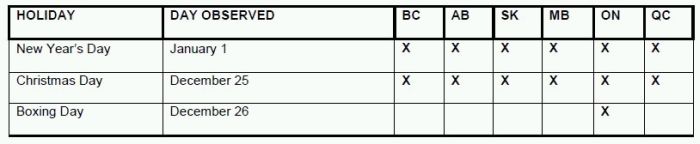

With the Christmas season around the corner, many are looking forward to the statutory holidays. To give a quick breakdown, Christmas Day (Dec. 25) and New Year's Day (Jan. 1) are statutory holidays across all provinces in Canada. However, Boxing Day (Dec. 26) is only listed as a statutory holiday in Ontario.

When these statutory holidays arrive, some businesses will close up shop, while others will remain open. For those that do carry on business, employees will be required to work. What are these employees entitled to if they must work on these dates?

Although most provinces are required to pay a premium rate to their employees working on a statutory holiday, each province differs as follows:

BC

Only eligible employees are entitled to statutory holiday pay. Eligible employees are those that have been employed for 30 days and have worked on at least 15 of the 30 calendar days preceding the statutory holiday. One caveat – employees who work under an averaging agreement, which permits hours of work to be averaged over a period of up to four weeks, do not have to meet the 15-day minimum requirement.

Any employee who is given the day off on a statutory holiday must be paid an "average day's pay." That amount is determined by dividing the amount that was paid or payable to an employee during the 30 days preceding the statutory holiday (including vacation pay but less amounts paid or payable for overtime) by the number of days the employee worked within that same 30-day period.

If an employee works on the statutory holiday, he or she must be paid the average day's pay (as outlined above) plus 1.5 times his or her regular wage for time worked on the statutory holiday up to 12 hours and double time for any hours thereafter.

Alberta

Only eligible employees are entitled to statutory holiday pay. Eligible employees are those that have worked at least 30 days in the 12 months before the holiday. An employee is not eligible for statutory holiday pay if the employee does not work on the holiday when required or scheduled to do so, or is absent from employment without the consent of the employer on the employee's last regular workday preceding, or the employee's first regular workday following, a holiday. Eligible employees will receive a regular day of pay if they did not work. Those who do work on the holiday will receive time-and-a-half or another paid day off. Employees who do not normally work on the day the holiday falls on and are asked to work will receive time-and-a-half.

Unless otherwise arranged, employees who do not normally work the day the holiday falls on and are not requested to work on the holiday will not be paid for the holiday. If an employee works an irregular schedule and there is doubt about whether a holiday is on a day that would normally have been a workday for the employee, the doubt is resolved as follows: if in at least five of the nine weeks preceding the work week in which the holiday occurs the employee worked on the same day of the week as the day on which the holiday falls, the employee is entitled to the holiday.

Saskatchewan

The pay for a statutory holiday is 5% of an employee's wages earned four weeks (28 days) before the holiday. Employees earn this pay whether or not they work on the holiday. One caveat – hourly paid construction workers will receive 4% of their annual wage (overtime not included). The employer can also request a permit to observe a statutory holiday on an alternative day. Employees who work on the statutory holiday receive time-and-a-half in addition to their holiday pay. Employees who operate well-drilling rigs receive their holiday pay on top of their regular pay only.

Manitoba

In Manitoba, all employees are eligible for statutory pay unless the employee is scheduled to work on a general holiday, but are absent without the employer's permission, or the employee is absent without the employer's permission from his or her last scheduled workday before the holiday, of his or her first scheduled workday after the holiday. Employees who work consistent hours receive a regular day's pay and those who have varying hours receive 5% of their wages over the course of the four weeks prior. One caveat – those in the construction industry receive 4% of their gross earnings.

Employees who work on the statutory holiday are paid a rate of time-and-a-half. Employees who work on a general holiday are normally entitled to time-and-a-half for the hours worked on the day in addition to his or her holiday pay. However, exempt employers do not have to pay employees who work on a general holiday time-and-a-half for the hours worked on that day in addition to the employees holiday pay if the employer provides another day off with general holiday pay within the next 30 days.

Ontario

Eligible employees, whether full-time or part-time, are generally entitled to a paid holiday on each public holiday recognized under the Employment Standards Act, 2000, including Christmas, Boxing Day and New Years' Day. However, an employee will not be eligible for a paid day off on the holiday if the employee either: (i) failed without reasonable cause to work his or her last regularly scheduled shift before and first regularly scheduled shift after the public holiday; or (ii) agreed to or was required to work on the public holiday, but failed without reasonable cause to work his or her entire shift on that day.

Public holiday pay is equal to the total amount of regular wages earned and vacation pay payable to the employee in the four work weeks before the work week in which the public holiday occurs, divided by 20. An employee who agrees or is required to work on a public holiday is entitled to be paid at his or her regular rate for all hours worked on the holiday, and be given a substitute holiday with public holiday pay. Alternatively, if the employee and the employer agree in writing, the employee may receive public holiday pay plus a premium rate of pay (1.5 times the employee's regular rate) for the hours worked on the public holiday. Only employees employed in a hospital, a "continuous operation," or a hotel, motel, tourist resort, restaurant or tavern may be required to work on a public holiday. Most retail employees generally have the right to refuse to work on a public holiday. The Ontario Minister of Labour offers a public holiday pay calculator on its website.

Quebec

All employees are eligible for holiday pay except those that miss work the day before or after. Those who do work will receive double time or a day off with pay in addition to their regular wage.

About Norton Rose Fulbright Canada LLP

Norton Rose Fulbright is a global law firm. We provide the world's preeminent corporations and financial institutions with a full business law service. We have 3800 lawyers and other legal staff based in more than 50 cities across Europe, the United States, Canada, Latin America, Asia, Australia, Africa, the Middle East and Central Asia.

Recognized for our industry focus, we are strong across all the key industry sectors: financial institutions; energy; infrastructure, mining and commodities; transport; technology and innovation; and life sciences and healthcare.

Wherever we are, we operate in accordance with our global business principles of quality, unity and integrity. We aim to provide the highest possible standard of legal service in each of our offices and to maintain that level of quality at every point of contact.

For more information about Norton Rose Fulbright, see nortonrosefulbright.com/legal-notices.

Law around the world

nortonrosefulbright.com

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.