FOREWORD

Welcome to Hospitality 2010 – our vision into mega-trends that will affect shareholder value over the next five years.

New York University (NYU) and Deloitte dedicated a joint team of professionals to develop a "Vision 2010" of the global hospitality industry. Our vision is supported by research, analysis and structured interviews with leading industry CEO's.

The report focuses on the strategic implications of the mega trends that are shaping the future of the hotel industry and which generate most shareholder value.

The mega-trends we have selected for review at this stage are:

- Brand

- Emerging markets

- Human assets

- Technology

We have included a section on air travel as this holds key information which relates to the changing shape of the hospitality sector by the year 2010.

We also recognise the importance of the business model and regulatory requirements and accordingly have identified these areas for review at a later stage.

We hope you find this report useful and we look forward to any feedback you may have and the opportunity to discuss with you the aspects affecting shareholder value in your business in more detail.

Alex Kyriakidis

Global Managing Partner

Tourism, Hospitality & Leisure

Deloitte

Dr. Lalia Rach

Associate Dean and HVS International Chair

Preston Robert Tisch Center for Hospitality, Tourism and Sports

Management

New York University

EXECUTIVE SUMMARY

Question: How Many Drivers Of Change Are There In Our Industry? Answer: Far Too Many!

To focus our strategic analysis, we used the Deloitte Enterprise Value Map® to filter all the possible drivers of change on the basis of their potential impact on shareholder value which, whether a public or private enterprise, is the key measure of financial success. We concluded that five "mega-trends" will have the greatest impact on shareholder value namely, Brand, Emerging markets, Human assets, Technology and the Business model.

Brand Is The Way Forward

As most gateway cities reach product saturation, brand, long held as the most important value driver in consumer business, is receiving the industry's full attention. The changes in customer lifestyle, demanding experiential stay, will mean that brand choice, as opposed to location choice, will lead the way in the future.

While brand is much talked about, there is no consensus within our industry on what it means or how it should be measured. We take the step in this report of proposing an industry definition for brand and a framework for the development of brand metrics. Interestingly, the industry analysts, commenting on brand value and innovation, are sceptical about the industry's ability to demonstrate "payback" on research and development (R&D) spend. Our research shows that spend on brand innovation is one of the key CEO priorities into the future. Further more, the growing focus on brand management versus asset management impose challenges on existing people development and reporting metrics.

Where Is The Next Big Thing?

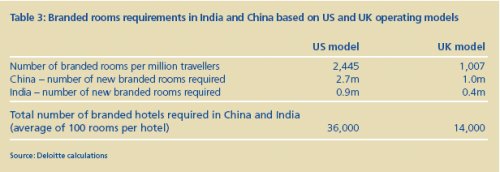

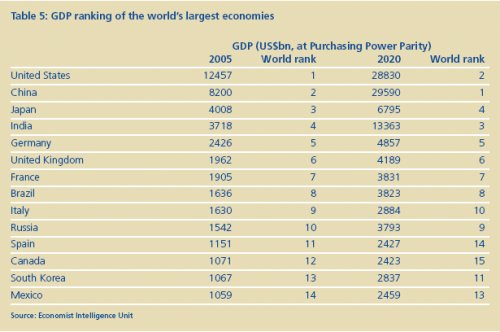

Three emerging markets stand out above all in terms of growth opportunities for the industry, China, India and the Gulf States. China and India, today 2nd and 4th in GDP purchasing power parity rankings, will move up to 1st and 3rd by 2020 with China overtaking the USA for the number 1 slot. Between India and China, we predict that a total of 1.4 million of additional branded hotel rooms will be required for those markets to reach the same branded hotel penetration as in UK.

Should those markets move to USA levels of brand penetration, the demand rises to 3.6 million of rooms, or 36,000 hotels. We predict that the majority of these rooms will be positioned in the economy and midmarket segments. The Gulf States are investing heavily in tourism infrastructure and markets such as Dubai, Qatar, Bahrain and Oman will challenge the traditional Continental Europe destinations for tourism – business, leisure and residential.

While these emerging markets offer exceptional growth opportunities, the world's largest tourism spend market – the USA – still has some way to go. Total travel & tourism spend in the USA, both domestic and outbound, is predicted to double from $830 billion to a staggering $1.6 trillion by 2015, leaving room for growth, particularly at the luxury end of the market.

The Generation Game

Attitudes and lifestyle differ between the main generation segments with the baby boomers (aged 42-60) living longer and enjoying a more active and younger outlook. These so called "silver" consumers are brand wise, travel more and desire new experiences both in terms of cultural and event based tourism. Our research shows that, by 2050 the world's population will grow to around 9 billion1 but less than 6% of that growth will come from developed countries. The percentage of the population aged 65 and over in Europe will increase from 15% in 2000 to nearly 25% by 2015 and increased travel by the "silver" segment will keep Europe as the number one tourism exporting region, delivering some 730 million travellers by 20202.

With a turnover rate of 50%, the industry needs to do a better job in attracting and retaining employees. The ageing population in many of the developed economies means that, increasingly, human assets will be sourced from developing countries and the industry will need to adopt new standards in HR management. The hotel of the future will be a micro-cosmos of generational, religious, nationality and cultural integration.

Technology: Playing Catch-Up

The industry, historically in the lowest quartile of spend on technology within consumer business, recognises the need for greater investment in technology, particularly in customer relationship management (CRM) systems, as a means of influencing customer behaviour. The airline industry leads the way, with travellers showing greater preference for airline miles than hotel points and making conscious decisions to fly with the same carrier despite inconvenient schedules. There is an opportunity to learn from other industries but also to innovate in terms of extending the customer touch-points with the brand well beyond the physical stay.

Key to the industry's success will be technology investment associated with the distribution puzzle. Our findings demonstrate that due to investment in online B to C systems, a more transparent pricing structure – with rate guarantees – and increased penetration of internet usage generally, the industry is winning a greater share of the online market. With up to 23.1% of room revenue at stake in intermediary commissions, there is a lot to go for.

From West To East

The future of air travel, the critical link in the tourism chain, is bright, with skyrocketing numbers of passengers flying by 2010. Over 1.6 billion passengers worldwide use the world's airlines for business and leisure travel. By 2010, we estimate that number to be in the range of 2.3 billion with Revenue Passenger Kilometres (RPKs) expected to reach 5 trillion. By 2010, we predict a shift from North to South and West to East with the emergence of India and China to capture 15% of the global passenger growth.

Safety & security concerns will prevail. Whether terrorism, natural disasters or pandemics, the industry will face shocks which will impact performance. On the positive side, tomorrow's traveller will take greater ownership of his or her safety & security through increased use of the internet for travel risk assessment and, if history is anything to go by, travellers will return to affected destinations as soon as they perceive the destination to be safe.

Looking Good But Needs Work

In summary, the fundamentals for the industry are very robust, now and into the future. The global demand for travel and tourism will provide unprecedented opportunities for the industry to grow but as this report shows, actions must be taken to seize the opportunities available. These are set out on page 24 of the report.

DELOITTE ENTERPRISE VALUE MAP®

The Deloitte Enterprise Value Map®, developed by the consulting team at Deloitte in 2005, is a tool to assist companies in assessing projects to ensure they are generating shareholder value. An interactive element allows management to map their ongoing and planned projects to shareholder value generators enabling them to review whether projects support the company's strategy and aims and whether they are evenly balanced across the generators.

We have tailored the high-level generators of the Enterprise Value Map® for the hospitality industry as shown at the back of this document. Using these generators we established that the key drivers of change which will impact shareholder value in the short to medium term divide into five themes – brand, human assets, emerging markets, technology and the business model. Given the resources available we concluded that whilst the business model, including a regulatory theme, is vitally important to the industry it would be deferred to be the subject of research next year.

Speaking to the CEOs confirmed that the five mega-trends identified were the key drivers of change they thought would impact shareholder value through to 2010. The notable difference between the CEOs is their view of the relative importance of the themes and the timescale in which they will impact. Three of the CEOs thought human assets were most important. Brand was the most important or second most important consideration for five CEOs. Regardless of what is most important with regards to shareholder value, most of the CEOs view technology and emerging markets as the themes which are moving most quickly and have the most public impact.

An adaptation of the Deloitte Enterprise Value Map® for the hospitality industry is attached as a fold out at the back of this report.

BRAND: TIME TO BUILD ON THE BRAND

Today, when customers browse through their hotel choices, location is usually the deciding factor. More than 97% of affluent leisure travellers and 93% of affluent business travellers consider location to be 'extremely influential'. In contrast, only 57% and 54% are influenced by the brand.3

However, this picture is gradually changing and, given the market saturation in gateway cities worldwide with leading brands sited close to one another, location is likely to become increasingly less important. This is already happening in Park Lane, London, which is home to five luxury hotels.

Tomorrow's traveller will be far more influenced by brand, and – importantly for the financial health of a hotel – guests who are loyal to their preferred brand are likely to stay more and spend more.

Loyalty programmes among airlines are increasingly popular, with travellers changing their itineraries – often at their inconvenience – to ensure they qualify for miles and tier points with the same carrier. Although it's debatable whether customers are being loyal to the airline or the points programme, these schemes are working well.

As a recent study confirmed, both business and leisure travellers prefer airline miles to hotel points, with 80% of travellers choosing to belong to an airline loyalty programme, and only 60% opting to join a hotel frequent guest programme.3

This may be because, until now the hospitality brand has been defined in narrow terms, focusing on image and consistency of experience, but without much innovation to capture customers' interest. However, there is now plenty of scope to increase the brand value, as companies in the broader consumer goods sector have done, by looking at additional elements such as globalisation, brand personality, brand leverage and meeting the needs of customers for different experiences.

More Than A Name

Our research reveals that, currently there is no consensus of what constitutes 'the brand', and few organisations within the hospitality industry use brand metrics beyond the traditional JD Power and RGI indices. But if hotels are to respond to shifts in market demand, it's time the industry adopted a more inclusive definition of what the brand covers.

|

Deloitte considers the brand to be an external and internal representation of everything the company stands for. It embraces each stakeholder interactions with the organisation and includes the stakeholder's expectations of the brand. The term stakeholder covers not only hotel guests, but employees, owners, franchisees, suppliers and intermediaries, because all of these groups help deliver the brand promise. |

Setting Expectations

In order to set stakeholder expectations, the brand promise must be defined and communicated. This often leads to the publication of a brand positioning statement that underpins internal and external communications. It should articulate clearly the brand promise. Often, there is an assumption that the brand promise matters only to customers, but in reality it must be adopted by everyone in the value chain.

The core message will not change, but it will be adapted slightly for each stakeholder group, such as employees and business partners.

Employees – who are the main deliverers of the brand promise within the hospitality sector – have a critical role. The most successful consumer business brands tend to be those where the reality of customer service matches the promises made by the company in all its marketing promotions.

This is only possible where employees understand and accept their organisation's brand attributes and are prepared to deliver them.

All operational and investment activities should be built on the brand promise, particularly staff training, advertising, portfolio decisions and renovations otherwise, the brand value could be diluted.

Consistency is paramount, as shown by some of the most successful global brands, where a consistent product experience is central to the brand's success and customer loyalty. However, because of the multitude of customer touch points, consistency is much harder to achieve in the hospitality industry.

When every touch point counts, budget hotels tend to be product-based with fewer customer touch points. For instance, with Accor's Formula 1 hotels it is possible to book online and check-in via credit card access to the room, with no human interaction.

In this case, consistently delivering the customer experience is relatively straightforward. At the other end of the spectrum, the customer experience in luxury hotels is built on a high level of personal service. Staying at a first class hotel can lead to multiple interactions with numerous people – such as the doormen, receptionists, porters, concierge, housekeeping, room service, spa staff and others. It therefore relies on a multitude of quality interactions with employees.

The larger the number of employee-customer interactions, the harder it is to keep control of the brand delivery at each touch point. We estimate that, for 250 property upscale hotel chain, up to 200 million guest touch points, per annum would occur, highlighting the challenge of consistent delivery of the brand promise.

Finding The Right Targets

In a crowded market place, a clearly differentiated brand persona is vital. It enables targeted marketing, which is well established in the consumer goods industry, but is relatively new in hospitality. A good example is Starwood with its 'W' brand. This approach enables clarity within a brand portfolio to prevent overlap across target market segments, and it avoids confusion in the minds of customers, owners and investors.

Clearly, the industry has a lot of work to do in this area, as consumers currently find it hard to articulate the differences between competing brands within a given segment. A recent Brandimensions analysis of online traveller discussions between 1 January and 31 October 2005, confirmed that guest perceptions toward different hotel brands were similar.4

Because of the fewer opportunities customers have to 'test' the brand, hotel companies find it harder than consumer goods organisations to build brand recognition. For example, 50% of the UK population had visited a coffee shop in 20055 but only around 35% had stayed at a UK hotel6. As 'trial' is one of the most popular forms of tactical marketing, this lack of personal experience is particularly relevant.

The Price Premium

Strong brands can demand higher prices, as can be seen in any High Street store. People expect to pay more for goods from a name they recognise, or from a popular brand, than they do for an unknown – and this applies as much to car insurance as it does to a T-shirt. However, while the price premium in consumer goods can be impressive, in the hospitality sector it is often marginal. For example, in the UK 2 litres of supermarket cola costs £0.39 whereas 2 litres of Coca Cola costs £1.36, a price premium of 249%7. Data from HotelBenchmark Survey by Deloitte shows the price premium for branded hotels in the First Class segment to be just 10%.

This lack of a price premium hits brand investment and innovation, as the business benefits can be very hard to quantify. Our discussions with Wall Street analysts on research and development (R&D) in the hotel industry confirmed a lack of confidence in the industry's ability to show an acceptable rate of return on R&D investments.

Without a proven business case, the analysts suggested, the markets would penalise a listed hotel company if R&D spending impacted Earnings before interest, taxes, depreciation and amortisation (EBITDA).

As a result, there has been little real innovation in the hospitality sector compared to other consumer businesses. In general, investment has focused on core 'safe' areas such as the bed, shower and television sets provided, although some hotel operators are creating a more high-tech experience for guests by adding the latest technologies.

Strong Enough To Stretch

In the consumer goods arena, brands are often flexible enough to extend their brand reach into new product areas. Confectionery and chocolate manufacturers moving into ice cream and hot drinks are good examples. The hospitality sector has also experimented with this approach, moving into vacation ownership, residential management and gaming at the macro level, and bathroom products at the other end of the scale.

Linking themselves with other brands – through sponsorship or partnerships – is another common approach; for instance, Starwood with Yahoo, Hyatt with Expedia and Sol Melia with Warner Brothers.

While the debate continues on whether the non-hotel branded products that make up a typical guest stay add to or detract from the hotel brand itself, there is no doubt that stronger brands can stretch themselves more easily, whereas weaker brands could snap.

The Virgin Group is the often-quoted example of a flexible brand, whose attributes apply equally to sectors as diverse as music, airlines and telephones, showing how a strong brand can add value to its original proposition. This opportunity to extend the marketing reach further reinforces the overall message that a strong brand is a pre-requisite for continued success in the hospitality sector.

Brand Measurement

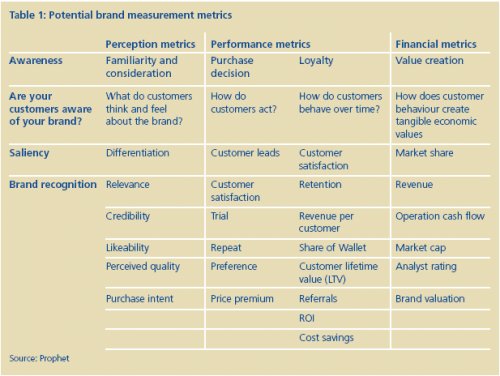

As in all business, rigorous measurement is the only way to define success, yet a recent brand management study revealed that less than one-third of all companies surveyed had any kind of measurement system to judge the performance of the brand.8

Implementing a balanced scorecard across the business will measure all the dynamics and enable the company to benchmark itself against the competition. The table above gives some examples of metrics we consider should be measured and tracked. Increasingly, the brand will impact the bottom line and delivering the brand promise will enable companies to differentiate themselves in an extremely competitive market.

Achieving Success In 2010

- Customers will expect the brand promise to cover every interaction with the organisation – pre-stay, stay and pos-stay. If the hotel gets it right, they can expect improved customer loyalty with a subsequent impact on RevPar. Location will then be less important as a driver of choice in many markets.

- Airlines have shown the value of well-structured loyalty programmes, but the major hospitality players have some way to go to achieve maximum returns on their own schemes. Research shows these must reflect customer's wishes.

- Today, there is a new breed of customer who is more interested in the experience of travel. Hotels, particularly at the luxury end of the market, have an opportunity to satisfy these new customers and generate greater differentiation.

- Consistency remains the single most important factor in brand delivery. Like all successful organisations, hotels must ensure everyone in the value chain delivers the brand promise. Employees particularly, need to understand their pivotal role.

EMERGING MARKETS: RE-SHAPE WORLD TOURISM

By 2010 there will be approximately one billion tourists a year, if annual increases match the World Tourism Organisation's (WTO) long term predictions of a 4.1% average annual growth rate. However, signs are that international tourist arrivals will overshoot these forecasts by some distance – creating dynamic opportunities for companies in the hospitality business.

By 2010, we expect to see 791 million intraregional travellers and 216 million long-haul9 travellers by 2010 as emerging markets such as China and India continue to grow, and new middle classes, keen to spend disposable income on travel, make the most of low cost carriers and the easing of visa restrictions.

While massive growth is forecast for these emerging markets, other regions around the world – particularly Europe and America – will remain among the most visited destinations. Even in maturing markets such as the US, there is plenty of room for growth – specifically at the high-end – as several CEOs confirmed in our discussions. Currently, China is taking the lion's share of the travel headlines. But with massive investment underway in India and the Gulf States, these are also areas to watch. These three markets, we believe, will see the fastest growth in hotel development outside of the US.

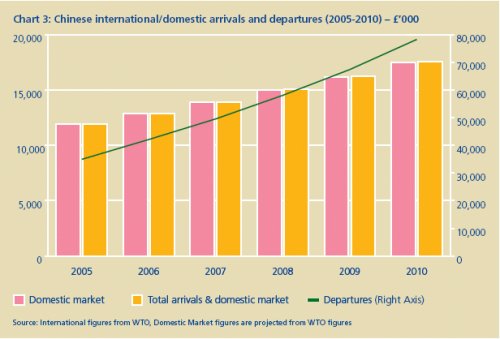

China – A Magnet For Travellers

International travel to China has quadrupled to 109 million today, compared to 199010. In the same time, revenue from international tourists has increased by a factor of 12, and now stands at US$25 billion10. This growth will continue, with the WTO predicting China will become the world's top destination by 2020, with 130 million tourists a year9.

The 2008 Beijing Olympics, the Shanghai-hosted World Expo two years later and the opening of Shanghai Disneyland in the next decade will all add to this fascinating country's attractions.

The Chinese domestic picture looks even brighter. Domestic tourism has grown by 10% over the past decade, accounting for more than 95% of all Chinese tourists today10. By 2010, the domestic travel industry will be worth US$100 billion, with 1.75 billion people visiting other parts of their own country11.

China is, naturally, investing heavily in travel and tourism, with spending expected to grow 8.3% (Annualised Real Growth) to 201612. US$35 billion, for example, is being spent on the Beijing Olympic games alone. This level of investment is far higher than comparable figures in the US, where a 2.6%12 increase is expected, albeit from a higher starting point.

The growing importance China is attaching to domestic travel has been confirmed by events such as the first China Tourism Investment Fair at Ningbo, the capital city of eastern China's Zhejiang province, last year. This welcomed delegations from 26 provinces and autonomous regions and 18 cities, bringing with them more than 1,000 development projects for discussion.13

India Invests For Growth

India's buoyant economy, and its boom in business and leisure travel are driving strong growth in tourism. This has been helped by lower airfares and an emerging middle class, keen to travel for the first time. The number of domestic tourists in India is expected to reach 750 million in 201014 from 368 million in 2004.15

As international tourist arrivals in India are also rising rapidly – up to 5.1 million by 20109 – we predict the country will need between 400,000 and 900,000 more branded hotel rooms in the next five years if it is to follow the UK or US model.

The emphasis will be on the lower end of the market, including economy hotels and serviced apartments. In response, Indian Hotels plans to invest US$328 million16 in building 150 IndiOne economy hotels in the next five years. A joint venture between InterGlobe Enterprises and Accor – InterGlobe Hotels – should lead to the development of 25 Ibis economy hotels in the next 10-12 years17. The Bird Group also plans to build 20 new hotels in the region17.

Like China, investment in India's travel and tourism industry is expected to increase, growing by 7.8% (Annualised Real Growth) by 201612, but starting from a base eight times lower. To get things moving, India's government set up a Viability Gap Funding Scheme last year to support large tourism infrastructure projects. It has also launched the Assistance for Large Revenue Generating Projects to increase public-private partnerships/investments in tourism initiatives, including tourist trains, cruise terminals, convention centres and golf courses18.

With this amount of growth underway, the region's airlines have taken prompt action. At last year's Paris Air Show, Indian airlines reportedly placed orders for around 190 aircraft, and this is set to rise to around 500 in 201019.

The Gulf States Move Ahead

To reduce the region's economic reliance on oil, many countries of the Gulf States are now focusing on tourism, capitalising on their natural assets, historic cultures and Islamic traditions. Massive investments are already paying off, as the Middle East is now the fourth most visited region in the world.20 An average annual growth rate of 7.3% is predicted, and by the year 2020, the region will be welcoming 4.4% of all tourist arrivals – around 68.5 million people21.

Investment in tourism in the Middle East is highest in the United Arab Emirates, followed by Saudi Arabia, with Qatar projected to have the highest growth15.

Dubai's hotel market currently ranks among the world's best. In 2005, a record 5.42 million guests stayed at the country's 371 hotels and hotel apartments, bringing in a total of US$1.7 billion22. By 2010, the government expects 15 million visitors a year to arrive in Dubai, about three times the current number23.

Dubai has built its reputation on luxury, which has been popular with both developers and consumers. Consider the development of Kempinski Hotels' five-star Swiss chalet-style hotel next to five indoor ski slopes inside one of the world's largest malls26; the building of the world's largest hotel tower; the Burj Dubai; and of course the Palms Jumeirah, Jebel Ali and The World.

However, there is room for expansion at the other end of the market, and last year InterContinental Hotels announced plans to build 20 Express by Holiday Inn hotels across the Arabian Gulf in the next seven years. Five of these will be in Dubai; and Accor – which already has a budget class hotel in the region – is planning seven more24.

More Mid-Market Choice

As new middle classes emerge in these three markets – China, India and the Gulf States – there will be a shift in demand for different types of hotel rooms. More budget and mid-market options will be needed for domestic leisure and business travellers, and middle-income inbound tourists will seek more economical options. New resorts will be developed for both domestic customers and international visitors, and as leisure tourism is growing faster than business travel, the mix of product will need to reflect this.

As the hotel sector in these regions responds to the new wave of travellers, the impact on industry brands will be dramatic and it's likely that new brands will be created to reflect the needs of target customers. If China or India were to adopt other countries' branded models – for instance 66% of hotel rooms in the US25 and 35% in the UK26 are branded – then a massive increase in branded hotels will result. If the UK model were copied, there would be potential demand for 10,000 new branded hotels in China and 4,000 in India based on current tourism levels. Demand would be even greater in 2010.

International tourism is part of the wider move towards globalisation, but the hospitality industry must not lose touch with its local roots. Like many industries that cross international borders – it must 'think globally and act locally'. Cultural differences, local traditions and customs must be kept in mind.

These new markets, while financially attractive, can throw up some unique barriers to entry, including political, ownership, business model and cultural challenges. Hotel companies will need to work through these to achieve the potential for success over the next few years, and we will look at them in detail in our business model report, to follow.

A more pressing concern will be the recruitment, training and retention of local staff to serve these emerging markets.

There is little tradition of hotel management to build on in these regions, and there is the added problem of finding enough people to fill the vacancies. Educational and training establishments will be needed, while language, religious traditions and cultural differences must be considered.

The overlying issue is the paradox of the international versus local brand, and hotel companies will need to tackle this before successful expansion can begin.

There are some good examples in Dubai, where luxury hotels have taken into account Islamic requirements and are alcohol-free premises. Al Sondos Suites by Le Meridien, an alcohol-free boutique hotel near the airport, had occupancy rates of over 95% for the final quarter of 200527. Coral International, a Dubai-based company claiming to be the world's first alcohol-free hotel management company24, has three hotels in Dubai and plans to open seven more by 200828.

Achieving Success In 2010

- Substantial opportunities are available for product in the emerging markets of China, India and the Gulf States.

- To date, hotel development in China, India and the Gulf has largely been four and five star to cater for international tourists in both leisure and business. But with the surge in both domestic tourism and international visitors looking for more economic options, these regions – particularly China and India – will need more mid-market and limited service hotels.

- Although globalisation of the industry is underway, more sensitivity towards cultural differences in marketing, hotel development, employee recruitment and training will be key to measure.

HUMAN ASSETS: THE PEOPLE PERSPECTIVE

Tourism is a people business. At its most basic level, the industry transports people from A to B, provides hospitality in a variety of forms, and then transports them back again.

But the industry has moved beyond the basics to become a diverse and dynamic interconnection of choice, meeting the incredibly varied demands of the one billion or more tourists who will be moving around the world by the year 2010.

People's expectations of travel – traditionally defined by age, background, culture and finances – are becoming more complex, while emerging markets are changing the demographic mix of the travelling population.

In Europe, the dominance of the silver segment will continue, and an ageing population in some other countries will hamper the hospitality sector's ability to find enough staff, shown in Chart 7. In this section, we look at hospitality from the people perspective.

It's A Generation Thing

Lifestyle preferences can often be matched to generation bands, and detailed research on preferences within these bands can help with the development of tailored tourism products.

Four generations currently dominate the US market – Matures, aged 61 to 77, Baby Boomers, aged 42 and 60, Generation Xers, aged 28 to 41, and Millenniums aged 12 to 27. There may be slight variations across Western Europe, but people in these four groups tend to have similar tastes in music, film and clothes, and enjoy the same social, cultural and political experiences.

Baby Boomers are a demanding bunch. Generally speaking, they will live longer, more productive lives than their predecessors and won't tolerate being ignored or marginalised by the travel industry. They are adventurous and sociable and have the necessary finances to fund their desire to travel and experience life to the full.

Although Boomers are growing older, they refuse to age and don't intend to live life in the slow lane. Whereas products directed at them in the past were Levi jeans, Ford Mustangs and Sony transistor radios, now it's more likely to be cosmetic surgery and anti-ageing products, along with quality clothing and high-tech sports equipment.

The Matures, like the Boomers, don't like to refer to their age much – so when hotel chains offer age-related promotions for 'seniors' the offers are not likely to be as popular today as they were with previous generations. Equally, Matures are not that keen on being addressed as seniors citizens or silvers.

Instead, travel and hospitality offers will need to match lifestyles, offer value or be connected to loyalty programmes to get these groups interested, and each customer would prefer to be identified by name – rather than age.

Generation Xers are great trendsetters. Most of all they live for the moment, blending work, with play and family.

This generation is brand wise, likes multipurpose products and is technology-savvy. Travel is important, but they want different propositions than those offered to Boomers or Matures. They also value relationships more, so are big fans of loyalty programmes. For hotels, this means the welcome, service, concern and commitment must cover the time before, during and after any booking, plus this generation wants to feel valued even when they have no current travel plans.

The Millenniums are the most interconnected, global and diverse generation in history. As children, they had a great deal of 'adult-free' time, watching TV, playing games or making calls from their bedrooms. As they watched TV without their parents, they developed their own perceptions of life.

They tend to have friends across the world – gathered through the internet, gap year travel or university – and friendships tend to be based on similar interests rather than proximity. They take travel for granted, and because they have grown up in a media-saturated world, they are not easily influenced by marketing.

Demographic Changes

While marketers can profit from appealing to these different generation groups, we are now seeing profound changes in the demographic make up of the typical traveller – if indeed there is such a person anymore.

Today, more women travel, more people travel alone, and the expansion of tourism in emerging markets – India, China and the Gulf States for instance – means many people are travelling for the first time.

The easing of visa restrictions, the rise in low cost carriers and the increase in disposable income have opened up the world of travel to millions who were previously excluded.

Whatever the age group, most people will welcome more choice, as Shangri-La hotels proved. It developed an interactive food and beverage experience where customers can chose exactly what meals they want, selecting their own ingredients and how they want them cooked.

Increasingly, people want more from their stay than just a good night's sleep and travellers will want to experience more of the cultures and customs around them.

Mix And Match

Travellers are increasingly keen on mixing budget and luxury to get the best value, so we're seeing people flying on a low cost carrier and then staying in a luxury hotel; or flying first class long-haul and then backpacking across the country.

In the same way that people shop at discount warehouses to save on food, household supplies, and personal care products and then take them home in a $30,000 car, travellers will opt to save money on one experience and splash out on others.

Often they will check with global community boards on-line to see where they can get the best value, with word-of-mouth advice travelling from one corner of the world to another in a nano-second.

And as the take up of the internet becomes more pervasive across China, this global community will include more people than ever before. The Chinese will make up the largest group of travellers within ten years, according to the World Travel and Tourism Council (WTTC), and – as you can see in Table 4 overleaf – tourism spending in both China and India is set to rise rapidly.

The concept of family travel is changing too, with the increase in the 'adults only' category. This is the couple who love to travel with children, grandchildren, nieces or nephews – but not all the time. And when they go off on their own, they don't want to share the swimming pool or restaurant with someone else's children. Resorts that currently make over-18 restrictions only for the pool will probably need to extend this to other areas to capture this market.

Today's consumers have become used to easy access to entertainment, and this will influence the design of airports, hotels, and restaurants. Regular travelers have become jaded over time and flying has become more of a chore than a pleasure. However, as can be seen in our chapter on air travel, many airlines are bringing back a more personalised service and extra facilities to try to recapture the joy of flying.

The Workforce Of The Future

With an ageing population in some countries, and little hotel management experience on which to build in others, sourcing the workforce of the future will become an issue.

More women are working than ever before, and in some countries, the percentage of employees who are employed either full or part time when they are over 60 will increase significantly.

As a result, many companies will need to re-think the way they attract, develop and retain employees, as discussed in a recent Harvard Business School Working Knowledge article: Can you manage different generations, Eric J. McNulty, 17 April 2006.

Staff turnover has plagued the hospitality business for years, with research suggesting it is among the highest of any industry. Studies have shown that the average turnover among non-management hotel employees in the US is about 50% and about 25% for management staff.29

Hilton Hotel Corporation has found an innovative way to increase the flexibility of its workforce. By implementing proprietary software across its entire hotel portfolio, once staff have been trained to use it they can easily move to other hotels anywhere in the world.

Many companies are sharpening up their talent agenda, and investing in new benefit programmes that focus on the values held by the various generation groups in their workforce.

The reward and recognition of employees should recognise productivity and the quality of guest service, with the latter closely aligned to the brand persona, as outlined in our chapter on the importance of the brand.

Human Resources (HR) will need to embody 2010 values, with a greater emphasis on work life balance and the change to more flexible working hours, both on-site and from a home location.

Working policies will need to become more inclusive and recognise the diversity of the modern workforce, thereby meeting the needs of different ethnic and religious groups. Investment in HR processes that enable and measure progress in this critical area - traditionally neglected by the industry – will be essential.

Achieving Success In 2010

- Innovation in product development will need to meet the needs of the four key generations segments. Above all, companies will need to connect with their target customers.

- The "one-size fits all" marketing campaign is gone forever. Changes will be needed in operations, sales, and marketing, as well as in the way employees interact with guests at all touch-points.

- HR divisions will need to re-think their talent agenda to ensure they can hire, train and retain a flexible workforce. Particular consideration will be required with respect to staffing in the new emerging markets.

|

cafe TOO, A Theatre of Food – Shangri-La Hotels and Resorts The innovative cafe TOO, brings all-day dining to a higher level of creativity. With a choice of seven different cooking theatres, cafe TOO is truly a theatrical experience where the interactive array of lights, colours, music and aromas combine to make a feast for the senses. Here, the chefs are the performers and the restaurant, their stage. International cuisine comprising pan-Asian, seafood and western appear on the à la carte menus or at the specially prepared buffets for breakfast, lunch and dinner. |

TECHNOLOGY: WHY TRAVEL AND IT ARE MADE FOR EACH OTHER

Given that travel has been the most popular product sold online for some years, it is still surprising that the global hotel industry is trailing behind other consumer businesses when it comes to investing in technology. The annual worldwide spending gap amounted to more than $22bn last year – around half of that in the US alone.

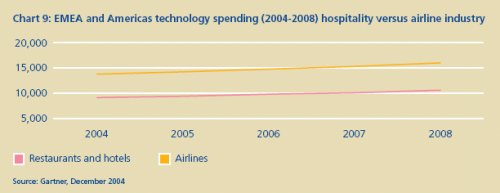

Comparing the amount spent on IT by the hospitality and airline industries shows hospitality is still the poor relation. Across EMEA, hospitality is 65% behind airlines and it's 20% behind in the Americas.

As the table shows, this trend is expected to continue over the next three years, so the gap is set to remain.

However, all the CEOs interviewed expect to increase IT investments, particularly in reservations, distribution, loyalty programmes and in CRM systems. But they share the same concern – who will pay? Without a clear business case proving which areas carry the best return on investment, owners, operators and franchisees will disagree on who foots the bill. One way to reduce upfront costs may be to use technology partners, but sharing the revenue will limit the benefits to the brand manager or owner.

Clearly, business leaders need to invest in the right technology, at the right time. The market demand and acceptance by customers have to be there, which wasn't the case when hotels first introduced kiosks. A few years down the line, when check in kiosks have become business as usual at many airports, customers are more willing to use them and some Hilton hotels now give guests the opportunity to check-in from kiosks at the airport's baggage claim area.

With more demanding customers, who have come to expect a more personalised service, effective CRM systems are a real benefit to the business, and most CEOs plan to build up capabilities in this area. There are, however, concerns over individual privacy, and how captured customer data can then be used to enhance the ongoing customer relationship.

Hotels Need To Catch Up

Traditionally, the hospitality industry has let the airlines test drive new IT before it follows suit. So, whereas today's air traveller can look up flight information, buy tickets, reserve a seat, choose a meal option and then print the boarding pass before setting out for the airport, all the hotel guest can do – generally – is make an online reservation.

Hotels need to catch up with other parts of the tourism industry fast, as travel products are ideally suited to online sales.

When electronic commerce first took off, travel – along with music and books – was one of the first great electronic commerce success stories. The product is intangible, it doesn't need to be "tried for size," so the buyer is not at any disadvantage compared to buying through traditional outlets.

For some time now, travel has been the most popular product sold online, accounting for around 35-40% of total online retail revenue. Airlines represent 62% of that, with hotels accounting for 14%30.

In the US last year, the online travel market added up to around 27% ($68 billion) of total travel revenue and is expected to reach 34% – or $104 billion – in 201031.

While Europe currently lags behind the US, with only 7% of bookings made online in 2004, spending is expected to double this year to more than $50 billion, and begin to catch up with the US31.

People don't just turn to the internet to make a travel booking, they also use it to find out about destinations, resorts and hotels rather than use more traditional means. Recent research showed that, across the US and Western Europe in the past year, more people relied on the web for travel information rather than friends and acquaintances32

Consumers are using the web more and more for sharing information, and there is a growing tendancy to base purchase decisions on other peoples product reviews and blogs. Suppliers in the hotel industry need to understand that in the future much of the 'marketing' of their products and services will be outside of their control.

New Age Travellers

As covered in other chapters in this report, emerging markets mean millions of new travellers, and these will boost the potential for online sales and distribution.

China offers massive opportunities for online business. Today, China has the second highest number of internet users after the US, yet penetration is still only 9% compared to 67% in the US. China's debut into the networked world is astounding and even if internet penetration only increases by around five percentage points in the next year, as predicted, this will expand the global online market by around 68 million people. Currently, the amount of travel booked on line by internet users in China is around half of that in countries such as the US, the UK, Japan and Germany, but as the technology take up increases, the trend towards online booking is expect to follow suit.

The Direct Approach

The challenge for suppliers in the hospitality industry is to drive bookings through their own web sites, rather than through those of agents and online intermediaries.

Today the battle is between online travel agencies, who currently draw the highest volume of visitors, and direct suppliers like airlines and hotels, who tempt customers to their web sites with aggressive, lowest-price guarantees and loyalty promotions.

|

OnQ – Hilton As early as the mid 1990s, Hilton executives determined that a "one system" approach for technology would provide a sustainable competitive advantage for the company. As a result of the acquisition of Promus in 1999, Hilton was in a position to integrate both companies' superior information systems and create one solution that was cost efficient and would open up new revenue opportunities that didn't previously exist for the newly created family of brands. OnQ is the Hilton Family of Hotels' proprietary technology platform comprised of a suite of highly-integrated components that automate business functions from end to end, including pricing, reservations and sales, guest service, operations, back office, and business intelligence. The strategic objectives of OnQ are

OnQ is revolutionary in its capabilities and integration. It connects to every guest touch-point and database, every brand and each individual hotel; therefore allowing complete access and information sharing to help sell rooms and services and build customer loyalty. No other major hotelier has OnQ (or anything like it) this is what gives us a big advantage in our industry In North America, OnQ has been implemented throughout more than 2,300 hotels across nine brands and plans are underway to deploy OnQ throughout the rest of the global Hilton Family of Hotels, which include Hilton, Conrad and Scandic properties by 2009. |

Fresh competition is coming from new travel search engines or meta-search companies such as SideStep and Kayak, but these are early days for the newcomers and they have not yet gained sizeable traction.

Since the late 1990s, suppliers seem to be the consumers' favourite. Across Europe, for instance, around 66% of online sales are now made direct with the suppliers – up from 45% in 199833.

This swing towards the suppliers is helped by a shift in consumer perceptions over who offers the best hotel prices. In 2002, 59% of travellers said internet agencies had the best prices, but this dropped to 45% in 2004.

Now, 38% of online buyers believe suppliers have the best prices – up from just 14% two years ago34. There is, however, still a lot of convincing to do if 62% don't think going directly to the operators can save them money.

Guarantees of low-fares by airlines and low room rates from hotels is driving more direct sales, but while these may dent the profits of the big online agencies, they are unlikely to end their domination.

As direct bookings cost suppliers less, pulling more customers to their online distribution channels remains a key focus.

To stay ahead, hotel operators need to be innovative and find ways to outsmart the intermediaries' next move.

No Longer A Luxury

What customers expect from a hotel has gradually evolved, so that what was once considered to be a luxury feature – such as a TV, internet connection point or a telephone – is now considered standard at budget hotels.

More pervasive technology is enhancing the guest experience, and as technology gets both smarter and smaller, hotels will move from providing standard technology options to supporting the guests' own technology solutions.

Achieving Success In 2010

- With the internet now becoming the first 'touch point' between the guest and the hotel, hotel companies' eCRM strategies will need to engage the guest of 2010 and capture personal data. The primary eCRM components, edistribution and ebrand differentiation will be key to enabling success in what is already a very competitive space for one-to-one customer interaction.

- Defining and implementing an online strategy for emerging markets such as China and India will be critical in maximising direct bookings by 2010. Suppliers will need to offer a compelling alternative to intermediaries who are already claiming major success in these markets, such as Expedia in China and Travelguru in India.

- Analysis and evaluation of emerging technologies needs to ensure investments in technology are sound, rather than following the latest 'fad'. The dual axis of software and product convergence will provide substantially greater opportunity for guest interaction, guest service and brand differentiation.

- Partnering with technology suppliers for in-room and public space technology would lower the investment burden on owners and allow on-going investment in technology upgrades across the portfolio. While collaborating with a mass market technology company may dilute the brand's ability to differentiate, too much bespoke technology carries a risk of non-acceptance by the customer or technological failures that are expensive to support.

Footnotes

1. Jacob Kirkegaard, Institute for International Economics – Demographics, speaking at World Travel and Tourism Council Summit 2006.

2. World Tourism Organisation.

3. Yesawich, Pepperdine, Brown & Russell, 2004.

4. Hotel Branding: Using Online Research To Drive Innovation – Brandimensions – January 2006.

5. Mintel.

6. Keynote.

7. www.tesco.com – 21 April 2006.

8. Prophet's 2002 Best Practices Brand Measurement System.

9. WTO Tourism 2020 Vision: Global Forecasts.

10. CLSA.

11. Deloitte projection based on CLSA current figures, assuming 9% annual growth.

12. WTTC.

13. SinoCast China Business Daily News, 7 November 2005.

14. Deloitte projection based on WTO current figures, assuming 15% annual growth.

15. Ministry of Tourism for India.

16. Indian Business Insight, 22 July 2005.

17. The Indian Express, 1 July 2005.

18. Indian Business Insight – Press Information Bureau, 16 August 2005.

19. The Financial Express, 21 June 2005.

20. Deloitte HotelBenchmark Middle East Performance Review, Summer 2005.

21. WTO Tourism 2020 Vision: Middle East.

22. AME Info – United Arab Emirates, 2 May 2005.

23. International Herald Tribune, 5 December 2005.

24. Ibid.

25. Smith Travel Research.

26. Mintel.

27. International Herald Tribune, 'Is Dubai's Hotel Boom Unstoppable?' by Otto Pohl, 05/12/05.

28. Coral International Website.

29. Knowledge Flight: The Challenge of Hotel Employee Turnover, Ambika Mehta, HVS International: March 2005.

30. Jupiter Research.

31. PhocusWright.

32. Global Market Insite Inc.

33. Centre for Regional & Tourism Research and Carl H. Marcussen, 23rd Sept 2005.

34.

To read Part Two of this article please click on the Next Page link below

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.