This post updates the public deal antitrust reverse termination fee database through October 31, 2017.

An antitrust reverse termination fee (ARTF), sometimes called an antitrust reverse breakup fee, is a fee payable by the buyer to the seller if and only if the deal cannot close because the necessary antitrust approvals or clearances have not been obtained. The idea behind an antitrust reverse termination fee is twofold: (1) it provides a financial incentive to the buyer to propose curative divestitures or other solutions to satisfy the competitive concerns of the antitrust reviewing authorities and so permit the deal to close, and (2) it provides the seller with some compensation in the event the deal does not close for antitrust reasons.

Our sample now covers 1121 strategic negotiated transactions announced between January 1, 2005, and October 31, 2017. Of these, 136 transactions, or 12.1% of the total, had antitrust reverse termination fees. The fees were very idiosyncratic and showed no statistically significant relationship to the transaction value of the deal or trend over time, with fees ranging from a low of 0.1% to a high of 39.8%. The average antitrust reverse termination fee for the entire sample was 5.4% of the transaction value, although several high percentage fees skewed the distribution to the high end. A better indicator may be the median, which was 4.6% of the transaction value.

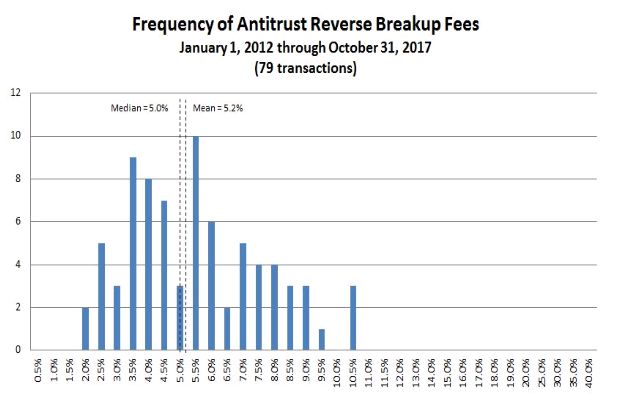

We thought it might be helpful to give some statistics for the more recent subsample covering the five-year-plus period from January 1, 2012, through October 31, 2017. This subsample covered 517 transactions, of which 79, or about 15%, had antitrust reverse termination fees. This suggests that antitrust reverse breakup fees are becoming more common in transactions that meet our sample criteria. These fees had a mean of 5.2%, not much different than the full sample, but a median of 5.0%, indicating that the fees were shifting in their distribution to a slightly higher percentage value. This is consistent with a tighter distribution of the fees, which ranged from a low of 1.5% to a high of 10.4%.

NB: The percentage intervals on the horizontal axis are not of equal size.

Of the 67 transactions signed since January 1, 2012, with an antitrust reverse termination fee for which the antitrust reviews have been completed, 49, or about 73%, were cleared without any antitrust challenge. One transaction (Halliburton/Baker Hughes) was terminated in the course of litigation with the U.S. antitrust enforcement agencies, four transactions (Sysco/US Foods, Staples/Office Depot, Aetna/Humana, and Anthem/Cigna) were terminated after the reviewing agency obtained a preliminary injunction in federal district court, and 13 transactions closed subject to a DOJ or FTC consent order.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.