Recently the Turkish Competition Authority (TCA) announced a new reasoned decision in relation to Turkish beer market and has preserved the rule for beer coolers. In a sense, with this decision the TCA has declared that the Authority is satisfied with the current competitive landscape of beer market, which is shaped also by the decisions of the TCA in the last decade.

In the last couple of years, the TCA once again started to examine the beer market with the application of Anadolu Efes, the leading beer brand in the Turkish market which has been holding the dominant position for many years. In this application, Anadolu Efes primarily requested an individual exemption for its four types of closed selling point1 agreements that are revised in accordance with the new market conditions in order to provide the realization of the investments and to allow for further future investment opportunities for closed selling points. In case Anadolu Efes' individual exemption request for these agreements of closed selling points was declined by the TCA, in the same application Anadolu Efes also requested the withdrawal of Tuborg's2 exclusivity granted by the TCA in 2010 and the nullification of the rule which allows Tuborg products to be displayed in Anadolu Efes' beer coolers since 2008 except Ekomini points3 of Anadolu Efes.

The TCA examined each request of Anadolu Efes. Firstly, the TCA rejected the negative clearance4 and individual exemption request of Anadolu Efes for its closed selling point agreements in July 2017.5 Secondly, in November 2011 the TCA revoked the individual exemption that was granted to Tuborg's exclusivity agreements for closed selling points since 2010.6 With its last decision in February 2018, the TCA finalized its evaluations regarding the application of Anadolu Efes and declined the request of the undertaking on the removal of the rule of beer coolers that allows the exposure of Tuborg beers in Anadolu Efes' coolers and vice versa.

In fact, the rule of beer coolers has stated that each closed selling point, which has an area of 100 square meters or less and has only a cooler of one brand, has to allow the exposure of other competitor brands. This exposure is restricted as a maximum amount of 20% of the total volume of the cooler(s) in the closed selling point.

In this regard, Anadolu Efes claimed that the market structure has changed dramatically since 2008, and Anadolu Efes loses its market share while its biggest competitor Tuborg's share is increasing regularly. Furthermore, the undertaking argued that the financial capabilities of Tuborg is at least as strong as Anadolu Efes and in this respect, the usage of Anadolu Efes coolers by Tuborg is not compatible with the essence of the TCA's beer cooler decision of 2008. And most importantly according to Anadolu Efes, the TCA's decision in 2008 has put the rule of beer coolers for the small companies in the Turkish beer market and has excluded both Anadolu Efes and Tuborg from implementing this rule for their coolers.

In light of all this information, the TCA examined the market from different aspects and asked for the opinions and regulations of different market players including Tuborg and the Tobacco and Alcohol Market Regulatory Authority. Moreover, the TCA conducted a detailed quantitative analysis on market concentration ratios, investments of Anadolu Efes and Tuborg on closed selling points, comparisons of availability level of both brands from different perspectives in order to have an explicit understanding of the effects of the beer cooler rule in the market.

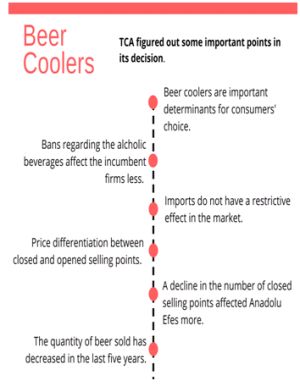

After all these examinations, we have seen from the reasoned decision that the TCA figured out some significant points about the Turkish beer market in general, and the TCA also gave information on the recent situation of the beer market. Some of the prominent findings of the TCA are listed below:

- Beer coolers are important determinants for consumers' choice in consideration of cool and diversified availability level of the product mainly in closed selling points.

- Dark market conditions are held in the Turkish beer market since 2013 due to bans on the publicity and advertisements of alcoholic beverages that may restrict new entries to the market or may strengthen the effects of current entry barriers in the market.

- Since incumbent firms have strong brand recognition and hence less need for advertisements, bans regarding alcoholic beverages have affected the incumbent firms less than small firms and new entrants in the market.

- Imports have restrictive competition constraint in the Turkish beer market due to the demand structure of individual and corporate customers, price effect of Special Consumption Tax and factors related to touristic services (such as high ratio of all-inclusive hotels in Turkey except İstanbul).

- Unsurprisingly, prices differentiate between closed selling points and open selling points. However, since 2013 the number of closed selling points have been decreasing dramatically while the number of open selling points is more stabile.

- The market figures show that the decline in the number of closed selling points mostly affected Anadolu Efes, whereas Tuborg relatively preserves its closed selling points.

- The numbers of closed selling points where both Anadolu Efes and Tuborg have coolers are close to each other, which depicts the role of beer coolers in the competitive structure of beer market.

- Although revenues acquired through open selling points and closed selling points were increasing during the last five years, the quantity of beer sold was decreasing in both channels.

- Market shares are steadily switching from Anadolu Efes to Tuborg in the last years.

- Importers and other small beer producers in the market have smaller market shares and limited competitive restriction on these two brands.

- Sales in the closed selling points have an important share on the total sales of both Anadolu Efes and Tuborg.

Having said that, all recent decisions of the TCA on the Turkish beer market showed us that the TCA is pleased with the effects of its previous decisions which transformed the beer market from one-single brand dominance to a market with two balancing competitors. With its last decision on the rule of beer coolers, it would not be wrong to say that the TCA keeps going in reshaping the market in order to develop a more competitive structure. We will continue to follow up the next moves of two strong players after the last decisions of the TCA.

Footnotes

1. Closed selling points consist of markets, kiosks and grocery stores whereas open selling points consist of bars, hotels, restaurants or cafes, etc. that serve beer in bottles, cans or from the taps for instant consumption together with food, music, accommodation or entertainment services.

2. Although Tuborg is the second biggest player in the Turkish beer market, its market share is far below Anadolu Efes. Moving on, the two undertakings, namely Anadolu Efes and Tuborg, have the licenses of many international brands.

3. Ekomini is a retail chain of Anadolu Group that sells non-alcoholic beverages and liquors with snacks.

4. Only exception is that the TCA gave negative clearance to the Standard Closed Selling Point Agreement.

5. TCA's decision dated 3.7.2017 and numbered 17-20/320-142.

6. TCA's decision dated 9.11.2017 and numbered 17-36/583-256.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.