Yesterday, the Supreme Court handed down judgment in the case of Playboy Club London Ltd v Banca Nazionale del Lavoro SPA [2018] UKSC 43. The decision examines the core principles which underpin the imposition of liability for a representation made to a third party, with whom the representor has no contractual relationship. This is classically thought of as Hedley Byrne v Heller & Partnersliability.

In Hedley Bynre, Heller & Partners gave a credit reference in respect of Easipower Ltd directly to Hedley Byrne's bank, National Provincial Bank. The House of Lords found that Heller had appreciated that Hedley Byrne, the bank's client, would reasonably rely on its credit reference, and that Hedley Byrne reasonably did rely on its accuracy. This gave rise to a direct relationship between Heller and Hedley Byrne, that involved a duty of care.

This is illustrated below:

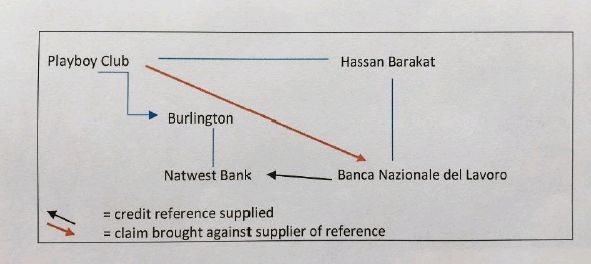

In Banca Nazionale, there was a vital difference.

Playboy Club London (the Club) operated a casino. Mr Hassan Barakat wished to gamble there with the benefit of a cheque cashing facility. Before providing that facility, the Club's policy was to seek a reference from a gambler's bank. Crucially, it did so via an agent company, Burlington. This was specifically so as to avoid disclosing the purpose of the proposed credit facility to the bank that would be providing the reference.

The result was that the bank would ordinarily not know that, in reality, the reference was being sought, and would be relied upon, by the Club. The Club was an undisclosed principal of Burlington, the agent to whom the bank's representation was actually made.

These facts are illustrated below, to show the distinction from the Hedley Bynre fact pattern. The difference is the introduction of the agent (Burlington), whose principal (the Club) is undisclosed.

Banca Nazionale (BNL) supplied a favorable credit reference for Mr Barakat to Burlington's bank. BNL was negligent: it had no valid basis for giving that reference. The Club relied on it, and granted Mr Barakat the cheque facility. Mr Barakat wrote cheques at the casino, which were later returned to the Club unpaid. The Club suffered loss, and brought a claim against BNL.

The Club accepted that there was no evidence that BNL knew that its reference would be communicated to or relied on by anyone other than Burlington.

However, the Club argued that because it was Burlington's undisclosed principal, the relationship between BNL and the Club was "equivalent to contract"; because in contract, the Club would have been entitled to declare itself as principal, and assume the benefit of the contract.

Lord Sumption called this an "ingenious" but "fallacious" argument, and dismissed the Club's appeal. His reasoning may be summarized as follows:

- The courts have resisted expanding the scope of liability for representations made to non- contractual parties, by controlling the category of persons to whom such a duty is owed. The defendant's voluntary assumption of responsibility to the party relying on the statement remains the cornerstone of this area of law: NRAM Ltd (formerly NRAM plc) v Steel [2018] 1 WLR 1190, paras 18-24 (Lord Wilson JSC).

- The foundation of that duty is proximity. Limiting factors identify the outer boundaries of the class of persons, whose reliance on a statement can properly be said to give rise to a sufficiently proximate relationship. The focus of those limiting factors is upon the defendant's knowledge of: (i) the person(s) known to be likely to rely on the statement, and (ii) the transaction in respect of which that reliance would be placed.

- BNL had no knowledge of the Club's role in the reference request, or the purpose for which the reference was being supplied (the transaction). BNL had no reason to suppose that Burlington was acting for someone else. In those circumstances, BNL had not assumed a responsibility towards the Club for the accuracy of the reference.

- The Club was wrong to suggest that these factual problems could be overcome by the contractual doctrine of the undisclosed principal. The relationship between a person (here BNL) dealing with another (the Club) through the latter's undisclosed principal (Burlington) was not at all analogous to the kind of relationship which will give rise to a duty of care. In fact, such a relationship is by definition not proximate: the agent is interposed, and the representor has no knowledge of the principal.

- Whether a relationship is sufficiently proximate in the law of tort to give rise to a duty of care is a question of fact, from which the law draws certain conclusions. In contrast, the liability of a contracting party to his counterparty's undisclosed principal is not a legal conclusion from any factual relationship between them. It is a purely legal construct.

The points I would highlight from this decision are:

- The proximity of the relationship between two non-contracting parties is always a sensitive question of fact. But one of the most important factors is the defendant/representor's knowledge. Any claimant seeking to impose liability on defendant for a negligent statement must carefully examine: (i) precisely what that defendant knew about the claimant, and its likely reliance on the statement; and (ii) precisely what that defendant knew about the particular transaction or purpose in respect of which the statement was sought.

- If the negligent statement was made to the claimant's agent, or to a subsidiary, there will need to be clear evidence that the defendant appreciated that its representation would nevertheless be passed to the claimant and that it would be relied upon by it. Legal doctrines of agency that may affect relationships in the law of contract will not create the required proximity if, in fact, the defendant was not aware of who would ultimately rely on its statement.

- This is because liability in this branch of the law of negligence remains rooted in whether it can justly be said that the defendant has assumed a liability to the particular claimant in question; and if so, for precisely what. The Courts remain alive to the potential perils of expansive liability to third parties for economic loss, and will use the facts to keep the incidence of such liability within carefully monitored bounds.

The full judgment can be found here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.