Foreword

By 2012, the analogue broadcast signals in most major television markets will have been entirely replaced by digital technology – a shift that has the potential to transform the technology, media and telecommunications (TMT) industries forever. The theme for this digital ‘turn on’ will be more. More content and channels. More mobility. More choices and pricing options. More personalisation and interactivity. And ultimately, more consumption, offering the promise of more revenues.

TMT companies will exploit increasingly advanced digital technologies to receive and deliver content across a widening range of devices and channels, creating unprecedented business opportunities. Of course, they are also likely to face unprecedented competition. Rapidly shifting customer needs are expected to fragment the established value chain, forcing TMT companies to stake out new and unfamiliar territory in the emerging digital ecosystem. Established players will try to defend and expand their existing markets. New companies will jockey for position both in new market spaces and against incumbents. And in many cases, old rivals will find themselves partnering – or even merging – to create just the right mix of capabilities to succeed in the digital realm.

In this report, the Technology, Media and Telecommunications practices of the UK and US member firms of Deloitte Touche Tohmatsu (Deloitte UK and Deloitte US) examine the impact and implications of the digital `turn on’. We look at the impact it will have on consumers, and on the overall TMT value chain. And we offer insights to help companies position themselves to capitalise on the new opportunities and trends. We hope you find this report valuable, and wish you great success in the digital marketplace.

Jolyon Barker

Head of Technology, Media & Telecommunications practice Deloitte & Touche LLP, UK

Executive summary

Media world turns on to digital

By the time the athletes reach the starting blocks at the 2012 Olympic Games in London, the creation and access to media will be an entirely digital process and revenue generated through content on demand will have come of age.

Before media companies can reach the starting blocks in 2012, they must not only train, they must evolve. Competition in 2012 requires that companies can offer content to the consumer where they want it, when they want it and how they want it and in accordance with how much they are willing to pay for it. The digital turn on is already transforming the media sector. It is leading to a proliferation of choices and content that will enable the consumer to have more control than ever before: it also implies tremendous opportunity for both new and established TMT businesses.

One key to success for every company will be to find an optimal position in the new digital media value chain. Horizontal integration across this value chain is expected to blur the distinction between distribution channels, and traditional labels such as ‘movie studio’ and ‘television network’ may well give way to a new paradigm where ‘content creators’ or ‘aggregators’ have roles that are not confined to a particular platform.

To claim these new roles as their own, TMT companies will need to develop strategies and structures that help them exploit content across a variety of platforms. They also need to develop profitable and sustainable business models that are robust enough to thrive in the market of today, yet flexible enough to capitalise on the market of tomorrow.

Let the digital games begin

By 2012, the landmark shift from analogue to digital will present technology, media and telecommunications companies with tremendous opportunities, as well as challenges. The London Olympic Games will mark the first global showcase for the digital turn on calling all TMT companies to ask strategic questions around their capabilities now to see whether they are ready to compete.

1. How do we increase our customer appeal? How can we make our offerings more relevant, personalised and attractive to customers and enhance our value proposition to them? How does our brand support this? How do we diversify our offerings without confusing our customers?

2. How can we leverage our customer relationships? How can we exploit our customer knowledge and manage our relationships better? How should this vary across our products and our services?

3. How significant is the opportunity for our company? How big a portion of the digital market will our company be able to win? When and what should we invest in? How complementary – or disruptive – will this be to our existing products and services? How do we balance emerging and legacy business priorities?

4. What is the best operating model for our company? How should we structure ourselves and align our operations for success? How do we ensure cooperation between our divisions and minimise cannibalisation? What type of talent do we need to employ and who needs to be retrained?

5. Can we go it alone? Do we have what it takes? If not, what should our partnering strategy be? Which companies should we partner with and which should we acquire? Which parts of the value chain should we compete in? Do we need to own the channels outright? If we partner, how do we apportion both revenues and liabilities?

6. What is the right content strategy? How can we ensure we exploit our existing content fully, or gain access to the right amount and type of third party content? How can we integrate and exploit compelling user-generated content? How can we leverage our content, formats or rights across all relevant multiple platforms? How do we manage the re-bundling of our content into multiple different packages?

7. How do we structure deals to protect our content? How can we manage our intellectual property and handle all the contracts, terms, rights and associated payments around our content deals? How can we protect our intellectual property from the rising threat of digital theft?

8. How much should we charge – or pay – for content? How much should we pay for content rights or sell our content for and on what terms? What are the best transaction platforms for each piece of content? How will we manage micro payments for content?

9. How do we maximise margins? How much control do we really have over costs and price, and how do we value our services? How will the competition respond? How do we counter commoditisation of product or service?

10. How can we avoid regulatory bottlenecks? How can we avoid getting into third party payment, revenue recognition or audit difficulties with increasingly complicated commercial dealings?

These are just some of the questions and challenges companies face as they strive for success in an increasingly digital world. This report examines these issues, and offers specific recommendations to help TMT companies position themselves for sustained success.

"After suffering through the ups and downs of the Internet bubble, major media companies had been understandably reluctant to plant a big stake in the digital landscape. This is steadily changing. Traditional media businesses are now embracing digital channels. Many are spending significant sums developing or acquiring new media divisions, businesses, platforms, capabilities and technology."

Ed Shedd, Deloitte UK

Revenue share from digital channels today

In the media market, prices and revenue contribution vary substantially by distribution channel (see Figure 1). Each channel is based on a

different business model, and contributes a different level of revenue to the content owner. Moving forward, this picture is likely to become

even more complex as new and hybrid business models develop around digital channels and offerings.

Today, while digitally created and stored content generates significant revenues, particularly in DVD format, major media companies derive only about one percent of their total TV and film revenue from digital distribution (Video-on-Demand (VOD), Pay-Per-View (PPV), downloads to PCs and mobile phones). Digital distribution revenues should increase, due to the combined influences of technological advance, falling prices and consumer preferences. Deloitte believes that by 2012, revenue from VOD, PPV, Internet and mobile distribution channels is expected to have increased by more than four times for most major media companies (from under 2% to at least 8%).

Choices put consumers in charge

The unrelenting migration from analogue content to digital content is expected to touch every aspect of the market, from technology and marketing to content generation and global distribution (see Figure 2). Platform owners (e.g. television/radio network operators, broadband providers) are already losing their monopoly on reaching the public, and media companies are losing their monopoly on creating content.

Meanwhile, consumers are enjoying – often encouraged by suppliers – more control of their consumption of content than ever. The consumer is also likely to become more engaged, contributing to and interacting with services rather than passively consuming them1.

Changes in the media market are driven by a continuous loop of technology, media experiences and content. Technology advances lead to new and improved media experiences, which lead to new forms of content, which lead to new investments that drive continued technology advances (see Figure 3).

One of the biggest changes associated with the digital turn on is likely to be the proliferation of choice. Content will remain critical, as always, but will appear in new forms to meet the diverse and changing needs of consumers. Media companies already offer an unprecedented variety of content, in more forms than ever before – for example, news and entertainment on mobile handsets; television programmes via the Internet – and this trend will accelerate as technology-savvy young people who are accustomed to choice grow up to become the mass market of tomorrow.

In the past, consumption patterns have been generally determined by a trade-off between coverage (that is, accessibility to content) and experience (the quality of the media experience). For example, daily newspapers offer excellent coverage because they are widely available and easy to carry, but offer an experience that is limited to printed words and pictures. In contrast, attending a live music concert or sporting event offers customers a much richer experience, but can only be consumed at a particular place and time (see Figure 4).

Currently media consumption is still largely constrained by this trade-off between coverage and experience. However, as TMT makes the leap from analogue to digital, more and more content is expected to be repurposed for delivery across a wide range of technology platforms, giving consumers more ability to define their own media experience. Newspaper publishers, normally the slowest to accept the challenges around the digital turn on, are already pushing the trade-off boundary between coverage and experience by becoming broader content providers, delivering their content via their printed newspaper product but complemented by differentiated digital product, such as delivering content and functionality via online and mobile channels.

As the public gains greater control over media consumption, three themes will dominate:

- The inexorable, accelerating proliferation of content choice and supply

- Content that is increasingly personalised and tailored to a customer’s specific needs, both for early adopters and the mass market

- Media companies will need to find ways of repurposing content and of partnering to push the boundaries of consumers’ optimum experience and coverage requirements. The emphasis will be on giving consumers what they want; when they want; where they want.

These themes will have far-reaching effects: reducing platform dependency, lowering barriers to entry for content, driving continued growth in non-linear media consumption, and increasing fragmentation of the media market. Pushed content will remain important, but expect consumers to use their newly found market power to demand content on their own terms.

Staking out a new position in the value chain

The balance of power between businesses and consumers is shifting. Companies can no longer dictate what content people consume, or how they consume it. Although that might sound like bad news, Deloitte believes consumers are using their newly found power to devour more content. TMT businesses are capitalising on this trend by delivering content on multiple platforms, creating new revenue opportunities and enabling companies to reach more customers in more ways.

Realising a company’s optimal value in a digital world calls for a review of its position – or positions – in the value chain, and for a fundamental reassessment of how to make money in the new digital ecosystem. Media companies, which traditionally have been on the creation side of the value chain, are constantly looking for new ways to reach audiences and sell more content. But in order to accomplish that, they must respond to consumers’ emerging preferences for pulling content on demand; receiving personalised push content; and contributing content of their own.

Telecommunications companies, which traditionally have been on the access side of the value chain, are currently making the lion’s share of capital investments to build the infrastructure and networks for the digital turn on. These companies – despite their heavy financial commitment – will also have to analyse their position and strengths to determine the most profitable places to be in the new ecosystem.

The digital ecosystem of 2012 demands that companies find their optimum position in the converged value chain – a position that maximises shareholder and stakeholder value through meeting customers’ needs for an increasingly compelling and personal experience.

"Changing from a predominantly B2B, aggregated consumer, push, broadcast model to a predominantly B2B, personalised, combination push-and-pull narrowcast model requires a completely new mindset, operations and technology."

David Tansley, Deloitte UK

Digital consolidation leads to value chain consolidation

Significant horizontal integration is expected as companies find their new role in the value chain and structure themselves accordingly. This will be a combination of both operational and technical convergence and traditional merger and acquisition-led integration. In this new value chain, traditional labels such as ‘movie studio’, ‘record company’ and ‘television network’ will give way to new roles such as ‘content creator’, ‘aggregator’ and ‘platform provider’ (see Figure 5).

Even within industry sub-sectors, the distinctions between traditional distribution channels will melt away – Technology, Media and Telecommunications companies will coexist in a converged value chain. Value will be largely derived from a company’s ability to push content to consumers (media creation value chain), and its ability to satisfy consumers’ desire to pull and interact with content (access value chain, where telecommunication platform providers, device and hardware interoperable network owners are playing and will increasingly play a role). Advertisers are likely to increasingly embed advertising into content throughout the chain, at times becoming content commissioners and creators themselves (see Figure 6).

Companies are expected to be increasingly interconnected, with relationships becoming more and more complex: adversarial, cooperative and symbiotic2. The future landscape is likely to become increasingly interactive, relationships between the players are likely to become more complex, and the value chain may be anything but linear, more of a value web3.

A question of ownership and control

Over the past few years, every technology that has opened and expanded the media market – whether home media centres, peer to peer file sharing, or convergence devices – has also prompted larger TMT companies to ask whether they should team up with others, or try to go it alone. Much of the recent merger and acquisition activity has been driven by increasing recognition that no single company has all the answers or capabilities to win the digital game on its own.

Historically, media companies have been reluctant – or in some cases, prohibited – to own and control the entire value chain. But digital convergence is increasing the pressure for companies to form alliances or merge, essentially creating TMT companies that control content, secure distribution and frustrate the competition (laws and regulations permitting). Of course, these alliances and acquisitions also increase the complexity of the business, making it harder and riskier to manage (see Figure 8).

An alliance is generally faster and less risky than an acquisition, at least in the short term. However, in some cases an acquisition might make more sense in the long run, particularly in critical areas where in-house capabilities could provide an enduring competitive advantage.

Ultimately the question of partnering encompasses both the capability development required to succeed and the businesses’ own view of what activities it must control, and whether control requires ownership. These questions are well understood in a traditional sense, although TMT companies that insist on owning all the means of production may become increasingly inflexible members of the digital ecosystem.

Creating a sustainable business model

With consumer as king and value chains converging, there is greater need for digital leaders to have structural flexibility and operational efficiency to maintain and enhance their relationships with customers to deliver service profitably at a price customers are willing to pay. They should also continually update their product and service offerings to meet the market’s changing needs.

As with many other industries, the media industry is subject to a cost/convenience trade-off whereby consumers are willing to accept some inconvenience (say in the form of advertising) in order to receive content for free or at a subsidised rate. The extent of this in media is considerably higher than for most industries. Many consumers therefore expect to receive content at low cost or for free although the penetration of multi-channel television has also shown that consumers are willing to pay for content they value, and for increased choice.

Today, three commercial models dominate, each of which has its share of success stories:

- Fully subsidised through advertising;

- Subscription services (flat fee irrespective of volume consumed);

- Pay-per-view or per consumption.

Hybrid models have also been developed, where consumption is part paid and part subsidised by advertisers or equipment manufacturers – providing customers with a choice not only on the content they want, but on how much they are willing to pay. Deloitte sees these models being increasingly successful as media companies turn on to digital so long as consumers do not become confused by a proliferation of mechanisms to pay for content.

In a digital environment the business model defines for an organisation:

- The business it is in: access or creation? Business to consumer or business to business?

- The target customers: mass market or niche? Defined by behaviour, demography or needs?

- How the business will make money: interplay of price and volume, revenue and costs, demand and supply.

- The skills and capabilities that are key to success.

- How the business sustains defensible competitive advantage and captures long-term value.

In a digital ecosystem, winning models require at a minimum three key foundations (see Figure 9):

- Technical robustness. The technology that supports the service the consumer is paying for must be trustworthy and, where possible, be unique or difficult to replicate. If you are on the media content side of the value chain, technology must be in place to support a company’s revenue recognition around intellectual property rights. If on the access side of the value chain, technology must support a universal service provision for the customer, providing uninterrupted service for media consumption.

- Consumer convenience and acceptance. The digital offering must be compelling, interesting, fashionable (where applicable), user-friendly, convenient, and easy to understand – and preferably all of the above. Not necessarily to everyone, but to at least a critical mass of customers. Market leadership and brand recognition is key. As consumers have less disposable time and increasingly more content from which to choose, they will turn to a brand to find what they are looking for.

- Appropriate financial compensation mechanisms. It is critical to get the right mix and balance of financial contributions from the right parties (for example, end consumers, equipment manufacturers, distributors and advertisers). This needs to be flexible as the mix may change over time. If the customer is unwilling to pay the full cost of service delivery, others may be willing to pick up the tab.

If any of these three elements is absent – even for a short time – a business may fail.

With regard to the actual price point within the pay models, we are seeing a period of considerable price experimentation – particularly with mobile, fixed line and Internet propositions. Providers are choosing to discount service offerings and subsidise the price of select services by bundling with others in order to attract customers for the longer term – such a move has been recently witnessed through Carphone Warehouse’s offer of free broadband.

As content providers learn more about their customers and are able to segment and target them more effectively Deloitte anticipate greater price discrimination, tiering and bundling in order to steadily reduce consumer surplus. Such customer information should also be incredibly valuable for personalised and targeted marketing – of incredible value to advertisers, but currently restricted in the UK under consumer privacy regulation.

"Occasional failure is an inevitable consequence of the fast moving, trial and error nature of developing new media offerings and business models. Setbacks should be viewed as learning opportunities, not an opportunity for retrenchment or headcount reduction. Media companies should become more culturally tolerant of failure and become more structurally agile in order to move on to the next big idea. This need not be organisation wide – but rather just focused on those business behaviours that matter to the consumer."

Terri Linder, Deloitte UK

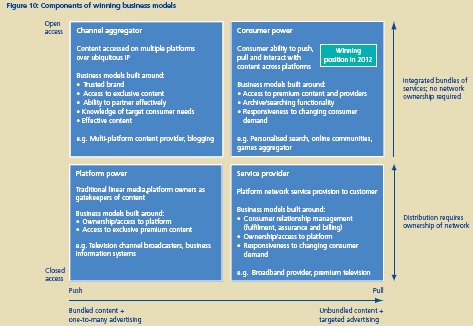

Components of winning business models

The year 2012 will be characterised by a world of consumer power, where ubiquitous IP will allow for open access to content, crossplatform delivery and consumer ability to push, pull and interact with content. To meet the consumers’ needs, hybrid and dynamic business models will emerge blending subscription, pay-as-you-go, and ad-funded content. Figure 10 outlines the key business model success factors by supplier type.

Structuring for success

Value chain consolidation isn’t just an external phenomenon. It also has a major impact inside the company. Most TMT businesses are currently organised around distribution channels and industry verticals. But as everything moves to digital, these traditional distinctions are blurring, becoming increasingly horizontally integrated, and forcing companies to find new ways of operating.

In this context several key structural considerations are evident:

Decision-making and investment. On the content creation side, development processes and revenue projections must be amended to reflect the amount of revenue generated by each distribution channel and platform – and the cost of repurposing content for them. Traditional methods for developing business cases and calculating return on investment (ROI) may not always work in this new environment. For example, while entry into a new platform area may seem prohibitively expensive, once the initial investment has been made, the extension of product lines and services – even into niche markets – may yield lucrative margins. For example, Deloitte expects that a growing digital radio listener base (an expected 50% increase in 2006, with DAB listeners consuming 16% more than the average radio listener4 will allow for improved digital audio trafficking, more targeted advertising and thus significant potential for advertising revenue uplift.

IT infrastructure. IT processes and infrastructures must be adapted to handle greater complexity across a wide range of areas, including: intellectual property and rights management; asset management; customer management; financial reporting and revenue recognition, integrated billing systems, customer intelligence and audience measurement. IT integration could be a major challenge in this new, highly fragmented business environment.

In following the lead of BBC’s decision to outsource their technology capability to Siemens Business Services, TMT companies may increasingly choose to outsource their own core and non-core technology functions as a means to cope with major business changes resulting from digital convergence5.

Organisational structure. Companies that have not already done so may need to establish digital media divisions to coordinate the creation and distribution of content across platforms. These divisions are not peripheral but most absolutely sit at the heart of the core creative and customer processes. In the future, nearly all channels and content types may be structured within a single content generation and exploitation engine, with only a few niche groups remaining to serve highly specialised platforms, content types or genres.

Human resource (HR) practices. Job descriptions, performance metrics and rewards are likely to change. Incentives and structures should foster cross-platform collaboration and innovation, starting at articulation at a senior level and cascaded down throughout the organisation. HR processes need to reinforce this culture, both in working with partners and alliances and across functions within the organisation.

Putting customers at the centre

There are three keys to leadership in the digital media ecosystem – all centred on customers.

1. Attracting customers requires a strong brand, and/or the creation of buzz around a product or service that is unique, compelling and user-friendly. (Example: Apple’s iPod and iTunes). Media companies that get this right naturally stand out from the pack, helping them reach consumers who are overwhelmed by more choices than they can handle.

2. Engaging customers requires content that is customised for specific groups and individuals or allows users to search or pull personalised content. Personalisation keeps people coming back again and again. (Example: MyYahoo!). In order to provide personalised content, companies should capture, maintain and interpret vast quantities of information, more of which is user-generated and engages customers as a community.

3. Maintaining the customer relationship requires agility in the face of changing consumer needs and preferences. Organisations need to be structurally flexible and operationally efficient in order to serve, maintain and enhance their customer relationship and continually update product and service offerings. (Example: Google with their product range from Google Maps to Google News to Google Calendar). Flexible and innovative business models are also required to balance the cost/convenience considerations of customers, while remaining sensitive to their willingness to pay.

Yahoo!, Google and Apple’s iPod are standout examples of TMT companies that have achieved digital leadership by excelling in all three of these areas. These organisations, once defined as technology companies but now regarded as pan TMT companies, have disrupted the traditional media value chain and have generated sustained value from putting the customer front and centre.

"It is telling that the genesis of iPod and iTunes was the strategically agile, innovative, and culturally creative Apple Computer, Inc. of today instead of an existing music or media company, which – one would assume – would understand the music market better."

Nigel Huddleston, Deloitte UK

Conclusion

Just three years ago, Deloitte identified digitally-enabled piracy as the number one challenge to the film industry6. Yet today, most TMT companies are learning to embrace digital content and distribution rather than fight it, seeing the digital turn on as an opportunity rather than a threat.

There is no question that the digital media marketplace can be a confusing and hazardous place. And there are still many issues to resolve, including questions about piracy, content acquisition, rights management, pricing, cannibalisation, alliances, privacy, regulatory compliance, intellectual property protection and more. In fact, the only thing that outweighs this long list of concerns about the move to digital is the long list of benefits.

The digital turn on is coming, and there’s no way to stop it. The only question is what you choose to do about it. So, are you ready to compete? Do you have what it takes to realise the benefits of digital content creation and distribution? Will you be on the starting blocks in 2012? And if so, will you get to the podium?

Notes

1 Capitalising on Convergence: Delivering Value and Driving Growth in the Digitally Converged World, Intellect, 2005.

2 The Network Society: A Shift in Cognitive Ecologies? by Mathew Wall-Smith.

3 The Death of "e" and the Birth of the Real New Economy, Peter Fingar and Ronald Aronica, 2000.

4 Digital Radio Broadcast Bureau, DAB Digital Sales Top 3 Million, 2 May 2006.

5 Computing: BBC’s IT outsourcing may be start of trend, Daniel Thomas, 2 March 2005.

6 Facing Piracy: Digital Theft in the Filmed Entertainment Industry, Deloitte MCS UK Ltd., 2004.

In this publication, Deloitte refers to one or more of Deloitte Touche Tohmatsu (‘DTT’), a Swiss Verein, its member firms, and their respective subsidiaries and affiliates. As a Swiss Verein (association), neither DTT nor any of its member firms has any liability for each other’s acts or omissions. Each of the member firms is a separate and independent legal entity operating under the names "Deloitte", "Deloitte & Touche", "Deloitte Touche Tohmatsu", or other related names. Services are provided by the member firms or their subsidiaries or affiliates and not by the DTT Verein.

In the UK, Deloitte & Touche LLP is the member firm of DTT, and services are provided by Deloitte & Touche LLP and its subsidiaries Deloitte & Touche LLP is authorised and regulated by the Financial Services Authority.

This publication has been written in general terms and therefore cannot be relied on to cover specific situations; application of the principles set out will depend upon the particular circumstances involved and we recommend that you obtain professional advice before acting or refraining from acting on any of the contents of this publication.

Deloitte & Touche LLP would be pleased to advise readers on how to apply the principles set out in this publication to their specific circumstances. Deloitte & Touche LLP accepts no duty of care or liability for any loss occasioned to any person acting or refraining from action as a result of any material in this publication.

© Deloitte & Touche LLP 2006. All rights reserved.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.