On July 17, 2020, the Government of Canada (Government) released draft legislative proposals (Proposals) that would extend the Canada Emergency Wage Subsidy (CEWS) until at least November 21, 2020, and make the CEWS available to an expanded group of employers.

Originally introduced on April 11, 2020, the CEWS provided a subsidy of up to 75 per cent to eligible employers in respect of remuneration for eligible employees for a 12-week period, beginning March 15, 2020. The original CEWS contemplated that it could be extended by regulation for additional periods ending no later than September 30, 2020.

In addition to extending the CEWS beyond September 30, 2020, the Proposals set out a new, expanded framework for qualification and a sliding scale of subsidy that gradually phases out the subsidy over future periods, and provide certain technical relief where the existing rules prevented employers from accessing the subsidy, along with other technical amendments. The Proposals would also allow taxpayers to dispute determinations made by the Canada Revenue Agency (CRA) in respect of CEWS claims. In the backgrounder accompanying the Proposals, the Government confirmed its intention to move forward with previously-announced draft regulations that would expand the categories of employers that are eligible for the CEWS.

Most of the Proposals, if enacted, would be effective as of the introduction of the CEWS regime on April 11, 2020. Taxpayers would now have until January 31, 2021, to make CEWS applications for any period. It continues to be the case that the CRA may publish the name of any person or partnership that makes an application for the CEWS. To date, CRA has not published any information in this regard, but has indicated that it is considering the process for doing so in the future.

ELIGIBLE ENTITIES AND EMPLOYEES

The CEWS is available to an "eligible entity," which includes a corporation that is not tax-exempt (which can include a non-Canadian corporation), an individual, a registered charity or non-profit organization (other than a public institution) and a partnership consisting of eligible entities. Public institutions, including municipalities and local governments, Crown corporations, wholly owned municipal corporations, public universities, colleges, schools and hospitals, are generally not eligible.

The Proposals would align the treatment of trusts and corporations by clarifying that an eligible entity includes a trust only if it is not tax-exempt. Further, the Proposals include a rule that deems an amalgamated corporation to be a continuation of its predecessors, unless one of the main purposes of the amalgamation was to cause the corporation to qualify for the CEWS. This technical change was needed so that a corporation that undertook an amalgamation was not precluded from qualifying for the CEWS by virtue of being deemed to be a new corporation for purposes of the Income Tax Act (ITA), such that it could not meet the drop in revenue test.

Proposed regulations released on May 15, 2020 would prescribe new categories of "eligible entities," including certain corporations and partnerships owned by one or more Aboriginal governments or similar Indigenous governing bodies, partnerships of which less than 50 per cent of the members are non-eligible entities, registered Canadian amateur athletic associations, registered journalism organizations, and persons or partnerships operating a private school or college.

Employees whose remuneration is eligible for the subsidy (eligible employees) are individuals employed in Canada by the eligible entity in the qualifying period. Under the existing rules, employees that were without remuneration by the eligible entity in respect of 14 or more consecutive days in a qualifying period are not eligible. Under the Proposals, this restriction has been removed in respect of the fifth and subsequent qualifying periods-that is, qualifying periods beginning July 5, 2020, and later.

QUALIFYING PERIODS

To avail itself of the CEWS, an eligible entity must file an application with the CRA. Under the existing rules, such application must be made before October 2020. In light of the extension of the program until at least November 21, 2020-and potentially to the end of 2020-the Proposals would extend the deadline by which an eligible entity must make a CEWS application in respect of any claim period to January 31, 2021. The individual with the primary responsibility for the financial activities of the entity must attest to the completeness and accuracy of its application. We would expect that, in most cases, such individual would be the chief financial officer. This contrasts with most other tax filings which can typically be signed by any authorized person of the taxpayer.

The initial CEWS program was broken into three four-week qualifying periods (each, a claim period), beginning March 15, 2020, and contemplated that subsequent claim periods, ending no later than September 30, 2020, could be prescribed by regulation. On May 15, 2020, the Government announced its intention to extend the CEWS to August 29, 2020.

The Proposals would extend the CEWS program to November 21, 2020, with a potential further extension by regulation to end no later than December 31, 2020. As with the initial program, the extended CEWS program is divided into four-week claim periods, of which there are now nine in total.

To qualify for the first claim period (March 15 to April 11, 2020), eligible entities must have had a reduction by at least 15 per cent of their qualifying revenues in March 2020, as compared to one of two reference periods, being March 2019 or the average of January and February 2020. For the two subsequent four-week claim periods, eligible entities must either have qualified by meeting the revenue reduction test in the immediately prior claim period, or show a revenue reduction of 30 per cent, as compared to the applicable month (April or May) in 2019 or the average of January and February 2020.

For the fourth claim period, which has already ended, the qualification criteria and program design are identical to periods one through three. That is, to qualify, eligible entities must have met the 30 per cent revenue reduction test in either May or June, as compared to the same month in 2019, or the average of January and February 2020, depending on which prior reference period was selected by the entity.

For the fifth and subsequent claim periods, the CEWS has been substantially redesigned. Eligible entities no longer need to demonstrate a particular percentage by which their revenues have been reduced in the relevant reference period in order to qualify for the CEWS. Instead, eligible entities need to demonstrate that their revenues have been reduced, but the amount of the subsidy to which an eligible entity is entitled depends on the extent to which its revenues have been reduced; for more information, see Amount and Treatment of Subsidy below. For the fifth and sixth claim periods, eligible entities that would have been better off under the prior program design are entitled to receive a subsidy calculated as it was for periods one through four, provided that they demonstrate the requisite 30 per cent decline in revenues. This ensures that employers that made retention and compensation decisions based on the existing design of the CEWS-after the extension to August 29, 2020, was announced and prior to the release of the Proposals-are not prejudiced by the overhaul.

COMPUTATION OF REVENUE

An entity's revenue for purposes of determining its qualification-and, in respect of the new program design, the extent of its subsidy-for any claim period (its qualifying revenue) means its inflow of cash, receivables or other consideration arising in the course of its ordinary activities, excluding extraordinary items, amounts derived from non-arm's length persons or partnerships-subject to an important exception for eligible entities that derive all or substantially all of their revenue from such sources-and amounts received under the CEWS. Such revenue is to be determined in accordance with its normal accounting practices; however, an election is available to use the cash-basis method of accounting, provided that such method is used consistently for purposes of the subsidy. The Proposals would add an ability to elect to use the accrual method of accounting for an entity that ordinarily uses the cash-basis method. The CRA has provided substantive guidance with respect to the computation of revenue and other aspects of the CEWS in their regularly-updated FAQ resource.

In the case of registered charities, qualifying revenues include revenues from related businesses, gifts and other amounts received in the course of their ordinary activities. In the case of other tax-exempt entities, qualifying revenues include membership fees and other amounts received in the course of their ordinary activities. Charities and non-profit organizations may, on an elective basis, exclude funding received from government sources from their qualifying revenues.

The starting point for determining the revenue of an eligible entity that is part of a corporate group is the group's normal accounting practices. For groups that normally prepare consolidated financial statements, however, an election is available to instead compute qualifying revenues on a separate entity basis. On the other hand, an election is available for affiliated groups of eligible entities-which may not ordinarily prepare consolidated financial statements-to determine revenue on a consolidated basis, in accordance with relevant accounting principles. This flexibility may provide a significant advantage for corporate groups that structure their affairs using multiple subsidiary corporations for various lines of business, rather than using divisions within the same legal entity, the revenues from which may be differently impacted by the pandemic crisis.

Where all or substantially all of the qualifying revenue of an eligible entity is from one or more non-arm's length persons or partnerships, its qualifying revenues for the current and prior reference periods are determined under a special test. The effect of this test is to determine the revenue reduction of such an eligible entity by reference to the qualifying revenues from arm's length sources-which may be non-Canadian sources-of the non-arm's length persons from which the eligible entity receives its revenues.

The Proposals include a rule intended to provide relief, in certain limited circumstances, to eligible entities that have made recent asset acquisitions. If business assets were acquired after the relevant prior reference period, the comparison of qualifying revenues for the current reference period in respect of a claim period to that prior reference period may not reflect the true impact of the pandemic crisis on the eligible entity's business. The proposed relieving rule is only available if, among other things, the assets acquired constituted all or substantially all of the assets that were used by the seller in carrying on business and it is reasonable to conclude that none of the main purposes of the acquisition was to increase the amount of the CEWS. Where it is available, the proposed rule allows the eligible entity to elect (with the seller of the assets, if it still exists) to treat qualifying revenues that are reasonably attributed to the acquired assets as qualifying revenues of the purchaser, and not of the seller, for both the prior reference period and the current reference period.

The legislation includes an anti-avoidance rule aimed at transactions or series of transactions undertaken-or failed to be taken-with a "main purpose" of reducing qualifying revenues in respect of a qualifying period. Where the anti-avoidance rule applies, the eligible entity is liable to a penalty that is generally equal to 25 per cent of the amount of the subsidy claimed for the relevant period, in addition to being required to repay the subsidy. The Proposals would adjust this anti-avoidance rule to the new program design, so that it applies where one of the main purposes of a transaction or series is either to cause an eligible entity to qualify for the CEWS, or to increase the amount of the subsidy received.

AMOUNT AND TREATMENT OF SUBSIDY

Amounts under the CEWS are deemed to give rise to an overpayment on account of the qualifying entity's income tax liability under the ITA. Typically, the amount of the overpayment is a weekly wage subsidy as described below. In addition, in respect of employees on paid leave-and, in respect of the fifth and subsequent claim periods, where the eligible employer's "revenue reduction percentage" or "top-up percentage" is greater than zero per cent-the overpayment also includes an effective refund of employer contributions under the Employment Insurance Act, the Canada Pension Plan, certain provincial pension plans and Quebec's Act respecting parental insurance. The overpayment is refundable at any time in the taxation year. It is reduced by amounts received under the 10 per cent Temporary Wage Subsidy, as well as by amounts received by eligible employees as work-sharing benefits under the Employment Insurance Act. The amount of the deemed CEWS overpayment is included in the eligible entity's income for purposes of the ITA as assistance received from a government, though this inclusion should normally be offset by a deduction for the corresponding employment expenses incurred.

First Four Claim Periods: 75 Per Cent Wage Subsidy

For claim periods one through four, the amount of the weekly wage subsidy in respect of each eligible employee that dealt at arm's-length with the eligible entity during the qualifying period is effectively is the greater of:

- 75 per cent of the amount of remuneration paid, up to a maximum benefit of C$847 per week; and

- The least of (a) the amount of remuneration paid, (b) 75 per cent of the average weekly eligible remuneration paid to such employee during the period between January 1 and March 15, 2020 (referred to as the employee's baseline remuneration), and (c) C$847.

Generally, in respect of employees that receive the same weekly remuneration both before and after the beginning of the COVID-19 crisis, the amount of the subsidy for the first four claim periods is simply 75 per cent of eligible remuneration paid to the employee for that week, up to a maximum subsidy of C$847 per employee per week. However, in respect of employees whose remuneration was decreased after the beginning of the COVID-19 crisis, the formula provides that the subsidy may be as high as 100 per cent of the eligible remuneration paid to the employee for a week, subject to the maximum subsidy of C$847 per employee per week.

A subsidy may also be claimed in respect of eligible remuneration paid to non-arm's-length employees, but in such a case the weekly subsidy is the lesser of (i) the actual amount of eligible remuneration paid for that week, and (ii) 75 per cent of the employee's baseline remuneration, in each case up to a maximum subsidy of C$847 per employee per week.

Fifth and Subsequent Claim Periods: Base Percentage and Top-Up Percentage

As described above, no minimum revenue reduction threshold must be met by eligible entities for periods beginning July 5, 2020, and later. Instead, for such claim periods, eligible entities that experience any decline in revenues as compared to the applicable prior reference period are entitled to a weekly wage subsidy in respect of active employees. The weekly wage subsidy is computed by multiplying the sum of the eligible entity's "base percentage" and its "top-up percentage" for the claim period by the least of three amounts:

- The amount of eligible remuneration paid to an eligible employee;

- C$1,129; and

- Where the eligible employee does not deal at arm's length with the eligible entity, the baseline remuneration in respect of the eligible employee for that week.

An eligible entity's "base percentage" is a function of the percentage by which its revenues have fallen in the current reference period for a claim period-for example, July 2020, for the fifth claim period-as compared to the prior reference period-either July 2019 or the average of January and February 2020, depending on the method elected-up to a maximum base percentage for each claim period. The base subsidy for which employers may be eligible begins at a maximum of 60 per cent for eligible entities whose revenues have been reduced by at least 50 per cent, and declines with each claim period, beginning August 30, 2020. The calculation of the base percentage for each claim period is set out in the table below.

|

Claim Period |

Period 5: |

Period 6: |

Period 7: |

Period 8: September 27 - October 24 |

Period 9: |

|

Base Percentage with revenue reduction percentage (RRP) of 50% or more |

60% |

60% |

50% |

40% |

20% |

|

Base Percentage with RRP < 50% |

RRP x 1.2 |

RRP x 1.2 |

RRP x 1.0 |

RRP x 0.8 |

RRP x 0.4 |

The "top-up percentage" provides an additional subsidy for eligible entities considered to have been the most adversely affected by the crisis. It is a function of the percentage (referred to as the top-up revenue reduction percentage) by which an eligible entity's revenues in the three months preceding the claim period-for example, April to June 2020 in respect of the fifth claim period-have declined as compared to either the same three months in 2020 or January and February 2020. Specifically, top-up percentage is computed as 1.25 multiplied by the amount by which the eligible entity's top-up revenue reduction percentage exceeds 50 per cent, capped at a maximum of 25 per cent. Accordingly, an eligible entity whose three-month revenue decline is 50 per cent or less is entitled to no top-up percentage.

As described above, for the fifth and sixth claim periods (July 5 to August 29, 2020), eligible entities that would be entitled to a greater wage subsidy under the "old" program design applicable to claim periods one through four will receive that amount, provided that they meet the 30 per cent revenue reduction test for those claim periods.

Similar to the existing rule that allows an eligible entity that meets the revenue reduction threshold to qualify automatically for the immediately subsequent claim period, the Proposals include a rule that deems an eligible entity that has a lower revenue reduction percentage in respect of a claim period than it had for the immediately prior claim period, to have experienced the same, higher, revenue reduction percentage.

If an eligible employee is employed in a week by two or more entities that do not deal with each other at arm's-length, the aggregate amount that may be claimed by the two entities in respect of that employee is limited to the amount that would arise if all of its eligible remuneration were paid by one entity.

Eligible remuneration includes most amounts paid as remuneration for employment, but does not include retiring allowances or stock option benefits. Eligible remuneration also does not include (i) amounts reasonably expected to be repaid to the eligible entity, a non-arm's-length person, or a person at the direction of the eligible entity, or (ii) amounts in excess of the employee's baseline remuneration, if it is reasonably expected that, after the qualifying period, the employee will be paid an amount that is lower than his or her baseline remuneration, and if one of the main purposes for the arrangement is to increase the amount of the wage subsidy.

Furloughed Employees

For the first six claim periods of the CEWS, eligible remuneration paid to employees on paid leave is treated identically to that paid to those in active employment, except that for periods five and six, no wage subsidy will be available unless the employer has either a positive top-up percentage or a positive revenue reduction percentage. Beginning with the seventh claim period, the weekly wage subsidy in respect of employees on paid leave is computed differently, as the least of four amounts:

- The amount of eligible remuneration paid;

- An amount determined by regulation (no such regulation has been released at this time);

- Nil, if the employee does not deal at arm's length with the employer and the baseline remuneration in respect of the week is nil; and

- Nil, if both the top-up percentage and the revenue reduction percentage of the employer are not greater than zero.

Although the Proposals do not, on their face, include a "cap" on the weekly wage subsidy that can be paid in respect of eligible remuneration paid to furloughed employees in periods seven and subsequent, our expectation-based in part on the accompanying backgrounder-is that such a cap would be introduced by regulation, and would have the effect of aligning benefits under the CEWS with those under the Canada Emergency Response Benefit and/or Employment Insurance.

COMPARING THE OLD AND NEW PROGRAMS

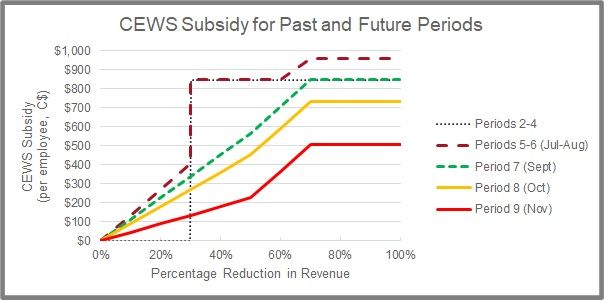

The new design of the CEWS is intended to address the "cliff effect" that resulted from the 30 per cent revenue reduction threshold necessary to qualify for the 75 per cent wage subsidy under the existing rules, provide the greatest assistance to those that have been most severely impacted, and provide for a gradual phase-out of benefits under the program. The following chart illustrates the level of CEWS benefits associated with different levels of revenue decline during claim periods under the existing-periods two through four-and proposed-periods five and following-rules. The chart assumes that the relevant employee is paid a sufficient wage to trigger the maximum CEWS-which generally means that the employee is earning at least about C$1,129 per week-and that the employer has experienced a constant revenue drop since the beginning of period two. The actual subsidies received by an employer will vary in practice based on the details of how the employer's revenue fluctuated over time and other factors.

For permission to reprint articles, please contact the Blakes Marketing Department.

© 2020 Blake, Cassels & Graydon LLP.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.