorporates GP Inc. in a Canadian jurisdiction and may wholly own it. The NSULC, GP Inc. and other investors (potentially including management) establish a limited partnership (the Partnership) that acquires the assets of the business from the vendor. The Partnership is a partnership for Canadian tax purposes, but will "check the box" to be treated as a corporation for U.S. tax purposes.

Figure 2

Some of the advantages of this structure are as follows:

- Income of the Partnership is allocated to the partners for Canadian tax purposes. The NSULC can deduct its interest expense on its debt owing to the U.S. investor against its share of the Partnership’s income; again this comes at a cost of Canadian withholding tax on the interest (when paid) at 10%.

- The U.S. investor can extract cash from the NSULC without Canadian withholding tax by having the principal of the debt owing to it repaid and by having the paid-up capital of the NSULC’s shares returned to it.

- Under the Canada-U.S. tax treaty, the U.S. investor can generally sell the shares of the NSULC and not be subject to Canadian tax on any capital gain realized, provided NSULC’s shares do not derive their value primarily from Canadian real property.

- The structure is also efficient from a U.S. tax perspective, depending on the nature of the U.S. investors (certain tax-exempt investors may need to consider the implications of unrelated business taxable income [UBTI] of this structure). The NSULC is disregarded, as is the subordinated loan owed by the NSULC. The U.S. investor is taxed on distributions from the Partnership, which are regarded as distributions from a corporation, to the extent of "earnings and profits" for U.S. tax purposes. Where distributions from the Partnership are limited to cover only the taxes of its partners, the income for U.S. tax purposes on that distribution will be much less than the NSULC’s share of the Partnership’s income for Canadian tax purposes. The major benefit of this structure is to permit interest expense on the internal debt (i.e., the 2:1 debt) to be deductible for Canadian tax purposes against the business income generated, but not taxable in the United States. Only the U.S. recognizable income in respect of distributions from the Partnership is taxable in the United States. The Canadian taxes payable by the NSULC in respect of its earnings may be eligible for foreign tax credit relief to the U.S. investor in computing the U.S. investor’s income for U.S. tax purposes. The Canadian tax savings generated from the interest deduction in the NSULC can be used to further pay down debt incurred to make the acquisition.

The use of NSULCs as the acquisition vehicle does raise questions of liability protection for its shareholders. Shareholders of the NSULC (U.S. investors) have no direct relationship with creditors and cannot be sued during corporate existence. However, on a winding-up, shareholders are jointly and severally liable for the NSULC’s obligations. To reduce the potential for liability, the U.S. investor may find the use of a Delaware LP or other liability blocker appropriate in structuring the acquisition.

Use of Hybrids to Acquire Canadian Businesses: Businesses in Corporate Form

A variation of the foregoing structure can be used where the Canadian business to be acquired is in a Canadian corporation (Canco) and the U.S. investor is required to buy shares of the Canco. The variation requires the owner of Canco to "continue" Canco as an NSULC (NSULC Opco) prior to its acquisition by the U.S. investor (a continuance of this kind is a tax-free event for Canadian tax purposes). The final structure would be as depicted in Figure 3:

Figure 3

Under the structure shown in Figure 3, the U.S.-based investor invests the "equity" portion of the acquisition price in a newly established NSULC by way of interest-bearing debt and equity on a 2:1 basis to comply with Canadian thin capital rules. The NSULC is a corporation for Canadian tax purposes, but is disregarded for U.S. tax purposes. The NSULC incorporates GP Inc. in a Canadian jurisdiction and may wholly own it. The NSULC, GP Inc. and other investors (potentially including management) establish a limited partnership (Finco). Finco is a partnership for Canadian tax purposes, but will check the box to be treated as a corporation for U.S. tax purposes. The NSULC invests all of its funds in equity of Finco. Finco borrows the debt portion of the acquisition price from third-party lenders. Finco then sets up a transitory acquisition NSULC, onlends the third-party debt proceeds to it and invests in subordinated debt and equity of that NSULC in the same way as the top NSULC was capitalized (on the 2:1 basis). The acquisition NSULC then buys the target NSULC Opco and amalgamates with it, leaving NSULC Opco with the same capital structure as the acquisition NSULC.

Some of the advantages of this structure are as follows:

For Canadian income tax purposes, NSULC Opco can deduct the interest expense on the subordinated debt (which originated with the U.S. investor) and also on the onloan of the third-party debt in computing its income; again this comes at a cost of Canadian withholding tax on the interest payable by the top NSULC (when paid) at 10%.

Finco will have interest income on the onloan of the third-party debt, which will be matched by the interest expense on the third-party debt; Finco will also have net interest income in respect of the subordinated loan to NSULC Opco; for Canadian income tax purposes, this interest will be allocated to the NSULC partner, which will have an offsetting interest expense on the matching subordinated loan from the U.S. investor.

For U.S. income tax purposes, NSULC Opco is disregarded so that Finco (a foreign corporation for U.S. tax purposes) will be considered to have acquired assets at fair market value, creating a high tax basis for U.S. tax purposes; this basis will be available to create shelter in computing the "earnings and profits" of Finco for U.S. tax purposes.

For U.S. income tax purposes, the top NSULC is also disregarded, as is the subordinated loan owed by the top NSULC; the "interest" on that loan will not be interest for U.S. income tax purposes but will instead be regarded as a distribution from Finco, which will be taxable in the U.S. only to the extent of the "earnings and profits" of Finco (which will be minimized for the reasons mentioned above).

The U.S. investor can ultimately extract cash from the structure and from the top NSULC without attracting Canadian withholding tax by having the principal of the debt owing to it repaid and by having the paid-up capital of NSULC’s shares returned to it.

Under the Canada-U.S. tax treaty, the U.S. investor can generally sell the shares of the NSULC and not be subject to Canadian tax on any capital gain realized, provided NSULC’s shares do not derive their value primarily from Canadian real property.

As described above, the structure is also efficient from a U.S. tax perspective (in general, UBTI issues are not a concern in this case). The major benefit of this structure is to permit the interest expense on the internal debt (i.e., the 2:1 debt that originates with the U.S. investor) to be deductible for Canadian tax purposes against the business income generated in NSULC Opco, but not taxable as interest in the United States. As is the case in the flow-through structure, the Canadian tax savings generated from the interest deduction in NSULC Opco can be used to further pay down debt incurred to make the acquisition.

Corrado Cardarelli is a partner in the Tax Department of Torys LLP in Toronto. His practice largely involves corporate taxation, including reorganizations, mergers, divestitures, joint ventures, acquisitions, restructurings of financially troubled corporations and corporate finance.

Stephen Donovan, co-head of the firm’s Private Equity Group, is a corporate/commercial lawyer whose practice includes mergers and acquisitions work and has acted in several management buyouts and leveraged buyouts of private and public companies.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.