Under the Proposals, the Listing Regulatory Committee (with equal representation from the SFC and the Exchange) will be established to decide on initial listing applications that have suitability concerns or broader policy implications. The Listing Committee, which comprises representatives of investors, listed issuers and market practitioners, together with the Listing Department of the Stock Exchange, will continue to decide initial listing applications which do not involve suitability issues or give rise to broader policy implications. After considering market feedback, the SFC and the Stock Exchange have decided not to pursue such proposal. The Stock Exchange will continue to make decisions under its Listing Rules (including decisions on suitability for listing), and the role of the Listing Committee as the decision-maker for IPO applications will remain unchanged.

The SFC, as the statutory regulator, will adopt a new approach and concentrate its manpower in more serious listing matters that fall within the scope of the Securities and Futures (Stock Market Listing) Rules ("SMLR") or the Securities and Futures Ordinance ("SFO"). Section 6(2) of the SMLR sets out the grounds on which the SFC may object to a listing application, including:

- the application does not comply with the Listing Rules or applicable law;

- the application does not contain such particulars and information which is necessary to enable an investor to make an informed assessment of the applicant and the rights attaching to its securities;

- the application is false or misleading as to a material fact or is false or misleading through the omission of a material fact;

- the applicant has failed to supply to the SFC such further information as the SFC may reasonably require for the performance of its functions under the SMLR; or

- it would not be in the interest of the investing public or in the public interest for the securities to be listed.

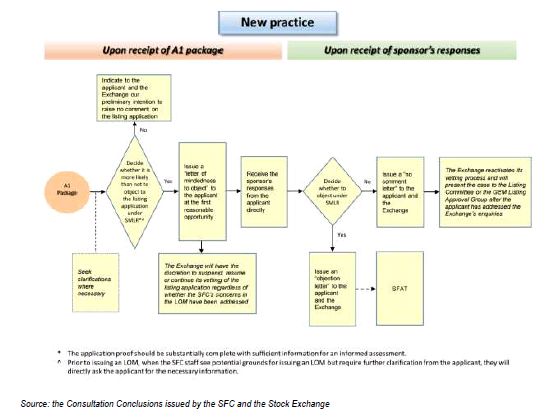

The SFC will cease to review a listing application once it determines that the case does not raise concerns under the SMLR. If the SFC forms the view that it is more likely than not that an objection will be raised under the SMLR, it will promptly issue a "letter of mindedness to object" ("LOM") with detailed reasons for its concerns directly to the listing applicant. If the SFC considers that an applicant's submissions in response to the LOM are inadequate, it will issue a final decision notice ("FDN") under the SMLR to object to the listing application. All requests for information, LOMs and FDNs will be issued within the time periods specified in the SMLR. The Stock Exchange, as the primary front-line regulator, will remain the contact point for all listing applications save in respect of concerns raised by the SFC under the SMLR. The following chart sets out the SFC's approach to processing IPO applications going forward:

SFC's Oversight of the Listing Function After considering the public submissions, the original proposal for the Listing Policy Committee (with equal representation from the SFC and the Stock Exchange) to replace the Listing Committee as the body responsible for oversight of the listing function and for the Listing Department of the Stock Exchange to report to the Listing Policy Committee on its work will not be pursued. Instead, the SFC will enhance its supervisory function of auditing or reviewing the Stock Exchange's performance by focusing on:

- whether the Stock Exchange, in carrying out its listing regulatory function, has discharged its duties under the SFO;

- adequacy of the Stock Exchange's systems, processes, procedures and resources for performing its listing function; and

- the effective management of conflicts of interest within the Stock Exchange as a regulator and as part of a for-profit organisation; including the supervisory functions performed by the Listing Committee.

According to the Consultation Conclusions, this enhanced approach will clearly delineate the role of the SFC as regulator and those of the Stock Exchange and HKEX as regulatees under the SFO. The SFC will publish its supervisory audit or review reports on the Stock Exchange's performance from time to time in accordance with current procedures. The joint consultation paper and the Consultation Conclusions are available at:

- http://www.hkex.com.hk/eng/newsconsul/mktconsul/Documents/cp201606.pdf

- http://www.hkex.com.hk/eng/newsconsul/mktconsul/Documents/cp201606cc.pdf

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.