ISSUES AFFECTING ALL SCHEMES

Data protection – new legislation in force

The EU General Data Protection Regulation (GDPR) came into force on 25 May 2018. On the same date, the majority of the provisions of the Data Protection Act 2018 came into force. The Act:

- repeals the Data Protection Act 1998; and

- sets new standards for protecting personal data, in accordance with the GDPR.

Action

If they have not done so already, trustees should review their data protection arrangements as a matter of urgency to ensure that they comply with the new legislative requirements.

Money laundering – HMRC announcement

HMRC has announced that schemes that are subject to the requirement to register with HMRC under the Money Laundering Regulations 2017 and that are registered with Pension Schemes Online (PSO) do not need to register separately with the Trust Registration Service (TRS). If a scheme is subject to the HMRC registration requirement under the Money Laundering Regulations 2017, and is not registered with PSO, it must still register with the TRS.

Schemes are still required to keep the written up-to-date records of the scheme's beneficial owners that are required separately under the Money Laundering Regulations 2017.

Action

Schemes which are subject to the registration obligation should confirm whether they are registered with PSO. If they are not, they should ensure that they have registered with the TRS.

Public financial guidance – new legislation

The Financial Guidance and Claims Act 2018 has received Royal Assent. Among other things, the Act:

- Establishes a single public financial guidance body to which the functions of TPAS, Pension Wise and the Money Advice Service will be transferred.

- Requires the government to make

regulations imposing an obligation on trustees, when a member or

survivor wishes to transfer or start receiving flexible benefits,

to ensure that the member/survivor is:

- referred to appropriate pensions guidance, and

- provided with an explanation of the nature and purpose of such guidance.

- Gives the government a power to ban pensions cold-calling.

Action

The majority of the Act's provisions have not yet been brought into force. However, trustees should keep this position under review as:

- Once the single public financial guidance body is established, schemes will need to update their member communications to replace references to TPAS and Pension Wise accordingly.

- Once the government makes the required regulations, schemes offering flexible benefits will need to make changes to their retirement and transfer procedures.

21st century trusteeship – new guidance

The Pensions Regulator has added guidance on managing risk to its 21st century trusteeship web resource. It has also added a round-up of months 4–6 of the 21st century trusteeship initiative which focused on trustee training, skills and experience, and advisers and service providers.

Action

No action required, but trustees may find the new guidance helpful when assessing their risk management processes.

Pensions Ombudsman – transfer to a suspected pensions scam vehicle

The Pensions Ombudsman has decided that there was no maladministration where a scheme followed good practice, including correct due diligence procedures, in relation to a pensions transfer, even though the transfer was made to a suspected scam vehicle. The member had a statutory transfer right and the transferring scheme could not therefore have unilaterally prevented the transfer. All it could do was take appropriate steps to bring the risks associated with the transfer to the member's attention which it had done by sending the member the Pensions Regulator's Scorpion leaflet and asking him to confirm that he wished to proceed before making the transfer.

Mr E (PO-15726)

Action

No action required, but schemes should ensure that they follow appropriate due diligence procedures when processing transfer requests and that they draw members' attention to the risks associated with transfers.

ISSUES AFFECTING DB SCHEMES

Scottish limited partnerships – proposals for reform

The government has published a consultation on proposed reforms to the regulatory regime governing Scottish limited partnerships (SLPs), including introduction of a requirement:

- for an SLP's principal place of business to be (and remain) in Scotland, and for this to be evidenced on a routine basis; or

- for an SLP to maintain a service address in Scotland.

The consultation closes on 23 July 2018.

Action

Schemes which use an SLP as part of an asset-backed

contribution arrangement should keep the progress of the government's proposals under review.

Financial support directions – Tribunal guidance

The Upper Tribunal has held that:

- The Pensions Regulator is not precluded from relying on events that took place prior to the coming into force of the Pensions Act 2004 (and outside the statutory two year look-back period for an financial support direction (FSD)) to justify imposition of an FSD.

- It is not necessary for the FSD target's conduct to have been morally hazardous in order for an FSD to be issued i.e. the target's conduct need not have been intended to avoid liability for funding the relevant pension scheme or to transfer that liability to the Pension Protection Fund.

ITV plc and others v Pensions Regulator and another [2018] UKUT 164 (TCC)

Action

No action required.

ISSUES AFFECTING DC SCHEMES

Master trusts – regulations finalised

The regulations which provide the detail of the authorisation and supervision framework for master trusts that is being introduced under the Pension Schemes Act 2017 have been laid before Parliament for approval. The regulations will come into force on 1 October 2018.

Action

If they are not doing so already, schemes which fall within the definition of a "master trust scheme" for the purposes of the Pension Schemes Act 2017 should start making arrangements to comply with the authorisation and supervision requirements.

New DC investment disclosure requirements – clarification

The government has clarified that the requirement for DC trust-based schemes to make certain information on charges and transaction costs and the scheme's default arrangement(s) contained in the scheme's annual governance statement for scheme years ending on or after 6 April 2018 "publicly available free of charge on a website" means that the specified information must be made available to the general public as a whole, rather than just to scheme members. As such, the website on which the information is made available must be accessible free of charge and without the use of a user name and/or password.

Action

Schemes which provide DC benefits (other than schemes whose only DC benefits are additional voluntary contributions) should ensure that they comply with the requirement to make the specified information available on an appropriate website.

MAYER BROWN EVENTS AND PUBLICATIONS

Upcoming events

If you are interested in attending any of our events, please contact Katherine Carter (kcarter@mayerbrown.com) or your usual Mayer Brown contact. All events take place at our offices at 201 Bishopsgate, London EC2M 3AF.

Trustee Foundation Course

11 September 2018

11 December 2018

Our Foundation Course aims to take trustees through the pensions landscape and the key legal principles relating to DB funding and investment matters, as well as some of the

Trustee Building Blocks Class

12 June 2018 – trustee discretions and decision-making

(FULLY BOOKED)

13 November 2018 – internal controls and risk management

Our Building Blocks Classes look in more detail at some of the key areas of pension scheme management. They are designed to be taken by trustees who have already taken our Foundation Course.

Mayer Brown media comment

- Stuart Pickford was quoted in CityAm and Law360 articles on the Court of Appeal hearing in British Airways plc v Airways Pension Scheme Trustee Limited

- Stuart Pickford wrote an article for Professional Pensions on how the courts can help trustees remedy problems in scheme rules

The View from Mayer Brown: UK Pensions Law Podcasts

Every month Richard Goldstein, a partner in our Pensions Group, places a spotlight on key developments that could affect your scheme in a podcast. Just 10-15 minutes long and available on iTunes, the podcasts provide a quick and easy way to stay on top of current issues in pensions law.

Listen to or subscribe to The View from Mayer Brown UK Pensions Law Podcasts via iTunes here:

Please note – subscribing above will only work on a device with iTunes installed. Alternatively, if you don't have iTunes, you can access the podcasts via our website.

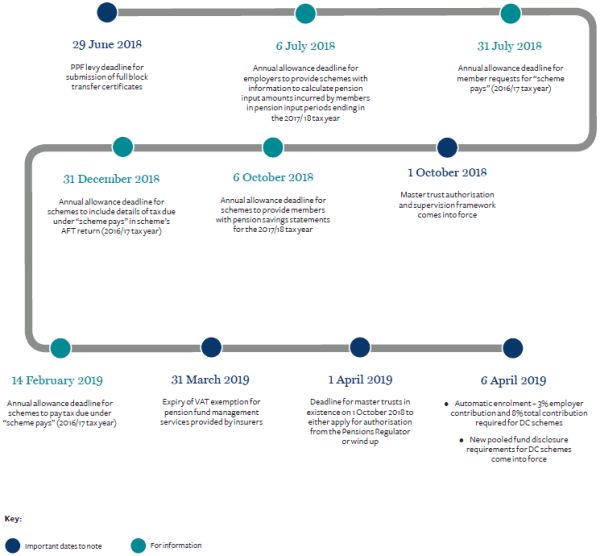

Dates to note over the next 12 months

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe – Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2018. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.