Upon termination of employment, your employer may pay you a lump sum payment. There are various issues that need to be considered at such a time and one of them would be to understand how the tax on such a payment works as there may be planning opportunities for you to reduce the tax.

What is an employment termination payment?

Not all payments made to you upon termination of your employment are an employment termination payment (ETP) as defined in the tax laws. It is important to identify if any of your payout is an ETP because ETP's can receive concessional tax treatment.

Employment Termination Payments (ETP's) include:

- A payment for unused rostered days off or for unused sick leave;

- A payment in lieu of notice;

- A payment due to redundancy or early retirement that exceeds the tax-free amount;

- A payment due to invalidity.

The following amounts are not ETP's but are usually paid as part of a lump sum payout:

- A payment for unused annual or long service leave;

- The tax-free amount of a redundancy or early retirement payment.

Can you direct an ETP into superannuation?

All ETP's must be taken as a cash lump sum. Once deposited into your personal bank account, the funds can then be used for any purpose including contributing it into superannuation.

How are ETPs taxed?

An ETP has two tax components – a tax-free amount and a taxable amount. In some instances, the payment may consist of only just one tax component.

A tax-free amount usually arises when the employee has been retrenched and s/he is under 65 years of age or if part of the payment relates to a period of employment prior to 1/7/1983 or if it relates to an invalidity payment. The remainder of the payment is taxable.

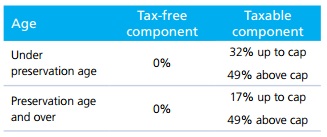

The tax treatment of an ETP1 received by an employee will depend on their age and whether the taxable amount of the ETP falls below the relevant 'cap', as shown in the table below:

What is the cap?

There are two tax caps – ETP cap and the Whole of Income (WOI) cap.

The ETP cap for 2014/15 is $185,000. This cap is indexed annually. The WOI cap is $180,000 and does not get indexed. To limit the tax concession obtained by high income earners, the WOI cap is reduced by other taxable income. For instance, if an employee has received a salary of $120,000 with no other income for the financial year then the WOI cap is reduced to $60,000 (i.e. $180,000-$120,000).

Which cap applies?

The ETP cap of $185,000 (2014/15) applies to excluded ETPs, which are ETPs that are received involuntarily by the employee. These payments generally include a redundancy payout, early retirement scheme payment or a payment due to invalidity.

All other ETPs are treated as non-excluded ETPs. The lesser of the following caps is applied against non-excluded ETPs:

- ETP cap2 (referred above), and

- Whole of income (WOI) cap of $180,000. This cap is reduced by any other taxable income earned in the same financial year.

The WOI cap does not get indexed.

To follow are two simple examples that illustrate how ETPs are taxed under different scenarios.

Example 1:

John is 60 years old and has received a redundancy payout of $150,000 in February 2015. Of this amount, $57,094 is tax-free and the remainder balance of $92,906 is taxable.

To find out how much tax John is liable for on the $150,000, the following steps can be followed:

Step 1: Find out which part of the payment is an ETP.

- The lump sum payment is $150,000. Of this amount, the tax-free amount of $57,094 is not an ETP. The taxable amount of $92,906 is an ETP.

Step 2: Determine which tax cap applies to the taxable amount of the ETP (i.e. $92,906).

- As the ETP is received due to redundancy, it is classified as an 'excluded' ETP. Therefore, the ETP cap of $185,000 applies.

Step 3: Determine if the cap has been exceeded.

- John's taxable ETP of $92,906 falls below the ETP cap of $185,000. Therefore, this entire amount is taxed at a lower tax rate.

Step 4: Calculate the tax.

- As John is 60 years of age, he is past his preservation age of 55. Therefore, the taxable amount of the ETP is taxed as follows:

Example 2:

Kirk is 50 years old and resigned from his role in February 2015. His employer paid him a golden handshake of $100,000 for his 15 years of service with the company. Kirk's earnings totalled $150,000 up until his resignation. He does not have any other investments.

Here are the steps to calculate Kirk's tax on his lump sum payout:

Step 1: Find out which part of the payment is an ETP.

- The lump sum payment is $100,000. The full amount is a taxable ETP because it is paid as a golden handshake.

Step 2: Determine which tax cap applies to the taxable amount of the ETP (i.e. $100,000).

- As the ETP Kirk received is not due to redundancy, invalidity or early retirement scheme, it is classified as a 'non-excluded' ETP. Therefore, the lesser of the following cap applies:

-

- ETP cap of $185,000;

- Whole of Income (WOI) cap of $180,000 reduced by his other taxable income of $150,000, resulting in a reduced WOI cap of $30,000.

- As the reduced WOI cap of $30,000 is the lesser amount, this cap will be applied to Kirk's ETP.

Step 3: Determine if the cap is exceeded.

- Kirk's taxable ETP of $100,000 is greater than the reduced WOI of $30,000. Therefore, Kirk only receives concessional tax treatment limited to $30,000 of the lump sum payment.

Step 4: Calculate the tax.

- As Kirk is below preservation age, the tax on the ETP is as follows:

Planning Opportunities

To reduce the tax payable on the lump sum payment, you may consider one or more of the following actions (where possible) to reduce your taxable income:

- Salary packaging (e.g. as super contributions),

- Defer part of the lump payment into a new financial year(if your income is expected to fall in the new year),

- Use up your leave entitlements whilst still on the job,

- Negative gearing.

Conclusion

The tax treatment of employment termination payments is a complex area and options on how to take these payments may not always be possible. However, if your employer provides you with some flexibility around its payment, appropriate advice may make a significant difference to your tax bill.

This publication is issued by Moore Stephens Australia Pty Limited ACN 062 181 846 (Moore Stephens Australia) exclusively for the general information of clients and staff of Moore Stephens Australia and the clients and staff of all affiliated independent accounting firms (and their related service entities) licensed to operate under the name Moore Stephens within Australia (Australian Member). The material contained in this publication is in the nature of general comment and information only and is not advice. The material should not be relied upon. Moore Stephens Australia, any Australian Member, any related entity of those persons, or any of their officers employees or representatives, will not be liable for any loss or damage arising out of or in connection with the material contained in this publication. Copyright © 2014 Moore Stephens Australia Pty Limited. All rights reserved.