In one fell swoop, Massachusetts has set in motion a plan to increase its minimum wage to $15.00 per hour and create a comprehensive paid family and medical leave program as the result of a "grand bargain" between employee advocates and representatives of the state's business community. Governor Charlie Baker signed the bill in a ceremony today at the State House, which will also eliminate premium pay for Sundays and holidays, and make the annual sales tax holiday permanent. What do Massachusetts employers need to know about this new law?

Minimum Wage Up, Sunday Premium Pay Out

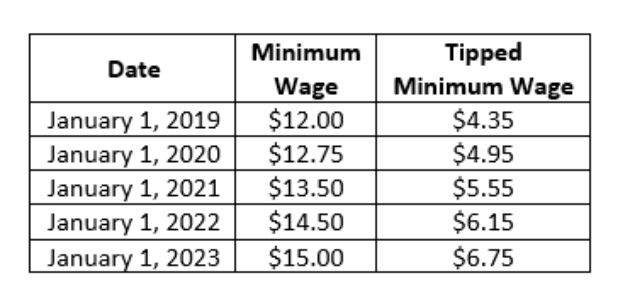

The new law will raise the minimum wage gradually from the current $11.00 per hour to $15.00 by January 1, 2023, marking the eighth increase in as many years. Tipped workers will also see an increase, with their minimum wage increasing from the current $3.75 to $6.75 per hour.

In the lone bit of welcome news for employers, the law will also update the Massachusetts blue laws to gradually eliminate the obligation to pay retail employees time-and-one-half for hours worked on Sundays and holidays. Beginning in 2019, the premium will be reduced by 10 percent each year until it is eliminated in 2023.

Though the changes are gradual, the first increase is just six months away. You should begin making arrangements to comply with the new wage rates promptly as employers are strictly liable for three times the amount of any unpaid wages plus attorneys' fees.

Paid Family & Medical Leave – Another Headache For Employers

The law also creates the state's first paid family and medical leave requirement, with the first payouts beginning on January 1, 2021. The leave may be used for bonding with a newborn child (or child placed for adoption) within 12 months of the birth or adoption, as well as a qualifying exigency related to a family member's service in the armed forces. Medical leave is available to care for an employee's own serious health condition or that of a family member.

While largely based on the federal Family and Medical Leave Act of 1993 (FMLA), the Massachusetts statute is much broader in many respects:

- Covered employees are eligible for up to 12 weeks for family leave and 20 weeks for medical leave (with a combined maximum of 26 weeks in any year);

- In addition to spouses, sons/daughters, and parents covered by FMLA, Massachusetts has expanded "family" to include parents-in-law, domestic partners, grandchildren, grandparents, and siblings with respect to who covered leave may be used for;

- Employers cannot require employees to exhaust other forms of paid time off prior to or during the use of paid family and medical leave; and

- Former employees remain eligible for leave within 26 weeks of separation from their employer.

Who's Paying for This?

The newly created Department of Family & Medical Leave is charged with implementing a trust fund as the depository for all employer contributions. Employers with 25 or more employees are required to contribute 0.63 percent of each employee's wages staring on July 1, 2019.

By way of example, the total contribution for a full-time employee earning $20 per hour is approximately $262 per year. The contribution rate will be adjusted annually to cover the costs of administering the program.

- Employers are responsible for paying 60 percent of the contribution for medical leave, and can deduct the remaining 40 percent from an employee's wages;

- Employers are not obligated to pay any part of the family leave contribution, however, as the law permits them to deduct 100 percent of the contribution from the employee; and

- Contributions are capped once an employee's wages exceed the amount set by the Social Security Administration for contributions to the Old-Age, Survivors, and Disability Insurance programs (currently $128,400).

How Much Do They Get?

The benefit rate is based on a calculation involving the "state average weekly wage" and the individual's average weekly wage, with a maximum weekly benefit of $850. The amount of an employee's average weekly wage that is less than or equal to 50 percent of the state average weekly wage is replaced at 80 percent, and the amount of an employee's average weekly wage greater than 50 percent of the state average weekly wage is replaced at 50 percent.

As of October 1, 2017, the state average weekly wage was $1,338.05. Using that figure, the table below shows the benefit amount for a full-time employee earning minimum wage, $20.00 per hour, and an employee who earns the state average weekly wage.

Anything Else?

The law prohibits employers from retaliating against employees for the use of paid family or medical leave and subjects employers to serious liability for doing so, including triple damages and attorneys' fees.

The law also creates a presumption that any "negative change in seniority, status, employment benefits, pay or other terms or conditions of employment" within six months of an employee's return from paid leave is presumed to be retaliatory. To overcome the presumption, an employer must be able to demonstrate with "clear and convincing" evidence that it would have done the same thing in the absence of the employee's leave.

Finally, employers will also be required to post a notice created by the Department of Family & Medical Leave, and inform all employees within 30 days of the law and the rights afforded by it.

How Should Businesses Respond?

In anticipation of the law's effective date—which will be here before you know it—you should prepare to take the following steps to make sure you stay on the right side of the law:

- Evaluate employees' pay and work schedules to ensure that, as the minimum wage increases, affected employees' rates of pay are increased;

- Monitor work on Sunday and holidays and be cognizant of the annual changes so that you are calculating premium pay properly;

- Review employee payroll to determine the proper family and medical leave contributions and make arrangements to cover the employer's contribution;

- Update your handbook and policies to comply with the law's new requirements—for example, the law requires that you provide notice to your employees of their right to be paid family and medical leave. You should likewise consider implementing a policy to comply with the law's notice and medical certification requirements;

- Train your managers and your HR staff on compliance with the new leave law; and

- Once the law is effective, carefully consider any disciplinary actions that may occur within the six-month presumption period.

When Does This Start?

The bulk of the "grand bargain" is effective on January 1, 2019. The minimum wage will increase annually each January 1 until 2023. Contributions for paid family and medical leave will begin in July 2019, and the first payouts will not occur until January 2021. Be on the lookout for regulatory guidance by March 31, 2019.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.