On December, 29, 2015, Law No. 7,176/2015 was published in the Official Gazette of the State of Rio de Janeiro. The law establishes a unique tax fee for services related to Rio de Janeiro State tax revenue, stating that the tax must be collected on a quarterly basis up until the business day immediately prior to the beginning of the following quarter in which the services covered by the tax fee will be provided or will be available to the taxpayer.

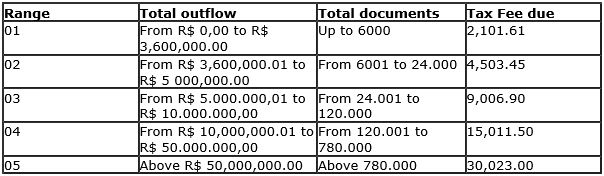

The tax fee will be calculated and collected according to the table below:

For tax rate calculation purposes, twelve (12) months prior to the last month before the beginning of the quarter will be considered the base period of the framework and will set the range category in which the taxpayer will fall under.

The taxpayer must pay the Tax Fee that corresponds to the applicable range given the "Total Outflow" or "Total Documents", whichever is higher, granting said amount on the date of the payment, as set forth in the sole paragraph of article 107 of Decree No. 05/1975.

The following services are not included in this law , thus the specific fees must be collected, as provided in item I of the table referred to in section 107 of Decree No. 05/1975:

- services related to legal or tax consultation analysis coordinated by the consulting management area of the Secretariat of State Treasury Office

- special regimes request;

- accumulated credit transfer request or recoverable balance.

In the case of establishments requesting state enrollment, they will be covered by the first range category, and the tax fee will be calculated proportionally to the months between the enrollment request and the end of the quarter.

The tax fee may be reduced, depending on the period in which the state enrollment was active.

The establishments exempt from the delivery of the GIA, SPED or issuance of tax documents will fall under the first range category.

The provision of any of the services covered by tax fees depends on the proof of payment of the fee applicable to a given quarter.

Failure to pay the tax fee will result in a penalty of 30% of the fee not paid, plus interest on arrears.

This Law shall be effective as of March 28, 2016.

Visit us at Tauil & Chequer

Founded in 2001, Tauil & Chequer Advogados is a full service law firm with approximately 90 lawyers and offices in Rio de Janeiro, São Paulo and Vitória. T&C represents local and international businesses on their domestic and cross-border activities and offers clients the full range of legal services including: corporate and M&A; debt and equity capital markets; banking and finance; employment and benefits; environmental; intellectual property; litigation and dispute resolution; restructuring, bankruptcy and insolvency; tax; and real estate. The firm has a particularly strong and longstanding presence in the energy, oil and gas and infrastructure industries as well as with pension and investment funds. In December 2009, T&C entered into an agreement to operate in association with Mayer Brown LLP and become "Tauil & Chequer Advogados in association with Mayer Brown LLP."

© Copyright 2015. Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. All rights reserved.

This article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.