This is a follow-up to a recently posted blog on January 30, 2014 titled, Changes Proposed for Exempt Offerings of Short-Term Debt and Securitized Products in Canada."

The designated rating provision under the existing Short-Term Debt Exemption in Section 2.35 of National Instrument 45-106 Prospectus and Registration Exemptions (NI 45-106) requires an issuer of short-term debt, such as commercial paper, to have at least one credit rating that meets or exceeds a specified minimum rating ( the "credit rating threshold condition"). Although an issuer of short-term debt does not require more than one credit rating, if the issuer obtains another credit rating of its commercial paper, each rating must be at or above the specified minimum. This additional rating requirement has been termed the "split rating condition". The CSA has modifiedthe "split rating condition" in proposed amendments to the Short-Term Debt Exemption in s. 2.35 of NI 45-106.

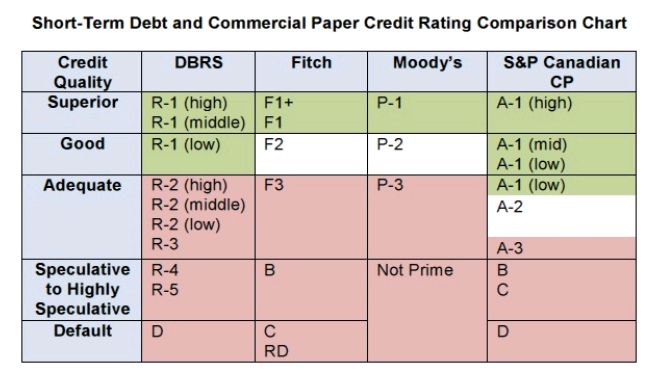

The chart below has been prepared to provide a better visual presentation of the "modified split rating condition".

Simply, a short-term debt issuer needs at least one credit rating in green to satisfy the credit rating threshold condition.

If the short-term debt has more than one credit rating, it cannot have a credit rating in the red, but it can have another credit rating in the white or green in order to satisfy the credit rating requirements under the Proposed Short-Term Debt Exemption.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.