The Internal Revenue Service (IRS) and Department of Labor (DOL) issued temporary relief on deadlines and procedural requirements applicable to employee benefit plans for employers impacted by Hurricane Harvey.

On Wednesday, August 30, 2017, the IRS issued Announcement 2017-11, which provides easier access to 401(k), 403(b) and 457(b) funds for individuals affected by Hurricane Harvey. For a list of locations, click here. On the same day, the Department of Labor (DOL) issued a news release giving relief to the timing rules for depositing participant contributions and loan repayments, and the requirement to issue blackout notices in the event investment trading in retirement plans was or is interrupted by Hurricane Harvey.

The IRS also issued a news release giving extensions for various tax filing deadlines. Included among the relief is an extension until January 31, 2018 to file Forms 5500 that are due between August 23, 2017 and January 31, 2018.

Loan and Hardship Withdrawal Relief

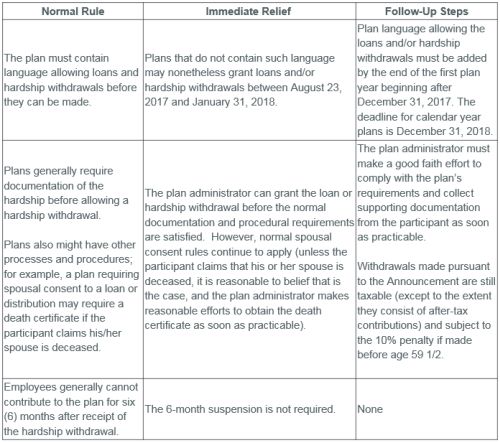

Under IRS rules, employees have access to their funds in employer retirement plans only upon the occurrence of certain events, such as termination of employment, disability or hardship. The distributions and withdrawals pursuant to these events are further governed by IRS rules and limitations. Wednesday's announcement eases some of these limitations for participants affected by Hurricane Harvey. Following is a summary of the normal rules, the relief afforded by the Announcement and the required follow-up steps.

The relief described in the Announcement can be extended to a participant even if he/she is a former employee. Withdrawals can be made not only for the participant's hardship, but for that of his/her lineal ascendant or descendant, or spouse or other dependent with a principal residence or place of employment in one of the covered disaster areas.

Contribution/Loan Repayment Timing and Blackout Relief

The DOL also issued relief with respect to deadlines for remitting retirement plan contributions to the plan and issuing blackout notices.

Guidance for Group Health Plans

The DOL acknowledged that deadlines under group health plans might be missed due to Hurricane Harvey, such as the deadline to issue a COBRA notice or make a COBRA election, or the deadline to file a benefit claim. The DOL's guidance encourages employers to make reasonable accommodations for employees to prevent the loss of benefits, and notes that it will give grace periods where appropriate when compliance with the plan's pre-established time frames under the plan's normal claim and appeal procedures is not possible due to Hurricane Harvey.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.