No contexto das ações anunciadas na última semana pelo Governo Federal para equilibrar as contas públicas, foi publicada em 22 de setembro de 2015, a Medida Provisória (MP) nº 692, em edição extra do Diário Oficial da União (DOU).

O que muda com regra proposta?

Entre outras disposições, a MP nº 692/15 introduziu as novas regras relativas à tributação pelo Imposto de Renda (IR) dos ganhos de capital apurados por pessoas físicas na alienação de bens e direitos, e por pessoas jurídicas não sujeitas às sistemáticas do lucro real, presumido e arbitrado na alienação de bens e direitos registrados no ativo não-circulante.

Ainda, mesmo a MP não tendo sido expressa, pode-se concluir que a MP pode impactar, de forma indireta, alguns casos de ganhos de capital auferidos por investidores estrangeiros, tendo em vista o fato de que a legislação tributária prevê que, de uma forma geral, o ganho de capital de residente ou domiciliado no exterior é apurado e tributado de acordo com as regras aplicáveis aos residentes no país.

Especificamente, a MP nº 692/15 estabeleceu uma sistemática progressiva de tributação dos referidos ganhos de capital pelo IR, de forma que, a partir de 1º de janeiro de 2016, a alíquota atual de 15% dará lugar às seguintes alíquotas progressivas conforme a parcela apurada do ganho:

i)15% sobre a parcela dos ganhos que não exceder R$ 1.000.000,00;

ii)20% sobre a parcela dos ganhos excedente a R$ 1.000.000,00 e inferior aR$ 5.000.000,00;

iii)25% sobre a parcela dos ganhos excedente a R$ 5.000.000,00 e inferior aR$ 20.000.000,00;

iv)30% sobre a parcela dos ganhos excedente a R$ 20.000.000,00.

A MP nº 692/15 também esclarece que, no caso de alienação em estágios do mesmo bem ou direito, a partir da segunda operação, o ganho de capital deve ser somado aos ganhos auferidos nas operações anteriores para fins de determinação das alíquotas aplicáveis. Este dispositivo impediria a segregação da alienação de um mesmo bem em parcelas para evitar as alíquotas mais altas, mas pode não alcançar, a depender das características do caso concreto, alienações em estágios de bens diferentes, mas de mesma espécie, como, por exemplo, ações de uma companhia.

O que não muda?

De qualquer forma, é importante frisar que a nova MP trata apenas das regras gerais de ganhos de capital e, portanto, seriam mantidas situações com regras específicas, incluindo isenções e tributações diferenciadas.

É o caso, por exemplo, (i) da sistemática de ganhos líquidos aplicável às operações realizadas por pessoas físicas em bolsa de valores e assemelhadas, cuja tributação específica é de 15%, (ii) do tratamento tributário diferenciado concedido para investidores não-residentes que não localizados em jurisdições de tributação favorecida (JTF) e que investem nos mercado financeiro e de capitais brasileiro nas condições estabelecidas pela resolução do Conselho Monetário Nacional (CMN) nº 4.373, de 29 de setembro de 2014, o qual ainda permite isenções e alíquotas específicas (Investidores 4.373); ou (iii) alíquotas majoradas de 25% para certos investidores localizados em JTF.

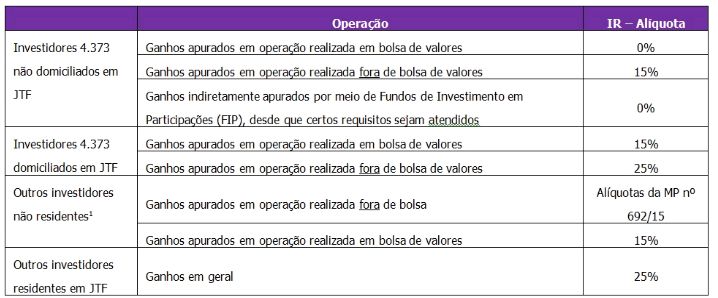

Para os investidores estrangeiros há, portanto, diversos detalhes a serem analisados para se avaliar em quais situações a MP nº 692/15 pode ser aplicada, como, dentre outros, a sua localização, a forma como o investimento é realizado, o ambiente no qual a operação de venda é conduzida.

Resumo do tratamento para os não residentes a partir das novas regras

Nesse contexto, de forma simplificada, considerando que MP seja aplicada e observando também as demais regras específicas dos investidores estrangeiros, algumas alíquotas aplicadas em ganhos apurados em venda de participações societárias podem ser assim resumidas:

1 Consideram-se aqui os investimentos estrangeiros que investem no Brasil nos termos dispostos na Lei nº 4.131, de 3 de setembro de 1.962, normalmente em empresas fechadas.

Outras questões a serem consideradas

Por fim, outros diversos aspectos controversos relacionados à aplicação da nova sistemática de tributação dos ganhos de capital da MP nº 692/15, como, por exemplo: (i) a tributação pela sistemática introduzida pela MP nº 692/15 às operações já realizadas até 2015, e que apresentem parcelas a prazo a receber já no cenário de eficácia das novas regras ou, ainda, parcelas futuras como aquelas depositadas em contas escrow ou vinculadas a eventos incertos, como valores de earn out dependentes de apuração de lucros da entidade alienada. Ainda que o tema não seja pacífico, parece consistente defender que tais operações devem permanecer na sistemática aplicável no momento em que a operação é realizada e não no momento em que os recebimentos ocorrem.

Ainda, é de se observar que, as novas regras de tributação de ganhos de capital introduzidas pela MP nº 692/15 devem também ter aplicação harmonizadas com as disposições estabelecidas no âmbito das convenções formadas pelo Brasil com outros países para evitar a dupla tributação da renda, as quais, em geral preveem alíquotas máximas, inferiores às estabelecidas pela nova MP.

Por fim, apontamos que, conforme disposto em seu artigo 4o, as novas regras devem entrar em vigor a partir de 1o de janeiro de 2016. Contudo, como o prazo para aprovação no Congresso pode chegar a 120 dias, vencendo em janeiro do próximo ano. Caso a MP nº 692/15 venha a ser convertida em Lei Ordinária durante o ano-calendário 2016, no entanto, entendemos que a eficácia da nova regra ficaria postergada para em 1o de janeiro de 2017.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.