The GST Council has been proactively taking up representations made by various industry stakeholders to remove hardships and increase compliance. Rulings by Authority for Advance Rulings (AAR) have also begun providing clarity and direction on various ambiguous provisions. With this, the GST regime could stabilize in the coming months. Furthermore, the decision to simplify compliances in the last GST Council meeting should also hasten this process.

Top Trends

- E-Way Bill on the intra-state movement of goods to be implemented across all remaining states by 3 June 2018.

- A centralized depository of rulings passed by AARs across all states to be created on the GST Council's website.

- Few key points that businesses should

ensure while finalizing their balance sheets: Reconcile sales

according to books of accounts with GSTR-1 and GSTR-3B.

- Input tax credit according to books match with electronic credit ledger on the GST portal.

- Input tax credit claimed matches with GSTR-2A.

- Certain functionalities have been

added to the GST portal:

- Taxpayers can make Input Tax Credit (ITC) reversal under one head without affecting the other head, e.g., reverse only CGST/SGST without affecting the other.

- Exporters claiming a refund of accumulated ITC would now be required to provide invoice-wise details of shipping bill, Export General Manifest (EGM), Bank Realisation Certificate (BRC) /Foreign Inward Remittance Certificate (FIRC), etc. while filing the refund application. A template has been provided for this purpose.

Judicial Pronouncements

| Issue | Ruling | SKP Comments |

| Whether hotel

accommodation and restaurant services provided to the employees and

guests of SEZ units, be treated as a supply of goods and services

to such SEZ units, and therefore, zero-rated? [AAR, Karnataka] |

|

|

| Whether a supply of UPS

along with battery can be treated as composite supply? [AAR, West Bengal] |

|

|

| Whether supply of

turnkey Engineering, Procurement and Construction (EPC) contract in

case of a solar power plant, wherein both goods and services are

supplied, should be construed as a composite supply or a works

contract? [AAR, Maharashtra] |

|

|

| Whether liquidation

damages should be subjected to GST? [AAR, Maharashtra] |

|

|

It is to be noted that an Advance Ruling is binding only on the applicant who had sought it and the concerned jurisdictional authority, i.e., an Advance Ruling is specific to an applicant and shall not be applicable to other taxpayers facing similar issues.

However, the above mentioned Advance Rulings provides clarity about the issues being faced and provide persuasive value in matters before the tax authorities.

Upcoming GST Due Dates

| Form | Applicable to | Period | Due Date |

| GSTR-1 (monthly) | Taxpayers with annual aggregate turnover more than INR 15 million | May 2018 | 10 June 2018 |

| GSTR-3B | All registered taxpayers | May 2018 | 20 June 2018 |

| GSTR-5 | Non-resident taxable persons | May 2018 | 20 June 2018 |

| GSTR 5A | Online Information and Database Access or Retrieval (OIDAR) | May 2018 | 20 June 2018 |

| GST TRAN-2 | Taxpayers not registered under pre-GST regime willing to claim transitional credit | Six tax periods for which the scheme is applicable | 30 June 2018 |

OTHER KEY ASPECTS

GST from a Macro Perspective

Return filing process

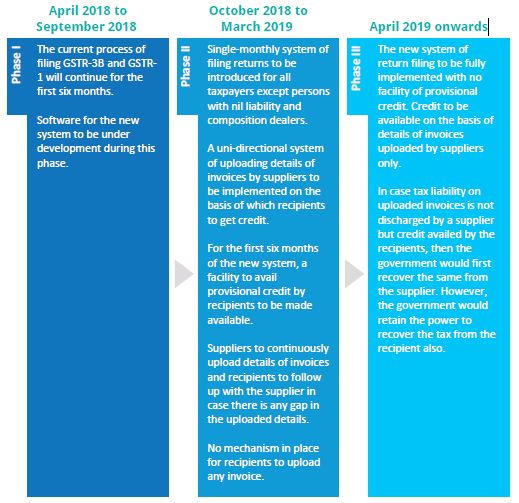

The GST Council in its 27th meeting held on 4 May 2018 has approved the simplified returns filing system which is bound to be implemented in a phased manner as follows:

Revenue collections

The GST revenue exceeded the INR 1 trillion threshold for the first time in April 2018 with gross GST collections standing at INR 1.03 trillion. The gross GST revenue for the month of May 2018 has dropped to INR 0.94 trillion. However, this is more than t e average gross GST revenue for the period of July 2017 to March 2018 which stood at INR 0.89 trillion.

e-Way Bill

Post the smooth rollout of the e-Way Bill system for inter-state movement of goods, the government is gradually implementing the system for intra-state movement of goods in the following manner:

e-Way Bill – A snapshot

- More than 22.6 million e-Way Bills generated in May 2018 (up to 21 May 2018).

- More than 50 million e-Way Bills generated till date.

- On an average 2 million e-Way Bills are being generated every day.

- State-wise GST officers have been appointed to resolve e-Way Bill related grievances.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.