The IRS has released a statement confirming that calendar-year C corporations that timely file an extension will be granted an automatic six-month extension to file an income tax return. The extended deadline to file Form 1120, U.S. Corporation Income Tax Return, for calendar year 2016 will be Oct 16, 2017, instead of Sept. 15.

The Surface Transportation and Veterans Health Care Choice Improvement Act of 2015 (the highway bill) modified the original and extended due dates for C corporations, partnerships and some other taxpayers. The unextended deadline for C corporations was generally shifted one month later, while the previously available six-month extension from the IRS was codified in the statute. However, calendar-year C corporations were granted only a five-month statutory extension until calendar year 2026. (C corporations with June 30 year-ends also have special rules.)

Despite the statute, the updated instructions to Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns, offer calendar-year C corporations the full six-month extension in 2016. The IRS has confirmed that this is correct. The IRS said it was granting a six-month extension now rather than a five-month extension based on its authority under Section 6081(a), which gives the IRS the discretion to allow for an extension of time up to six months. The statement appears to acknowledge some confusion in the taxpayer community as to which extension period was correct.

Effective for returns for tax years beginning after Dec. 31, 2015, all C corporations, except those with a June 30 year-end, now have three-and-a-half months from the end of the tax year to file their return and are allowed an automatic six-month extension. (The deadline for the 2016 calendar year is April 18, 2017, because of a holiday.) Taxpayers with a June 30 year-end have only two-and-a-half months to file, but are allowed a seven month extension. (This is scheduled to change in 2026.) The IRS considers any short year ending in June to be a June 30 fiscal year. The unextended due date for calendar year partnerships filing a Form 1065, U.S. Return of Partnership Income, is one month earlier for tax years beginning after Dec. 31, 2015 (due on March 15, 2017, for the 2016 calendar year). But partnerships now receive a six-month extension, so their extended deadline is unchanged.

Taxpayers may also want to consider the tax accounting implications of this change in extended due dates, as they may relate to the reporting period of return-to-provision true-ups.

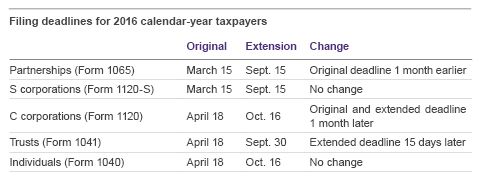

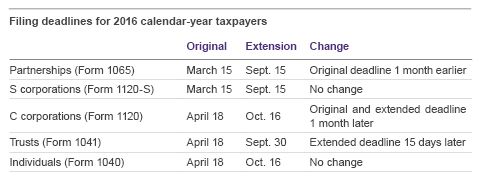

The following chart provides guidance on what the original and extended due dates are for various classifications of entities:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.