To read Part 3 of 6 please click here

Part 4 of 6 of the Executive Compensation Disclosure Memo Series summarizes the principal aspects of the supplemental tables that are required to accompany the Summary Compensation Table (discussed in part 3 of 6) in proxy statements (or 10-K’s for companies not subject to the proxy rules) filed during the upcoming proxy season.

Grants of Plan-Based Awards Table

The Grants of Plan-Based Awards Table, which appears on the third page, is intended to complement the information in the Summary Compensation Table by providing comprehensive material information concerning awards made during the last fiscal year under any incentive plan or otherwise contingent on the achievement of performance goals. An incentive plan is defined as any contract, authorization or arrangement, whether or not contained in any formal document. While the Summary Compensation Table contains the grant date fair value of such awards, the Grants of Plan-Based Awards Table is organized based on two general characteristics: (1) whether the award was an equity or non-equity award, and (2) whether the award was linked to performance.

For a standard option grant that contains only status-based (i.e. continued employment) vesting elements, the number of securities underlying the option will be disclosed in column (j). If the company did not grant any awards in which the size of the award or vesting is based on performance (i.e. financial performance of

the company or the stock price) then columns (c) through (h) may be left blank. The table covers only the named executive officers ("NEOs"), and is similar in some respect to the old LTIP/Option Grants in Last Fiscal Year Table, but requires a much broader array of information.

- Each award granted to an NEO during the year must be reported on a separate line, and the particular plan under which the award was granted must be identified if awards were granted under more than one plan during the year.

- The grant date must be disclosed for each equitybased award granted during the year. In addition, the placement of a supplemental column adjacent to the grant date column will be necessary if the FAS 123 (R) grant date is different from the date on which the compensation committee (or other committee or the full board) took action or was deemed to take action to grant such award.

- The per-share exercise price for all options granted during the fiscal year must be reported in the Grants of Plan-Based Awards Table; however, if the exercise price of the options reported in the table is less than the closing market price of the underlying security on the FAS 123(R) grant date, an additional column must be added to show the market price on the grant date and the methodology for determining the exercise price must be disclosed by footnote. For example, if the exercise price is set to be equal to the closing price of the company’s stock on the business day prior to the board or committee’s action or equal to the average price on the date of grant (as many plans provide), this additional column and footnote will be required.

The narrative following the table should provide significant information about each award. In addition to a general description of the formula or criteria to be applied in determining the amounts payable under the award, the narrative may need to cover the following information:

- Any vesting schedules;

- Whether dividends are paid and information on the dividend rate;

- A description of performance-based conditions and any other material conditions applicable to the award;

- A description of when the option is first exercisable; and

- Whether there are any tandem awards.

ACTIONS TO TAKE NOW

- Address option exercise price methodology and determine whether plans should be amended to conform to a close of market grant date price or whether additional disclosure is required

- Begin a calculation for each NEO of change in actuarial present value of accumulated benefit under each defined benefit and actuarial pension plan

- Assess the company’s preparedness to provide required disclosure of contributions to, withdrawals from and all earnings on nonqualified deferred compensation

- Review and analyze executive employment, severance and change-incontrol agreements and payments, including the specific circumstances that would trigger these payments

Grants of Plan-Based Awards

Outstanding Equity Awards at Fiscal Year-End Table

The Outstanding Equity Awards at Fiscal Year-End Table, which appears on the next page, requires disclosure of each NEO’s equity awards as of the end of the fiscal year, and will include both awards that are subject to performance conditions and non-performance-based awards. Instead of disclosure of equity awards on an aggregate basis, this table will illustrate a complete inventory of all awards held by NEOs. Multiple awards may be aggregated only where the expiration date and the exercise or base price of the instruments are identical.

- Information on option holdings must be presented on a grant-by-grant basis.

- The aggregate value of and the number of shares subject to outstanding stock awards and Equity Incentive Plan Awards may be reported on a single line.

- If options or stock awards are subject to performance conditions, they are reported in column (d) (for options) or columns (i) and (j) (for stock). If the performance conditions have been satisfied but the awards remain subject to forfeiture or service-based vesting conditions, then the awards remain in this table but are shifted into columns (b) and (c) for option awards, or columns (g) and (h) for stock awards, until they are exercised or vest. Footnote disclosure may be necessary in this case, as a new option or larger stock award would appear in the table, but would not correspond to a recent grant in the Summary Compensation Table.

- Information as to performance awards will be disclosed if threshold performance goals have been met and the prior year’s performance has not met target or maximum levels.

As with the Summary Compensation Table and the Grants of Plan-Based Awards Table, specific footnote disclosure is required for this table. First, a footnote must be added to explain the vesting dates for options, other stock awards (such as restricted stock) and awards under incentive plans. Vesting should be disclosed separately in a footnote by award. Second, a separate footnote is needed if an award was transferred by the NEO other than for value, and such footnote must explain the nature of the transfer.

SMALL BUSINESS REPORTING COMPANIES

The new executive compensation rules require a decreased level of disclosure for small business reporting companies. Of the tables discussed in this memorandum, only the Outstanding Equity Awards at Fiscal Year-End Table and the related narrative disclosure will be required for SB filers.

Outstanding Equity Awards at Fiscal Year End

Option Exercises and Stock Vested Table

The Option Exercises and Stock Vested Table, which appears on the following page, requires disclosure of each NEO’s options and SARs exercised during the year, as well as other types of equity awards that vested during the year, such as restricted stock and restricted stock units. The amounts realized on transfers of awards for value, based on the market value of those shares at the time of exercise or vesting, must be disclosed. Footnotes to the Option Exercises and Stock Vested Table are required to include information quantifying the amount and the terms of any amount deferred upon exercise of an option or vesting of a stock award.

Option Exercises and Stock Vested

Pension Benefits Table

The company must disclose the actuarial present value of each NEO’s accumulated benefits under each qualified and nonqualified defined benefit plans. The Pension Benefits Table, which appears on the following page, thus requires disclosures for many Supplemental Executive Retirement Plans (SERPS) in addition to traditional pension plans, but does not require disclosure of defined contribution plans, such as 401(k) plans. The actuarial present value and other information is computed as of the pension plan measurement date, for financial statement reporting purposes, of the company’s last completed fiscal year. In addition, the new table requires disclosure of the number of years of service credited to the NEO and any pension plan payments made to the NEO during the last fiscal year.

Assumptions used to calculate the actuarial present value must conform with generally accepted accounting principles and must be described in a narrative section accompanying the table. Retirement can be assumed to occur at the normal retirement age set forth in the plan and compensation at retirement is to be based on the NEO’s current compensation (instead of a projected amount). A separate row must be included in the table for each different plan in which the NEO participates.

In addition to the calculation assumptions required in the narrative disclosure, any material factors necessary to gain an understanding of each plan must also be described. The SEC has indicated that the following factors may be material:

- All material terms and conditions of each disclosed plan, including benefit formulas, eligibility standards and early retirement provisions;

- The specific elements of compensation used in determining the NEOs’ payment and benefit formula;

- If an NEO participates in more than one plan, the reason for each plan;

- If any NEO is currently eligible for early retirement, the identity of the NEO and the plan, the plan’s early retirement payment and eligibility standards; and

- Any company policies regarding the crediting of additional years of service.

Pension Benefits

Nonqualified Deferred Compensation Table

In addition to the Pension Benefits Table, which applies solely to NEO’s participation in qualified and nonqualified defined benefit plans, a new Nonqualified Deferred Compensation Table for the disclosure of employer and employee contributions to, earnings under and aggregate balances of nonqualified defined contribution and other deferred compensation plans is also required. Some SERPs will fall into this category, and an examination of the SERP itself will be necessary to determine whether it is a defined benefit or defined contribution plan. All earnings are to be disclosed, regardless of whether they are determined to be above-market or preferential.

A company is required to use footnotes to identify and explain portions of "contributions" and "earnings" entries that are also reported on the same year’s Summary Compensation Table. In addition, the company should use footnotes to identify portions of the "aggregate balance" entry that had been reported on the Summary Compensation Table for the NEO in prior years. This may take some lead time to present on an annual basis, depending on how the company’s payroll and accounting records are organized.

Similar to the Pension Benefits Table, the Nonqualified Deferred Compensation Table must be supplemented by additional narrative disclosure, in which any material factors necessary to derive an understanding of the table must be disclosed. The SEC has listed several examples of material factors, including:

- The types of compensation that may be deferred and any limitations on the amounts of compensation that may be deferred;

- The measures for calculating interest or other earnings under the plan, including whether the measures are selected by the NEO or the company and the frequency and manner in which such measures may be changed, with quantification of any earnings measures applicable during the last fiscal year; and

- Material terms regarding payouts, withdrawals and distributions.

Nonqualified Deferred Compensation

Other Potential Post-Employment Payments

Potential post-employment compensation that is or may become payable upon an actual or constructive termination of employment, or a change in control of the company, must be disclosed separately in narrative format, although a tabular disclosure may be used as appropriate to help clarify and explain the various payment outcomes. The previous $100,000 threshold for disclosure for post-employment payable compensation was eliminated and the previous disclosure rules expanded to include disclosure of the following:

- The specific circumstances that would trigger termination or change-in-control benefits;

- The estimated payments and benefits that would be provided in each circumstance, including the form, duration and the source of such payments (including perquisites and health care benefits);

- Any specific factors used to determine the payment and benefit levels;

- Any material conditions on receipt of payments, including the type and duration of any restrictive covenants and provisions regarding the waiver and breach of these covenants;

- The amounts of any related tax gross-ups; and

- Any other material factors necessary for understanding the termination and change-in-control arrangements.

Although the old $100,000 disclosure threshold for potential post-employment payments has been eliminated, there is still a $10,000 disclosure threshold for the aggregate amount of any post-employment perquisites before disclosure is required. Disclosure of change-in-control and termination provisions in employment agreements should be made in the narrative disclosure section accompanying the Summary Compensation Table only when such provisions have been paid during the year and are being disclosed in the appropriate place in the Summary Compensation Table. Where the termination or change-in-control provision has not yet been triggered, the disclosure regarding it should be made in the narrative section describing potential post-employment payments.

The quantitative dollar amount disclosure of the estimated benefits payable upon each potential triggering event is required even where uncertainties as to the amounts required exist. In the case of any uncertainty, the company is required to make reasonable estimates regarding the amount of payments and benefits, and it must disclose the material assumptions underlying such estimates. Finally, the amounts disclosed should be compiled prior to disclosure with a tally sheet or other compensation summary tool, and presented periodically to the company’s compensation committee to assist with setting compensation.

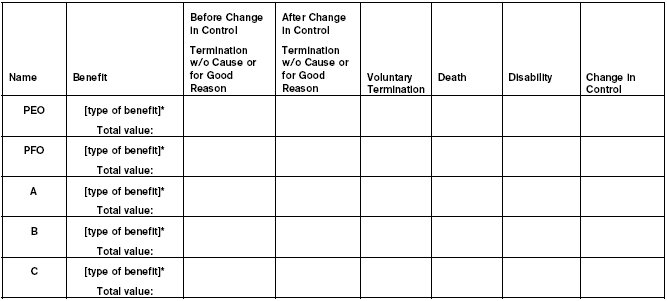

No disclosure is necessary for any post-termination arrangements that do not discriminate in scope, terms or operation in favor of a company’s NEOs and are generally available to all salaried employees. Although tabular presentation is not required, it is recommended as a means of clearly presenting the quantitative aspects of termination and change in control arrangements. A sample table is presented below.

[Fiscal Year] Potential Payments Upon Termination or Change in Control

* List each applicable type of benefit in a separate row, e.g., severance pay, bonus payment, stock option vesting acceleration, health care benefits continuation, relocation benefits, outplacement services, financial planning services or tax gross-ups.

As you begin to implement many of these items in preparation for the 2007 proxy season and need additional advice or assistance, please feel free to contact your regular Powell Goldstein contact.

This Client Alert is prepared by the Financial Institutions Practice Group of Powell Goldstein LLP as a client service. The information discussed is general in nature and may not apply to your specific situation. Legal advice should be sought before taking action based on the information discussed.