There were many interesting trademark cases coming out of 2018, a few of which are discussed below.

Earlier this month we also issued a round-up of notable patent decisions from the last year, and our 2018 highlights in Canadian Life Sciences IP covers decisions on the merits in that space.

The scope of Canada's anti-dilution remedy (section 22 of the Trademarks Act) is not limited to a defendant's use of a mark identical to a registered trademark: Energizer Brands, LLC v The Gillette Company, 2018 FC 1003

This is a decision on a motion for summary judgment brought by the defendants ("Duracell") to strike certain allegations from the plaintiff's ("Energizer's") Statement of Claim.

Duracell had made various comparative claims and used Energizer's registered trademarks ENERGIZER and ENERGIZER MAX, as well as the terms "the next leading competitive brand" and "the bunny brand", on labels of its DURACELL brand batteries.

Although Duracell did not use Energizer's registered ENERGIZER BUNNY design trademarks (depicted below) on its packaging, the Court found that "the somewhat-hurried consumer seeing the words 'the bunny brand' in relation to batteries...would make both a link with and a connection to the ENERGIZER Bunny Trade-marks", and refused to strike Energizer's claim.

On the other hand, Duracell's use of the term "the next leading competitive brand" did not offend the Trademarks Act because no mental association would be made between Energizer's marks and the phrase "the next leading competitive brand" used on Duracell's batteries. Such an association, the Court said, "would involve imputing to the somewhat-hurried consumer details of market share in respect of which expert third-party evidence was filed in this Court". These allegations were therefore struck from Energizer's claim.

The remaining issues as to whether Duracell's comparative advertising claims violate the Trademarks Act and the Competition Act will be heard by the Trial Judge. Although the matter was originally set down for a trial commencing December 3, 2018, this is to be rescheduled for a later date. An appeal was filed on November 14, 2018 (A-357-18).

We invite you to read the full summary of the decision here.

Precedent setting decision where a design mark, without words, was found to be confusing with a word mark: Imperial Tobacco Canada Limited v Philip Morris Brands SARL, 2018 FC 503

Nine appeals were heard together of Opposition Board decisions rejecting Imperial Tobacco Canada Limited's ("ITL") oppositions to the registration of Philip Morris ("PM")'s various design marks based upon alleged confusion with ITL's registered trademark MARLBORO. The issue central to the appeals was whether the trademarks were confusing in light of new survey evidence filed on appeal.

With respect to the survey evidence, the Court held it to be

admissible in relation to one decision. The Court held that the

rule in Mattel that the mark used in a survey be

"precisely" the mark applied for is to be given a wider

berth when a design mark is the subject of the survey.

The survey questions were not suggestive or speculative by

presenting the design marks on a no-name getup as opposed to merely

presenting the applied-for marks in isolation. As a result, this

decision was reviewed on a correctness standard.

The Court proceeded to consider whether there was a likelihood of confusion between each of the four applied-for design marks in this decision and ITL's registered trademark MARLBORO in light of all the evidence, including the new survey evidence.

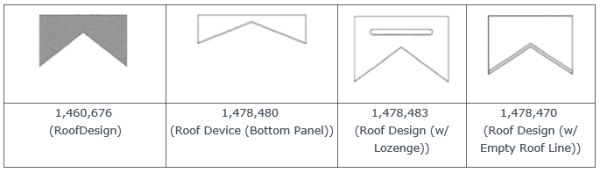

The Court ultimately concluded that there was sufficient resemblance in the ideas suggested by the design marks and the word MARLBORO to establish a likelihood of confusion. The Court allowed the appeal in part and directed that PM's trademark application number 1,460,676 (Roof Design) be refused and PM's trademark application numbers 1,478,480 (Roof Device (Bottom Panel)), 1,478,483 (Roof Design (w/ Lozenge)) and 1,478,470 (Roof Design (w/ Empty Roof Line)) be refused but only with respect to the "cigarettes".

For the remainder of the Registrar's decisions, the survey evidence was considered to be inadmissible. These decisions were reviewed on the reasonableness standard, and the appeals were dismissed.

Appeals were filed on June 13 and 14, 2018 (A-172-18; A-173-18).

"Retail store services" do not require a bricks-and-mortars establishment: Dollar General Corporation v 2900319 Canada Inc, 2018 FC 778

The decision reaffirms the Court's position that providing "retail store services" does not require a "bricks-and-mortar" establishment or direct delivery of products to Canada to constitute "use" of a trademark in Canada. So long as there is a sufficient level of interactivity with potential Canadian customers such that Canadians receive a benefit, then offering secondary or ancillary services on a website or an internet app equivalent to what one might find in a bricks-and-mortar store can constitute use of the trademark in connection with the provision of retail store services in Canada.

We invite you to read our full article regarding this case here.

"Services" can be performed in Canada without a Canadian bricks-and-mortar location: Hilton Worldwide Holding LLP v Miller Thomson, 2018 FC 895

In this case, the Registrar expunged a registration for the trademark WALDORF-ASTORIA for "hotel services" on the basis that the owner did not have a physical hotel in Canada and the only services which Canadians could access from Canada were hotel reservation services and a hotel loyalty program. On appeal, the Federal Court overturned the Registrar's decision to expunge Hilton's registration for the trademark WALDORF-ASTORIA in association with "hotel services" even though it did not have a "bricks-and-mortar" hotel in Canada. In particular, the Court held that the Board erred in ignoring the benefits provided to Canadians by Hilton (e.g. the ability to book and pay via the website, and collect loyalty points). The Court reaffirmed its position that the term "services" should be liberally construed, and can include primary, incidental or ancillary services, which is consistent with Dollar General Corporation v 2900319 Canada Inc., 2018 FC 778.

An appeal was filed on October 5, 2018 (A-325-18).

A consent letter from a registered trademark owner is still not sufficient to overturn the Registrar's decision: Holding Benjamin et Edmond de Rothschild v Canada (Attorney General), 2018 FC 258

This was an appeal of an Examiner's Report refusing an application to register the mark EDMOND DE ROTHSCHILD in connection with a wide range of services, including financial services, on the basis that the mark is confusing with the registered mark ROTHSCHILD in the field of financial services.

On appeal, the applicant submitted new evidence that included consent from the owner of the cited trademark as well as evidence as to the co-existence of the marks in the field of financial services in other geographic territories. The Court held that the evidence would not have had a material impact on the Registrar's decision, and applied the reasonableness standard.

The Court considered the consent to be of limited value as the Registrar must still consider its goal of protecting consumers by guaranteeing the origin of goods and services. While the registered trademark owner may not regard the marks as confusing, the Court emphasized that it is the perspective of the average customer that must be assessed and not that of the owner of the cited mark. The Court also rejected the evidence of co-existence in foreign jurisdictions as it did not discuss factors such as the parties' trade channels, services offered and the applicable legal test for confusion in other jurisdictions.

In reviewing the appeal on the reasonableness standard, the Court noted that the marks solely consist of words without any visual element to distinguish them, and they would co-exist in the same market in which they would be the only two trademarks to share the term "ROTHSCHILD".

The Court concluded that the Registrar's decision fell within the range of possible, acceptable outcomes, and dismissed the appeal.

Sales to employees at cost considered to be promotional in nature and not "in the normal course of trade": Riches, McKenzie & Herbert LLP v Cosmetic Warriors Ltd, 2018 FC 63

The applicant appealed the Registrar's section 45 decision maintaining the registration of the trademark LUSH in association with t-shirts. On appeal, the Federal Court reversed the Registrar's decision and cancelled the mark for non-use holding that sales to employees of t-shirts bearing the mark did not constitute "use" within the meaning of the Trademarks Act.

In particular, the Court found that the transfer of t-shirts to employees at cost did not establish use in the normal course of trade: "I find that in the circumstances of this case, given the absence of profit, the promotional and de minimis nature of the sales to employees, and the fact that the Respondent is not normally in the business of selling clothing, the Registrar's determination...is unreasonable". Furthermore, in the absence of any profit, the sales were considered by the Court to be primarily, if not exclusively, promotional in nature and not in the normal course of trade.

In addition to sales to its Canadian employees, the respondent relied upon its sales to its US employees, and argued that, under subsection 4(3), this was sufficient to maintain the registration as there is no requirement in subsection 4(3) that sales be "in the normal course of trade".

While the Court agreed that subsection 4(3) does not require use "in the normal course of trade", the Court emphasized that it is important not to lose sight of the purpose of this subsection "which is to protect Canadian entities who would be entitled to protection under the Act but for the fact that their sales place exclusively outside of Canada...where a party's activities do not establish use of a trademark, those same activities do not rise to the level of use because an export has taken place. A party cannot be allowed to make an end run around the normal requirements of the Act by shipping a product across the border".

The appeal was allowed, and the Court cancelled the registration.

An appeal was heard by the Federal Court of Appeal on October 1, 2018. The decision was reserved (A-70-18).

American Express Marketing & Development Corp v Black Card LLC, 2018 FC 362

American Express Marketing & Development Corp ("Amex") filed appeals of 10 Opposition Board decisions in which the Board dismissed Amex's oppositions to applications for the trademark BLACKCARD and variations thereof. The applicant withdrew seven of its trademark applications before Amex filed its Memorandum of Fact and Law.

The appeals dealt with the issues of i) whether the appeals respecting the seven abandoned trademark applications were moot and, if so, whether the Court should nevertheless exercise its discretion to decide them, and whether the trademarks were ii) confusing with Amex's unregistered BLACK CARD trademark; iii) distinctive; and iv) clearly descriptive. New and material evidence was filed by Amex, which prompted the Court to apply a standard of correctness in reviewing the Board's decisions.

i) Mootness

Amex's appeal concerned all 10 applications, even though seven of the applications had been abandoned following the Board's decision.

Amex attempted to distinguish the present case from the general rule that the withdrawal of a trademark application renders moot the corresponding appeal. The Court concluded that, although the three appeals regarding the pending trademark applications addressed issues in common with the appeals filed against the now abandoned applications, these decisions were to be decided on the record before the Court and any future proceedings that may arise from the parties' competing trademark applications are to be decided according to their specific facts and on their own merits. The Court therefore held that the appeals regarding the seven abandoned trademark applications were moot, and chose not to exercise its discretion to hear them out of concern for judicial economy and an awareness of the Court's proper function in relation to the independent role of the Registrar of Trademarks.

ii) Likelihood of confusion

On appeal, Amex filed new evidence relying upon an advertising campaign and a letter sent to Amex cardholders concerning a "mysterious black card". However, there was no evidence that Amex had commenced to perform any services in Canada in connection with "black card" by the material date. Further, the Court found that Amex's use was descriptive and not trademark use.

iii) Non-distinctiveness

Amex alleged that the respondent's trademarks were non-distinctive because they were: a) confusing with Amex's unregistered BLACK CARD trademark and black-coloured Centurion Card; b) descriptive because the respondent's credit cards were black in colour and third parties also issued black-coloured credit cards in Canada; and c) descriptive because "black card" connotes a "high end" charge or credit card. Amex relied on new evidence in addition to that submitted to the Board to demonstrate public association of black credit or charge cards with Amex's Centurion Card. However, the Court found that Amex's evidence was insufficient to satisfy this ground of opposition.

iv) Clearly descriptive

Amex claimed that its marketing strategy had been to link the idea of exclusive services with black credit or charge cards and that the notion that black cards are "high end" had attained widespread recognition in Canada. In assessing the issue of descriptiveness, the Court stated that this must be assessed from the perspective of the average retailer, consumer or everyday user of the services in question. While the Court found that the new evidence demonstrated that some Canadians associated black credit cards with prestigious or premium services, the evidence was insufficient to establish that the trademarks were "clearly" descriptive. The use of the word "clearly" implies that the impression created in the mind of the consumer must be self-evident or plain, and this was not established by the evidence.

The decision was not appealed (T-1547-16).

Black Card was successfully represented by Daniel Anthony of Smart & Biggar.

The preceding is intended as a timely update on Canadian intellectual property and technology law. The content is informational only and does not constitute legal or professional advice. To obtain such advice, please communicate with our offices directly.