As you may be aware:

- Most Australians with private health insurance currently receive a 30% rebate from the Australian Government to help cover the cost of their premiums.

- You have to pay the Medicare levy surcharge (MLS) if your income is above a certain threshold and you (or any of your dependants) don't have appropriate private patient hospital cover.

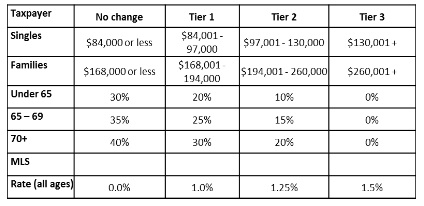

From 1 July 2012 the private health insurance rebate and the MLS will be income tested.

How will these changes affect you

- If you expect to earn more than $84,000 as a single person or more than $168,000 as a family in the 2012-13 financial year, your rebate will be diminished.

- If you are single, earn more than $84,000 and don't have private health insurance hospital cover you will pay the MLS.

- If you are a family, have a combined income of more than $168,000 and don't have hospital cover for you, your partner, or your children – you or your partner will have to pay MLS (The MLS will also apply if you cancel your existing hospital cover.)

These changes are summarised in the following table. The tiers are based on your "income" for MLS purposes:

Note:

- Single parents and couples (including de facto couples) are subject to the family tiers. For families with children, the thresholds are increased by $1,500 for each child after the first.

- "Income" for MLS purposes includes:

- -taxable income

- -exempt foreign employment income (if your taxable income is $1 or more)

- -reportable fringe benefits (as reported on your payment summary)

- -total net investment losses (includes both net financial investment losses and net rental property losses)

- -reportable super contributions (includes reportable employer super contributions and deductible personal super contributions)

You may claim the rebate if you are eligible for Medicare and have an appropriate level of private health insurance. Generally speaking this means that the policy should cover hospital treatment, general treatment (also known as ancillary or extras) or both, and that the excess on the policy doesn't exceed $500 for singles or $1,000 for any other policy, if taken out after 24 May 2000.

You can claim your rebate in three ways:

- As a premium reduction through your private health insurer (i.e. you pay less upfront to your insurer). If you want to claim your rebate as a reduced premium, contact your insurer to arrange this;

- As a direct payment from Medicare; or

- As a tax offset when lodging your annual income tax return.

If you choose to receive your rebate through your insurer as a premium reduction or Medicare, you should contact your insurer to nominate the tier you expect to be in to avoid a potential tax liability at the end of the year. There is no penalty for nominating an incorrect tier.

Prepaying your insurance premiums before 30 June 2012

On 4 June 2012, the Tax Office released a fact sheet entitled Changes to private health insurance rebate and Medicare levy surcharge. The fact sheet indicates that it is possible to pre-pay your private health insurance premiums for the 2012-13 financial year and beyond and still make a claim for a private health insurance tax offset in your 2011-12 income tax return.

To claim the rebate, the premiums must be actually paid to your insurer (receipted by them) before 30 June 2012 and the rebate must not have been claimed as a premium reduction or as a claim from Medicare.

Is there a tax benefit in prepaying my premiums?

For taxpayers not affected by these changes there will be no benefit in prepaying your premiums.

For tier 1, 2 and 3 taxpayers pre-paying your premiums before 30 June 2012 will be an attractive way to reduce your total health insurance costs over the period to which the prepayment relates.

The Tax Office's fact sheet does not state that you are limited to claiming a rebate for the 2012-13 financial year only. In this respect, we are aware that some insurers are offering policy holders the ability to lock in today's premium for a period beyond the next 12 months, however conditions apply. You need to act quickly if this something you wish to take advantage of.

This publication is issued by Moore Stephens Australia Pty Limited ACN 062 181 846 (Moore Stephens Australia) exclusively for the general information of clients and staff of Moore Stephens Australia and the clients and staff of all affiliated independent accounting firms (and their related service entities) licensed to operate under the name Moore Stephens within Australia (Australian Member). The material contained in this publication is in the nature of general comment and information only and is not advice. The material should not be relied upon. Moore Stephens Australia, any Australian Member, any related entity of those persons, or any of their officers employees or representatives, will not be liable for any loss or damage arising out of or in connection with the material contained in this publication. Copyright © 2011 Moore Stephens Australia Pty Limited. All rights reserved.