The Canada Not-for-profit Corporations Act (the Act) came into force on October 17, 2011. It replaces Part II of the Canada Corporations Act, which will be fully repealed after the three-year transition period which began with the Act's coming into force. During this transition period, which will end October 17, 2014, existing federally incorporated not-for-profit corporations (NFPs) currently governed by Part II of the Canada Corporations Act must apply for continuance under the Act or be forcibly dissolved.

This is one in a series of bulletins examining and explaining selected provisions of the Act. Previous bulletins have addressed the transition steps under the Act, innovations in the area of members' rights, and the new distinction between soliciting and non-soliciting corporations. This bulletin addresses the accounting requirements contained in the Act.

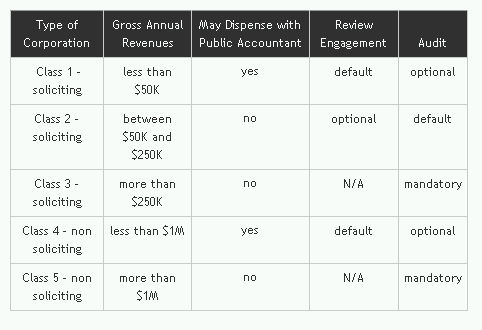

The key factors that determine the accounting requirements applicable to a given corporation in a given year are: (i) gross annual revenues for last completed financial year (AR); and (ii) whether or not the corporation is a soliciting corporation.1 Based on these factors, a corporation may fall into one of five classes. Accounting requirements will differ according to class and the decisions taken by the members; either an audit engagement, a review engagement, or a compilation will be required. The five classes may be summarized as follows.

Soliciting corporation; AR equal to or less than $50,000

- Corporations in this class must appoint a public accountant (PA), unless the members unanimously resolve to waive this requirement (s. 182(1)).

- If a PA is not appointed, then a compilation is required.

- If a PA is appointed, then a review engagement is required (s. 188(1)), unless the members specifically require, by way of ordinary resolution, an audit engagement (s.188(2)).

Soliciting corporation; AR above $50,000 up to and including $250,000

- Corporations in this class must appoint a PA, and the members may not waive this requirement.

- An audit engagement is required (s. 189(1)), unless the members pass a special resolution waiving this requirement in favour of a review engagement (s. 189(2)).

Soliciting corporation; AR above $250,000

- Corporations in this class must appoint a PA, and the members may not waive this requirement.

- An audit engagement is required (s. 189(1)), and the members

may not derogate from this requirement.

Non-soliciting corporation; AR equal to or less than $1million

- Corporations in this class must appoint a PA, unless the members unanimously waive this requirement (s. 182(1)).

- If a PA is not appointed, then a compilation is required.

- If a PA is appointed, then a review engagement is required (s. 188(1)), unless the members specifically require, by way of ordinary resolution, an audit engagement (s. 188(2)).

Non-soliciting corporation; AR above $1 million

- Corporations in this class must appoint a PA, and the members may not waive this requirement.

- An audit engagement is required (s. 189(1)), and the members may not derogate from this requirement.

The following table, reproduced from the commentary accompanying the draft Regulations of the Act, is a helpful summary.

Under section 190 of the Act, a soliciting corporation may make application to the director to have its AR deemed lower than it actually is. Where the director is satisfied that no prejudice to the public would result, he may choose to: (a) deem the corporation's AR to be equal to or less than $50,000, thus placing the corporation in Class 1; or (b) deem the corporation's AR to be between $50,000 and $250,000, thus placing the corporation in Class 2.

The Act requires that the directors immediately fill the office of PA should it become vacant (s. 185(1)), unless the articles of the corporation provide that such vacancy is to be filled by a vote of the members (s. 185(3)).

Corporations falling into Classes 1 and 4 are referred to by the Act as "designated corporations" (s. 179); their specificity is that their members may resolve not to appoint a PA. Such a resolution, however, is not valid unless all members entitled to vote at an annual meeting consent to it, and such a resolution is only valid until the following members' meeting (s. 182).

At the time of applying for continuance or incorporation under the Act, applicants should gain a clear understanding of which accounting obligations will apply and what the available options are.

Footnotes

1 See our bulletin of June 2011 for a detailed discussion of the rules on soliciting corporations.

Norton Rose OR LLP

Norton Rose OR LLP is a member of Norton Rose Group, a leading international legal practice offering a full business law service to many of the world's pre-eminent financial institutions and corporations from offices in Europe, Asia Pacific, Canada, Africa and the Middle East.

The Group's lawyers share industry knowledge and sector expertise across borders to support clients anywhere in the world. The Group is strong in financial institutions; energy; infrastructure, mining and commodities; transport; technology and innovation; and pharmaceuticals and life sciences.

Norton Rose Group has more than 2600 lawyers operating from 39 offices in Abu Dhabi, Amsterdam, Athens, Bahrain, Bangkok, Beijing, Brisbane, Brussels, Calgary, Canberra, Cape Town, Dubai, Durban, Frankfurt, Hamburg, Hong Kong, Johannesburg, London, Melbourne, Milan, Montréal, Moscow, Munich, Ottawa, Paris, Perth, Piraeus, Prague, Québec, Rome, Shanghai, Singapore, Sydney, Tokyo, Toronto and Warsaw; and from associate offices in Dar es Salaam, Ho Chi Minh City and Jakarta.

Norton Rose Group comprises Norton Rose LLP, Norton Rose Australia, Norton Rose OR LLP, Norton Rose South Africa (incorporated as Deneys Reitz Inc), and their respective affiliates.

On January 1, 2012, Macleod Dixon merges with Norton Rose OR, creating a global energy and mining powerhouse within Norton Rose Group. For more information, please visit nortonrose.com.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.