By Anne MacNamara

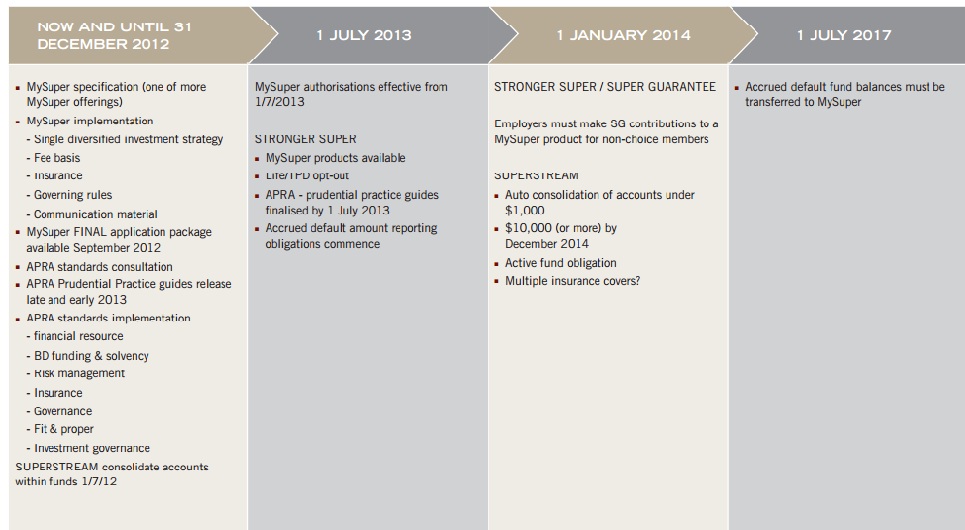

Timeframes for the MySuper authorisation process, compliance with APRA prudential standards and implementation of SuperStream changes were too tight from the outset.

A timetable1 which summarises the legislative and regulatory process for super trustees is attached.

What is clear from the timetable is that waiting for more

certainty in regulation is not an option for trustees intending to

apply for a MySuper authorisation.

There is too little time. Trustees and fund professionals should now be engaging with experts, such as our team at Henry Davis York, to identify, prioritise and implement changes.

The gap analysis needed in relation to business strategy and governance requirements will likely highlight the need for trustee boards of directors to obtain strategic legal advice in relation to:

- the annual determination of sufficiency of scale in respect of the MySuper product, and any proposal to merge with another fund.

- New governance and directors' duties, including investment and insurance governance.

- Risk management, including the trustee board's annual risk management declaration, and the operational risk financial requirement.

- The strategy for transition of accrued default amounts to a MySuper product.

The strategic issues are complex, and in many instances may

require a different approach to strategic decision making by

trustee boards. For an in-depth review, see our related piece

–

Scale, strategy and super fund boards.

Super fund compliance and operational professionals will, we

expect, focus on documents to be reviewed and revised and legal

advice to be provided in relation to:

- The MySuper authorisation process.

- Compliance with required MySuper product features, including amendments to trust deeds, technical fee rules including fee allocation between members and cost recovery rules, and insurance requirements.

- Compliance with product and investment disclosure requirements.

- Compliance with required governance policies.

- Compliance with required risk management policies.

- The review of outsourcing contracts.

- The implementation of transition of accrued default amounts to a MySuper product, account consolidation and implementation of SuperStream data standards.

Don't get left behind - there are a range of additional regulatory requirements that you need to be across and understand.

Footnote

1Legislative & Regulatory Changes Affecting Superannuation

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.