The new Strata Defects Regime will have short- and long-term effects on developers, and they should be getting ready now.

New South Wales' new Strata Defects Regime established under the Strata Schemes Management Act 2016 is about to commence on 1 January 2018, and with the release of the Strata Schemes Management Regulations 2016 developers have more clarity about their various obligations under the scheme.

Developers and builders will need to familiarise themselves with their new obligations to avoid fines and the risk of delays in receiving an occupation certificate, and ensure that any contracts in negotiation but not signed before 1 January 2018 reflect them.

The new Strata Defects Regime at a glance

Developers of residential or partially-residential strata properties that do not require coverage under the Home Building Compensation Fund (ie. with three or more stories in height) will be required to lodge defect bonds with the Commissioner for Fair Trading, Department of Finance, Services and Innovation (Secretary) for construction contracts signed (or if there is no contract where building work commences) on or after 1 January 2018. We explored this in our previous article.

The new Regulations now provide details about:

- documents to be lodged with the building bond;

- persons qualified to be appointed as building inspectors;

- the "contract price" for determining how the 2% bond will be calculated;

- validity periods for building bonds;

- deadlines for the owners corporation to call on bonds;

- the process for payment of the building bonds; and

- the process for review of decisions by the Secretary.

We'll look at these in more depth below.

Documents to be lodged with the building bond

A developer must, when giving a building bond to the Secretary, also provide (amongst other things) the following documents and information:

- address for service of the developer and the owners corporation;

- a copy of any documents relevant to the determination of the contract price used to calculate the amount of the building bond;

- a copy of the contract or contracts for the building work between the developer and the builder;

- a copy of the specifications for the building work and any variations;

- a copy of any written warranties relating to the building work;

- a copy of any schedule of non-conforming works relating to the building work;

- a copy of all "issued for construction" and "as built" drawings and specifications relating to the building work,

- a copy of any development consent or other consents, approvals or certificates issued under the Environment Planning and Assessment Act 1979 relating to the building work,

- a copy of any alternative solutions and fire engineering reports, and the applicable assessment and approval by the principal certifying authority relating to the building work,

- a copy of any design certificates relating to the building work,

- a copy of the Building Code of Australia compliance certificates by each subcontractor for any part of the building work carried out by the subcontractor; and

- a copy of any inspection report obtained by the developer or building relating to the building work.

Developers will need to make sure they have these documents ready for submission so there is no delay in issue of the occupation certificate.

Qualified building inspectors

Developers will need to appoint inspectors to carry out interim and final inspections of the building works.

For the purposes of the Act a person is qualified to be appointed as a building inspector if that person is a member of a class of persons prescribed by the Regulations. The Regulations do not specify specific qualifications required by an inspector but rather require that the inspector be a person who is a member of a strata inspector panel established by one of a number of industry bodies listed in the Regulations (eg. the Housing Industry Association or the Master Builders Association of NSW).

Contract price for determining value of building bond

Under the scheme, developers will be required to a provide a building bond to the Secretary for the value of 2% of the contract price. The Regulations have now clarified that the contract price is calculated as the total price paid under all applicable contracts for the building works as at the date of the issue of the occupation certificate. The Civil and Administrative Tribunal may also on application of the owners corporation, the developer or the Secretary make an order determining the contract price of the building work for the purposes of determining the amount of the building bond.

If there is no written contract for the building work or the parties to the building contract (i.e. the developer and the builder) are related or connected persons, the contract price for the building works must be identified in a cost report prepared by an independent quantity surveyor who is a member of the Australian Institute of Quantity Surveyors or the Royal Institute of Chartered Surveyors.

The cost report prepared by the quantity surveyor must include costs of the following and be accompanied by a certificate by the quantity surveyor that he or she has inspected the premises, the as-built documents and the specifications for the strata plan:

- construction and fitout costs, not including appliance and PC items;

- demolition and site preparation;

- excavation;

- car parking;

- cost for the common property that is included in the property plan, including landscaping, pools, fencing and gates;

- professional fees; and

- taxes applied in the calculation of the as built construction.

Developers using in-house building capability will need to be aware of this additional requirement to value the works before submitting the defect bond (again potentially delaying the issue of the occupation certificate). This will be the case even where the contract sum has been negotiated on an arm's-length basis (as is often the case).

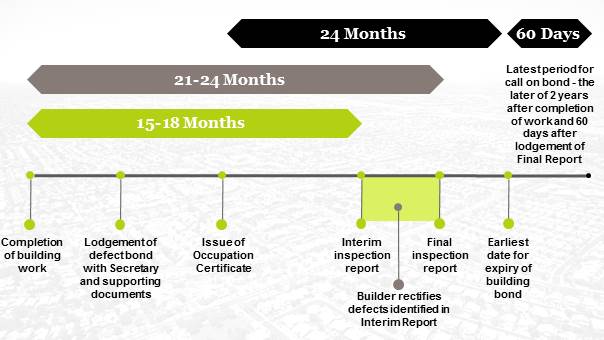

Validity periods for building bonds and deadlines for call by the owners corporation

The developer must ensure that the building bond, whether in the form of a bank guarantee, unconditional undertaking, security bond or another form of security as prescribed by the Regulations, is valid for at least two years (and no more than three years) after the date of issue of the relevant occupation certificate.

An owner's corporation can apply to the Secretary for payment of the building bond, to meet the costs of rectifying any defective building work, identified in the final report (which is to be completed within 21-24 months after the date of completion of the building work).

A building bond must be claimed or realised within two years after the date of completion, or within 60 days after the final report is given to the Secretary, whichever is the later (Bond Claim Date). An application by the owners corporation to claim a building bond must be made no later than 14 days before the last day of the Bond Claim Date.

The Secretary must not pay the whole or part of an amount secured by a building bond unless the Secretary has given at least 14 days written notice to the owners corporation, the developer and the builder of the proposed payment. This 14 day notice period allows the builder and developer the opportunity to make an application for review of the Secretary's decision. Where there has been an application for review a payment of the bond cannot be made until the review has been determined or withdrawn.

Review of decisions of the Secretary

Interested persons including the developer, the owners corporation, the owner of a lot or the builder may apply for review of the following decisions of the Secretary:

- a decision to appoint a building inspector to carry out a final report;

- a decision under the Act to vary the period within which an interim or final report is to be provided or other action is to be done under the building defect regime;

- a determination that the developer is not required to arrange a final report;

- a decision that the whole or part of the building bond may be claimed or realised for payment to the owners corporation, developer or other person.

The application for review of a decision must be made no later than 14 days after the notice of the decision is given by the Secretary to the interested person and must:

- be in writing;

- specify the decision for which a review is sought and the grounds on which the review is sought; and

- specify any information not previously provided to the Secretary and indicate why the information was not previously provided.

In reviewing a decision, the reviewer (who will be independent of the initial decision maker) may affirm, vary, set aside the Secretary's initial decision and make a decision in substitution for the decision that is set aside.

Interested persons are not entitled to a review of any decision that has previously been reviewed. However the Act does not affect any action that may be taken, or remedy that may be sought by or in respect of the building works under any other law and any court, tribunal or other body may take into account any payment made, rectification work done or any other action taken in relation to the building work under the building defects scheme.

Getting ready for the new Strata Defects Regime

The new regime will have short- and long-term effects on developers.

In the short-term, any developer currently in negotiations but who is unlikely to sign a contract before the New Year should be taking the new laws into consideration now, and ensuring the terms and conditions reflect them. In particular, they should review their building contracts to ensure that, as far as possible, obligations are backed down to their builder, which might include:

- extended defects liability periods to align with the length of time available to the owners corporation to claim on the defects bond; or

- the provision of bonds direct from the builder to the Secretary or, at the least, back to back bonds to cover the developer's exposure.

In the long term, developers need to be prepared for the additional administrative burden imposed by the new regime, by:

- ensuring they have all paperwork and calculations of contract value ready to go upon completion of the building work, so they can promptly lodge their defect bonds and supporting documents with the Secretary to avoid any delay in issue of the occupation certificate;

- when using in-house building capability, lining up a quantity surveyor to prepare a final cost report to calculate the contract price for the works; and

- ensuring they provide a detailed initial maintenance schedule to the owners corporation to mitigate the risk of defect claims.

Seeking bank guarantees from financial institutions may be difficult for smaller scale developers and they may be required to use more of their own equity to fulfil bond requirements. Developers should start engaging with banks to discuss their options for securing bonds.

Developers and builders also need to be prepared to ensure they are ready to respond quickly to claims against the bond. Given the tight 14 day time-frame to apply for review of the Secretary's decision, builders and developers will need to be aware of any potential claims by owner's corporations, in particular any defects identified in the final report, to ensure they are prepared for any claims against the bond.

RELATED KNOWLEDGE

Clayton Utz communications are intended to provide commentary and general information. They should not be relied upon as legal advice. Formal legal advice should be sought in particular transactions or on matters of interest arising from this bulletin. Persons listed may not be admitted in all states and territories.