Governance reporting has come a long way since the foundations were laid by the Cadbury Report

On 1 December 1992, Whitney Houston was atop the charts with 'I Will Always Love You' and 'The Bodyguard' was showing in cinemas.

It was less than a month since Bill Clinton had been elected as US president and in the world of business a string of high profile corporate scandals – including Guinness, BCCI, Polly Peck and Maxwell – were still fresh in the memory.

Against this backdrop, the Cadbury Committee on the Financial Aspects of Corporate Governance published its final report.

Time capsule

The Barclays' 1992 annual report was published a few months later – the scanned document is still available as a PDF on their website – and included three paragraphs on the Cadbury Code of Best Practice.

This consisted of a statement that Barclays Group complied with the disclosure requirements of the code, apart from three provisions, and a brief explanation of how the board was comprised of a majority of non-executive directors, how it maintained an audit and compensation committee and how the chief executive had been appointed to also serve as chairman of the board.

Fast-forward to 2017, and governance disclosures look very different. Barclays' 2016 governance report tells a detailed and insightful, company-specific story. Case studies and a detailed explanation of the board evaluation process are presented with clear linkage between board activities, strategy and principal risks.

Comparing these two reports provides a clear sense of how the governance report has evolved to become an insightful narrative account of the company's governance practices.

A changing relationship

Governance and reporting have gone hand-in-hand since the Cadbury Report's conception. The original Cadbury Report stated that 'boards should aim for the highest level of disclosure consonant with presenting reports which are understandable'. Improving transparency has therefore always been a goal of corporate governance in the UK.

However, the relationship between governance and reporting has changed. The initial focus of the Cadbury Report was on improving oversight of companies' financial reporting and on strengthening internal control.

However, as investors are increasingly holding boards to account over their governance arrangements, there has been pressure to produce more insightful governance reports that explain how the company's governance framework supports long-term value creation.

Companies are themselves beginning to see the benefits of greater transparency and to recognise the link between good reporting and good governance.

In a recent speech, FRC CEO Stephen Haddrill emphasised this point by highlighting that 'trustworthy information and trustworthy behaviour support the needs of investors and generate confidence in boards, ultimately leading to the long-term success and health of an organisation'.

Tracking developments

We have been able to track the development of governance reporting through our annual 'Complete 100' research – first published in 2006 – into the narrative reporting trends of the FTSE 100.

In the initial years of our research the governance section changed little and was largely compliance-driven. Between 2004 and 2006 the number of companies whose governance sections were less than five pages long remained around the 50% mark (2004: 50%; 2005: 47%; 2006: 48%).

By comparison, in 2016 the average length of FTSE 100 governance reports was 55 pages, reflecting a clear increase in the level of insight and disclosure.

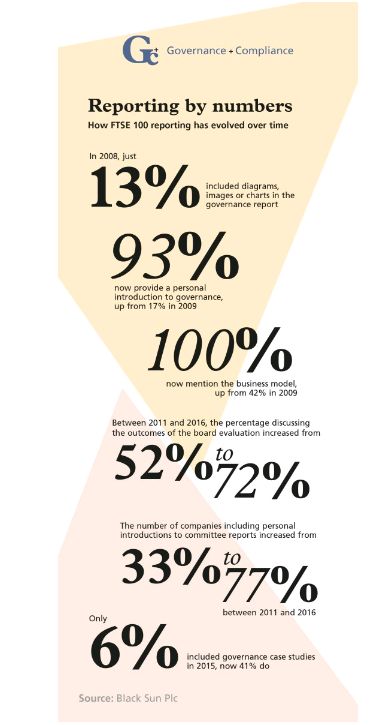

The fact that companies were not using the annual report to clearly communicate key messages around governance is underlined by the fact that in 2008 only 13% of companies included diagrams, images or charts to bring the governance section to life.

The financial crisis

The financial crisis of 2008–2009 was a watershed moment for governance reporting.

In March 2009, many respondents to the FRC's call for evidence on the UK Corporate Governance Code commented on the poor quality and limited usefulness of governance disclosures, arguing that governance statements provided only minimal information and tended to be boilerplate in nature.

Later that year, the Walker Review published its final recommendations. Although focused on banks, it put forward a number of suggestions that were adopted by the FRC in their review of code.

One of the recommendations included was that there should be 'enhanced reporting of the board evaluation, the process for identifying the board's skill requirements, and the chair's communication with shareholders'.

The review also recommended the development of a stewardship code to enhance the quality of engagement between investors and companies, which the FRC duly introduced in 2010. This called for investors to do more to hold companies to account over their governance practices, increasing the pressure on companies to demonstrate transparency.

The code was updated in 2010 and encouraged chairmen to 'report personally on how the principles relating to the leadership and effectiveness of the board have been applied'. Also included was the requirement to conduct externally-facilitated board evaluations every three years and a requirement to discuss the company's business model.

The key themes of the debates that took place between 2008 and 2010 are reflected in the reporting trends. For example, in 2009, 17% of companies provided a personal introduction to governance. This number had jumped dramatically to 49% by 2011.

The number of personal governance statements has continued to rise steadily and in our latest research 77% of companies included a chairman's introduction to corporate governance that provides a real personal insight into governance at the company, with an additional 16% providing a more boilerplate letter.

Increased disclosure of the objectives and outcomes resulting from the board evaluation process is another trend that has its roots in this period.

Between 2011 and 2014, the percentage of companies disclosing outcomes rose from 52% to 64%, with those disclosing objectives increasing from 40% to 63% in the same period. By 2016, the figures for outcomes and objectives rose to 72% and 73% respectively.

Finally, although the business model must now be included in the strategic report, it was originally introduced as a code requirement. Even before the introduction of the strategic report, the code clearly impacted business model reporting.

In 2009, only 42% of the FTSE 100 mentioned their business model, whereas in 2011, 84% of companies included a business model in their report. In our latest research, all the FTSE 100 referred to the business model, with 81% providing detailed or very detailed discussion.

Real innovation

The debates arising from the financial crisis lit the blue touch paper for reporting on governance. Since then, governance reporting has gained a momentum of its own, with companies going beyond what is strictly required and providing greater insight into their governance practices.

A major driver came in 2012, when the FRC's update to the code included a supporting principle for the board to confirm that the annual report as a whole is fair, balanced and understandable.

This was important as it encouraged greater board engagement with the annual reporting process and got boards to think about the annual report, including the governance report, as a whole and how it can be used to tell a coherent, connected story.

This push for fair, balanced and understandable reports was supported by other best practice developments.

From 2012, when the update to the code encouraged more informative reporting by audit committees, more companies began including personal introductions from committee chairmen. In 2011, just 33% of the FTSE included personal letters or quotes from committee chairmen but this figure rose to 77% by 2016.

More recently, culture has become a key focus area, following the introduction of the concept of the board setting the 'tone from the top' on culture, value and ethics. This is reflected in the number of companies discussing culture in the chairman's introduction to governance, which increased from 14% to 46% between 2014 and 2016.

In the last two years, we have seen some real innovations with leading companies using communicative features such as case studies and governance at-a-glance spreads to convey key messages.

In 2016, 41% of companies provided governance case studies, up from just 6% in 2015. More companies are also providing a visual representation of board skillsets, although most still shy away from discussing a board skill-gap analysis, even in retrospect.

A second tipping point

Although much progress has already been made in the 25 years since the Cadbury Report, there are clear signs that we are on the edge of a second tipping point in governance reporting. Thanks to the inquiries into BHS and Sports Direct, and the weight placed on the issue by the prime minister, governance is once again under scrutiny.

Reporting looks set to be a central part of the current reforms. The FRC is updating the code to make it a sleeker, slimmed down document that places greater emphasis on reporting how the code's top-line principles have been implemented.

This will encourage further organisation-specific insight as companies explain how the principles have been applied specifically to their businesses with less focus on code provisions.

Linkages between the corporate governance statement and the strategic report are also set to increase, as the FRC has indicated that companies will be expected to explain the application of code principles throughout the annual report, not just in a siloed governance section.

Reporting on stakeholders could act as a bridge between annual report sections, as a focus on the directors' duty to promote the success of the company while having regard for stakeholders is expected to be included in the updated code, with the government also introducing a formal reporting requirement on section 172 in March 2018.

In light of these changes, companies will have to rethink how they report on governance, just as they did with the move towards more personal reporting following the financial crisis.

As the Cadbury Report enters its second quarter century, governance and reporting are converging. This provides an opportunity for boards to use external reporting as an exercise for strengthening their internal processes to promote a culture of transparency and integrity. This will, in turn, help to develop companies' trust among key stakeholders.

Sallie Pilot is chief engagement and insight officer at Black Sun Plc

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.