On September 11th, 2017, British Columbia Finance Minister Carole James provided a British Columbia Budget update. Below is a summary of some of the tax and other measures announced in the update.

Income Tax Measures

Corporate Income Tax Rates

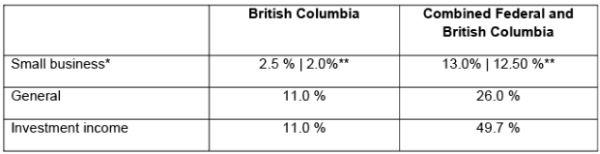

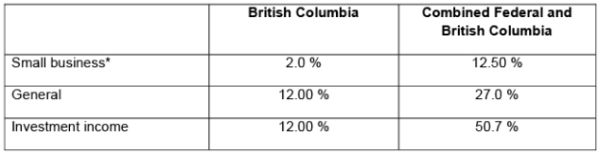

The general corporate income tax rate will be increased by 1% from 11% to 12% effective January 1, 2018. British Columbia's corporate income tax rates for 2017 and for 2018 are as follows:

2017

2018

In order to maintain tax integration, the British Columbia Dividend Tax Credit for the taxable amount of eligible dividends will increase from 10% to 12% effective January 1, 2019.

Personal Income Tax Rates

A new top personal income tax bracket is introduced effective for 2018 and onwards. The income threshold for this new tax bracket will be set at $150,000 in 2018, with taxable income in excess of this amount being taxed at a rate of 16.8%. Below are the top combined Federal and British Columbia personal tax rates for 2017 and for 2018:

Below is a summary of some of the other income tax measures that were included in the update, some of which were announced in previous Budgets:

Back-to-School Tax Credit

The Back-to-School Tax Credit was announced in 2016 and is a non-refundable tax credit available to individuals with school-aged children (5 to 17 years of age) of up to $250 per child. The credit is available for 2016 only (previously the credit was announced as being available for the 2016, 2017 and 2018 taxation years).

Children's Fitness, Children's Fitness Equipment and Children's Arts Tax Credits

These credits have been eliminated for the 2018 and subsequent tax years.

Education Tax Credit

The 2017 Budget announced the elimination of the Education Tax Credit effective January 1, 2018. This Budget update maintains this tax credit.

Book Publishing Tax Credit

The Book Publishing Tax Credit is extended until March 31, 2018 (previously the credit was extended to 2019).

Training Tax Credits

The British Columbia Training Tax Credits are extended to the end of 2018 (previously the credits were extended to 2020).

Other Measures

Medical Services Plan

Effective January 1st, 2018, Medical Service Plan ("MSP") premiums will be reduced by 50%. Previously during the 2017 Budget it was announced that this 50% reduction would only be available to households with annual net incomes of up to $120,000.

For more information on the Budget update, please visit the government of British Columbia website.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.