The Centers for Medicare & Medicaid Services (CMS) recently published a major final rule that will base Medicare clinical laboratory fee schedule (CLFS) reimbursement on private insurance payment amounts, as required by the Protecting Access to Medicare Act of 2014 (PAMA). In the coming year, "applicable laboratories" will have to report to CMS the private payor rates made to them during a specified six-month data collection period for this year. Among other important changes from the proposed rule, CMS will implement the new payment policy beginning January 1, 2018, rather than in 2017. This alert provides a summary and analysis of major provisions of the rule, including the rule's complex new payment methodology, and a checklist of pending issues for which labs should be alert.

Although Medicare payments are constantly subject to updates and refinements, it is relatively rare that existing Medicare payment methods are replaced by new ones. It has also generally been taken for granted that Medicare payment rates are the standard by which most other payment rates are determined. Significantly, the Protecting Access to Medicare Act of 2014 (PAMA) not only establishes an entirely new payment methodology for lab tests, but it does so by reversing the status quo: going forward, Medicare will establish payment rates for most lab tests, not by conducting its own analysis of costs, clinical utility, and myriad other factors, but by looking at, and performing a calculation based on, what other payors are paying for the same service. To do this, PAMA imposes a substantial, and previously non-existent, data-reporting requirement on labs.

Specifically, the Centers for Medicare & Medicaid Services (CMS) recently published a major final rule that will base Medicare clinical laboratory fee schedule (CLFS) reimbursement on private insurance payment amounts, as required by PAMA.

In the coming year, "applicable laboratories" will have to report to CMS the private payor rates made to them during a specified six-month data collection period for this year – a time period that in fact has already passed. Among other important changes from the proposed rule, CMS will implement the new payment policy beginning January 1, 2018, rather than in 2017. A subset of tests on the CLFS – advanced diagnostic laboratory tests (ADLTs) – will have different data collection, reporting, and payment policies associated with them as required by the statute. The impact of the final rule itself, once in effect, will be significant: CMS estimates FY 2018 payment reductions of $390 million, with reductions totaling $3.93 billion through FY 2025. This alert provides a summary and analysis of major provisions of the rule, including the rule's complex new payment methodology, and a checklist of pending issues for which labs should be alert.

Applicable Laboratories Defined: Four-Prong Test

PAMA placed payment rate reporting responsibility on "applicable laboratories," with the specific definition of that term left to CMS. Many of the approximately 1,300 commenters on the October 1, 2015, proposed regulation expressed strong views on the appropriate definition, arguing among other things that data from various lab constituencies (e.g., large labs, small physician labs, hospital labs) should or should not be included, and advocating what revenue and expenditure thresholds should apply.

In the final rule, and through subregulatory guidance issued July 20, 2016 – Medicare Part B Clinical Laboratory Fee Schedule: Guidance to Laboratories for Collecting and Reporting Data for the Private Payor Rate Based Payment System (Guidance) – CMS adopts a four-prong test in identifying applicable laboratories:

- Is the lab certified under the Clinical Laboratory Improvement Amendments of 1988 (CLIA)?

- Does the CLIA certified lab bill Medicare Part B under its own National Provider Number (NPI)?

- Does the lab meet the majority of Medicare revenues threshold?

- Does the lab meet the low expenditure threshold?

The first step in identifying whether a lab is an "applicable laboratory" is to determine whether the lab is CLIA certified. CLIA applies to all labs performing testing on human specimens for a health purpose, and a lab must be CLIA certified in order to receive Medicare payments. CMS clarifies in the Guidance that any facility that receives any CLIA certificate, including a CLIA certificate of waiver, is considered a laboratory, and so may be an "applicable laboratory."

Per the second and third prongs, a lab – using its National Provider Identifier (NPI) – is considered an applicable laboratory if more than 50 percent of its total Medicare revenue is received under the CLFS and the Physician Fee Schedule (PFS). CMS decided against adopting its proposed use of the Taxpayer Identification Numbers (TINs) as a mechanism for defining an applicable laboratory, although reporting will be at the TIN level. CMS clarifies in the Guidance that a lab must look to final paid claims received by its own billing NPI during the data collection period in order to determine if the Medicare revenue threshold is met. The Guidance further provides a detailed equation for calculating a lab's Medicare revenue.

The final prong in the definition of applicable laboratory involves a "low expenditure" threshold. CMS will generally exclude a lab from being an applicable laboratory, and thus from having to report its private payor data, if it is paid less than $12,500 under the CLFS during a data collection period (compared with the proposed threshold of $50,0001); note that the $12,500 threshold does not apply to a single laboratory that furnishes an ADLT. As with the Medicare revenue threshold, the low expenditure threshold must be calculated based upon final paid claims received by a lab's own billing NPI during the data collection period. The Guidance further provides a detailed equation for calculating whether a lab meets the low expenditure threshold.

A hospital outreach laboratory that is independently enrolled in Medicare and has its own NPI would meet the definition of an applicable laboratory if at least 50 percent of its Medicare revenues are from CLFS and PFS services, and its revenues from the CLFS are at least $12,500 during a data collection period. Several other examples of applicable laboratories are provided in the Guidance.

CMS estimates that the low expenditure criterion will exclude about 55 percent of independent labs and about 95 percent of physician office labs from the private payor data reporting obligation. At the same time, it notes that physicians and labs for which private payor rates will be required to be reported account for approximately 92 percent of CLFS spending on physician office labs and approximately 99 percent of CLFS spending on independent labs. Thus, the low expenditure threshold ensures that those labs receiving the bulk of Medicare's total CLFS expenditures will be subject to the data reporting requirement.

What Applicable Laboratories Must Report

The final rule specifies that applicable laboratories must report two types of information ("applicable information"), by Healthcare Common Procedure Coding System (HCPCS) code:

- Each private payor rate for which final payment has been made during the data collection period; and

- The associated volume of tests performed corresponding to each private payor rate.

As mandated by the PAMA statute, CMS defines "private payor'' as a health insurance issuer or a group health plan, a Medicare Advantage plan, or a Medicaid managed care organization. CMS defines the "private payor rate" as the final amount that was paid by a private payor for a CDLT after all private payor price concessions are applied, and does not include price concessions applied by a lab. The private payor rate would also include payments from secondary payors if the final payment was made during the data collection period, and any patient cost-sharing amounts required by the payor. CMS excludes data from tests for which payment is made on a capitated basis. Furthermore, only private payor payment rates for tests paid under the CLFS constitute private payor rates; payment rates for lab tests paid only under the PFS are not considered to be private payor rates and should not be reported as applicable information. Additional information on when private payor rates must be reported, and when they are excluded, is provided in the Guidance. For example, the Guidance explains that the following types of payments are excluded from private payor rates: zero dollar ($0.00) payments, payments that are the subject of an unresolved appeal, "encounter"-based payments, and payments where the associated test volume cannot be determined from the payor's remittance. CMS intends to publish a list of HCPCS codes subject to reporting on its website.

Although data collection is done at the NPI level, data reporting is done at the TIN level. That is, the TIN-level entity must report applicable information for all of its NPI-level components that are applicable laboratories. The Guidance provides several examples of this reporting scheme, and makes clear that reporting entities are not permitted to (1) report applicable information for NPIs that do not meet the definition of an applicable laboratory, or (2) selectively omit reporting certain applicable information for those NPIs that do meet the definition of an applicable laboratory.

What is an ADLT?

Advanced Diagnostic Laboratory Tests (ADLTs) are a subset of clinical diagnostic laboratory tests (CDLTs), and are treated somewhat differently than CDLTs under PAMA and the final rule.

Under the statute, an ADLT is a CDLT that:

- Is covered under Medicare Part B;

- Is offered and furnished only by a single laboratory;

- Is not sold for use by a laboratory other than the original developing laboratory (or a successor owner); and

- Meets one of the following

criteria:

- The test is an analysis of multiple biomarkers of DNA, RNA, or proteins combined with a unique algorithm to yield a single patient-specific result; or

- The test is cleared or approved by the Food and Drug Administration (FDA); or

- The test meets other similar criteria established by the Secretary.

CMS' final definition of ADLT reflects its interpretation of the statute, and incorporates CMS' favorable response to several criticisms of its proposed rule. For example:

- In the proposed rule, CMS excluded protein-only based tests from ADLT status. In the final rule, CMS includes protein-only based tests as ADLTs and removes the proposed requirement that an ADLT must be a molecular pathology test. However, CMS makes clear its expectation that only "complex protein-only tests" qualify as ADLTs, given the "unique algorithm" portion of the statutory definition.

- In the final rule, CMS does not adopt its proposal to define a "single laboratory" as a facility with a single CLIA certificate. Recognizing stakeholder complaints that such a definition would require all aspects of the test to be performed only at a single physical location – which does not comport with how labs operate – CMS instead defines "single laboratory" in the final rule as one "which furnishes the test, and that may also design, offer, or sell the test."2 The final definition of "single laboratory" includes entities that own, or entities that are owned by, the lab furnishing the test.

CMS did not accept all suggestions for revisions to its proposed definition of ADLT. Despite pushback, CMS retained its requirement that an ADLT provide new clinical diagnostic information that cannot be obtained from any other test or combination of tests.

An application process for labs requesting ADLT status is forthcoming. However, CMS does note that the information requested in the application will be consistent with its definition of ADLT. In response to stakeholder comments asking for protection of confidential information that may be disclosed in the application, CMS noted that there is no explicit protection of information in the application, but instead pointed to Freedom of Information Act (FOIA) and its protection of trade secrets.

Complex New Payment Provisions

Revised payment amounts for tests will depend upon the type of test (non-ADLT or ADLT) and whether the test is "new." There are three categories of tests for purposes of setting payment rates: (1) CDLTs (including ADLTs), (2) "New CDLTs," and (3) "New ADLTs."

- Payment for all CDLTs furnished on or

after January 1, 2018, will equal the weighted median of private

payor rates for the CDLT. The weighted median will take into

account each private payor rate reported and the volume of tests

reported under each of those private payor rates. Rates, which are

not eligible to be appealed, for CDLTs will be updated every three

years, and for ADLTs will be updated annually.

CMS recognizes that there are a multitude of reasons that payment information may not be reported for CDLTs – for example, the test is not performed for any privately insured patient during the data collection period. When no private payor information is reported, CMS will use crosswalking and gapfilling to set payment rates. - Payment for New CDLTs that are not ADLTs will be calculated based on crosswalking and gapfilling methods. A "New CDLT" is a test that is assigned a new or substantially revised HCPCS code, and that does not meet the definition of an ADLT.

- Payment for New ADLTs – that

is, ADLTs for which payment has not been made under the clinical

lab fee schedule prior to January 1, 2018 – is based upon the

actual list charge for the test for the first three quarters the

test is on the market. This so-called "Initial Period"

begins the first day of the first full calendar quarter following

the later of the date a Medicare Part B coverage determination is

made or ADLT status is granted. The actual list charge equates to

the lowest publicly available rate (i.e., the lowest rate available

on public forums, such as a lab's website) on the first day

that the New ADLT is available for purchase.

CMS had proposed substantial recoupment for New ADLTs where actual list charges are later determined – after the Initial Period – to exceed the weighted median-base payment rates (the "market-based rate"). Specifically, where the actual list charge is determined to be more than 130 percent of the market-based rate, CMS would have recouped the entire difference. Instead, under the final rule, CMS will pay up to 130 percent of the market-based rate in the Initial Period, so that any recoupment will be the difference between 130 percent and payments above 130 percent. For example, if CMS determines that the actual list charges are 140 percent of the market-based rate, it will recoup the difference between 140 percent and 130 percent.

The reductions in payment rates resulting from implementation of the final rule will be phased-in, based on safeguards set forth in PAMA. In the first three years of implementation (2018-2020), rates will be reduced by no more than 10 percent. In the next three years (2021-2023), rates will be reduced by no more than 15 percent. The maximum reduction is to be based upon the previous year's payment rate, not the original payment rate.

Multi-Year Implementation Schedule

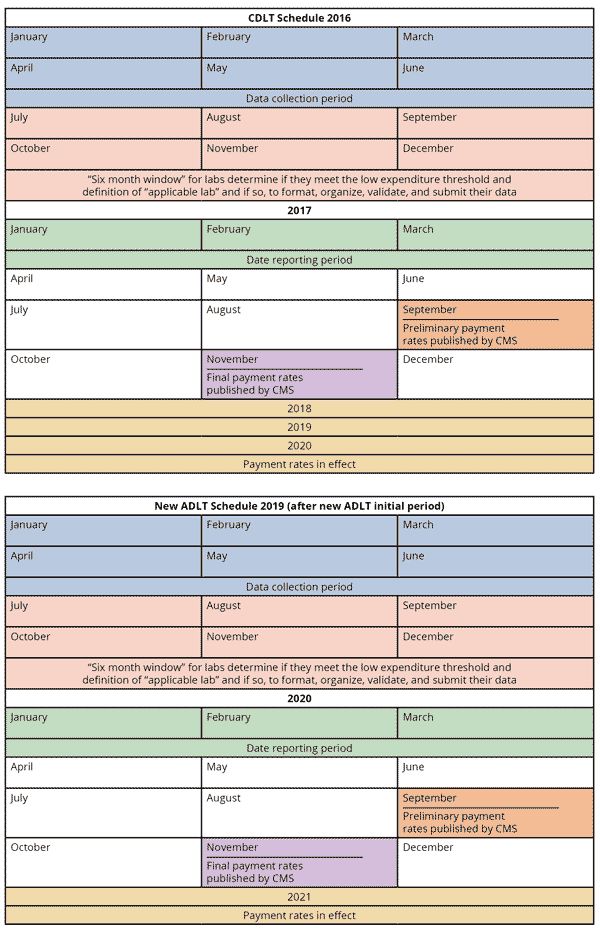

The final rule implements a new schedule for collection of applicable information, reporting applicable information, and CMS' establishment of payment rates. The new schedule reflects both the delayed implementation date of January 1, 2018, as well as the decrease in the collection period from 12 to six months. The calendars below illustrate the schedules for CDLTs (beginning January 1, 2016) and for New ADLTs after the New ADLT Initial Period (beginning January 1, 2019). The schedule begins again every three years for CDLTs (January 1, 2019) and annually for New ADLTs (January 1, 2020).

CMS provides an example of the schedule for New ADLTs during the Initial Period:

Certification by Executive Required; Civil Monetary Penalties

The final rule requires that the accuracy of a lab's reported data must be certified by the president, chief executive officer (CEO), or chief financial officer (CFO) of the reporting entity, or by an individual who has been delegated to sign for, and who reports directly to, such an officer. The signing individual must attest that the data reported is accurate, complete, and truthful, and meets all the reporting parameters. Additional information on the process for such certifications is to be addressed in pending subregulatory guidance.

PAMA authorizes CMS to issue civil monetary penalties (CMPs) of up to $10,000 per day that an applicable lab fails to report applicable information or misrepresents applicable information that is reported. In response to stakeholder concerns over the severity of these CMPs – particularly by small labs that contend that they would be forced to close if such a penalty were applied – CMS clarified that $10,000 is a maximum, not a minimum. It further made clear its intention to work with the Office of Inspector General (OIG) to assess appropriate CMPs that reflect the facts and circumstances of each violation. At the same time, it notes that PAMA was not intended to have a draconian impact:

We will consider all relevant information when determining the amount of a CMP, and we will work with the OIG to ensure that any penalties assessed are fairly applied. The purpose of PAMA is to collect complete and accurate data in order to set payment rates, not to force a laboratory to close as a result of a CMP assessment.3

CMS states that it will not impose penalties for "minor errors." CMS also notes that it will be issuing additional guidance "on the assessment of CMPs, including what would constitute a failure to report or a misrepresentation or omission in reporting."4

Other Provisions in Final Rule

The final rule also addresses a variety of other definitions, implementation details, and policy issues, including: certification of submitted information; confidentiality and public release of limited data; temporary coding for new tests; and the potential designation of Medicare Administrative Contractors (MACs) to establish coverage policies and potentially process claims for lab tests in a consolidated manner (CMS is not changing any lab-related MAC functions in this rule).

Outlook for the Future: Other Developments to Expect

As noted, the final rule is lengthy and complex, and the details of some data collection and reporting remain somewhat unclear. Hence, CMS plans to issue additional subregulatory guidance on multiple aspects of the final rule. Among the issuances for which labs should be on the lookout are the following:

- A listing of specific HCPCS codes for tests paid on the CLFS for which labs must report private payor rates

- Details on laboratory registration

- Specific process requirements by which the executives of reporting entities provide certifications of the reported data's accuracy and completeness

- CMS guidelines on when CMPs will be imposed for reporting errors (misrepresentations and omissions), and failure to report at all

- Details concerning a web-based portal to be developed by CMS for reporting applicable information – likely the same type of portal that is now used for Open Payments reporting by drug and device manufacturers

- Specifics about the scope and nature of raw data CMS intends to make available regarding its rate calculation methodology

- Information to be required of entities seeking ADLT status for a test (e.g., application form, process for consideration, medical evidence to be submitted), and how often such applications will be considered/approved by CMS

While there is still much to be explained by CMS, there is no doubt that clinical labs are in store for major changes over the next several years. Reed Smith continues to monitor developments and will provide updates as they become available. For now, clinical labs, if they have not already started, must determine if they meet the definition of "applicable laboratory" and, if so, prepare and review the data to be submitted to CMS early next year.

Glossary of Acronyms

ADLT Advanced Diagnostic Laboratory Test

CDLT Clinical Diagnostic Laboratory Test

CEO Chief Executive Officer

CFO Chief Financial Officer

CLFS Clinical Laboratory Fee Schedule

CLIA Clinical Laboratory Improvement Amendments of 1988

CMP Civil Monetary Penalties

CMS Centers for Medicare & Medicaid Services

FDA Food and Drug Administration

FOIA Freedom of Information Act

HCPCS Healthcare Common Procedure Coding System

MAC Medicare Administrative Contractors

NPI National Provider Number

OIG Office of Inspector General

PAMA Protecting Access to Medicare Act of 2014

PFS Physician Fee Schedule

TIN Taxpayer Identification Number

Footnotes

1. The low expenditure threshold was changed consistent with CMS' decision to define "applicable laboratory" based on whether it bills under an NPI (versus a TIN, as proposed) and consistent with CMS' decision to establish a six-month data collection period (versus a full calendar year, as proposed).

2. 81 Fed. Reg. at 41059.

3. 81 Fed. Reg. at 41069.

4. Id.

This article is presented for informational purposes only and is not intended to constitute legal advice.