As businesses grow and evolve, there becomes an increased exposure to lack of quality controls and assurances and business risk.

Business risks come in many forms, including operational risks, financial risks, business continuity risk, strategic risk and many others. Fine tuning of corporate governance and a robust Quality Control and Assurance program are mandatory practices for progressive organisations. Nexia ASR has recently revamped its governance structure to clearly establish how we are directed and controlled. This governance structure specifies the distribution of rights and responsibilities among different participants in the organisation and spells out the rules and procedures for making decisions. By doing this, it also provides the structure through which our objectives are set, and the means of attaining those objectives and monitoring our performance.

Quality control is an ongoing process which needs to be viewed as an investment rather than a cost. Nexia ASR has - as has the whole accounting profession - been required to put in place mandatory quality control practices.

The Accounting Professional and Ethical Standards Board (APESB) issued the APES 320 Quality Control for Firms, which became mandatory for all firms from 1 July 2006. The purpose of this standard is to establish basic principles and essential procedures and to provide guidance regarding the firm's responsibilities for its system of quality control.

To comply with the new standards, Nexia ASR has established a system of quality controls designed to provide it with reasonable assurance that the firm and its personnel comply with these professional standards and regulatory and legal requirements and that reports issued by the firm or engagement partners are appropriate.

The firm's system of quality control addresses each of the following elements:

- Leadership responsibilities for quality within the firm.

- Ethical requirements.

- Acceptance and continuance of client relationships and specific engagements.

- Human Resources.

- Engagement performance.

- Monitoring.

- Documentation.

We are required to be fully conversant with the policies and procedures so as to provide evidence that all partners and personnel comply with professional and legislative requirements to provide quality work to our clients.

Quality control is a process employed to ensure a certain level of quality in a product or service. The basic goal of quality control is to ensure that the products, services, or processes provided meet specific requirements and are dependable, satisfactory, and fiscally sound.

Quality control is often confused with quality assurance. Though the two are very similar, there are some basic differences. Quality control is concerned with the product, while quality assurance is process-oriented. Basically, quality control involves evaluating a product, activity, process, or service. Simply put, quality assurance ensures a product or service is manufactured, implemented, created, or produced in the right way; while quality control evaluates whether or not the end result is satisfactory.

Nexia ASR has embraced the rigorous compliance costs of governance and quality control requirements and has installed ongoing processes and procedures to ensure these are constantly reviewed and challenged.

We see our role as trusted advisers to our clients to play an active role in assisting them to assess their current strategic options by reviewing their governance structure, risk strategies and quality control procedures as part of our "Value Beyond Numbers" philosophy.

*****

Federal Budget 2008 Summary

The Government has stated that the 2008-2009 Federal Budget begins a "new era of responsible economic management", with a raft of changes to various Income Tax, GST and FBT measures. The underlying surplus of the Budget is estimated to be $23.1 billion. Here are a few of the more relevant measures introduced in the Budget.

2. Fringe Benefits Tax - exemption for eligible work-related items and removal of 'double-dipping'

With effect from 13 May 2008, the Government will tighten the current Fringe Benefit Tax (FBT) exemption for certain work-related items (including laptop computers, personal digital assistants and tools of trade) by ensuring the exemption only applies where these items are used primarily for work purposes.

This is a change from current practice which disregards the actual use of these items. The FBT exemption will generally be limited to one item of each type per employee per year.

The measure reduces the FBT concession and tax expenditure for work-related items. The measure will ensure consistency with the rules applying to mobile phones, computer software and protective clothing. The list of FBT-exempt workrelated items will also be updated to reflect changes in technology.

The Government will also deny employees depreciation deductions for FBT-exempt items (items purchased primarily for work purposes) purchased from 13 May 2008. This measure seeks to ensure that employees are no longer able to gain a double benefit by obtaining an FBT-exempt item (such as a laptop computer) from their pre-tax income and then claim a deduction for depreciation.

3. Goods and Services Tax - changes to the Margin Scheme (integrity measures)

The Government has proposed, in principle, that the interactions between a number of provisions in the GST law do not allow real property transactions to be structured to reduce the GST liability. These measures will have effect from the date of Royal Assent. The GST provisions dealing with real property are intended to ensure that GST is payable on the value added to land once it enters the GST system.

This measure provides that where the Margin Scheme is used after a GST-free or nontaxable supply, the value added by the registered entity which made that supply, is included in determining the GST subsequently payable under the Margin Scheme.

The proposed measures are intended to strengthen the GST anti-avoidance provisions to ensure that they can apply to contrived arrangements entered into to avoid GST. Unfortunately, there is very little additional information on this measure and we wait for any future statements made by the Government in this important area of GST.

4. Managed funds - changes to the Eligible Investment Rules

Under the current Eligible Investment Rules, managed funds that limit their activities to certain investments, such as investing in land primarily for rent, retain trust taxation treatment rather than being taxed like companies.

The proposed measure will clarify the scope and meaning of investment in land for the purpose of deriving rent, and introduce a 25 per cent allowance for non-rental income from investments in land (excluding capital gains), and expand the range of financial instruments that a managed fund may invest in or trade.

This is an important proposal for many managed funds that may have had difficulty in satisfying the "primarily for rent" test.

Again, we await further detail from the Government on this point.

*****

Police Paint Picture Of Criminal Powers

Fittingly, the April and May Think Tanker meetings held in the Nexia ASR boardroom were on the subjects of Organised Crime Strategy 2005- 2009 and "The Gangland Murders", coinciding with the Court of Appeal application by Carl Williams and the controversy surrounding the not-sobanned in Victoria Underbelly television series.

At the April meeting, Detective Superintendent Richard Grant presented the "Victoria Police Organised Crime Strategy 2005-2009 - creating a hostile environment for organised crime". DS Grant has an illustrious career over more than 30 years as a member of Victoria Police, including operational responsibility for the Purana Taskforce, Armed Crime Taskforce, Drug Taskforce and several other taskforces formed to address serious and organised crime.

In May, Detective Senior Sergeant Stuart Bateson of the Crime Strategy Group, Victoria Police, gave us a gripping insight into the gangland murders.

DSS Bateson has been a member of Victoria Police for more than 20 years. Nine of his 15 years within the specialist criminal investigation field have been spent in the Homicide Squad. Within that period, he was a Detective Sergeant Team Leader in the highly respected Purana Task Force.

To date, Purana has produced 93 arrests for 226 offences, 24 arrests for 26 offences of murder, significant asset seizures and significant seizures of drugs.

After hearing the presentations of both DS Grant and DSS Bateson we were left with a great sense of admiration and gratitude for the professionalism of the development of the Organised Crime Strategy and the efforts undertaken by the members of the Purana Task Force in the commitment to bring those involved to justice notwithstanding the risk to their families and themselves.

*****

Superannuation Guarantee Late Payment Offset

At the time of writing this, the proposed Bill is not yet law, but by way of background, under the current superannuation payment system, whereby an employer fails to pay the required minimum superannuation amount within 28 days after the end of a quarter, the employer is liable for a non-deductible charge, known as the Superannuation Guarantee Charge.

In many situations, shortly after the due date, employers would pay the 9 per cent superannuation to each employee's nominated superannuation fund in the mistaken belief that the Superannuation Guarantee Charge (a penalty) is not payable.

Under the current regulatory system, the Superannuation Guarantee Charge remains payable to the Australian Taxation Office even where the employer pays superannuation late to the employees' superannuation funds.

Under proposed new measures (not yet law) late payments to an employee superannuation fund will be capable of offset against the Superannuation Guarantee Charge.

The contribution to the employee superannuation fund will first be used to offset against the nominal interest component of the Superannuation Guarantee Charge for the quarter for the employee, before any remainder of the contribution is used to offset against the employer's Superannuation Guarantee shortfall for that quarter for that employee.

In effect, this provides employers with relief from double payments of superannuation, once to the superannuation fund and once to the Australian Taxation Office.

All three components of the Superannuation Guarantee Charge remain non-deductible for taxation purposes, and this includes the administrative penalty and interest component.

Therefore, there is a tax incentive to ensure quarterly superannuation is paid on time, that is, within 28 days after the end of the quarter.

*****

Enhancing Sales Value Series (Part 2) - Preparing Your Business For Sale

Entrepreneurs establish and grow their business for essentially one reason - reward.

That reward can come in many forms whether it be fulfilling a passion, gaining respect or recognition or achieving a lifestyle. One common trait through all business owners is that they want to build value.

We have seen many business plans, long or short, simple and sophisticated. However, a consistent fault with many is that they do not reference their actions or strategies against what impact these may have on the business value - short or long-term. When asked why, a typical response is that they do not know how to realistically value the business - hence, have no measurement tool.

At another level, we continually try to give the message to business owners that they should always have an exit or succession plan, no matter what stage of their business' lifecycle. Whether it be via family succession, management buy-out, trade sale or IPO, the plan for exit will or should largely drive the actions and strategies of the business to increase value.

So, what is a business worth? In very simple terms, it is the best price you can get at a given time. The price issue is long-standing. The seller wants to get as much as possible, the buyer wants to pay as little as possible, and the value lies somewhere in between. However, this is not always reasonable. For example, at a given time, there may be no buyers or investors that have expressed an interest. You should not therefore conclude that the business is worth nothing. So how can you arrive at a reasonable valuation, or if you are selling, a realistic asking price?

Alternative Valuation Models

While the valuation process has often been described as an art form, there are four generally accepted methods for business valuation. Generally, a buyer will follow one (or two) of these methodologies to form a view on what they were prepared to pay for the business.

Capitalisation Of Earnings

The capitalisation of Future Maintainable Earnings (FME) method is the most common methodology for valuing an existing business in good order. This method involves multiplying an estimate of future maintainable earnings by the capitalisation rate. The capitalisation rate varies between industries and businesses and takes into account numerous factors regarding the business itself and the industry. In the public domain this is usually expressed as a multiple of Net Profits after Tax (the price/earnings ratio, or PE). With private transactions, this is normally expressed as a multiple of earnings before interest, tax, depreciation and amortisation (EBITDA).

Discounted Cash Flow

The discounted cash flow method is usually used to value new or immature businesses or a business in which there is considerable variation in income or expenditure expectations. This method estimates future cash flows (operating and capital) and then applies a discount rate. The discount rate increases with the level of risk and the estimated time taken for the business to reach sustainable cash flow.

Sum Of Parts

The notional realisation of assets is used to value a business which is not expected to continue in its current form. This is the case where the potential purchasers are interested in utilising only parts of the business, so that various elements of the business are purchased by different parties. For example, an agri-business may be dispersed in three separate sales: land, stock and equipment.

Market-Based Valuations

It is a common perception that in some industries there are a sufficient number of business sales on an ongoing basis for a rule-of-thumb valuation to be applied to all businesses in that sector. For example, newsagencies and financial planning firms where a price based on multiples of revenue are often quoted, or the publishing industry where six times earnings is quoted as a fair price. In reality, market statistics should only be regarded as a guide.

No two businesses are the same and at the end of the day purchasers will buy a business on what return on investment it will provide to them, whether that be net profit, additional contribution margin or other factors such as access to specialist equipment, IP or personnel.

Combining Valuation Methods

Combining valuation methods is another common misconception in private transactions.

One cannot reasonably take a value based on an earnings multiple and then add the value of the assets - regardless of whether they are plant, stock, equipment or goodwill. To illustrate this point, it is the equivalent of looking at the PE Ratio of a publicly-listed company, multiplying the earnings by the ratio to obtain the value, then adding the net assets to arrive at the price.

Comparing Valuations By Different Methods

Comparing valuations by different methods can be quite informative and a useful crosscheck of business value. If one method reveals a higher valuation than another, it may reveal something about the business. For example:

- If the discounted cash flow valuation is greater than the earnings multiple valuation it may imply that the business is expected to substantially increase profits; or

- If the earnings multiple valuation is greater than the discounted cash flow valuation, it may imply that substantial capital re-investment is required to sustain those earnings; or

- If the notional realisation of assets valuation is greater than the earning multiple valuation it implies that the business is either over capitalised or underperforming.

Comparing valuations of different businesses

As a potential owner (or investor) it is important to realise that the fundamental business value rests on its ability to generate income for its owners into the future. If all things are equal, then a rule-of-thumb assessment facilitates this. However, all things are rarely equal and so variations in earnings multiples are inevitable.

The essence of an earnings multiple valuation is that it enables an investor (or owner) to compare different investment opportunities based on the level of income they will generate. Factors that affect the ability to generate sustained or increasing earnings will be considered. These account for some of the observed variations in earnings multiples between businesses and industries. However, it is the ability to make cross comparisons that makes the earnings multiple so useful. It is no coincidence that the publicly-listed company equivalent, the PE Ratio, is so commonly used as a reference.

What Affects Value?

In property, the generic valuation guide is dollars per square metre for various neighbourhoods, but other factors need to be considered when assessing an individual property. The process in a business valuation is no different. A generic guide is often the earnings multiple for investments generally, or industries and business size. However, other factors need to be considered when assessing an individual business.

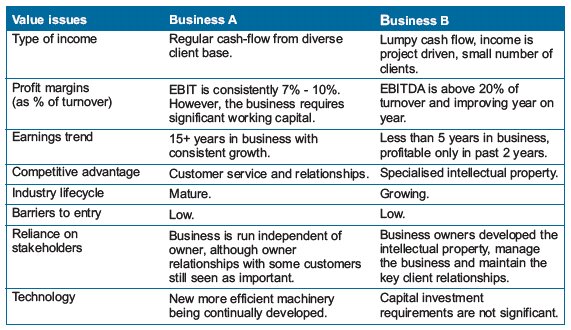

The issues or risks list can be exhaustive. Typical risk areas assessed will be the type of income, profit margins, earnings trends, working capital requirements, capital investment, barriers to entry, competitive advantage, industry lifecycle, reliance on stakeholders (e.g., owners, key employees, key customers, suppliers etc.) and legislative environment.

Consider how a purchaser might view an opportunity to invest in either Business A or Business B (as shown in table below).

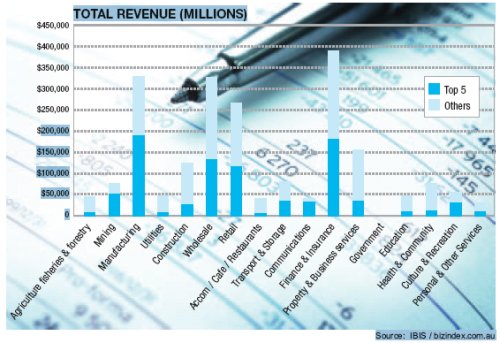

Make Your Business Stand Out

There are more than one million business entities in Australia, roughly one per 20 Australians. Of these, less than 1 per cent are either government entities or public companies. While some of Australia's private businesses are among the largest companies in Australia, the vast majority (some 900,000+) of them are small. The disparity between large and small is striking. The top five companies in 431 different ANZIC classification codes represent just 0.02 per cent of Australian businesses. However, in all industries except education, they represent at least a double-digit share of the revenue. In many industries it is a case of whales and minnows. A recent RMIT/Boyd Study revealed that more than 44 per cent of the private businesses in Australia are forecast to be sold over the next 10 years, to usher the baby boomer owners into retirement. With this as a backdrop, the increasingly pertinent questions for business owners to ask are "How much is my business worth?" and "What do I do to make it more valuable?".

*****

Tax Booklet Makes Wealthy Australians Wiser

THE ATO RECENTLY released an information booklet entitled "Wealthy and Wise: a tax guide for Australia's wealthiest people", which essentially reminds taxpayers that they are responsible for their own tax affairs, regardless of the advice they have received.

The release of the booklet is targeted towards people who effectively control $30 million or more in net wealth and poses a series of questions for them to consider, ensuring they are in the low-risk category.

The booklet is a guide to tax compliance for wealthy individuals and provides a reference for the wealthy to maintain high standards of governance over their tax affairs. The booklet describes the strategies and processes the ATO employs to ensure the compliance of wealthy individuals, including:

- preliminary risk reviews;

- comprehensive risk reviews; " audits;

- expanded returns, and

- entity questionnaires.

The booklet also:

- discusses the issues and characteristics that will attract Tax Office attention and constitute risk, and

- supplies key information to help the wealthy comply with their tax obligations.

In a recent media release, the Tax Commissioner Michael D'Azcenzo stated that "Wealthy and Wise gives wealthy people the tools to ensure they get their tax right. Those who deliberately attempt to evade tax risk penalties, interest, back taxes and prosecution. The chance of getting caught is high and getting higher."

Mr D'Azcenzo has stated that the high wealth individuals task force will undertake 200 risk reviews and start 40 audits this financial year.

A copy of the booklet is available on the Tax Office website at: www.ato.gov.au

*****

ATO To Crack Down On Share Options

In early may 2008, the Federal Government announced it would move to close down "loopholes" that have allowed recipients of share options (particularly executives) to defer payment of tax (if any) on the value of share options.

Current tax law defaults to a position where the taxing point of share options is deferred until the time of exercise of the option. The amount assessed at that time is the difference between the market price of the share, on the date of exercise, and the exercise or strike price. This is assessed as ordinary income.

The law also provides an opportunity for the recipient to elect to pay some income tax "up front" at the time of the options grant, based on a "market value" and have any increase in value from that point treated on a capital gains account. This does require declaration of the income (being the market value) in the tax return lodged in the year the options were granted.

Typically, the market value for tax purposes of an option at the time of the grant is not significant. However, because of uncertainties associated with shares and options (including restrictions on vesting, exercise, etc.), many recipients do not normally make the election.

It appears that the ATO has perhaps been lax in the administration of the compliance and audit enforcement of these provisions, as the Government believes many taxpayers have been retrospectively electing to pay income tax up front - sometimes years after the option was granted - claiming they had "forgotten" the share options in the year of the grant.

As with many Government/ATO announcements about changes to income tax rules, the media release and subsequent discussion is very short on detail, particularly about the real issue and solutions.

We can only assume that the "loophole" to which the Government refers is the ability of taxpayers to lodge an amendment to a tax return up to four years after the original date of assessment.

For example, if someone was granted options in say, October 2003, they would generally have up to say, early June 2008, the ability to lodge an amended return and elect to pay income tax up front on the original (October 2003) market value of the options. Even with the share price falls experienced by many companies over the last four to six months, as a rule, most options granted in October 2003 would still be well "in the money", given the SRP ASX 200 is still 73 per cent higher at April 2008 compared to October 2003.

Many executive share option grants have only a five to seven-year life. Accordingly, with the market having performed so well over the past few years, the ability to "retrospectively" elect to pay income tax up front, on a much lower value, and have the subsequent increase treated as a capital gain (with the 50 per cent CGT concession available) is generally financially beneficial.

The only specific detail in the Treasurer's announcement was that the "loophole" would be closed from 1 July, 2008. As noted, it is still only speculation what the "loophole" is.

If it is only, as we suspect, the fouryear amendment allowances, then the "loophole" could be fixed simply by some administrative changes. However, it is possible that the Government will use the opportunity to close down what has been seen to be a significant benefit only available to the already "well paid" executives. One thing that can be certain is that from 1 July, 2008, the benefits of ESOPs will change.

What the pending deadline does mean is that anyone who has outstanding share options should review their affairs and consider how these have been or should be treated in their tax affairs.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.