To read Managing Talent In A Turbulent Economy - Playing Both Offense And Defense please click here

Key Findings

This report presents the major findings of a March 2009 Deloitte survey about ways top executives and talent managers in industries worldwide are adjusting their workforces to navigate a course through the rough waters of today's turbulent economy. The study, the second in a three-part longitudinal survey, also examines how strategic priorities and talent tactics have changed since our January 2009 survey:

- In the March survey, senior executives reported they expect significant challenges to persist in the broader economy, just as they had in January, and few believe the worst is behind us.

- In response, surveyed executives are focused sharply on cost cutting, including layoffs and other austerity measures. Efforts to align company costs with today's economic realities are now crowding out plans to keep and expand the customer base—a significant change since the January survey.

- Reducing employee headcount remains the top talent priority and, over the last quarter, surveyed talent managers have shifted the criteria being used to determine workforce reductions. As layoffs get deeper and more difficult, even employees with critical skills filling key roles are at risk of losing their jobs.

- While layoffs and other belt-tightening measures dominate executive attention, surveyed corporate managers still recognize the need to retain and train key talent. Layoff survivors can expect to feel the impact of the difficult economy through lower compensation and benefit levels.

- With governments taking a higher-profile role in business, the intersection of talent and risk management and regulatory compliance has emerged as an area of rising concern for surveyed business leaders and HR executives.

Global Economic Outlook Remains Extremely Challenging

As the global recession deepens, executives in every major market and across every major industry are struggling to bring corporate costs in line with falling revenues and depressed profits. According to the 397 international executives surveyed for Deloitte by Forbes Insights in March 2009, austerity measures occupy an increasingly significant portion of management time, outranking efforts to increase sales and serve customers as top priorities now and in the coming months.

Layoffs remain widespread, as newspaper headlines attest. This survey suggests that headcount cuts are getting deeper and more difficult for executives and talent managers to make. These managers are struggling with how best to align their workforces with the reality of what many expect to be a prolonged downturn.

The March 2009 survey is the second edition in a three-part longitudinal study designed to examine ways executives are responding to the perilous and often unpredictable currents of today's economy. In addition to gauging broad trends in talent management, this study also spotlights the actions companies are taking to implement and integrate talent management in their risk management and regulatory compliance operations.

|

Digging Deeper: Corporate leaders surveyed in Life sciences/Health care companies expressed a moderately more optimistic view about economic conditions, with just 24% suggesting the worst is still to come, compared to 32% overall. |

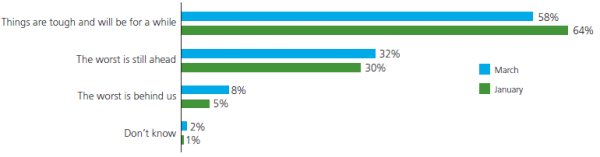

In March, as in January, corporate executives surveyed clearly recognize the mounting economic challenges they face and the need to reorder their strategic priorities to survive. An overwhelming 90% of executives surveyed expect the business environment to remain depressed, with one-third predicting that still tougher times lie ahead. A mere 8% believe the worst is behind us (fig. 1).

Figure 1. Executive Outlook On The Economy: March vs. January

Cutbacks And Layoffs Dominate The Corporate Talent Agenda

In keeping with this grim economic outlook, cutbacks and layoffs are dominating the corporate talent agenda. Between November 1, 2008 and April 28, 2009, the 500 largest U.S. corporations announced layoffs totaling more than 544,000 workers, according to Forbes.com. But workforce reductions are not confined to the United States. The Organization for Economic Cooperation and Development warned in late March that the world's 30 richest countries are facing a combined jump in unemployment of 25 million people in the current economic crisis, pushing the jobless rate to over 10% from a 2007 low of 5.6%.

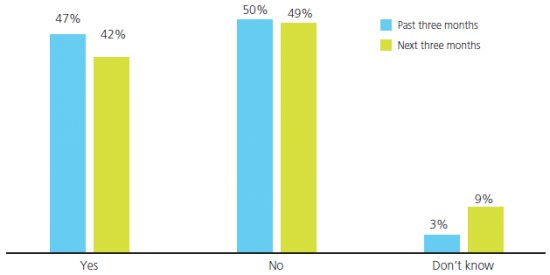

This trend was clearly evident in our March survey, with nearly half (47%) of the executives questioned reporting layoffs over the last three months (fig. 2), markedly more than those who had predicted layoffs (38%) in our January study. More than four in ten (42%) expect more layoffs to come over the next quarter, as companies struggle to "rightsize" their workforces for a weaker economy.

Figure 2. Organizations Conducting Layoffs

Companies already feeling the pain of layoffs report little relief in sight. Of the companies surveyed that experienced layoffs in the last quarter, seven out of ten (71%) expect more layoffs in the coming quarter, while only 17% of the companies that did not experience layoffs over the last three months expect to conduct them in the next three months.

|

Digging Deeper: Energy/Utility companies surveyed were the least likely to experience layoffs over the past three months (37%) and were the least likely to predict layoffs over the next three months. |

Public companies, under greater pressure from shareholders to hold down costs, appear more likely to turn to layoffs than privately held companies. In the March survey, 59% of publicly traded companies reported laying off workers over the last three months, compared to 39% of privately owned companies. Half of the public companies (51%) surveyed expect layoffs over the next three months, well above the 35% of private companies.

Cuts Get Deeper And More Difficult

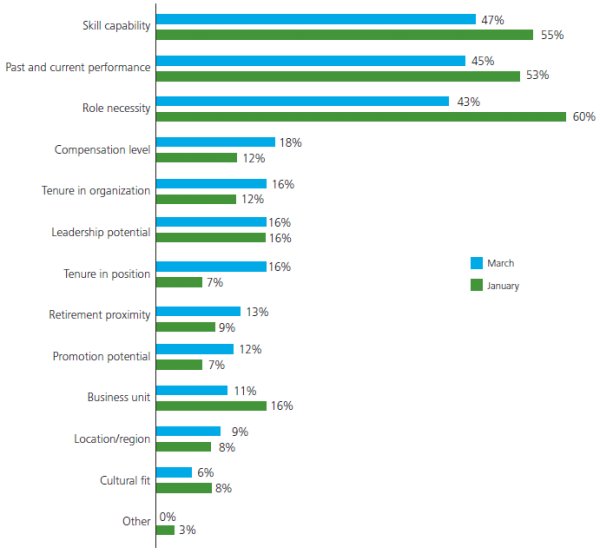

The criteria used by executives surveyed in making workforce reductions has shifted significantly since January, suggesting that talent managers are being forced to consider job reductions that cut deeper into their companies and are more difficult to make. Even employees with strong skills filling necessary roles are at risk in some companies.

In March, 43% of executives surveyed list "role necessity" as a key factor in making decisions about workforce reductions—a 17 percentage point drop from January. Some 47% reported "skill capability" was an important criterion in layoff decisions, compared to 55% in January. Past and current performance is no guarantee of job security, with less than half of managers (45%) reporting this as a top factor, compared to 53% in January (fig. 3).

Figure 3. Top Criteria For Making Workforce Reduction Decisions: March vs. January

|

Digging Deeper: Justifications for cutbacks also vary greatly by industry. Life sciences/Health care companies surveyed were much less likely to use "skill capability" (32%), "role necessity" (32%), and "past and current performance" (27%) as workforce reduction criteria, while Energy/Utility companies were much more likely to use "past and current performance" (63%) and "skill capability" (60%). Executives in the Consumer/Industrial products sector appear much less concerned with "leadership potential" (7%), while their counterparts at Technology/Media/Telecom companies are more concerned (23%). |

Layoff Survivors Also Feel Impact Of Tough Economy

Employees who survive the waves of layoffs can expect to bear the pain of tough economic times. Companies experiencing layoffs are also more likely to be decreasing compensation and benefit levels, but they are not the only ones focused on cutting costs.

|

Digging Deeper: When it comes to reducing costs, companies in the Europe/ Middle East/Africa (EMEA) region surveyed are more likely to use reductions in retirement plan contributions (25%) than those in the Americas (14%) or Asia Pacific (APAC) (13%). |

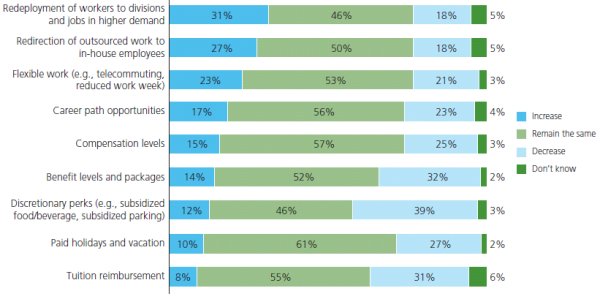

By strong margins, executives surveyed reported that over the next 12 months their companies are more likely to decrease rather than increase compensation levels (25% to 15%), benefit levels and packages (32% to 14%), and discretionary perks such as subsidized food and parking (39% to 12%) (fig. 4). Corporate bonuses are also being pared back, with more than a third (35%) reporting they expect bonuses to decrease this year.

Figure 4. Anticipated Changes In Retention Focus Over Next 12 Months

As layoffs become more frequent and less predictable and benefits are curtailed, it is no surprise that employee morale remains low. More than one in three executives surveyed (36%) reported that employee morale decreased over the past three months, while 25% reported trust and confidence in leadership declined (fig. 5).

Figure 5. Impact Of Economic Climate On Talent Efforts Over Past Three Months

Cost Cutting Crowds Out Sales And Service As A Key Strategic Priority

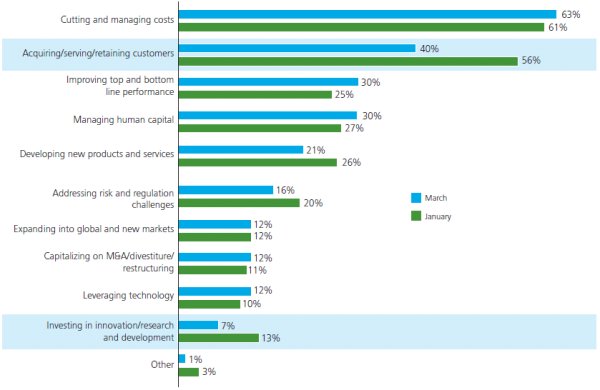

While the overall ranking of key strategic priorities for senior executives surveyed remains unchanged since January, cutting and managing costs are now by far the primary concern of the executive suite, outdistancing other priorities by more than 20 percentage points. When asked to identify the strategic issues that currently occupy most of management's attention, executives ranked cutting and managing costs first (63%), acquiring/serving/ retaining customers second (40%), and managing human capital and improving top and bottom line performance third (tied at 30%) (fig. 6).

Although "acquiring/serving/retaining customers" ranked second in this survey as it did in January, the number of top managers who gave it a top rating dropped precipitously from 56% in January to 40% in March. Cost cutting now exceeds sales- and service-related activities by a 23-point margin (63% to 40%), compared to just five percentage points in the previous survey. Investing in innovation/research and development dropped by roughly half between January and March (fig. 6).

Figure 6. Current Strategic Issues: March vs. January Highlighting Significant Changes

|

Digging Deeper: Life sciences/Health care and Energy/Utility companies surveyed see improving top- and bottom-line performance as a lower priority than other companies—a finding consistent with their more optimistic overall economic outlook. Just 22% of Life sciences/ Health care and 17% of Energy/Utility executives ranked it as a top priority versus 30% overall. Public companies, which must answer to restless shareholders, were more concerned (37%) about improving top/bottom line performance than privately held ones (24%). |

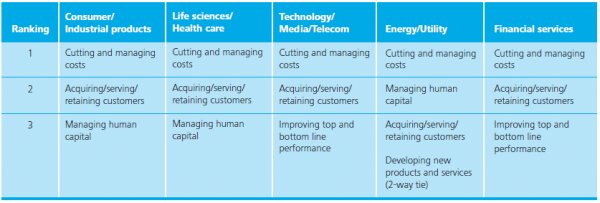

The shift to cost-cutting mode becomes more pronounced when comparing March and January results by industry. Unlike in January, executives surveyed in every industry now rank cutting and managing costs as their number one strategic priority. In March, for both Consumer/Industrial products and Technology/Media/Telecom, cutting costs displaced landing and keeping customers as their top priority (fig. 7).

Figure 7. Current Strategic Issues By Industry

As companies shift their focus away from sales and customers, talent managers surveyed are also pulling back on training activities in this area. Roughly one in five (22%) now report they are decreasing job-specific training in sales and customer service versus 13% in January, while the number increasing this training fell from 29% to 24%. The declining focus on sales was more pronounced among non-HR executives, with just 34% ranking "acquiring/serving/retaining customers" as a top management priority, compared to 54% in January.

The generally pessimistic economic outlook of executives surveyed and the strong emphasis on reducing costs may also be cutting into plans aimed at repositioning companies for better times ahead. While January's survey revealed a mix of offensive and defensive measures, March responses indicate executives are clearly on defense. Other than Energy/Utility executives, no survey participant in March listed investing in R&D or developing new products as one of their top three priorities.

|

Digging Deeper: Are executives in different regions employing different strategies to manage through difficult times? Yes, according to the March survey. Far more executives surveyed in the Americas (21%) are looking to leverage technology to improve operations than their counterparts in APAC (6%) and EMEA (8%). By eight percentage points, APAC companies are more focused on expanding into global or new markets than companies in the Americas. The reverse is true when it comes to capitalizing on M&A/divestiture/restructuring opportunities; 16% of executives in the Americas ranked this as a top priority, compared to 7% in APAC. |

Focusing On Defense: Talent Priorities Reflect The Rough Economy

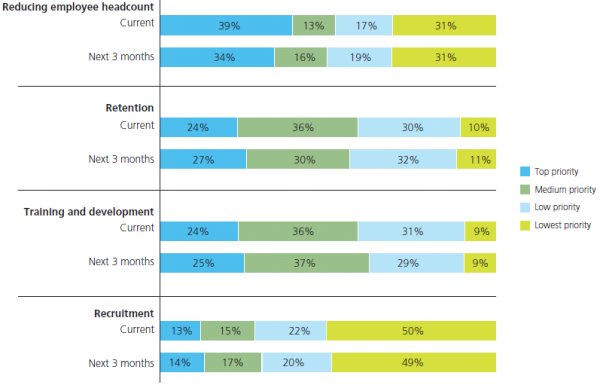

Corporate executives, firmly in cost-cutting mode, reported that reducing employee headcount represents the top talent priority today and will remain so over the coming quarter. Nearly four in ten (39%) survey participants named reducing headcount as their top talent priority, about the same (38%) as in January. Looking forward, a slightly smaller, but still substantial minority (34%) report lowering headcount will be their top talent priority three months from now (fig. 8).

Figure 8. Current And Anticipated Talent Priorities

Headcount reductions are a higher talent management priority in some industries than in others. By a 12-point margin compared to total respondents, companies surveyed in the Financial services sector rank reducing headcount as their top current talent priority. Reducing headcount now and over the next three months ranks as a lower talent priority for Life sciences/Health care companies and Energy/Utility companies.

|

Digging Deeper: From a global perspective, EMEA companies surveyed stood out for being less focused today on reducing headcount, with only 20% currently ranking it their top talent management priority. Looking to the next quarter, these same EMEA-based companies anticipate a turn for the worse, with 35% reporting that reducing headcount will be the top talent priority over the next three months. |

Recruiting Down For All But Experienced Hires

With many companies looking to lower headcount, recruiting remains the lowest talent priority in companies surveyed across every industry and throughout every region. Half of the executives surveyed report recruitment is currently their lowest talent priority, similar to January's 46%, and a nearly equal number (49%) report it will remain so three months from now (fig. 8).

|

Digging Deeper: Given their focus on reducing headcount, it is not surprising that Financial services companies surveyed are also less focused on recruiting—with 70% ranking it their lowest priority. Life sciences/Health care companies—which are somewhat less focused on cost-cutting—report they are more focused on recruiting, with 20% rating it a high priority compared to other industries surveyed. |

New hires from college campuses can expect to feel the brunt of this hiring "freeze." Only 15% of executives surveyed plan to increase campus hires, compared to 35% who reported they will decrease their focus on these recruits. But college seniors are not the only potential employees struggling to find employment in today's difficult economy. More than one in three (35%) executives reported that they plan to decrease part-time hires over the next year—a jump from 26% in January (fig. 9).

Figure 9. Anticipated Changes In Focus On Recruitment Over Next 12 Months

One group still in demand remains experienced recruits. Over the next year, 27% of executives surveyed plan to increase experienced hires, nearly identical to January's 28%. In fact, experienced hires were the only recruitment category showing a greater increase than decrease in focus (27% vs. 24%), with campus hires, contract hires, part-time hires, and offshore/outsourced hires all seeing net declines over the next 12 months (fig. 9).

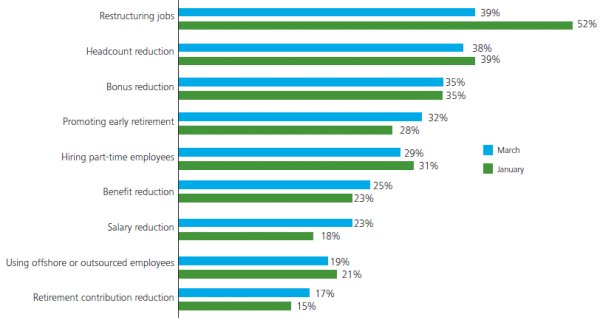

In the latest survey, the percentage of executives who reported they planned to restructure jobs to lower costs and increase efficiency fell significantly from 52% in January to 39% in March, suggesting there may be fewer gains to be made from restructuring going forward (fig. 10).

Figure 10. Area Of Increased Focus On Reducing Costs And Employee Headcount Over Next 12 Months: March vs. January

|

Divergence Between HR/Talent And Other Company Executives In training and development, HR executives surveyed were more likely (by 11-13 percentage points) than non-HR executives to expect their company's focus to increase when it came to onboarding and orientation, leadership and management development, high-potential employee development, and job-specific training. In recruitment, 29% of HR executives saw an increased focus on using contract hires compared to 16% of non-HR executives; similarly, 31% of HR executives indicated an increased use of part-time hires compared to 20% of their non-HR colleagues. |

Companies Surveyed Still Recognize The Need To Retain And Train Key Employees

Even in a time of layoffs, benefit reductions, and other belt-tightening measures, corporate executives surveyed recognize the imperative to retain and train key talent. Six out of ten executives ranked retention either #1 or #2 among current talent priorities, identical to the percentage ranking training and development #1 or #2 (fig. 8).

In order to retain employees, executives surveyed are increasingly focused on three areas: redeploying workers to divisions and jobs in higher demand (31%), redirecting outsourced work to in-house employees (27%), and increasing the use of flexible work through telecommuting and reduced work weeks (23%) (fig. 4).

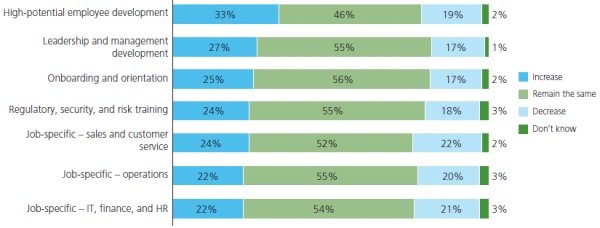

Despite widespread cost-cutting, talent managers and corporate executives surveyed remain committed to developing the top talent and future leaders within their companies. When asked to anticipate how their company's focus on training and development will change over the next year, 33% reported they would increase training and development for high-potential employees— slightly less than in January (37%), but still the highest of any category. Leadership and management development continued to rank second, but declined from 36% in January to 27% in March (fig. 11).

Figure 11. Anticipated Changes In Focus On Training And Development Over Next 12 Months

|

Digging Deeper: Life sciences/Health care and Energy/Utility executives surveyed are more likely to have a high level of concern over losing key employees, while Financial services firms are much less likely to be concerned about the issue. |

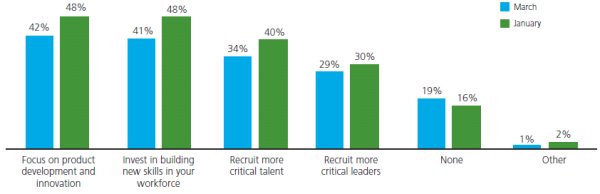

One possible reason for the continued emphasis on employee retention and training is the recognition by companies surveyed that they must make the most of current employees instead of recruiting talent from the outside. One-third (34%) of executives report they plan to recruit more critical talent given current economic conditions, compared to 40% in January. The percentage of executives who report they are investing in building new skills in their workforces remained relatively high at 41%, but fell from 48% in January (fig. 12).

Figure 12. Actions Anticipated Due To Economic Climate: March vs. January

The tough economic climate and strong emphasis on reducing headcount has done little to calm executive fear that rival companies may try to poach their most talented employees. In the March survey, 44% reported their concern about competitors recruiting high-potential employees was either very high or high (compared to 43% in January) and only 19% reported their concern was very low or low (compared to 23% in January).

Spotlight On Talent And Risk

The events of the past year have demonstrated that risk and compliance issues can endanger even highly regulated companies with the most sophisticated risk management practices. At a time when all organizations are experiencing intense scrutiny from lawmakers, regulators, and shareholders, corporate risk and compliance efforts must continue to be an integral part of doing business. Talent managers have an opportunity—indeed, an obligation—to play a front-line role in ensuring that the importance of risk management is properly communicated to employees and that employees have the training, skills, and resources they need to manage risk effectively.

With enhanced scrutiny comes increased responsibility to build risk management capabilities into every aspect of a company. This raises some critical questions: Is risk management really ingrained into a corporation's culture? Are employees aware of their role in addressing risk in the organization? Do they have the time and ability to fulfill that role? Have they received the appropriate cues from the organization on why they need to do it, typically referred to as the "tone at the top"?

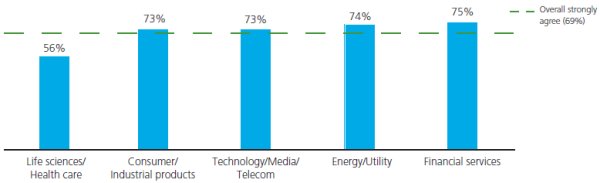

As part of Deloitte's March survey, executives were asked whether they agreed or disagreed with a series of statements designed to gauge the progress companies are making at the intersection of talent and risk management and whether they have the tools to get the job done.

Overall, there was strong agreement among executives surveyed that risk management is ingrained in business decisions and is viewed by employees as an integral part of doing business, not just an administrative burden. To most survey statements, approximately 20-25% strongly agreed and 40-50% agreed, with 10% or fewer disagreeing. However, there were a few revealing responses in the data:

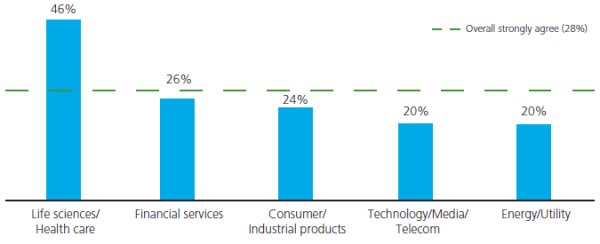

- In terms of industry groups, Life sciences/Health care companies surveyed appear to be focusing more attention on instilling responsibility for risk management across their talent pool—46% of executives at these companies strongly agreed that "Responsibilities for risk management are clearly defined in all job descriptions and performance expectations." In other industry segments, the number strongly agreeing with that statement was 20-26% (fig. 13).

Figure 13. Respondents Who Strongly Agree That Responsibilities For Risk Management Are Clearly Defined In All Job Descriptions And Performance Expectations (By Industry)

- By a 16-point margin (84% to 68%), surveyed CHROs and HR Directors appear more likely to agree that their companies periodically review attitudes toward risk management and compliance than their colleagues in other areas of the company.

- Respondents were asked if they agreed with the statement that compliance is an integral part of doing business, not simply an administrative burden. One quarter of sales/marketing executives and an equal percentage of those in CFO/Treasurer/Comptroller positions disagreed with that statement, compared to fewer than 10% who shared that sentiment overall. As far as industries were concerned, by a 2:1 margin, Life sciences/Health care executives were more likely to share this disagreement than their counterparts in other industries.

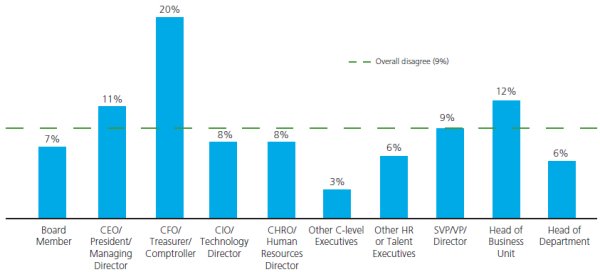

- By a 2:1 margin compared to total respondents, executives surveyed in CFO/Treasurer/Comptroller roles were more likely to disagree that employees in their firms knew how to identify fraud and other behaviors that could endanger their companies (fig. 14).

Figure 14. Respondents Who Disagree That Employees At All Levels Know How To Identify Behavior Such As Fraud That Could Endanger The Enterprise (By Job Title)

Surveyed companies in the Americas appear to be more likely to encourage whistle blowing related to compliance. More than one-third (35%) of Americas' respondents strongly agreed that "Employees and business partners can raise issues in good faith about how things are done in the business without fear of retaliation," compared to 19% of APAC respondents and just 11% of EMEA respondents (fig. 15).

Figure 15. Respondents Who Strongly Agree That Employees And Business Partners Can Raise Issues In Good Faith Without Fear Of Retaliation (By Region)

Executives surveyed generally agreed their companies are preparing employees to manage risk and compliance issues, but the survey suggested a few areas where organizations may be falling short:

- Executives surveyed in financial positions (CFO/ Treasurer/Comptroller) were twice as likely to disagree that new employees and current employees in new positions are receiving effective orientation about their risk responsibilities.

- Leaders at not-for-profit and government organizations surveyed identified more shortcomings in their risk and compliance efforts than executives at for-profit firms. By an 11-point margin, these executives were more likely than total respondents to disagree that their organizations' performance incentive systems reinforce desired risk and compliance behavior.

Most executives surveyed appear to believe their companies have adequate resources to handle risk management and compliance issues, with a few notable exceptions:

- By 13 percentage points, executives at Life sciences/ Health care companies were less likely than total respondents to agree that they had adequate internal talent to address risk/regulatory issues (fig. 16).

Figure 16. Respondents Who Strongly Agree Or Agree That They Have Adequate Internal Talent To Address Risk And Regulatory Issues (By Industry)

- By a 24-point margin, sales/marketing executives surveyed were less likely to agree their companies had adequate internal risk/compliance talent; by 18 percentage points they were less likely to agree that risk/compliance professionals are getting the training they need; and, by that same 18 point margin, they were less likely to agree that risk/compliance requirements are integrated into their business routines.

Risk management will remain in the headlines over the coming months, and the intersection between risk and talent will continue to be a critical issue for all organizations. While the data from the March survey suggests executives surveyed currently have a positive view of the risk and compliance efforts at their companies, we believe the intersection of talent and risk management may be a critical "leading indicator" of potential challenges in this area in the future. Deloitte will continue to monitor this issue and dig deeper to uncover potential challenges as we move forward with additional surveys.

Survey Participants

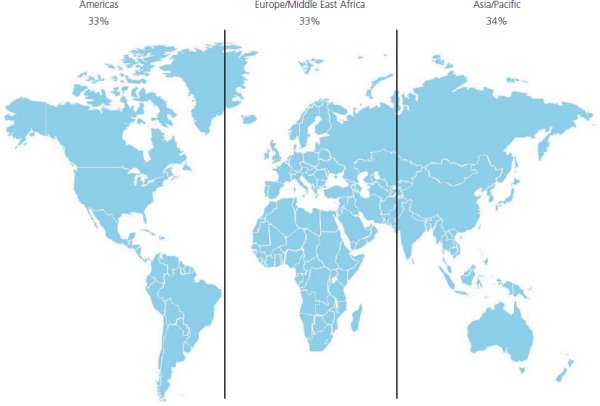

For the second edition of Deloitte's three-part longitudinal study, Forbes Insights surveyed 397 international executives located in the three major economic regions: the Americas (33%); Europe/Middle East/Africa (33%); and Asia Pacific (34%) (fig. 17).

Figure 17. Respondents By Region

All companies reported revenues of more than $500 million during the most recent fiscal year, with 66% of companies above $1 billion and 20% above $10 billion (fig. 18).

Figure 18. Company Revenues

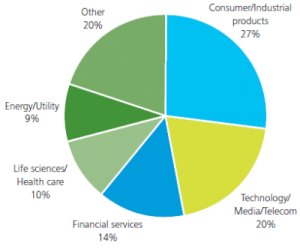

Executives surveyed were employed in senior positions in a cross-section of industries. Half held C-suite positions and 35% headed either their business unit or department. Industry sectors were split between Consumer/Industrial products (27%), Technology/Media/Telecom (20%), Financial services (14%), Life sciences/Health care (10%), and Energy/Utility (9%) (fig. 19).

Figure 19. Company Industries

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.