Introduction

As mentioned earlier, GSTR 1 is the base document on the basis of which the rest of the returns are auto-populated. As the supplier of goods or services enters details of invoices raised by him towards the buyer of goods or services, an intimation of the same is sent to the buyer confirming the same in the form of GSTR 2A. Once the said transaction is confirmed at the buyer's end, the details of which get auto-populated in the GSTR 2 at the suppliers end.

As GSTR 1 contains details of all sales, GSTR 2 consists of details of all the inward purchases. All the inward supplies from registered businesses, including the supplies on which tax needs to be paid on reverse charge are required to be captured at the invoice level to file GSTR 2. Since details of sales is filed by all GST taxpayers vide GSTR 1 before the 10th of every month, most of the data in GSTR 2 will be auto-populated. The taxpayer would have to verify the data on their portal and provide limited additional information.

Due date for filing GSTR 2 Return

A 5-day gap between GSTR-1 & GSTR-2 filing is there to correct any errors and discrepancies. As GSTR 1 has to be filed on 10th of every month, GSTR 2 is as follows:-

- As per Notification No. 29/2017

dated September 5, 20171

Month Due Date for Filing GSTR-2 July 2017 11th-25th September August 2017 6th-10th October September 2017 onwards 15th of next Month and onwards

Who should file GSTR 2?

Every registered person is required to file GSTR 2 irrespective of whether there are any transactions during the month or not.

The following registered persons are exempted from filing the GSTR 2:-

- Suppliers of online information and database access or retrieval services (OIDAR), who have to pay tax themselves (as per Section 14 of the IGST Act)

- Input Service Distributor (they have to file GSTR 6)

- Non-Resident Taxable person (they have to file GSTR 5)

- Composition Scheme Taxpayer under Section 10. (they have to file GSTR 4)

- Tax Deductor at source under Section 51 (they have to file GSTR 7)

- Tax collector at Source under Section 52 (they have to file GSTR 8)

What is the penalty for not filing GSTR 2 Return?

In case there is a delay in filing of GSTR 2, a late fee with certain amount of interest @ 18% has to be paid. It has to be calculated by the tax payer on the amount of outstanding tax to be paid. Time period will be from the next day of filing (16th of the month) to the date of payment. Late fee is INR 100 per day. It is INR 100 per day under CGST & INR 100 per day under SGST, total amounting to INR 200 per day. Maximum fee is INR 5000.

Particulars to be filed under GSTR 2

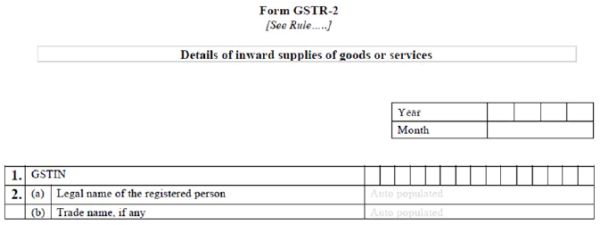

1. GSTIN - GSTIN of the taxpayer will be auto-populated at the time of return filing.

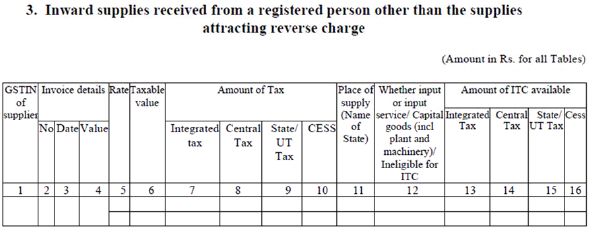

2. Inward supplies received from a registered person other than the supplies attracting reverse charge

3. Inward supplies on which tax is to be paid on reverse charge

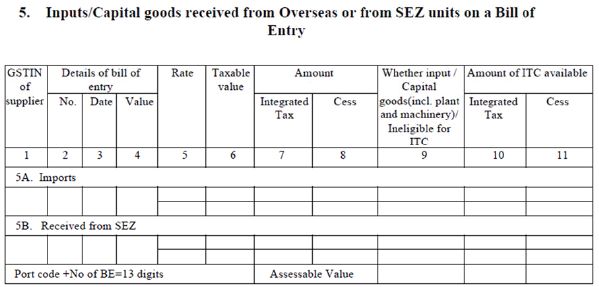

4. Inputs/Capital goods received from Overseas or from SEZ units on a Bill of Entry

5. Amendments to details of inward supplies furnished in returns for earlier tax periods in Tables 3, 4 and 5 [including debit notes/credit notes issued and their subsequent amendments]

6. Supplies received from composition taxable person and other exempt/Nil rated/Non GST supplies received

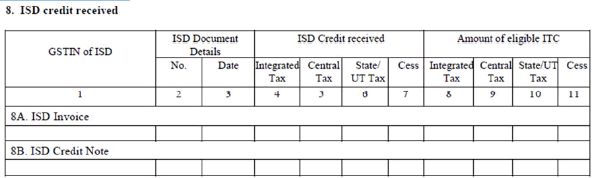

7. ISD credit received

8. TDS and TCS Credit received

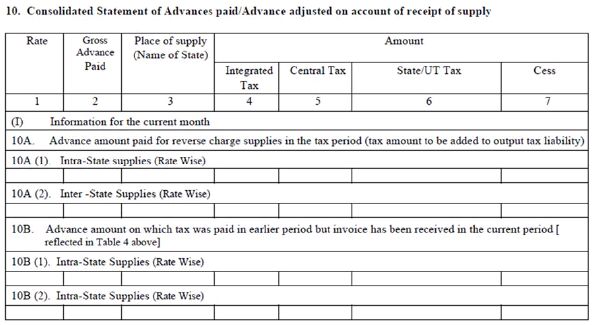

9. Consolidated Statement of Advances paid/Advance adjusted on account of receipt of Supply

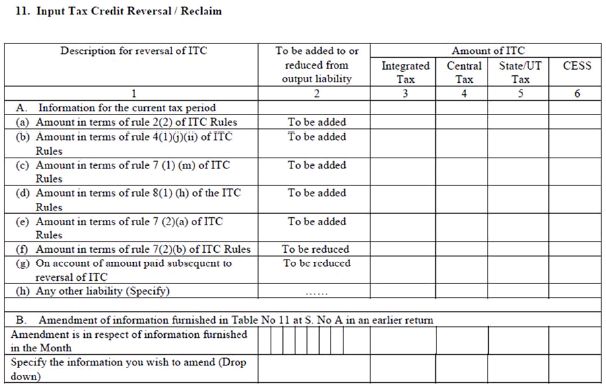

10. Input Tax Credit Reversal / Reclaim

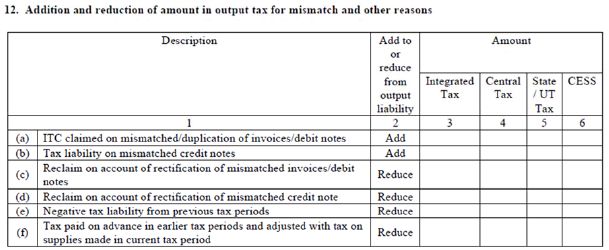

11. Addition and reduction of amount in output tax for mismatch and other reasons

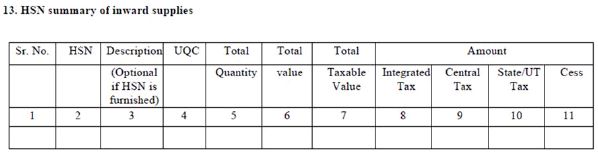

12. HSN summary of inward supplies

Footnote

1 http://www.cbec.gov.in/resources//htdocs-cbec/gst/notfctn-29-central-tax-english.pdf

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.