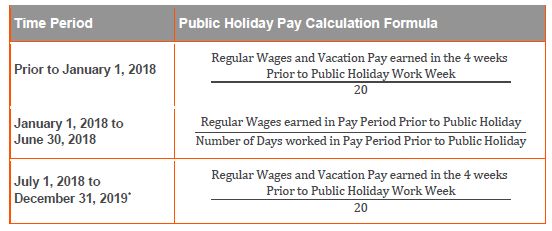

As many of you know, the Government of Ontario introduced a new formula for calculating public holiday pay effective January 1, 2018. This was one of the many changes made to the Employment Standards Act, 2000 under The Fair Workplaces, Better Jobs Act ("Bill 148"). The new formula took the regular wages earned by the employee (before taxes and statutory deductions) in the pay period immediately prior to the public holiday and divided it by the number of days the employee actually worked to earn those wages.

This new formula created considerable controversy as it resulted in a significant increase in public holiday pay for part-time and other casual employees. For example, under the new formula, an employee who worked two (2) days and earned $200 in regular wages ($100 per day) in the pay period prior to the public holiday is entitled to the same amount of public holiday pay as an employee who worked ten (10) days and earned $1,000 in regular wages ($100 per day) during that same period.

After receiving a considerable amount of negative feedback, the Wynne government decided to temporarily reinstate the public holiday formula that applied prior to Bill 148. As a result, the old formula will apply effective July 1, 2018. Specifically, the regular wages and vacation pay earned by the employee in the four (4) weeks before the work week in which the public holiday occurs will be divided by twenty (20) to determine a per diem rate. The Wynne government had planned to conduct a comprehensive review of the public holiday system over the next year to develop a new public holiday pay formula. However, with the change in government after the June election, it is unclear what approach the Ford government will take on public holiday pay so...stay tuned.

Quick summary:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.