INTRODUCTION

In an era of globalization where foreign entities are looking at rapid expansion and consequently turning to newer markets including India, they often find themselves exposed to various tax risks and disputes in geographies which have taxation systems which they are not altogether familiar with. A tax dispute can potentially have serious long-term ramifications with respect to both the profitability of the entity as well as the reputation of the business enterprise. In the Indian context, the last decade has seen an upsurge in tax disputes, with a number of high profile cases currently being contested at various levels. Multinational companies such as Vodafone, Nokia, Shell, Aditya Birla and NDTV are all cases in point.

The main causes for the rise in tax disputes are:

- The recent efforts of the Indian tax authorities to widen the tax base of India by emphasising source-based taxation

- "Creative" structures being implemented by taxpayers to achieve a tax effective structure / transaction

- Lack of clarity on new provisions coupled with aggressive interpretations by both taxpayers and tax authorities

- Conflicting rulings pronounced by different appellate forums or authorities across the country contributing to delays or multiplicity of tax disputes

Some high-profile tax disputes and controversies in India which have gathered attention in the recent years include:

- The USD 11 billion Vodafone case wherein the question of taxability of indirect transfer of Indian assets was decided upon by the Supreme Court of India.

- The Nokia case involving taxation of royalty payments by Nokia India to the Finnish parent company where the Income Tax Department had slapped a notice on Nokia's subsidiary in India and froze its assets.

- The Shell India and Vodafone case involving additions on account of transfer pricing provisions applied to issue of shares involving alleged under-valuation of shares to avoid tax in India.1

- The Aditya Birla-AT&T deal involving the question of "indirect transfer" of Indian assets and applicability of the India-Mauritius tax treaty.

- The recent NDTV case wherein the Tax Tribunal collapsed the entire multi-jurisdictional corporate structure created by NDTV and taxed certain amounts received by it as unexplained income.

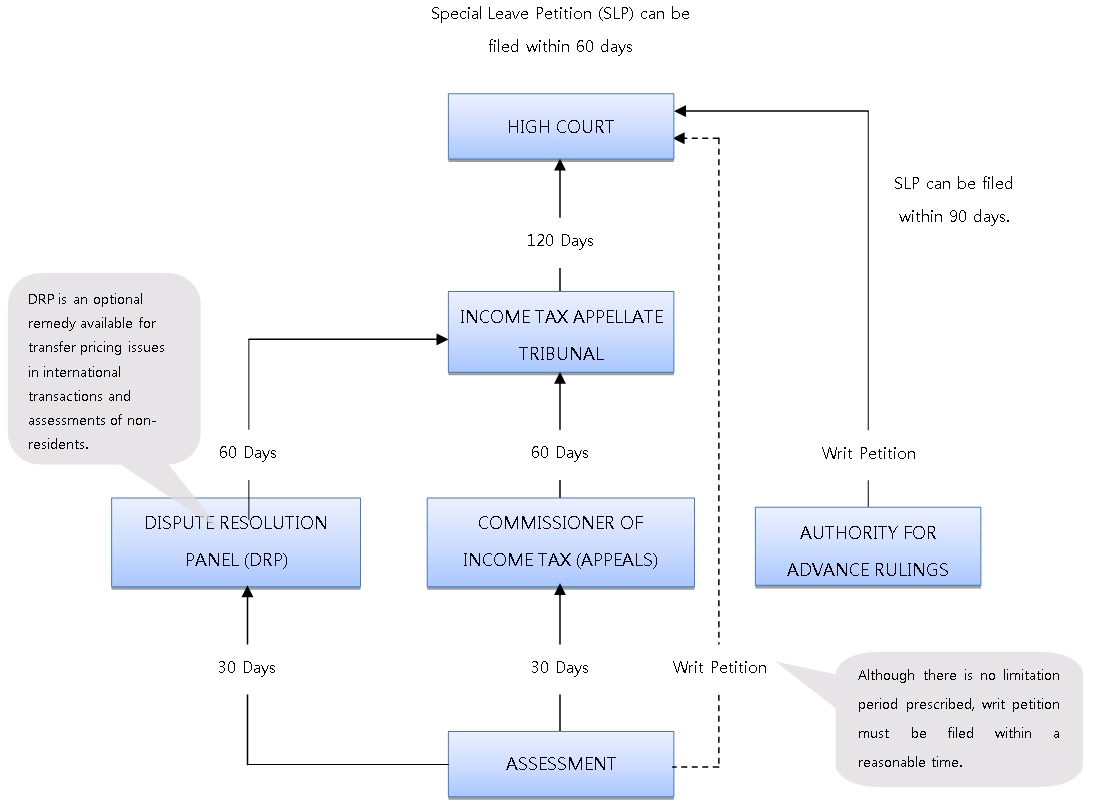

The diagram below provides an overview of the appeal process in India and the timelines for filing such appeals / objections:

DEVELOPING PROPER STRATEGIES FOR EFFECTIVE HANDLING OF TAX LITIGATION

The importance of sound tax counselling and developing effective legal strategies cannot be overemphasized to mitigate tax disputes. Such strategies can be of much help both before and after a transaction is consummated. Unless handled properly, litigation can turn out to be a long drawn and expensive affair. Some of the key factors that could help avoid or reduce tax litigation are set out below:

Avoidance of tax disputes

- Vetting of transactions from an income tax perspective to ensure compliance with all applicable laws and its legal do-ability

- Appropriate drafting of legal documents and its vetting from tax perspective to capture the intended structures to avoid unnecessary litigation or disputes going forward. With the introduction of the General Anti Avoidance Rules ("GAAR"), it is important that the commercial intent behind each transaction is immaculately captured in the transaction documents.

- While undertaking transactions such as acquisitions, mergers, slump sale, share sale, etc. one should ensure that all relevant documents and evidences are preserved, including supporting evidences with respect to the valuation of the assets involved.

- Taking a proactive approach and making the best use of the forums available for speedy dispute resolution, e.g. approaching Authority for Advance Ruling ("AAR") for determination of taxability of a transaction, etc.

- Appropriate disclosures in tax returns, bringing relevant facts and legal documents on record of the tax authorities in the beginning itself to lay foundation for a strong case. This can also help in defending against the levy of any penalty, if the claim/stand of the taxpayer is not accepted in the tax assessment.

- When undertaking international transactions with related parties, it is good to ensure that a transfer pricing study is undertaken prior to undertaking the transaction, as opposed to the same being an afterthought. Taxpayers may also take benefit of the Advance Pricing Agreements mechanism available under the Indian tax laws, or adhere to the prescribed safe harbour rules to mitigate disputes.

- In today's challenging times, another useful strategy or approach could be to consider obtaining a "tax insurance policy" to safeguard against any potential tax demands in the future.

Handling Tax Disputes

- It is critical that the taxpayer has proper and effective representation before the tax and appellate authorities, and all key facts, arguments, supporting evidence and relevant documentation are put forth in a comprehensive manner. It should be noted that the High Court and the Supreme Court generally decide on questions of law and do not go into questions of facts. Further, they do not routinely permit introduction of additional evidence. There should also be timely compliance with official procedures and follow-up to push for speedy disposal of disputes.

FORUMS/OFFICES THAT FACILITATE SPEEDY RESOLUTION OF DISPUTES

Under Indian Income Tax Laws, the following forums could be used to avoid or facilitate speedy resolution/ avoidance of tax disputes:

AAR

This forum is primarily available to non-residents and foreign companies. An advance ruling can be obtained for a completed transaction as well as for a proposed transaction (but not for a "hypothetical transaction"). An AAR ruling is binding both on the tax authorities and on the applicant who sought the ruling in respect of the concerned transaction and therefore, provides certainty and enables non-residents and foreign companies in knowing their tax position in India. Even though a ruling of the AAR is binding on the applicant and the tax authorities, however in several instances, High Courts/Supreme Court have entertained appeal against advance rulings by way of a writ petition/special leave petitions (SLPs) under the Constitution of India.

It may be noted that the prerequisite for filing an application before AAR is that the question raised by the applicant must not be pending before any income tax authority or appellate tribunal or any Court.

The benefit of approaching the AAR is that potential proceedings before a tax officer are usually put on hold from the date of application till the date of ruling. Consequently, an application to the AAR negates the possibility of the tax authorities raising tax demands and following up for the recovery thereof.

While the provisions prescribe a time limit of 6 months, within which the AAR is supposed to pronounce its ruling, of late the AAR has been taking up to 2-4 years to pronounce a ruling due to factors such as vacancy in the office of the Chairman, backlog of cases etc. One hopes that this situation will soon improve and the AAR will be back to pronouncing rulings in the prescribed timeframe.

Advance Pricing Agreements (APAs) for transfer pricing matters

Globally as well as in India, transfer pricing related litigation accounts for a major portion of tax litigation. With a view to reduce such litigation, the Indian government has introduced a framework for APAs to be entered into between the tax authorities and certain specified taxpayers who enter/ propose to enter into international transactions with their associated enterprises. An APA is an agreement between a taxpayer and the tax authority on an appropriate and mutually agreed upon transfer pricing methodology for a set of transactions over a fixed period of time.

An APA shall be valid for as many tax years as are specified in the agreement subject to an upper limit of five consecutive tax years. A rollback provision is also available and the APA can thus be made applicable to past years as well. The APA shall be binding only on the concerned taxpayer and the Commissioner (including tax authorities subordinate to him) in respect of the transaction in relation to which the agreement has been entered into. The APA shall not be binding if there is any change in law or facts having bearing on such APA.

An APA provides the following benefits to the taxpayers:

- Certainty with respect to the international transactions covered in the agreement;

- Low annual reporting cost;

- Grants flexibility in developing pragmatic and workable solutions for complex transfer pricing issues owing to the joint endeavours of the taxpayer and the tax authorities;

- The possibility of APA renewal gives excellent returns for the time and efforts put in while negotiating the original APA; and

- Reduction in risk /cost associated with transfer pricing audits and litigation over the term of the APA.

As on 31 July 2017, the tax department has entered into 171 APAs, which includes 12 bi-lateral APAs and 159 Uni-lateral APAs.

Withholding tax authorization

An act done with the consent of the tax authorities generally helps in avoiding litigation going forward.

If the payer / recipient believes that a proposed payment is not taxable in India, or is taxable at a lower rate it may approach tax authorities for their authorization (which is given by way of issuing a lower/nil tax withholding certificate) to make such payment without deducting tax or deducting tax at a lower rate.

This mechanism could reduce the possibility of disputes later on as the tax is deducted (or not deducted) after obtaining authorisation of the tax authorities. It should however be noted that a lower/nil tax withholding certificate is not a conclusive determination of the tax position of the recipient of such income. The tax authorities usually reserve their right to make a final determination of the tax liability at the time of assessment of the taxpayer post filing of tax return for the relevant period.

Dispute Resolution Panel ("DRP")

The DRP is another mechanism formulated by the Indian government to facilitate expeditious resolution of tax disputes. The DRP consists of a collegium of three Commissioners of Income Tax who adjudicate matters concerning adjustments proposed by the tax officer in tax assessments of foreign companies and cases involving transfer pricing adjustments.

If the taxpayer has objections against the proposed adjustments in its tax assessment, it can approach the DRP and submit its objections. The DRP then considers the objections and after hearing both the sides, gives necessary directions to the tax officer. Thereafter, the tax officer is obliged to frame the tax assessment based on the directions of the DRP. The DRP is required to provide its directions in a time bound manner for speedy disposal.

Mutual Agreement Procedure ("MAP") under tax treaties

This is a special mechanism for dispute resolution provided under tax treaties. MAP applies to cases where an action or a proposed action leads to double taxation of income, which is not in accordance with the concerned tax treaty. On receipt of an application for a MAP made by the taxpayer, the "Competent Authority" of the taxpayer's country of residence will take up the disputed matter with the "Competent Authority" of India to discuss the issues and try and arrive at a resolution.

The Resolution under MAP and domestic laws can be carried out simultaneously, and the tax payer has an option to accept or decline the resolution reached by the "Competent Authorities" under MAP.

POTENTIAL TRIGGERS TO TAX LITIGATION – BEWARE!

GAAR

One cannot discuss the Indian income tax provisions without examining the impact that the introduction of GAAR is going to bring. Moving to a "substance" over "form" approach, the introduction of GAAR from 1 April 2017 is expected to change the landscape of taxation in India.

GAAR may be invoked by the tax authorities where the main purpose of an arrangement is to obtain a tax benefit. The GAAR provisions empower the tax authorities in India to declare any such arrangement as an "impermissible avoidance arrangement" and consequently disregard entities in a structure, reallocate income and expenditure between parties to the arrangement, alter the tax residence of such entities and the legal situs of assets involved, treat debt as equity and vice versa, and the like. By doing so, the tax authorities may even deny tax benefits conferred under a tax treaty.

Accordingly, it would have to be ensured that there is commercial substance behind every transaction / structure to mitigate the risk of GAAR being invoked. A taxpayer may also approach the AAR, for determining whether a particular proposed transaction would be hit by the provisions of GAAR.

Transfer Pricing:

The Indian Transfer Pricing provisions are fast evolving and the recent budget demonstrates the Indian Government's endeavour to protect the Indian tax base.

Transfer Pricing has always been a subject of heavy litigation in India, the controversies in the cases of Vodafone and Shell being evidence of the same. In addition, the recent Finance Act brought to the Indian taxation sphere the introduction of two international practices, one being the introduction of "thin capitalisation norms" and the second being "secondary adjustments."

Even with risk mitigation and dispute resolution mechanisms such as APAs and Safe Harbour Rules, being available to tax payers in India, there is a substantial increase in tax disputes relating to Transfer Pricing. With the increase in India's role in the global economy and steady growth of foreign collaborations with India, one can only expect an increase in the Transfer Pricing related disputes in India.

"Indirect Transfer" tax Provisions

The indirect transfer tax provisions were introduced in 2012 with retrospective effect, to negate the effect of the ruling of the Supreme Court in the case of the Vodafone tax dispute. Under the indirect transfer tax provisions, gains earned by a non-resident taxpayer, on the transfer of shares or interest in a foreign company or entity (Target), that derives "substantial value" from assets situated in India, are liable to tax in India, subject to benefits available under tax treaty, if any

For the purpose of determining whether a foreign company / entity derives "substantial value" in India, certain threshold limits are provided, based on the value of the asset and the foreign company. Considering, that the application of the indirect transfer provisions is based on the valuation of the foreign company as well as the Indian asset, one can expect tax disputes arising with respect to the applicability of the indirect transfer provisions to a specific transaction.

Place of Effective Management

In 2016, the test for corporate residency of foreign companies moved from "control and management being situated wholly in India" to "place of effective management" (POEM) in India. The determination of POEM is a factual determination, based on 'substance' over 'form', taking a holistic approach on a year to year basis. Considering the subjective nature of the guidelines issued for determining the POEM of a foreign company, disputes may most probably arise in this regard.

Valuation Norms

As per recently introduced provisions, a minimum fair value test is to be fulfilled by the acquirer of assets situated in India, as well as the transferor of equity shares in India. The fair value of equity shares is to be computed by a hybrid mechanism, based on the asset composition of the company. For the purpose of valuation of equity shares, the fair market value of any downstream investments, onshore or offshore, are also to be taken into consideration.

In addition, there is ambiguity with respect to the application of these Valuation Norms to instances such as conversion of instruments, bonus issue etc. Considering the complexities that may arise in obtaining a valuation of this nature, and the ambiguity surrounding the application of these provisions, it should be ensured that sound legal advice is taken at the time of entering into any transaction.

Implementation of the BEPS program

Over the past few years, India has been adopting the BEPS program, and has introduced the concepts of Equalisation levy and thin capitalization norms. It is expected, that India shall steadily adopt many of the concepts under the BEPS Action Plan, leading to constant changes in the Indian tax regime. Further, India has signed the Mutlilateral Instrument issued by the Organisation for Economic Cooperation and Development ("OECD") in line with the BEPS Action Plan. The MLI seeks to amend the existing network of more than 3000 bilateral tax treaties of the signatory countries. With the ratification of the MLI by each country, the tax treaties between India and other signatory jurisdictions will stand amended. The provisions and impact of the MLI would involve a great amount of study, and advice from experts should be sought prior to entering any transaction

CONCLUSION

Given the adversarial nature of tax assessments and the costs involved in tax disputes resolution, the most ideal approach and way to conduct one's business would be to ensure that the cause for a dispute doesn't arise in the first place. However, as has been noted earlier, sometimes despite the efforts of the taxpayer, litigation becomes inevitable owing to the nature of the transaction or the magnitude of the stakes involved or due to a different view or position taken by the tax authorities.

In this challenging environment where the stakes in the disputed cases are high, it calls for the best possible strategy for managing tax disputes which involves maintenance of proper and robust documentation, capturing the commercial substance of the transaction appropriately in the legal documents, careful drafting of legal submissions before the judicial authorities, bringing all the relevant facts to the fore at the first possible instance and effective and persuasive representation by tax lawyers before the authorities.

Onus is also on the government to ensure that the income tax authorities demonstrate a sense of urgency and promptness in resolving tax disputes and refrain from making delayed or frivolous appeals. A set of stringent guidelines could be framed to ensure that orders of judicial authorities in favour of the taxpayers are challenged only if they are demonstrably perverse or apparently erroneous. The merits of the case have to be the guiding factor in order to determine if a tax dispute should be pursued further and not merely the quantum of tax or stakes involved in the matter. Some mechanism could also be put in place for making the tax authorities accountable for making frivolous or vexatious tax demands.

Footnotes

1 This issue is now settled by a decision of the Bombay High Court in the case of Vodafone, supported by a press release by the Indian Government, accepting such decision of the Bombay High Court

The content of this document do not necessarily reflect the views/position of Khaitan & Co but remain solely those of the author(s). For any further queries or follow up please contact Khaitan & Co at legalalerts@khaitanco.com