People affected by the tragic siege in December 2014 at the Sydney Lindt Café will be entitled to be paid compensation after the Federal Treasurer declared the event a "terrorist incident" and for the first time activated the Australian Reinsurance Pool Corporation.

Insurance policies usually give the insurer the right to exclude or cancel the insured's claim where there is terrorist event. As a result, the reinsurance pool was established by the Australian Government to make sure that insured businesses are not left with an unfulfilled claim. The siege at the Lindt café provides an example of how this scheme operates.

When an incident is declared as a "terrorist incident", the reinsurance pool operates to pay claims under eligible policies. However, there are limitations on what type of policy is reinsured in the event of a declared "terrorist incident" and this article examines those and how the reinsurance scheme operates.

How does the legislation operate?

Section 9 of the Insurance Contracts Act 1984 (Cth) permits insurers to vary or cancel cover for risks related to terrorism. This usually results in insurers including terrorism as a "general exclusion" or an "excluded peril" within the insurance policy.

In the event of a terrorist incident, an insurer can rely on the exclusion to avoid making a payment on a claim. While some insurers do rely on the exclusion, others are sympathetic to the terrorism events and, as a matter of public policy, choose not to do so and pay out claims. This was exemplified in the events surrounding the Lindt Café where, as at 19 January 2015, three insurance companies had stated that they would not rely on terrorism exclusion clauses.

However, if an insurer does rely on the terrorism exclusion clause, this has the potential to leave the insured without an avenue to make a claim or receive a payment. To counter this, in 2003 the Australian Parliament passed the Terrorist Insurance Act 2003 (Cth) (TI Act): a move that was largely a response to the 9/11 terrorist attacks.

Section 6 of the TI Act provides that where a terrorist act occurs within Australia, the Treasurer can declare that event as a "terrorist Incident". This declaration will mean that:

- a terrorist exclusion clause has no effect in an insurance policy

- a reduction percentage on claims can be applied as part of the declaration, and

- the insurer is reinsured with the Australian Reinsurance Pool Corporation.

What kind of policy can be reinsured?

Generally, insurance policies relating to loss or damage of the property of the insured will be covered, as will business interruption and consequential harm insurance. However other insurance policies, including home building insurance and many forms of travel-related insurance, are not covered under the reinsurance scheme.

The process of a reinsurance claim

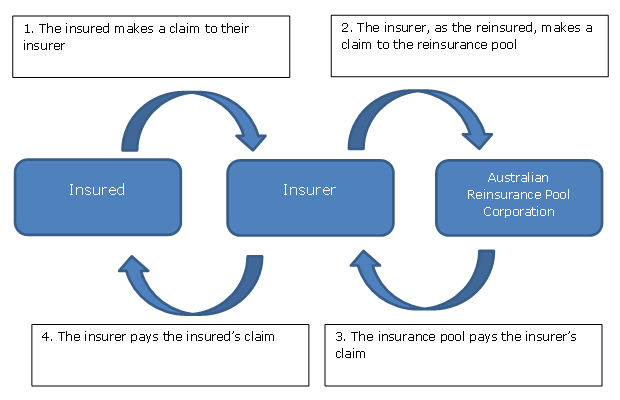

In effect, where an event is declared by the Treasurer as a "terrorist incident", a claim is made by an insured to their insurance company, who is then reinsured and paid by the Australian Reinsurance Pool Corporation. This is demonstrated in the flow chart below.

Lindt Café – An example of the reinsurance scheme

The TI Act was relied on after the terrorist events at the Lindt Café in Martin Place. On 15 January 2015, the Treasurer, Joe Hockey, after consultation with the Attorney-General (as prescribed by s 6(1) the TI Act) and the Insurance Council of Australia, declared the hostage situation in Martin Place a "terrorist incident" with no applicable reduction percentage on claims.

In time, as hostages and the owners of the Lindt Café make claims against their insurance policies, the relevant insurers will be reinsured by the Australian Reinsurance Pool Corporation. This will ensure that the claims are paid out and that none of the hostages are left with ineffective insurance policies.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.